Citi Wealth Outlook 2023

Citi Global Wealth Investments Roadmap to recovery: Portfolios to anticipate opportunities

If you are visually impaired and would like to speak to a Citi representative regarding the details of graphics included in this document, please call +1 (800) 788-6775. INVESTMENT PRODUCTS: NOT FDIC INSURED · NOT CDIC INSURED · NOT GOVERNMENT INSURED · NO BANK GUARANTEE · MAY LOSE VALUE

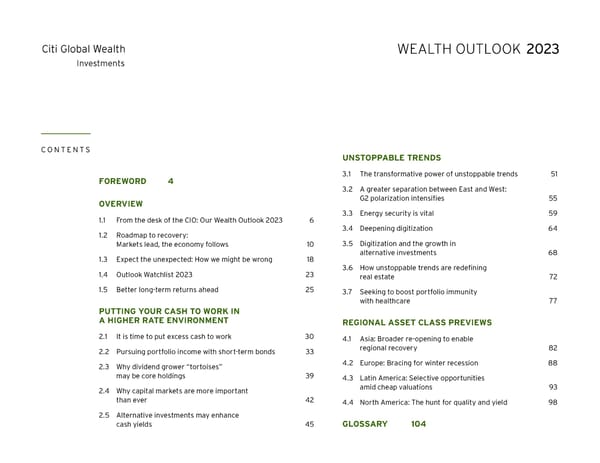

Citi Global Wealth Investments CONTENTS UNSTOPPABLE TRENDS 3.1 The transformative power of unstoppable trends 51 FOREWORD 4 3.2 A greater separation between East and West: OVERVIEW G2 polarization intensifies 55 3.3 Energy security is vital 59 1.1 From the desk of the CIO: Our Wealth Outlook 2023 6 3.4 Deepening digitization 64 1.2 Roadmap to recovery: Markets lead, the economy follows 10 3.5 Digitization and the growth in alternative investments 68 1.3 Expect the unexpected: How we might be wrong 18 3.6 How unstoppable trends are redefining 1.4 Outlook Watchlist 2023 23 real estate 72 1.5 Better long-term returns ahead 25 3.7 Seeking to boost portfolio immunity with healthcare 77 PUTTING YOUR CASH TO WORK IN A HIGHER RATE ENVIRONMENT REGIONAL ASSET CLASS PREVIEWS 2.1 It is time to put excess cash to work 30 4.1 Asia: Broader re-opening to enable 2.2 Pursuing portfolio income with short-term bonds 33 regional recovery 82 2.3 Why dividend grower “tortoises” 4.2 Europe: Bracing for winter recession 88 may be core holdings 39 4.3 Latin America: Selective opportunities 2.4 Why capital markets are more important amid cheap valuations 93 than ever 42 4.4 North America: The hunt for quality and yield 98 2.5 Alternative investments may enhance cash yields 45 GLOSSARY 104

slowing growth, international conflict and an intensified Foreword US-China tech rivalry. For the first time in decades, equities and fixed income suffered significant falls simultaneously, alongside alternative asset classes. While 2023 will still have its share of challenges, we also see it as a year of change and opportunity. In the US, we expect a mild recession, with regions such as the eurozone being more heavily impacted. As inflation subsides, we see the US Federal Reserve pivoting from interest rate hikes to cuts and markets shifting focus to 2024 recovery, unlocking more potential opportunities for investors. As the markets continue to swing, timely guidance has become even more valuable. Our insights help us engage in deeper client conversations and create strategies that achieve your investment objectives. The value of keeping JIM O’DONNELL portfolios fully invested remains increasingly important – CEO of Citi Global Wealth market timing can come at a great cost, as turning points Welcome to Outlook 2023, our annual publication that often arrive with little warning. sets out our expectations and key investment themes For your convenience, we have also created helpful for the coming year and beyond. This edition, “Roadmap summaries, including Findings & Opportunities and a new to recovery: Portfolios to anticipate opportunities,” version of this publication in just two sides. highlights steps that we believe you should consider to help seek returns. We look forward to continued partnership and success in the new year. Investing over the past year has come with its challenges and uncertainties due to inflation, monetary tightening, Citi Global Wealth | 4 Investments

Citi Global Wealth Investments CONTENTS 1 Overview 1.1 From the desk of the CIO: Our Wealth Outlook 2023 1.2 Roadmap to recovery: Markets lead, the economy follows 1.3 Expect the unexpected: How we might be wrong 1.4 Is your portfolio ready for a year of change and opportunity? 1.5 Better long-term returns ahead

1.1 FROM THE DESK OF THE CIO: Our Wealth Outlook 2023 For investors, 2022 will not be missed. The year presented a series of firsts and worsts. The tragic war in Ukraine hugely distorted global food and energy supply chains, further emphasized the divide between the US and China – see A greater separation between East and West: G2 polarization intensifies – and accelerated the onshoring of critical business infrastructure. The Fed instigated its fastest set of interest rate increases ever. In doing so, it responded to the inflation it caused by adding excessive liquidity to counteract the effects of the pandemic. As the safe- haven US dollar strengthened, goods almost everywhere else became more expensive, adding to global central bank tightening pressures. These are all sources of instability. In this environment, equities and bonds declined in tandem by the most ever in 2022, with joint losses of about 20% at the low point. DAVID BAILIN Cash outperformed almost every asset class. As we look ahead, Chief Investment Officer however, we need to remember that markets lead economies. The and Global Head of Investments poor market returns of 2022 anticipate the economic weakness Citi Global Wealth we expect in 2023 – see Roadmap to recovery: Markets lead, the economy follows. Citi Global Wealth overview | | 6 Investments

Citi Global Wealth overview | | 7 Investments We believe that the Fed’s rate hikes and shrinking bond portfolio have been First, though, we need to get through a recession in the US that has not stringent enough to cause an economic contraction within 2023. And if started yet. We believe that the Fed’s current and expected tightening will the Fed does not pause rate hikes until it sees the contraction, a deeper reduce nominal spending growth by more than half, raise US unemployment recession may ensue. The most recent inflation data and Fed minutes above 5% and cause a 10% decline in corporate earnings. The Fed will likely suggest that the Fed is aware of these risks. Yet Fed policymakers’ tendency reduce the demand for labor sufficiently to slow services inflation just as toward excess gives us pause as we plan for 2023. high inventories are already curtailing goods inflation. With perfect hindsight, sitting out 2022 would have been worthwhile. But The relative health of corporate and personal balance sheets has delayed to think that way is dangerous for wealth preservation and creation. One an economic downturn, for now. Household borrowing is sustaining growth year is just a “moment” in the lifetime of a portfolio. Sidestepping the presently, but this dissaving is likely unsustainable, especially given financial pandemic and war-laden past three years would have been a major mistake market and real estate price deflation. Also, when short-term rates are for equity investors. Between December 2019 and November 2022, the S&P higher, there is a natural bias to deferring purchases. 500 Index rose 25% and the MSCI World 15.4%. For 2023, we reiterate the fundamental wisdom of keeping fully invested portfolios – see for example, It We remind investors that over the past 100 years, no bear market associated is time to put excess cash to work. with a recession has bottomed before the recession has even begun. (Of course, there is a first time for everything.) We believe that the current bear Remember, the world economy is highly adaptive and resilient. So too market rally is based on premature hopes that the recession will not occur – are markets. a so-called “soft landing” – and that there will not be a meaningful decline in corporate earnings. Thinking about 2023 Second, we need to get through a deeper recession in Europe as it struggles through a winter of energy scarcity and inflation. We also need to see a Markets in 2023 will lead the economic recovery we foresee for 2024. sustained economic recovery in China, whose prior regulatory policies and Therefore, we expect that 2023 may ultimately provide a series of current COVID policies curtail domestic growth. meaningful opportunities for investors who are guided by relevant Third, we need to see the Fed truly pivot. Ironically, when the Fed does finally market precedents. reduce rates for the first time in 2023 – an event that we expect after several negative employment reports – it will do so at a time when the economy is already weakening. We think this will mark a turning point that will portend the beginning of a sustained economic recovery in the US and beyond over the coming year.

Citi Global Wealth overview | | 8 Investments Higher returns may be on the horizon If the economy does go into a mild recession, the US yield curve will initially invert more deeply. We can imagine thus that longer duration bonds may After the big drop in valuations in 2022, our 10-year return forecasts – or perform well at the stage. After this stage, we would look to redeploy assets “strategic return estimates” (SREs) – have risen. A year ago, our strategic more widely. asset allocation methodology pointed to annualized returns for Global Equities over the coming decade of 6.1%. Today, that stands at 10%. SREs Broadening equity exposures for Private Equity and Real Estate are higher still. Likewise, the Global Fixed Income SRE has climbed from 3.7% to 5.1%. Even Cash now has an SRE of In the near term, we believe equities in companies with strong balance 1 3.4%, up from 1.5% – see Better long-term returns ahead. sheets and healthy cash flows will provide investors with greater portfolio resilience – see Why dividend grower “tortoises” may be core holdings. A “sequence of opportunities” We expect that as 2023 progresses, opportunities to increase portfolio risk While no one can know the precise timing and sequence for selecting will evolve. Once interest rates peak, we will likely shift toward non-cyclical investments globally at a time of significant uncertainty, we think that there growth equities. These have already repriced lower, and we expect them to are numerous data points to suggest that a potential set of opportunities will begin performing once more before cyclicals. Among non-cyclical growth arise in 2023. equities are many exposed to our Unstoppable Trends – see Deepening digitization. Subsequently, early in the recovery period, we will also seek Ahead of the expected recession, we are committed to selectivity and a reentry opportunity in cyclical growth industries, as value equities may quality. This begins with fixed income, which we believe offers genuine prosper when supply pipelines are unable to meet revived demand. portfolio value now for the first time in several years. Short-duration The dollar could continue rallying for longer than fundamentals justify. US Treasuries present a compelling alternative to holding cash. For US Overshoots have been a characteristic of prior periods of dollar strength. investors, municipal bonds also seek better risk-adjusted after-tax returns. Around a durable dollar peak, we will look to add more non-US equities Broader investment-grade bonds offer a range of higher yields at every and bonds. maturity. And loans in private markets – think private equity lending – offer larger yield premiums with lower loan-to-value ratios than at any time since 2008-09. 1 Source: Citi Private Bank Global Asset Allocation team. 2023 SREs are based on data as of 31 Oct 2022. Global Equity consists of Developed and Emerging Market Equity. Global Fixed Income consists of Investment-Grade, High-Yield and Emerging Market Fixed Income. Strategic Return Estimates are in US dollars; all estimates are expressions of opinion, are subject to change without notice and are not intended to be a guarantee of future events. Strategic Return Estimates are no guarantee of future performance. Citi Private Bank Global Asset Allocation Team. SREs for Mid-Year 2022 are based on data as of 30 Apr 2022. Returns estimated in US dollars. Strategic Return Estimates (SRE) based on indices are Citi Private Bank’s forecast of returns for specific asset classes (to which the index belongs) over a 10-year time horizon. Indexes are used to proxy for each asset class. The forecast for each specific asset class is made using a proprietary methodology that is appropriate for that asset class. Equity asset classes utilize a proprietary forecasting methodology based on the assumption that equity valuations revert to their long-term trend over time. The methodology is built around specific valuation measures that require several stages of calculation. Assumptions on the projected growth of earnings and dividends are additionally applied to calculate the SRE of the equity asset class. Fixed Income asset class forecasts use a proprietary forecasting methodology that is based on current yield levels. Other asset classes utilize other specific forecasting methodologies. Each SRE does not reflect the deduction of client advisory fees and/or transaction expenses. Past performance is not indicative of future results. Future rates of return cannot be predicted with certainty. The actual rate of return on investments can vary widely. This includes the potential loss of principal on your investment. It is not possible to invest directly in an index. SRE information shown above is hypothetical, not the actual performance of any client account. Hypothetical information reflects the application of a model methodology and selection of securities in hindsight. No hypothetical record can completely account for the impact of financial risk in actual trading. See Glossary for definitions.

Citi Global Wealth overview | | 9 Investments Alternative investments As we look ahead to 2023, it is a time for pragmatism and practicality. There has been no economic period like this one, buffeted by the collective impact In our view, 2023 will potentially be a great vintage for alternative of a pandemic, a war and a highly reactive Fed. That said, we maintain investments. Higher interest rates have caused a repricing of private our realistic view that the world will see businesses improve the lives of assets amid much higher borrowing costs. As such, specialist managers customers across the world. For example, we believe that the climate will be able to deploy capital into areas of distress and illiquidity – see challenges will ultimately be addressed and provide fuel for profits along Alternative investments may enhance cash yields. Across the venture the way – see Energy security is vital. We believe that the post-pandemic capital industry, capital is now being deployed more judiciously and at more period will accelerate the development of new treatments for disease and favorable valuations for investors – see Digitization and the growth in new tools to prevent future calamities – see Seeking to boost portfolio alternative investments. immunity with healthcare. We believe that new global macro realities will present opportunities to reshape supply chains and alliances. And we also For real estate, a higher bar is now in place for new investment across believe that a return to a “new normal” is the likeliest outcome for the global almost all markets and property types. We see this as a favorable backdrop economy – though not the only one. for real estate investors in 2023 – see How unstoppable trends are redefining real estate. Our strategic return estimates in these areas are now It has been a great honor to work with a highly capable team in our Office materially higher than they were just a year ago when interest rates were of the CIO these last years as we provide you, our valued clients, with much lower, indicative of how much value may be earned over time by taking insights designed to make your lives better as we make your portfolios illiquidity risk when others are less willing to do so. more resilient. Wishing us all a better, healthier and peaceful 2023. Toward a new normal with new risks Over the past six months, we have written about the “little fires” burning DAVID BAILIN across the globe.2 No one knows how or when the war in Ukraine will end. Chief Investment Officer and We cannot be sure of China’s trajectory given its election of like-minded Global Head of Investments leadership. And we certainly do not know what political events will unfold Citi Global Wealth in response to the recession itself, as governments will lack the resources needed to support individuals and companies as they did through the pandemic. In short, markets today are assuming that none of these little fires grow bigger or come together in an untimely way – see Expect the unexpected: How we might be wrong. That itself means that investors need to think of “sequencing” as a useful investing discipline. 2 The Squeeze Is On - CIO Strategy Bulletin, Citi Global Wealth Investments, 9 Oct 2022

1.2 Roadmap to recovery: Markets lead, the economy follows We expect global growth will deteriorate for some of 2023. Markets will then increasingly focus on the recovery that lies beyond. We enter the year defensively positioned but expect to pivot as a sequence of potential opportunities unfolds. STEVEN WIETING Chief Investment Strategist and Chief Economist ƒ The Fed’s cumulative monetary tightening will likely stifle the world economy no later than mid-2023 ƒ For portfolios now, we remain cautious, seeking returns through high-quality equities and bonds, as well as capital markets and alternative strategies for suitable investors ƒ Markets will start focusing on 2024’s recovery sometime in 2023, enabling us to take greater investment risks across a variety of asset classes ƒ As interest rates peak, we would expect to shift first to quality growth equities in non-cyclical industries ƒ A 10% decline in broad corporate profits in 2023 should hit many cyclical industries before any recovery takes hold ƒ As unemployment rises, we expect the Fed to reverse course by the second half of 2023, with fixed income yields dropping ƒ The US dollar’s bull market could overshoot even higher, but chances are building of non-US assets and currencies finding a “deep value bottom” in 2023 ƒ While Fed drama has distracted many investors, we call for renewed attention on the unstoppable trends transforming the world economy Citi Global Wealth overview | | 10 Investments

Citi Global Wealth overview | | 11 Investments The post-COVID economic boom of 2021 has FiGUre 1. How THe Cov iD SHoCK HAS DiSTorTeD GrowTH AND iNFLATioN given way to a bad “hangover” as we head into 2023. As with any day-after pain, today’s 25% Post WWII CPI-U Real US GDP headache will not last. But many investors find boom it difficult even to imagine recovery. We believe 20 "Great inflation" change for the better will come in 2023, even as 15 WWII Korean OPEC COVID, e War embargo Ukraine markets face challenges along the way. g n a 10 Vietnam Gulf War Growth and inflation were never destined to Ch War 5 stay in their previous narrow ranges given the % COVID shock and war in Ukraine – FIGURE 1. /Y 0 Much of today’s economic distortion derives Y from unusual disruptions to supply and vast, -5 unpredictable swings in demand. Aggregate Arrows show historically wide range demand stimulus was not the right medicine -10 for these problems. Stimulating demand '40 '47 '54 '61 '68 '75 '82 '89 '96 '03 '10 '17 '24 without stimulating supply generates painfully Source: Haver, as of 29 Sep 2022. high inflation. Chart shows year-on-year (%) changes in consumer price inflation and real US GDP, with arrows around the 2020-2023 period to denote historically One way to avoid compounding a hangover is to wide ranges in real GDP. stop drinking. Tightening fiscal and monetary policy is the economic equivalent of that. US FiGUre 2. FiSCAL AND MoNeTArY reSTrAiNT reTUrN federal spending has fallen 11% year to date, for example – FIGURE 2. Real consumer goods 150% spending has fallen about 1% in 2022 to date Reserve bank credit outstanding with the bulk of Fed monetary tightening’s 125 impact yet to come. The slowdown in consumer e 100 g spending and the sharp rise in goods inventories n 75 a will put the brakes on global trade growth and Ch50 corporate profits in 2023 – FIGURE 3. % 25 /Y 0 Y -25 -50 Federal outlays '72 '77 '82 '87 '92 '97 '02 '07 '12 '17 '22 Source: Haver, as of 29 Sep 2022. Chart shows US Federal spending and Federal Reserve credit Y/Y%.

Citi Global Wealth overview | | 12 Investments FiGUre 3. SoAriNG iNveNTorieS, weAKeNiNG TrADe AHeAD We expect a global recession in 2023 – FIGURE 4. Indeed, the 1.7% annual global growth we expect is likely to be weakest in forty Recession Real manufacturing & trade Nominal retail 25% years outside of the Global Financial Crisis year of 2009 and the COVID shutdown year of 2020. 20 Among the major economies, the eurozone and 15 the UK are likely to come out worst, with full- year contractions of 0.5% and 1% respectively 10 as they contend with sky-high energy costs, as 5 well as policy tightening. 0 China looks to be one year ahead of the US and -5 may provide some diversification to portfolios in the years to come. Amid weak labor markets and % change year-on-year-10 a real estate crisis, the world’s second-largest -15 economy is already in monetary easing mode. After two dismal years, we expect low Chinese -20 profits to rise along with expanding money '70 '75 '80 '85 '90 '95 '00 '05 '10 '15 '20 supply, just as US profits and money supply contract. However, its near-term prospects rely Source: Haver, as of 29 Sep 2022. on the ongoing relaxation of its strict COVID Chart shows year-on-year percentage changes in real manufacturing and trade inventories and nominal changes in retail inventories. Gray shaded measures and continued support for its nascent areas are recessions. real estate recovery – see Asia: Broader re- opening to enable regional recovery. FiGUre 4. reAL GDP AND CiTi GLoBAL weALTH iNveSTMeNTS’ ForeCASTS With the US likely entering a mild recession and Citi Global wealth investments unemployment probably exceeding 5%, we see the greatest surge in inflation as largely behind real GDP Forecasts (Updated as of August 2022) us in 2022. That said, US inflation is unlikely 2020 2021 2022 2023 2024 to reach pre-COVID norms in 2023. We see it China 2.4 7.5 3.5 4.5 4.0 retreating to 3.5% by end-2023 and 2.5% by US -3.4 5.7 1.6 0.7 2.0 end-2024, while averaging higher during those calendar years. Our estimates are unchanged eU -6.5 5.3 3.0 -0.5 1.0 despite our reduced economic growth forecasts UK -9.3 7.4 3.4 -1.0 1.0 since June 2022 and slow recovery expectation Global -3.2 5.7 3.3 1.7 2.3 for 2024. Source: Citi Global Wealth Office of the Chief Investment Strategist assumptions, as of June 24, 2022. Chart shows real GDP changes in percentage for China, the US, EU, UK and world between 2020 and 2024, with forecast data from 2022 onward. All forecasts are expressions of opinion, are subject to change without notice are not intended to be a guarantee of future events. Indices are unmanaged.

Citi Global Wealth overview | | 13 Investments The Fed has not been able to end recessions What might mark the bottom for markets amid reports of falling inventories. Such datapoints quickly once underway. However, it does have a the coming recession? As usual, producers will will be among the preconditions for recovery. history of frequent policy reversals. In the past overreact to demand weakness, cutting output Earnings per share will likely only follow equities 45 years, peak policy rates have been sustained too far. Within several months of that moment, higher, with the past lag having been about six for only seven months on average before cutting the “excessive caution” will be followed by months – FIGURE 5. rates. If the Fed can soon find a balance between the excessive easing of 2021 and the rapid tightening it has “rhetorically” encouraged in FiGUre 5. eArNiNGS Per SHAre BoTToM LATer THAN MArKeTS 2022, it might avoid amplifying financial and economic excesses. EPS estimate MSCI World AC (6-month lead) 90% Positioning for a year of 70 challenges and change r 50 Across 2022, investors braced for the forecast a e 30 2023 recession. The resulting bear market is r-y well underway, although incomplete. A new bull e v 10 market has never begun before a recession has r-o even started. Most typically, a bull market begins a -10 e at around the mid-way stage of a recession. Y The very strong communications of the Fed’s -30 intentions and a year of bearish anticipation may see markets bottom somewhat sooner -50 than usual. However, as of late November 2022, -70 a recessionary decline in employment and corporate profits has not even begun. '97 '99 '01 '03 '05 '07 '09 '11 '13 '15 '17 '19 '21 '23 Within 2023, we expect investors to start discounting 2024’s recovery. Only twice in the Source: Haver, as of 30 Nov 2022. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes past century – including the Great Depression only and do not represent the performance of any specific investment. Past performance is no guarantee of future results. Real results may vary. – did US equities take more than two calendar All forecasts are expressions of opinion, are subject to change without notice, and are not intended to be a guarantee of future events. years to find a lasting bottom. But further losses might still come first.

Citi Global Wealth overview | | 14 Investments FiGUre 6. DoLLAr reACHiNG HiSToriC eXTreMeS The US dollar may overshoot 140 In the coming environment, we look for an end to the US dollar’s mighty ascent. This period of strength has been its third such secular bull market since it began floating freely in 1971 – 130 FIGURE 6. However, there is a risk that it will overshoot, rising for longer than is justified by fundamental drivers. There are precedents for such an overshoot. 120 While the Fed began easing during the 1982 recession, the dollar continued rising sharply until 1985. And the currency’s strength persisted through much of 2002, despite the 2001 tech 110 bubble burst. The US experienced an asset bubble-induced recession in 2001. Despite sharp declines in real 100 interest rates and a dramatic drop in equity valuations during the period, the US dollar Dollar Index (Jan 2006 = 100) continued to rise through much of 2002. Given this, predicting a peak in the US dollar is 90 tricky. We feel confident in our view that US and global equities will find a bottom and US rates a peak. Nevertheless, present circumstances suggest a peak value for the dollar – and trough 80 values for major currencies – will be reached in 75 80 85 90 95 00 05 10 15 20 the coming year. This will have lasting positive implications for returns in non-US assets for Source: Haver, as of 30 Oct 2022. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes many investors for years to come. only and do not represent the performance of any specific investment. Past performance is no guarantee of future results. Real results may vary. Chart shows US dollar index between 1973 and 2022. Gray areas represent US recessions.

Citi Global Wealth overview | | 15 Investments A possible path through: FiGUre 7. oUr PoTeNTiAL “GLiDe PATH” For 2023 opportunities now, THE GLIDE PATH THROUGH 2023 opportunities later In the year of challenges and change that we expect, we see various potential opportunities for investors. A sharp fall in valuations across FEDERAL RESERVE FED HALTS MARKET ANTICIPATES ECONOMY many markets have driven up our ten-year RAISES RATES TO RATE RISES RECOVERY BOTTOMS strategic return estimates – see The brighter 4.75-5.0% (AND EVENTUALLY CUTS) long-term outlook for asset classes. On a tactical view, the opportunities may present themselves in a sequence, some sooner and others later. In early 2022, rapidly rising interest rates created uncertainty for valuing any financial asset. The rough doubling in POSITIVE EMPLOYMENT US AND GLOBAL government bond yields over the past year has TURNS TO NEGATIVE RECESSION UNDER- THE DOLLAR boosted higher quality fixed income yields to EMPLOYMENT WAY BEGINS TO FALL a more appropriate level for the first time in several years. Given a slowing cyclical backdrop, we see a stronger potential opportunity for fixed income assets within overall portfolio construction and to earn income on excess cash – see Pursuing portfolio income with short- term bonds. In the environment we expect, US 10-year Treasury yields may end 2023 at 3.0%. Heading into 2023, we believe defensive equities may perform best near term and we remain Source: CGWI Office of the Chief Investment Strategist, as of October 11, 2022. All forecasts are expressions of opinion, are subject to change overweight US dollar assets. By contrast, we without notice, and are not intended to be a guarantee of future events. Indices are unmanaged. An investor cannot invest directly in an index. remain cautious on Europe and Japan. However, we note that most non-US equities’ poor performance in 2022 was owing to collapsing local currencies rather than local returns falling. This may start correcting in 2023 as peak fear and peak policy divergence with the US sets in – FIGURE 8.

Citi Global Wealth overview | | 16 Investments If so, long-lasting income-producing assets in Although the valuations of many innovative such as cybersecurity and green tech – Energy Europe, Japan and others might be bought companies and sectors are under pressure, security is vital. By contrast, at the end of the at unusually depressed values – see Europe: there is no fundamental change in their “dot-com” bubble in the early 2000s, both Bracing for winter recession and Asia: Broader prospects. While there were many distortions in valuations and fundamentals unwound very re-opening to enable regional recovery. Just as the COVID economy, we do not expect a global sharply together. a single example, German REITs have returned reduction in expenditures in essential areas negative 40% in US dollar terms in 2022 and now yield 12%. If Europe were to recover half of its losses of the past two years, the annualized FiGUre 8. US DoLLAr SUrGe CoULD reverSe AFTer overSHooT return would be 19% in US dollars, even assuming no change in REITs’ price. Country/region YTD return (local ccy) YTD return (USD) YTD FX return (vs USD) For many cyclical industries, however, a Brazil 7.7 12.5 4.8 bottom may occur late in 2023. Before then, US -15.9 -15.9 0.0 economic weakness will depress interest rates. Switzerland -13.7 -17.7 -4.0 Industry-leading growth equities may bottom Canada -3.3 -9.1 -5.8 before cyclicals, however. We also look for the China (A shares) -22.1 -30.9 -8.8 recessionary conditions to create potential europe -7.3 -16.7 -9.4 opportunities for certain alternative strategies – see Alternative investments may enhance Australia 4.8 -5.0 -9.8 cash yields. Korea -19.1 -29.2 -10.1 We continue to focus on what drives economic india 3.5 -5.7 -9.1 growth over time and generates real investment Taiwan -18.6 -27.8 -9.2 returns. Apart from population growth, real UK 5.6 -8.0 -13.6 economic growth is entirely determined by Japan 0.5 -18.6 -19.0 innovation. Developing new tools or better processes leaves us with means to create Source: Haver, as of 24 Nov 2022. more output per person. Money – what central Table shows the performance of various national equity markets in local currency terms, US dollar terms and the contribution to return of foreign banks give and take away – provides us none exchange movements. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do of it. In general, the information technology not represent the performance of any specific investment. Past performance is no guarantee of future results. Real results may vary. and healthcare sectors have capitalized most on innovation and enjoyed the most potent demographic forces to drive superior long-run returns – FIGURES 9 AND 10. We explore these in How unstoppable trends are redefining real estate and Digitization and the growth in alternative investments.

Citi Global Wealth overview | | 17 Investments FiGUreS 9 AND 10. iT AND HeALTHCAre’S wHAT To Do Now? GrowiNG iMPorTANCe While investing in 2022 was deeply challenging, any one year IT Recession Share of EPS Share of Mkt Cap represents a mere “moment” in the lifetime of a portfolio. And even 40% though the economic environment in 2023 may prove to be difficult, 35 the greatest risk at times like these comes not from enduring the turbulent conditions but from trying to avoid them by market timing. 30 025 Given the high probability of recession in the US and elsewhere in 0 2023, we enter the year with a defensive asset allocation, albeit fully 5 20 &P invested. However, as 2023 unfolds we will take a dynamic approach S15 to tactical asset allocation. As markets ultimately find a bottom, f our positioning is set to evolve toward equities and alternatives that o 10 % anticipate a recovery. 5 As a first step toward building portfolios for the year ahead and 0 beyond, investors should assess their present positioning. To help our '85 '90 '95 '00 '05 '10 '15 '20 existing clients in this review, our Outlook Watchlist report can review HEALTHCARE your exposure to key sources of potential risk and return, including 20% our long-term investment themes. We can then discuss actionable 18 strategies to help you adjust your allocation for the coming year and 016 beyond. Please note this is not available to prospective clients at 0 this time. 5 14 &P12 Outlook 2023 is your roadmap to understanding the route to economic S f recovery. Let us be your partner and guide on this road to recovery. o10 %8 6 4 '85 '90 '95 '00 '05 '10 '15 '20 Source: FactSet, as of 21 Nov 2022. Charts show the rising trend of the market capitalization and earnings per share for the IT and healthcare sectors, expressed as a % of the total S&P 500 Index. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Past performance is no guarantee of future results. Real results may vary.

1.3 Expect the unexpected: How we might be wrong While we expect recession in 2023, it STEVEN WIETING could be deeper than we expect – or not Chief Investment Strategist and Chief Economist happen at all. We consider this and other risks to our views in both directions. ƒ Monetary tightening amid ongoing supply shocks will likely hurt economic growth in 2023, albeit with inflationary pressure diminishing ƒ Self-reinforcing, 1970s-style inflation would force key central banks to drive a much harder economic landing than we expect ƒ But if inflation fades quickly, the US economy particularly has a small chance of avoiding recession ƒ US-China military escalation or a complete breakdown of trade relations are major if improbable risks for the world economy ƒ Issues over Russia’s oil exports and Ukraine’s agricultural exports could still cause disruptions ƒ A large-scale cyberattack also could potentially create widespread economic damage ƒ In the face of all these and other risks, we advocate globally diversified asset allocation, in line with your specific investment objective Citi Global Wealth overview | | 18 Investments

Citi Global Wealth overview | | 19 Investments The past three years have seen both the fastest including WWII have not caused turning points in on “unlicensed” US citizens from working for pace of economic contraction on record and economic activity – FIGURE 1. Chinese firms in producing advanced chips. the fastest recovery. The period has also seen a new ground war in Europe on a scale not But what about the exceptions? World War II was As COVID-related supply chain disruptions seen since World War II, with nuclear warnings a grave catastrophe for humanity that deserves highlight, there are acute vulnerabilities in from global leaders for the first time since the special consideration. That conflict aside, the the trade of intermediate products such as 1980s. Relations between the US and China are OPEC oil embargo of late 1973 catalyzed a world- semiconductors. Disruptions could hamper a critically important to both sides yet precarious. wide recession and higher consumer prices at much larger share of the economy than the In short, this is not an environment in which to the same time. value of individual components might imply. The have overly confident views. world’s vast dependency on Taiwan-sourced The present Russia-Ukraine war – along with semiconductors represents such a concentrated In response to nuclear rhetoric from Russia, the first Gulf War of 1990 and Iraq-Iran war supply risk in our view – FIGURE 2. President Biden drew parallels with the Cuban beginning in 1980 – has strong similarities to Missile Crisis. The 35-day standoff in October- the OPEC embargo shock. Each of these events November 2022’s meeting between Presidents November 1962 arose when the USSR sought to had significant negative regional impacts and Biden and Xi helped boost confidence that station nuclear weapons on the island just 90 some notable global effects. Importantly, central neither side seeks immediate escalation – see miles (145 km) from the US mainland. It stands banks have never been able immediately to Asia: Broader re-opening to enable regional as a powerful example of binary geopolitical risk. offset the inflationary impact of supply shocks recovery. The world can only hope that the G2 It is widely regarded as the closest the world has no matter what their hoped-for inflation targets superpowers continue to prevent their strategic come to nuclear warfare since the end of World might have been. competition from evolving into conflict. War II. The leaders of the US and USSR pulled back The risk of overlapping shocks If inflation persists from the doomsday scenario. Subsequently, the world economy grew strongly between 1963 and Today, we worry about overlapping shocks and Massive fiscal and monetary stimulus in 1969. The US economy grew an average 4.3% the willingness of the US to pursue multiple response to the COVID shock tested the global annually during the period, including a recession problems at the same time, creating “joint economy’s “speed limit.” Policymakers took that began fully eight years later. With one probability risk.” Monetary tightening, strategic too much for granted, and inflation surged short bear market to endure, investors enjoyed competition with China and isolating Russia worldwide. Large shifts in demand within the strong equity market returns over most of the are all being pursued simultaneously, raising economy led to shortages of goods. Some remaining decade. the likelihood that a trigger event will cause consumers were willing to purchase these goods a cascade of impacts that ripple across world at much higher prices. Within the short period of grave nuclear risk markets and the economy. that could have ended very differently for all of Following a surge in goods prices and a humanity, US equities dropped less than 10% The decision of the US administration to limit temporary drop in employment, US consumers before regaining it all and more. So, what is the US content in China’s computing industry – turned their sights on labor-intensive services. lesson of the Cuban Missile Crisis for investors? particularly advanced semiconductor equipment Demand persistence – and a labor force still Among many conclusions, we would highlight – was expected. However, the extent of the suffering from COVID distortions – has had that 90% of geopolitical shocks since and US’ actions went much further than most second-order impact on wages. These have risen investors ever expected. It included prohibitions by the most on a per-person basis since the early 1980s.

Citi Global Wealth overview | | 20 Investments FiGUre 1. SeLeCTeD HiSTorY oF GeoPoLiTiCAL CoNFLiCTS, SHoCKS AND MArKeT reACTioNS S&P 500 (% since Nikkei (% since event date) MSCi world ex USA DXY Dollar index Geopolitical event Date event date) (% since event date) initial 30 days 90 days initial 30 days 90 days initial 30 days 90 days initial 30 days 90 days reaction reaction reaction reaction Cuban Missile Crisis 19 oct 1962 -3.78 7.61 17.16 JFK assasination 21 Nov 1963 -2.81 3.06 8.28 US bombs Cambodia 29 Apr 1970 -15.30 -6.43 -4.94 -15.93 -12.49 -7.64 -10.45 -17.01 -16.07 -0.20 -0.23 -0.51 Arab oil embargo 18 oct 1973 -16.23 -8.45 -13.04 -1.81 -1.44 -4.47 -14.68 1.96 -18.53 7.48 5.28 14.04 USSR invades 24 Dec 1979 -2.27 5.37 -7.78 0.57 2.63 0.68 3.94 3.94 11.85 -1.06 -0.71 5.91 Afghanistan US bombs Libya 15 Apr 1986 2.95 -1.39 0.16 3.09 3.73 16.08 0.00 6.19 8.16 -4.15 -4.80 -5.30 US invades Panama 15 Dec 1989 -2.06 -3.73 -3.43 0.63 -3.71 -14.63 0.00 3.67 -7.04 0.31 -1.69 -0.44 Gulf War 24 Dec 1990 -4.16 0.09 12.10 -6.95 -4.43 10.47 1.75 1.75 15.97 -0.21 -3.61 4.90 World Trade 26 Feb 1993 -0.31 1.67 2.04 -0.44 12.36 23.00 0.00 8.52 18.62 0.18 -1.15 -4.79 Center bombing 911 11 Sep 2001 -11.60 0.45 4.34 -6.28 1.48 3.68 -8.48 3.24 5.48 -1.08 0.29 1.85 US invades Iraq 20 Mar 2003 2.49 2.06 15.57 4.77 -1.02 12.94 1.53 4.58 22.05 0.84 -1.85 -7.89 NorTH KoreA-reLATeD Korean War 23 Jun 1950 -12.80 -8.67 1.20 Operation 18 Aug 1976 -3.15 1.64 -4.32 -0.75 -0.21 -4.52 0.00 -0.26 -7.60 0.07 -0.57 -0.12 Paul Bunyan 2009 nuclear test 25 Apr 2009 -1.28 5.09 13.05 -2.46 6.92 14.20 -2.32 12.28 21.21 0.52 -5.54 -7.04 2016 nuclear test 9 Sep 2016 -2.55 -0.81 2.97 -2.03 0.39 10.65 -2.06 -0.81 -0.72 -0.01 1.36 6.05 2017 escalation 7 Jul 2017 -0.24 -0.64 4.44 -0.30 -3.89 12.43 -0.26 -0.49 3.60 0.23 -1.22 1.62 PoLiTiCAL eveNTS Nixon/Watergate 15 Mar 1974 -1.72 -7.28 -8.04 -1.80 1.05 4.42 0.00 -2.57 -6.12 -1.04 -1.57 -2.12 Clinton 20 Aug 1998 -12.30 -6.20 5.59 -8.34 -11.66 -6.74 -12.75 -12.75 -6.37 -1.76 -5.18 -6.58 intern scandal Brexit 23 -2.30 4.30 3.72 -6.93 3.50 4.62 -5.31 -0.37 1.70 1.85 4.00 2.46 Jun 2016 Source: Haver, as of 14 Oct 2022. Table lists select geopolitical events since the Pearl Harbor attacks of 1941 until Russia’s invasion of Ukraine, and the associated initial, 30-day and 90-day performances of the S&P 500 Index, crude oil, the MSCI World Index ex USA and US dollar Index. Past performance is no guarantee of future results. Real results may vary. Indices are unmanaged. An investor cannot invest directly in an index. Index returns do not include any expenses, fees or sales charges, which would lower performance. They are shown for illustrative purposes only.

Citi Global Wealth overview | | 21 Investments FiGUre 2. US DePeNDeNCY oN iMPorTS oF TAiwANeSe SeMiCoNDUCTorS US labor markets today are more competitive and the economy is more open than in the 1000 1960s-1980s period. Nonetheless, many Fed 900 Recession policymakers fear inflation will develop “a life of 800 Taiwan exports of its own” and persist beyond the initial sources of semis to US instability. Indeed, if wages and services prices 700 beyond shelter costs fail to decelerate, the Fed n 600 would likely maintain a restrictive monetary b 500 policy deep into a US economic contraction and $ 400 with little regard for wider global impact. This 300 is the most likely path to a deeper economic contraction than we expect, and one that does 200 not depend on any new external shocks. 100 0'02 '05 '08 '11 '14 '17 '20 If inflation slows quickly Source: Haver, through 10 Nov 2022. Given our pessimistic near-term outlook, we Chart shows US imports of advanced technology from Taiwan, including semiconductors. Gray shaded periods denote recessions. must acknowledge upside risk to our views. Since early 2020, US employment has only grown 0.7%, far from a boom. Exogenous FiGUre 3. Fewer HoUSeS SoLD, Fewer CoNSTrUCTioN worKerS NeeDeD inflation – arising from a variety of outside shocks including pandemic impact and conflict- 1100 1400 driven trade disruptions – held the economy New single family back but this drag on consumer incomes is 1000 houses sold (right) 1200 already diminishing. While the most reliable long-term leading indicator of the US economy s 900 1000 s – the yield curve – is signaling recession for the d d coming year, no indicator is flawless. The near- n n a a term outlook is one of still-rising US employment s 800 800 s u u and falling inflation. This is a brief window for o o h h the Fed to “de-escalate” its tightening campaign. T 700 600 T Residential After all, unlike the 1970s-1980s period, inflation 600 constructions 400 expectations remain very contained. Price- employment (left) resistant consumers are likely to help the Fed 500 200 by reining in demand and will not assume wages will accelerate. '86 '90 '94 '98 '02 '06 '10 '14 '18 '22 Unfortunately, the most likely case for the Source: Haver, as of 24 Nov 2022. economy is one of both weakening growth and Chart shows new home sales in thousands compared to residential US construction employment in thousands, both series seasonally adjusted Gray slowing inflation. We believe the lagged impact shaded periods denote recessions. of the Fed’s very potent action to date will

Citi Global Wealth overview | | 22 Investments find its way into economic activity and trigger adjustable rates – the housing market of 2023 wHAT To Do Now? 1 an employment contraction within 2023. The doesn’t support the same level of employment – Fed is also tightening further and will continue FIGURE 3. While we do not have the same There are various major risks to the world shrinking its balance sheet until something detailed history of construction categories, economic outlook. The future could involve changes its policy. since the end of WWII, all periods of at least a many different outcomes, not just the year or more of broad construction employment one best expressed in our existing asset After a more than doubling of mortgage decline have seen total private employment drop allocation or where we expect to take it. As rates in the US in 2022 – and even more in – FIGURE 4. the COVID pandemic so brutally reminded some other economies with heavy reliance on us, major but improbable risks are always with us. We thus seek to preserve and FiGUre 4. wHeN CoNSTrUCTioN eMPLoYMeNT FALLS, So DoeS THe overALL grow wealth by way of a diversified asset JoBS MArKeT allocation rather than taking highly concentrated risks in pursuit of the highest Construction employment (left) Total employment (right) returns. While there are specific hedging techniques that your relationship team 20% 10% may recommend based on your suitability 15 8 and objectives, our analysis shows that 6 strong risk-adjusted returns over the 10 past 80 years have been earned from e 4 e g 5 g investment allocations including lowly n 2 n a a correlated or negatively correlated assets.2 Ch Ch 0 0 Such an allocation can be constructed % % around suitable risk and return objectives. /Y -5 -2 /Y Y -4 Y -10 -6 -15 -8 -20 -10 '47 '53 '59 '65 '71 '77 '83 '89 '95 '01 '07 '13 '19 Source: Haver, as of 24 Nov 2022. Chart shows percentage year-on-year changes in construction employment and total private industry employment between 1947 and 2022. 1 Haver, as of 20 Nov 2022 2 Our analysis is based on Adaptive Valuation Strategies, the Private Bank’s proprietary strategic asset allocation methodology that has a historical database dating back to 1926. Our analysis was performed at an asset class level using indices as a proxy for each asset class. For more details, please see https://www.privatebank.citibank.com/insights/a-new-approach-to-strategic- asset-allocation. All forecasts are expressions of opinion, are subject to change without notice are not intended to be a guarantee of future events. Past performance is not indicative of future returns.

While global growth is set to worsen for For current clients, our personalized Outlook some of 2023, we also expect markets Watchlist compares your portfolio to the Is your portfolio ready to start focusing on the recovery that allocation we recommend for you. And our lies beyond. Global Investment Lab’s wider range of tools We believe this calls for dynamic portfolios can highlight other potential opportunities to for a year of change that are ready to pivot as a sequence of prepare your portfolio for the years ahead. and opportunity? potential opportunities unfolds. This includes Please request your personalized Watchlist quality investments amid the present report from your relationship team today. uncertainty and exposure to the sources of long-term growth. 1/1 1/1 1/1 Citi Global Wealth | 23 Investments

Citi Global Wealth overview | | 24 Investments OUR POSITIONING DECEMBER 2021 DECEMBER 2022 Opportunities GLOBAL EQUITY -2.0% More defensive equities for the near term, including 6.0% dividend growers Developed Equities 1.7% -6.6% Quality short- to intermediate-term US dollar fixed income, such as Treasuries and investment-grade Large US 1.5% 0.5% rated corporates/munis/preferreds Large Developed ex-US 1.2% -2.1% Various “deep value” non-US dollar assets (such as income-producing real estate) once the US dollar peaks Developed Small- and Mid-Cap -1.0% -5.0% Tailored investments that take advantage of higher rates Thematic Equities 4.0% 3.0% and volatility to provide yield and/or market participation with embedded downside hedges Emerging Market Equities 0.3% 1.6% Tailored investments delivering immediate yield or exposure to markets at entry points below current spot prices GLOBAL FIXED INCOME -5.0% 1.0% Digitization, such as robotics, semiconductor equipment, cyber security, fintech and real estate Developed Investment Grade -8.0% 1.3% Strategies around e-commerce logistics, multifamily US Investment Grade 1.9% 11.7% homes and quality, sustainable offices Alternative strategies positioned for distressed lending/ Developed High Yield -1.5% -1.5% recapitalization Thematic Fixed Income 4.0% 2.0% Companies driving the transition to secure cleaner sources of energy Emerging Market Debt 0.5% -0.8% Healthcare equities, including pharmaceutical biologics, life science tools, value-based care and agetech Overweight Cash -1.0% -1.0% Potential beneficiaries of G2 polarization as supply Underweight chains are reconfigured, including sectors in India, Thematic Commodities: Gold 0.0% 2.0% Southeast Asia and Mexico Neutral Figures are active over- and underweights on our GIC Risk Level 3 Portfolio. Source: Office of the Chief Investment Strategist, as of 1 Dec 2022.

1.5 Better long-term returns ahead 2022 saw valuations fall across asset GREGORY VAN INWEGEN Global Head of Quantitative classes. This points to potentially higher Research and Asset Allocation, returns over the coming decade, according Citi Investment Management to our proprietary methodology. PAISAN LIMRATANAMONGKOL Head of Quantitative Research ƒ Our strategic asset allocation methodology and Asset Allocation, Citi Investment Management predicts higher returns over the decade ƒ Meanwhile, many investors are sitting on excess cash in their portfolios ƒ History suggests this is likely to prove a costly mistake over time ƒ Our Investment Philosophy calls for fully invested, globally diversified portfolios throughout economic cycles Citi Global Wealth overview | | 25 Investments

Citi Global Wealth overview | | 26 Investments Being an investor was very tough in 2022. A rare simultaneous selloff FiGUre 1. AvS’ LoNG-TerM oUTLooK For ASSeT CLASSeS across many risk assets and the highest quality government bonds meant diversification failed for a time. Put simply, there was almost nowhere 2023 2022 Mid-Year 2022 return to hide, as the final column in FIGURE 1 shows. However, this cloud has Sre * Sre a long-term silver lining. The broad-based declines have driven many Global equities 10.0% 8.3% asset valuations down to levels that imply more rewarding future returns, Global Fixed income 5.1% 3.7% according to our proprietary strategic asset allocation methodology. Developed Market equities 9.5% 8.0% -19.22% Adaptative Valuation Strategies (AVS) looks out over a ten-year horizon. It emerging Market equities 13.6% 10.5% -30.86% uses current asset class valuations to produce annualized return forecasts investment-Grade Fixed income 4.6% 3.4% -14.57% or “Strategic Return Estimates” (SRE) for the decade ahead. This is based High-Yield Fixed income 7.4% 5.2% -12.35% on the insight that lower current valuations have given way to higher returns over time, whereas higher valuations have been followed by lower returns. It emerging Market Fixed income 7.8% 6.0% -23.32% then allocates to each asset class according to its outlook for returns. Cash 3.4% 1.5% 1.42% Hedge Funds 9.5% 6.5% -6.68% For Global Equities, AVS has an SRE of 10.0% out to 2033 – FIGURE 1. Within Private equity 18.6% 15.7% -15.50% this, Emerging Market Equities – shares from economies such as China, India and Brazil – have an SRE of 13.6%. Developed Market Equities – shares from real estate 10.6% 9.4% -27.89% economies such as the US, most of Europe and Japan – have an SRE of 9.5%. Commodities 2.4% 2.0% 17.65% For context, the SRE for Global Equities in the middle of 2022 was 8.3%. Cheaper bond valuations also point to higher returns. Investment-Grade Source: Citi Global Wealth Investments Global Asset Allocation team. Fixed Income – which includes bonds from the most creditworthy sovereign 2023 SREs are based on data as of 31 Oct 2022. Global Equity consists of Developed and Emerging Market and corporate issuers – now has an SRE of 4.6%. This is up from 3.4% Equity. Global Fixed Income consists of Investment-Grade, High-Yield and Emerging Market Fixed Income. in mid-2022, mainly due to interest rate hikes which pushed bond yields Strategic Return Estimates are in US dollars; all estimates are expressions of opinion, are subject to change without notice and are not intended to be a guarantee of future events. Strategic Return Estimates are no up globally. Despite selling off alongside equities in 2022, this asset class guarantee of future performance. Citi Private Bank Global Asset Allocation Team. SREs for Mid-Year 2022 has been less correlated to equities over time, helping investors to build are based on data as of 30 Apr 2022. Returns estimated in US dollars. Strategic Return Estimates (SRE) diversified portfolios. based on indices are Citi Private Bank’s forecast of returns for specific asset classes (to which the index belongs) over a 10-year time horizon. Indices are used to proxy for each asset class. The forecast for each The SRE for High-Yield (HY) Fixed Income – bonds issued by less specific asset class is made using a proprietary methodology that is appropriate for that asset class. Equity creditworthy corporate borrowers – has increased to 7.4%. Similarly, the asset classes utilize a proprietary forecasting methodology based on the assumption that equity valuations SRE for Emerging Market Fixed Income – bonds issued by emerging country revert to their long-term trend over time. The methodology is built around specific valuation measures that require several stages of calculation. Assumptions on the projected growth of earnings and dividends are governments and companies – has increased to 7.8%. The SRE for Cash has additionally applied to calculate the SRE of the equity asset class. Fixed Income asset class forecasts use a risen to 3.4%, meanwhile. proprietary forecasting methodology that is based on current yield levels. Other asset classes utilize other specific forecasting methodologies. Each SRE does not reflect the deduction of client advisory fees and/or In alternative asset classes, the SRE for Hedge Funds has risen to 9.5%. transaction expenses. Past performance is not indicative of future results. Future rates of return cannot be As at the mid-year stage, Private Equity remains the asset class with the predicted with certainty. The actual rate of return on investments can vary widely. This includes the potential highest SRE at 18.6%. This SRE is derived from small-cap public equity loss of principal on your investment. It is not possible to invest directly in an index. SRE information shown valuations, which are at historically cheap levels. By contrast, the SRE for above is hypothetical, not the actual performance of any client account. Hypothetical information reflects the application of a model methodology and selection of securities in hindsight. No hypothetical record can Real Estate has only edged up to 10.6%. completely account for the impact of financial risk in actual trading. See Glossary for definitions. * AVS SRE methodology was enhanced in 2022 and mid-year SREs reported reflect this enhancement.

Citi Global Wealth overview | | 27 Investments FiGUre 2: GLoBAL MULTi-ASSeT CLASS Having been the top performing asset class in 2022, Commodities are not DiverSiFiCATioN vS A CASH-HeAvY ALLoCATioN expected to do so well over the next ten years. Indeed, its SRE of 2.4% is the SiNCe 1985 lowest of the ten asset classes that AVS addresses, even below Cash. 31 Dec 1985 to 31 AvS risk Level Cash-heavy The perils of hoarding cash oct 2022 3 allocation allocation Developed Market equity 27% 34% The turmoil in 2022 has left many investors in a highly cautious mode. A emerging Market equity 5% - common reaction we encounter is holding large amounts of cash, perhaps investment-Grade 33% 33% as much as one-third of a total portfolio, with equal proportions in equities Fixed income and fixed income. And in fact, certain financial professionals, influenced by High-Yield Fixed income 3% - clients’ behavior, may be tempted to recommend such an allocation in the emerging Market Fixed income 3% wake of market shocks. How would such an allocation have performed over Cash 2% 33% time compared to one created by AVS? Hedge Funds 12% FIGURE 2 shows an AVS Global US dollar allocation at Risk Level 3. This is Private equity 10% intended for an investor seeking modest capital appreciation and capital real estate 5% preservation. Given this investor’s moderate appetite for risk, some Commodities 0% allocation to alternative and illiquid asset classes are suitable. ANNUALiZeD MeAN reTUrN 6.2% 3.9% The bottom two rows in FIGURE 2 show the hypothetical performance of ANNUALiZeD voLATiLiTY 9.0% 5.5% these two allocations over the past 37 years. Over the entire period, the AVS Risk Level 3 allocation would have outperformed the cash-heavy allocation portfolio by an annualized 2.3%. Hypothetically in dollar amounts, an initial Source: Citi Global Wealth Investments Global Asset Allocation team, as of 31 Oct 2022. investment of $1 million would have become $7.5 million for the Level 3 The performance of the AVS Global USD Risk Level 3 and the cash-heavy portfolio was calculated on an asset allocation, while the “cash-heavy” allocation would have grown to just $3 class level using indices to proxy for each asset class. million. That said, its volatility is also lower, at 5.5% versus 9.0%. However, 1 Net performance results for both portfolios reflect a deduction of 2.5% maximum fee that can be charged this is less risk than an investor at Risk Level 3 could take. As a result, they in connection with advisory services that covers advisory fees and transaction costs. Individuals cannot are inappropriately sacrificing performance potential by having too little directly invest in an index. The performance is for illustrative purposes only. risk exposure. 2 These are preliminary asset allocations for 2023. All performance information shown above is hypothetical, not the actual performance of any client account. Hypothetical information reflects the application of a model methodology and selection of securities in hindsight. No hypothetical record can completely account for the impact of financial risk in actual trading. For example, there are numerous factors related to the equities, fixed income or commodities markets in general which cannot be and have not been accounted for in the preparation of hypothetical performance information, all of which can affect actual performance. The returns shown above are for indices and do not represent the result of actual trading of investable assets/securities. The asset classes used to populate the allocation model may underperform their respective indices and lead to lower performance than the model anticipates.

Citi Global Wealth overview | | 28 Investments At moments of crisis, a cash-heavy approach FiGUre 3. GLoBAL MULTi-ASSeT DiverSiFiCATioN vS CASH-HeAvY ALLoCATioN has tended to outperform, but this can come AFTer THe GLoBAL FiNANCiAL CriSiS at great cost. For example, consider these two sets of allocations in August 2008, just before CUMULATIVE RETURN AFTER GFC 2008 the major selloff in risk assets – FIGURE 3. By the subsequent market lows seven months later 200% Recover from trough (March 2009), the cash-heavy approach would AVS Risk Level 3 have declined only by 17%, compared to 27% for Gain 10% the AVS Risk Level 3 allocation. However, after 180 Gain 30% this point, both began to recover and reached Gain 50% breakeven in 20 and 13 months respectively. 160 Thus, the AVS Risk Level 3 allocation recovered much faster than the cash-heavy allocation. Ten years later, the cash-heavy allocation would 140 have returned only 21%, compared to 50% for the AVS Risk Level 3 allocation. 120 Cash-heavy wHAT To Do Now? 100 Forecast 10-year returns have risen across 80 all asset classes, albeit in some cases more than others. Nevertheless, many investors are sitting on excess cash, whose 60 outlook has also improved from very low to modest levels. Our Investment Philosophy ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 ‘18 ‘19 ‘20 ‘21 ‘22 suggests this will prove an expensive mistake over time. We advocate fully Source: Citi Global Wealth Investments Global Asset Allocation team, as of 31 Oct 2022. invested, globally diversified portfolios for The performance of the AVS Global USD Risk Level 3 and the cash-heavy portfolio was calculated on an asset class level using indices to proxy for each the long term, aligned to an appropriate asset class. strategic asset allocation. 1 Net performance results for both portfolios reflect a deduction of 2.5% maximum fee that can be charged in connection with advisory services that Is your portfolio following a customized covers advisory fees and transaction costs. Individuals cannot directly invest in an index. The performance is for illustrative purposes only. long-term plan? 2 These are preliminary asset allocations for 2023. All performance information shown above is hypothetical, not the actual performance of any client account. Hypothetical information reflects the application of a model methodology and selection of securities in hindsight. No hypothetical record can completely account for the impact of financial risk in actual trading. For example, there are numerous factors related to the equities, fixed income or commodities markets in general which cannot be and have not been accounted for in the preparation of hypothetical performance information, all of which can affect actual performance. The returns shown above are for indices and do not represent the result of actual trading of investable assets/ securities. The asset classes used to populate the allocation model may underperform their respective indices and lead to lower performance than the model anticipates.

Citi Global Wealth Investments CONTENTS 2 Putting your cash to work in a higher rate environment 2.1 It is time to put excess cash to work 2.2 Pursuing portfolio income with short-term bonds 2.3 Why dividend grower “tortoises” may be core holdings 2.4 Why capital markets are more important than ever 2.5 Alternative investments may enhance cash yields

2.1 It is time to put excess cash to work Rising rates and volatile markets unsettled STEVEN WIETING Chief Investment Strategist investors in 2022. The new resulting and Chief Economist higher rate environment creates potential for seeking portfolio income. ƒ Difficult market conditions increased the temptation to sit on excess cash ƒ But 2022’s turmoil has also created more possibilities for putting cash to work ƒ Our expectation is for interest rates to peak and inflation to decline before long ƒ We favor various short-term US dollar–denominated bonds and dividend grower equities ƒ Suitable clients may consider select alternatives and capital markets strategies Citi Global Wealth PUTTiNG YoUr CASH To worK iN A HiGHer rATe eNviroNMeNT | | 30 Investments

Citi Global Wealth PUTTiNG YoUr CASH To worK iN A HiGHer rATe eNviroNMeNT | | 31 Investments Seeking refuge from stormy conditions is a FiGUre 1. THe CoST oF MArKeT TiMiNG fundamental human instinct. When financial markets are in turmoil, this often manifests itself HYPOTHETICAL GROWTH OF 10,000 USD IN S&P 500 SINCE JAN 1990 as an urge to switch from risk assets to cash. After all, sitting on the sidelines in cash can help 50 $16,130 you avoid the emotions that come from seeing a big drawdown in your portfolio’s value. It can also give you hope of buying risk assets later at a lower price. 30 $35,715 In 2022, the temptation to sit in cash was powerful for many investors. A rare 10 $95,205 simultaneous selloff in equities and bonds – as well as in many other asset classes – made Missing top # days the environment especially difficult. Cash did $131,251 generate a small gain in nominal terms, making 5 it the year’s second-best performer of ten broad asset classes – see Better long-term Full returns ahead. Period $207,811 With recession likely in the US and elsewhere in 2023, heightened uncertainty looks set to persist for now. Nevertheless, we believe Source: Haver and Bloomberg, as of 29 Sep, 2022. Hypothetical performance results have many inherent limitations. The portfolio performance that holding excess cash is risky. History has and return information reflects the benefit of hindsight and does not reflect the impact that material economic and market factors might have had shown that trying to time an entry into the on decision making of the Investment Lab or its affiliates were actually advise an investor in investing in these investments or managing an actual portfolio. Since the trades of the simulated performance results have not actually been executed, the results may have under- or over-compensated markets almost always fails. One reason for for the impact of certain economic and market factors, such as lack of liquidity. Also, hypothetical trading cannot fully consider the impact of financial this is that missing out on the gains at the risk, such as ability to withstand losses. An investor‘s investment in an actual portfolio will be made in different economic and market conditions start of a market recovery can seriously dent than those applicable during the period presented. It should not be assumed that an actual investor portfolio will experience returns comparable to long-term performance. the portfolio performance and return information presented herein. As a result of market activity following the date of the period presented, current performance may be different from that shown herein. All forecasts are expressions of opinion, are subject to change without notice and are not Amid the uncertainty, we see various ways to intended to be a guarantee of future events. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative put cash to work and seek portfolio income. purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary. Indeed, we believe the conditions that made life Chart shows the hypothetical performance of a market timing investor. Had such an investor missed only the ten highest returning days in the S&P so challenging for investors in 2022 have also 500 Index since 1990 – a period encompassing almost 8,000 trading days – their overall return would have been less than half of that of an investor created potential opportunities. who stayed fully invested. The short-term comfort of holding cash at stressful moments comes at a disproportionately large cost.

Citi Global Wealth PUTTiNG YoUr CASH To worK iN A HiGHer rATe eNviroNMeNT | | 32 Investments The US Federal Reserve’s interest rate hikes FiGUre 2. HiGHer rATeS, BUT NoT For MoNeY MArKeT STrATeGieS in 2022 were the fastest in its history. This proved painful for many assets, but particularly 6.0 for growth equities and longer term bonds. Fed funds rate (upper target) However, the resulting higher interest rate US Money Market Fund rate environment has left certain yields looking 5.0 2yr US Treasury yield attractive once more. As FIGURE 2 shows, though, these are not to be found in money market funds. 4.0 When it comes to certain US dollar-denominated bonds, however, it’s a different story. Yields ) on a range of assets have risen to levels not % ( seen in some years. And with the interest rate 3.0 te hiking cycle perhaps nearing completion and Ra inflation set to retreat in 2023, we see potential for Pursuing portfolio income with short- and 2.0 intermediate-term bonds. We also favor dividend growth equities, those with a track record of growing shareholder 1.0 payouts throughout economic cycles. Over time, these consistent dividend equities have outperformed their more dynamic 0.0 “growth” counterparts, rather like the tortoise '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 beating the hare – see Why dividend grower “tortoises” may be core holdings. Source: Haver Analytics, as of 22 Oct 2022. All forecasts are expressions of opinion, are subject to change without notice and are not intended to For suitable investors, we see potential for be a guarantee of future events. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes seeking to turn equity market volatility into a only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which source of income – see Why capital markets are would lower performance. Past performance is no guarantee of future results. Real results may vary. more important than ever. Likewise, we set out the case for various private market strategies – see Alternative investments may enhance cash yields. Higher interest rates have reshaped the investment landscape. Do not assume you will get security from holding excess cash. Rather, this is a time for putting liquid resources to work.

2.2 Pursuing portfolio income with short-term bonds Yields have risen sharply across 2022. This BRUCE HARRIS has created income-seeking opportunities Head of Global Fixed Income Strategy in US dollar short-term issues. KRIS XIPPOLITOS Global Fixed Income ƒ Fed tightening has driven bond prices down sharply, Portfolio Strategist, driving short-term rates to their highest since 2008 Citi Investment Management ƒ We believe the peak of the Fed hiking cycle may be coming into view ƒ As such, 2023 could bring opportunities to add shorter term, less volatile US-denominated bonds to portfolios ƒ Potential opportunities include shorter term US Treasuries, investment-grade credit, munis and preferred securities Citi Global Wealth PUTTiNG CASH To worK iN A HiGHer iNTereST rATe eNviroNMeNT | | 33 Investments

Citi Global Wealth PUTTiNG YoUr CASH To worK iN A HiGHer rATe eNviroNMeNT | | 34 Investments Yesterday’s bad news may be today’s FiGUre 1. FeD FUNDS rATe iMPLieD BY eUroDoLLAr FUTUreS opportunity. US dollar-denominated fixed income suffered its worst total return in many 6.0 decades in 2022. As of 22 November 2022, the Eurodollar Bloomberg US Aggregate Index total return for December yield the year was negative 13.3%, with sub-indices 2022 representing US investment-grade debt negative 5.0 2023 by 16.1%, US high yield shedding 11.2% and the US dollar-denominated emerging markets debt 2024 index 17.6% lower. Even US Treasury Inflation Protected Securities (TIPS) were down 12%. 4.0 In sum, fixed income investors had nowhere to hide. What caused the selloff? From a starting level ) % 3.0 ( of almost 0%, the Fed has raised its policy rates d 375 basis points (bps) in an effort to choke off l e i stubbornly high inflation, as of 3 November Y 2022. The market expects a bit more to come, 2.0 with the Fed funds rate seen ending 2022 at 4.5%. Potential additional hikes in 2023 would take the terminal rate – the peak of the rate- hiking cycle – to about 5.0%. 1.0 Unlike the Fed, the market has priced in a very brief stay at the terminal rate in 2023, followed by at least one rate cut by the end of 2023 – FIGURE 1. We believe the impact of 0.0 higher rates will hurt global economic growth May 21 Jul 21 Sep 21 Jul 21 Jan 22 Mar 22 May 22 Jul 22 Jul 22 Nov 22 as more cashflow goes to servicing debt, while also raising US unemployment as discretionary spending falls and sectors such as housing see a collapse in demand and construction. Source: Bloomberg, as of 21 Nov 2022. All forecasts are expressions of opinion, are subject to change without notice and are not intended to be a guarantee of future events. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary. Chart shows the Fed funds rates for periods ahead as implied by Eurodollar futures contracts.

Citi Global Wealth PUTTiNG YoUr CASH To worK iN A HiGHer rATe eNviroNMeNT | | 35 Investments As the Fed funds rate is likely to be around 4.5% FiGUre 2. TreASUrY rATeS HiGH CoMPAreD To eXPeCTeD HeADLiNe iNFLATioN by the end of 2022, we think the rate-hiking 8 cycle will be nearing completion. As such, 2023 2yr US TIPS yield could bring a major opportunity to add shorter term, less volatile bonds to portfolios to lock in 6 peak interest rates. “Shorter term” in this case means any issues with four years to maturity or less, although this will depend on your overall 4 2yr US nominal investment objectives and suitability. If rates Treasury yield keep rising, longer duration bonds will suffer ) greater losses. % (2 d l The main reason we prefer shorter term e i instruments – in addition to their high historical Y 0 yields – is that typically mark-to-market losses experienced in these instruments will be earned back once the bonds repay at maturity. Below, -2 we present some alternatives to consider for investing in shorter term bonds. -4 US Treasuries '04 '06 '08 '10 '12 '14 '16 '18 '20 '22 US Treasuries come in many different maturities, but the shorter maturities offer high rates by Source: Bloomberg, as of 21 Nov 2022. All forecasts are expressions of opinion, are subject to change without notice and are not intended to be recent past standards. Also, Treasuries offer a guarantee of future events. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only more liquidity and generally more yield than and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary. bank certificates of deposit (CDs), which typically Chart shows the nominal yield on 2-year US Treasuries and the yield on 2-year US Treasury Inflation Protected Securities (TIPS). can pay 50-100bps less than the same maturity Treasury. In addition, US Treasuries of course are issued by the US government so, unlike bank CDs, do not carry credit risk. These nominally high risk-free US government rates are also high compared to expected headline inflation as measured by TIPS – FIGURE 2.

Citi Global Wealth PUTTiNG YoUr CASH To worK iN A HiGHer rATe eNviroNMeNT | | 36 Investments Investment-grade credit FiGUre 3. SHorT-TerM CorPorATe YieLDS HAve CLiMBeD SHArPLY Corporate bonds have higher rates than 10 Treasuries, depending on their relative credit 9 risk. From a repayment perspective, the least US Corporate risky of these would be short-term investment- 8 Bond (1-3yr) yield grade–related (IG) bonds issued by large, healthy companies with low levels of debt compared 7 to earnings. In contrast, lower rated high-yield bonds with higher levels of debt to earnings ) 6 generally have more repayment risk. The short- % term IG index comprises debt of 1- to 3-year ( 5 d maturities, with low average duration – or price l e sensitivity to interest rate changes – of about i Y 4 1.9 years. The IG index currently yields about 5.34%, almost 1% above comparable maturity 3 (i.e., 2 year) Treasury bonds – FIGURE 3. 2yr US Besides investing in an index, investors may 2 Treasury consider owning individual bonds, as there may 1 yield be higher yield levels on individual IG-rated bonds for investors who understand the credit 0 risk of the issuer. An index is an “average” of '00 '02 '04 '06 '08 '10 '12 '14 '16 '18 '20 '22 yields, so today there are numerous examples of high-quality credits that pay above index yields. Source: Bloomberg, as of 21 Nov 2022. Past performance is no guarantee of future results. Real results may vary. Indices are unmanaged. An For example, many of the largest US banks investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific currently have bonds of less than three years’ investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. See Glossary for definitions. maturity that yield near or above 5%. For those Chart shows the yields on US short-term investment-grade corporate fixed income and 2-year US Treasuries. wishing to seek returns above those of the index, actively managed fixed income strategies are a wise consideration.