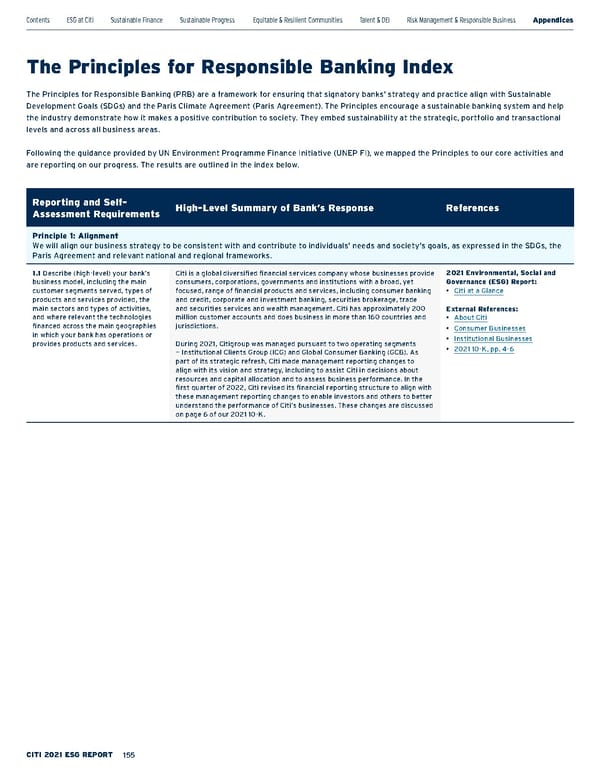

Reporting and Self- Assessment Requirements High-Level Summary of Bank’s Response References Principle 1: Alignment We will align our business strategy to be consistent with and contribute to individuals’ needs and society’s goals, as expressed in the SDGs, the Paris Agreement and relevant national and regional frameworks. 1.1 Describe (high-level) your bank’s business model, including the main customer segments served, types of products and services provided, the main sectors and types of activities, and where relevant the technologies financed across the main geographies in which your bank has operations or provides products and services. Citi is a global diversified financial services company whose businesses provide consumers, corporations, governments and institutions with a broad, yet focused, range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, trade and securities services and wealth management. Citi has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. During 2021, Citigroup was managed pursuant to two operating segments — Institutional Clients Group (ICG) and Global Consumer Banking (GCB). As part of its strategic refresh, Citi made management reporting changes to align with its vision and strategy, including to assist Citi in decisions about resources and capital allocation and to assess business performance. In the first quarter of 2022, Citi revised its financial reporting structure to align with these management reporting changes to enable investors and others to better understand the performance of Citi’s businesses. These changes are discussed on page 6 of our 2021 10-K. 2021 Environmental, Social and Governance (ESG) Report: • Citi at a Glance External References: • About Citi • Consumer Businesses • Institutional Businesses • 2021 10-K, pp. 4-6 The Principles for Responsible Banking Index The Principles for Responsible Banking (PRB) are a framework for ensuring that signatory banks’ strategy and practice align with Sustainable Development Goals (SDGs) and the Paris Climate Agreement (Paris Agreement). The Principles encourage a sustainable banking system and help the industry demonstrate how it makes a positive contribution to society. They embed sustainability at the strategic, portfolio and transactional levels and across all business areas. Following the guidance provided by UN Environment Programme Finance Initiative (UNEP FI), we mapped the Principles to our core activities and are reporting on our progress. The results are outlined in the index below. Contents ESGatCiti SustainableFinance SustainableProgress Equitable&ResilientCommunities Talent&DEI RiskManagement&ResponsibleBusiness Appendices ESGS ataC ius niblnG 155

Citi ESG Report Page 154 Page 156

Citi ESG Report Page 154 Page 156