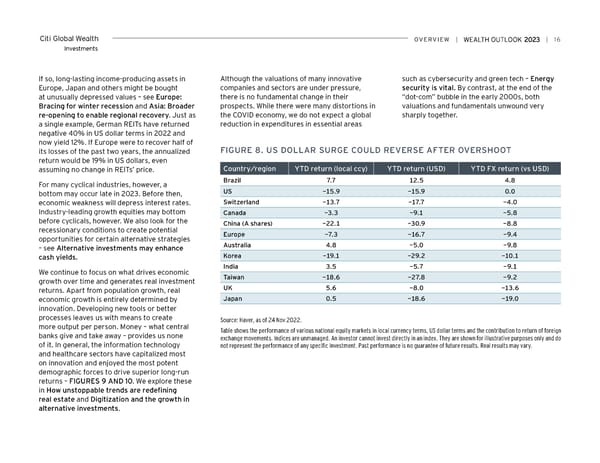

Citi Global Wealth overview | | 16 Investments If so, long-lasting income-producing assets in Although the valuations of many innovative such as cybersecurity and green tech – Energy Europe, Japan and others might be bought companies and sectors are under pressure, security is vital. By contrast, at the end of the at unusually depressed values – see Europe: there is no fundamental change in their “dot-com” bubble in the early 2000s, both Bracing for winter recession and Asia: Broader prospects. While there were many distortions in valuations and fundamentals unwound very re-opening to enable regional recovery. Just as the COVID economy, we do not expect a global sharply together. a single example, German REITs have returned reduction in expenditures in essential areas negative 40% in US dollar terms in 2022 and now yield 12%. If Europe were to recover half of its losses of the past two years, the annualized FiGUre 8. US DoLLAr SUrGe CoULD reverSe AFTer overSHooT return would be 19% in US dollars, even assuming no change in REITs’ price. Country/region YTD return (local ccy) YTD return (USD) YTD FX return (vs USD) For many cyclical industries, however, a Brazil 7.7 12.5 4.8 bottom may occur late in 2023. Before then, US -15.9 -15.9 0.0 economic weakness will depress interest rates. Switzerland -13.7 -17.7 -4.0 Industry-leading growth equities may bottom Canada -3.3 -9.1 -5.8 before cyclicals, however. We also look for the China (A shares) -22.1 -30.9 -8.8 recessionary conditions to create potential europe -7.3 -16.7 -9.4 opportunities for certain alternative strategies – see Alternative investments may enhance Australia 4.8 -5.0 -9.8 cash yields. Korea -19.1 -29.2 -10.1 We continue to focus on what drives economic india 3.5 -5.7 -9.1 growth over time and generates real investment Taiwan -18.6 -27.8 -9.2 returns. Apart from population growth, real UK 5.6 -8.0 -13.6 economic growth is entirely determined by Japan 0.5 -18.6 -19.0 innovation. Developing new tools or better processes leaves us with means to create Source: Haver, as of 24 Nov 2022. more output per person. Money – what central Table shows the performance of various national equity markets in local currency terms, US dollar terms and the contribution to return of foreign banks give and take away – provides us none exchange movements. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do of it. In general, the information technology not represent the performance of any specific investment. Past performance is no guarantee of future results. Real results may vary. and healthcare sectors have capitalized most on innovation and enjoyed the most potent demographic forces to drive superior long-run returns – FIGURES 9 AND 10. We explore these in How unstoppable trends are redefining real estate and Digitization and the growth in alternative investments.

Citi Wealth Outlook 2023 Page 15 Page 17

Citi Wealth Outlook 2023 Page 15 Page 17