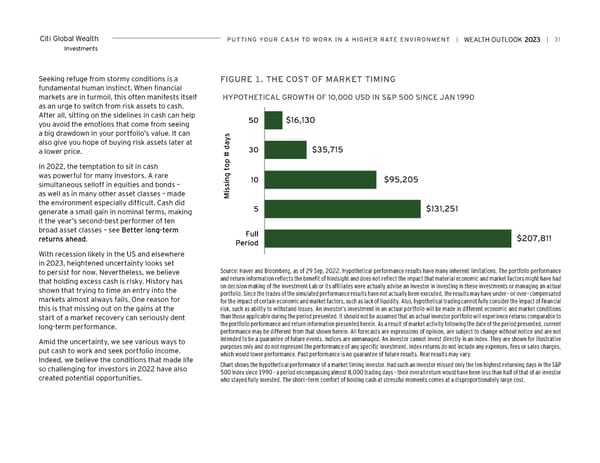

Citi Global Wealth PUTTiNG YoUr CASH To worK iN A HiGHer rATe eNviroNMeNT | | 31 Investments Seeking refuge from stormy conditions is a FiGUre 1. THe CoST oF MArKeT TiMiNG fundamental human instinct. When financial markets are in turmoil, this often manifests itself HYPOTHETICAL GROWTH OF 10,000 USD IN S&P 500 SINCE JAN 1990 as an urge to switch from risk assets to cash. After all, sitting on the sidelines in cash can help 50 $16,130 you avoid the emotions that come from seeing a big drawdown in your portfolio’s value. It can also give you hope of buying risk assets later at a lower price. 30 $35,715 In 2022, the temptation to sit in cash was powerful for many investors. A rare 10 $95,205 simultaneous selloff in equities and bonds – as well as in many other asset classes – made Missing top # days the environment especially difficult. Cash did $131,251 generate a small gain in nominal terms, making 5 it the year’s second-best performer of ten broad asset classes – see Better long-term Full returns ahead. Period $207,811 With recession likely in the US and elsewhere in 2023, heightened uncertainty looks set to persist for now. Nevertheless, we believe Source: Haver and Bloomberg, as of 29 Sep, 2022. Hypothetical performance results have many inherent limitations. The portfolio performance that holding excess cash is risky. History has and return information reflects the benefit of hindsight and does not reflect the impact that material economic and market factors might have had shown that trying to time an entry into the on decision making of the Investment Lab or its affiliates were actually advise an investor in investing in these investments or managing an actual portfolio. Since the trades of the simulated performance results have not actually been executed, the results may have under- or over-compensated markets almost always fails. One reason for for the impact of certain economic and market factors, such as lack of liquidity. Also, hypothetical trading cannot fully consider the impact of financial this is that missing out on the gains at the risk, such as ability to withstand losses. An investor‘s investment in an actual portfolio will be made in different economic and market conditions start of a market recovery can seriously dent than those applicable during the period presented. It should not be assumed that an actual investor portfolio will experience returns comparable to long-term performance. the portfolio performance and return information presented herein. As a result of market activity following the date of the period presented, current performance may be different from that shown herein. All forecasts are expressions of opinion, are subject to change without notice and are not Amid the uncertainty, we see various ways to intended to be a guarantee of future events. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative put cash to work and seek portfolio income. purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary. Indeed, we believe the conditions that made life Chart shows the hypothetical performance of a market timing investor. Had such an investor missed only the ten highest returning days in the S&P so challenging for investors in 2022 have also 500 Index since 1990 – a period encompassing almost 8,000 trading days – their overall return would have been less than half of that of an investor created potential opportunities. who stayed fully invested. The short-term comfort of holding cash at stressful moments comes at a disproportionately large cost.

Citi Wealth Outlook 2023 Page 30 Page 32

Citi Wealth Outlook 2023 Page 30 Page 32