Climate Tech Report Template

Podbook

Key Statistics ❖ Globally, the number of emerging technology companies tackling the climate crisis has increased 4x, by over 35,000 firms since 2010 to reach 44,595 in 2022. ❖ The UK is second only to the United States for the number of climate tech startups and scaleups - with over 5,200 climate tech pioneers now operating, compared to the US’ 14,300. ❖ 2021 was a record year for climate tech investment, with over $111bn raised by startups and scaleups globally, of which $4bn was raised by UK companies, and just under $39bn by US based companies. ❖ In 2021 climate tech companies globally raised more than enterprise software at $103.7bn, and in the footsteps of healthtech and fintech -

companies in which sectors raised $119bn and $129.4bn respectively. Overall, climate tech represented 15.3% of all investment into tech startups and scaleups in 2021 ($111bn of $726.4bn raised in total). in deals of over $250mn, compared to just 10.5% in 2017. ❖ The US dwarfs other countries when it comes to climate tech raises - at over 4x investment raised by these pioneering firms than the UK, in second place. Notably, France and Germany have seen some of the highest increases in climate tech investment over recent years (Germany registering a 344% increase in investment from 2020-2021, for example) eclipsing Sweden, which was second only to the UK for climate investment in Europe in 2020. ❖ 2022 is set to be another year for the books, with investment currently at $73.86bn. The recent high levels of climate tech investment are, in part, being driven by large rounds ($185mn +) into later stage companies ❖ The rising tide of tech investment has not been the sole cause of spiking climate tech deals, climate tech investment as a proportion of all investment has increased from just over 3% in 2017 up to 16.88% in 2022 ❖ Globally there are 160 climate tech unicorns, companies valued at over $1bn, of which 6% are based in the UK

❖ The US is home to the majority of high value climate tech firms, with 91 unicorns, including the likes of Rivian Automotive, creating emissions-free Electric Adventure Vehicles, Impossible Foods, and Tesla Motors - valued currently at $694.1bn. ❖ Estonia, a country known for its strong startup and scaleup sector, outperforms all other countries for investment per tonne of CO2 emitted ($79). Total investment in climate tech companies in Estonia reached over $1bn for the first time in 2022 and Estonia emissions are low (12 MMtCO2e or 0.04% of global emissions) due to its small population. ❖ Sweden invests $53 per tonne of CO2 emitted, placing it second behind Estonia. The nation is a leader in this space because of its climate innovation strategy. It promises to invest SEK 100 million per year towards climate strategies, and technological innovations in energy intensive industries. ❖ 73% of companies applying to Tech Nation’s two Net Zero programmes in 2022 highlighted growing partnerships as a scaling challenge, placing it as the top scaling challenge faced by climate tech startups and scaleups. This was closely followed by expanding into Europe and growing sales.

Introduction Name, Position Company Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse lobortis malesuada enim. In non pretium elit. Ut venenatis quam dui, at sodales erat pharetra et. Vestibulum non viverra nisl. In mollis, arcu sed cursus cursus, eros orci hendrerit massa, vitae vestibulum urna erat id erat.

Sed tincidunt aliquet tortor congue mollis. Suspendisse sit amet bibendum tellus. Morbi turpis massa, venenatis at tortor ac, efficitur malesuada metus. Proin maximus ullamcorper libero, quis ullamcorper orci sollicitudin et. Aliquam ac ligula finibus, ultrices diam nec, tempus dolor. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Nunc eleifend, libero posuere molestie condimentum, purus purus suscipit velit, nec pulvinar velit nulla ut orci. Aliquam vel massa purus. Suspendisse finibus, ex vitae elementum pulvinar, elit felis pretium libero, ac sodales mi metus sit amet ante. Duis aliquam aliquet porttitor. In dictum tortor in odio tempor, at rhoncus nibh volutpat. Pellentesque dapibus, odio vel consectetur tempus, lorem nulla cursus est, eu accumsan leo mauris ac leo. Nam ac velit ullamcorper, interdum leo eget, sagittis arcu. Quisque pharetra blandit elit, sed eleifend nibh dignissim et. Vestibulum auctor in lectus ut egestas. In sit amet tortor vel augue eleifend pharetra non sed nulla. Nam non lacus nec urna finibus pellentesque. Nulla imperdiet egestas ex et consequat. Nullam diam ligula, pharetra sit amet interdum ac, cursus id neque. Nullam vestibulum, enim et porttitor vulputate, diam sem sollicitudin elit, ac eleifend purus risus ac lacus. Maecenas ut nibh at eros eleifend malesuada.

Data Partners Many thanks to our data partners for this report, who have enabled a deeper understanding of the climate tech ecosystem than ever before. Special thanks to: (insert company names). Company Company 2 Company 3 1 Company 4 Company 5

Forewords Name, Position Company Nam ac velit ullamcorper, interdum leo eget, sagittis arcu. Quisque pharetra blandit elit, sed eleifend nibh dignissim et. Vestibulum auctor in lectus ut egestas. In sit amet tortor vel augue eleifend pharetra non sed nulla. Nam non lacus nec urna finibus pellentesque.

Sed tincidunt aliquet tortor congue mollis. Suspendisse sit amet bibendum tellus. Morbi turpis massa, venenatis at tortor ac, efficitur malesuada metus. Proin maximus ullamcorper libero, quis ullamcorper orci sollicitudin et. Aliquam ac ligula finibus, ultrices diam nec, tempus dolor. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Nunc eleifend, libero posuere molestie condimentum, purus purus suscipit velit, nec pulvinar velit nulla ut orci. Aliquam vel massa purus. Suspendisse finibus, ex vitae elementum pulvinar, elit felis pretium libero, ac sodales mi metus sit amet ante. Duis aliquam aliquet porttitor. In dictum tortor in odio tempor, at rhoncus nibh volutpat. Pellentesque dapibus, odio vel consectetur tempus, lorem nulla cursus est, eu accumsan leo mauris ac leo. Nam ac velit ullamcorper, interdum leo eget, sagittis arcu. Quisque pharetra blandit elit, sed eleifend nibh dignissim et. Vestibulum auctor in lectus ut egestas. In sit amet tortor vel augue eleifend pharetra non sed nulla. Nam non lacus nec urna finibus pellentesque. Nulla imperdiet egestas ex et consequat. Nullam diam ligula, pharetra sit amet interdum ac, cursus id neque. Nullam vestibulum, enim et porttitor vulputate, diam sem sollicitudin elit, ac eleifend purus risus ac lacus. Maecenas ut nibh at eros eleifend malesuada.

A Comment from (Company Name) Company Nam ac velit ullamcorper, interdum leo eget, sagittis arcu. Quisque pharetra blandit elit, sed eleifend nibh dignissim et. Vestibulum auctor in lectus ut egestas. In sit amet tortor vel augue eleifend pharetra non sed nulla. Nam non lacus nec urna finibus pellentesque. Nulla imperdiet egestas ex et consequat. Nullam diam ligula, pharetra sit amet interdum ac, cursus id neque. Nullam vestibulum, enim et porttitor vulputate, diam sem sollicitudin elit, ac eleifend purus risus ac lacus. Maecenas ut nibh at eros eleifend malesuada.

Growth & Investment

Companies in Climate Tech The number of emerging technology companies tackling the climate crisis has increased nearly 4x, by over 35,000 rms since 2010 to reach 44,595 in 2022 This explosion of firms throughout the 2010s reflects the exponential growth of climate tech, and reinforces hope that the key climate technologies are increasingly being funded to support the planet and the world tackle climate change. However, with the economic downturn negatively affecting the stock market and threatening investments to slow down, it is imperative that the private and public sector ensure that climate tech is prioritised and protected from any risk of financial decline.

(Source: Tech Nation, Net Zero Insights, 2022) On top of the UK’s first ever extreme heat warning being issued, heat records being broken and wildfires spreading across Europe, a recent study led by the UK Met Office has concluded that the probability of the world exceeding 1.5°C within the next 5 years is close to 50%, representing perhaps the starkest warning yet that the future of the planet hangs in the balance.

We would expect to see just over 66.5k climate tech companies globally by 2030 if the number of companies founded continues at the rate seen over the last decade, at a conservative estimate, this would mean climate tech companies would make up around 3% of the global startup and scaleup population by number. Using the same ten year trajectory for investment, by 2030 funding into UK climate tech would be just under $20bn per year, but this is still far from

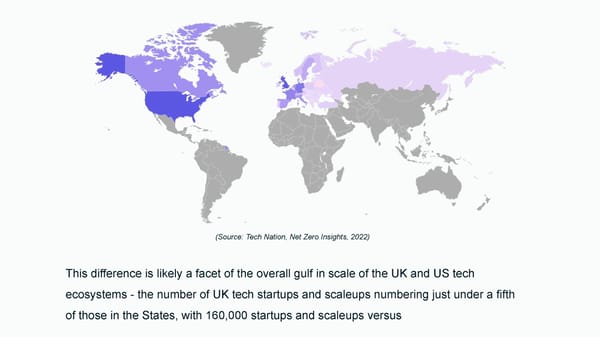

the ambitious investment targets set ahead of COP26 that would be needed to achieve the climate change outcomes desired, and it would need to happen alongside a significant ramping up of cross-industry de-carbonisation. It is encouraging nevertheless that climate tech startups and scaleups have shown no signs of slowing down in terms of outcomes. Climate tech stocks are currently still outperforming the Nasdaq stock market, which we hope are the first signs of a decoupling of climate tech from being affected from any potential recession. International Distribution of Firms The UK is second only to the United States for the number of rms working to address the climate crisis - with over 5,200 climate tech pioneers now operating, compared to the US’ 14,300.

(Source: Tech Nation, Net Zero Insights, 2022) This difference is likely a facet of the overall gulf in scale of the UK and US tech ecosystems - the number of UK tech startups and scaleups numbering just under a fifth of those in the States, with 160,000 startups and scaleups versus

857,000 respectively. By this measure alone, it could be suggested that the UK is punching above its weight in terms of companies founded in climate tech, with just over a third (37%) of those in United States. (Source: Tech Nation, Net Zero Insights, 2022)

Climate tech sectors The 44,000+ climate tech rms are distributed across 8 climate tech areas of focus: ❖ Energy: Any solution combatting the production and sale of energy – including the distribution or transmission of energy, and energy storage – which contributes to net zero. ❖ Farming and Food Production: Companies involved in farming and food production; management and modification of the natural environment or wilderness into the built environment, such as settlements and semi-natural habitats such as arable fields, pastures, and managed woods that contribute to net zero.

❖ Circular Economy: Companies contributing to the circular economy model which involves sharing, leasing, reusing, repairing and refurbishing existing materials and products to minimise the loss of value of products, components and materials. ❖ Mobility: Companies supporting the movement of people or goods, including freight and logistics, airlines, marine, road and rail, and transportation infrastructure that contributes to net zero. ❖ The Built Environment: Reduction of GHG emissions from any man-made surroundings that provide the setting for human activity, ranging in scale from buildings to parks (particularly improving efficiency in construction, everyday life, and reducing waste). ❖ Manufacturing: Manufacturing of articles and materials in bulk that contribute to net zero, including activities and actions required to manage waste in manufacturing. ❖ Carbon Accounting & Climate Risk: Any software-based tool that facilitates GHG performance management, risk mitigation, and GHG accounting and reporting. This includes technology that creates or monitors data for use by other climate technologies.

❖ GHG Removal: Any company working on the removal of greenhouse gases from the atmosphere and their storage for long periods. Many sub-areas exist within these sectors, which we have outlined in the sections below. It is possible for companies to contribute to more than one climate tech area of focus.

(Source: Tech Nation, Net Zero Insights, 2022) Energy production and consumption has the highest number of startups and scaleups, and makes up 29.1% of climate tech companies.

Second to energy is farming and food production which make up 23.6% of all startups and scaleups. GHG removal startups and scaleups make up the smallest proportion of the market at 0.5%. (Source: Tech Nation, Net Zero Insights, 2022)

Mobility and farming and food production swap ranks when contrasting the proportion of startups and scaleups with total investment into these areas in 2022. Mobility makes up 8.6% of companies but has received $13.86bn in investment. Larger rounds into electric vehicles companies like Polestar and Arrival, drive total investment up for Mobility. Farming and food production startups and scaleups have received $9.16bn but make up 20.2% of all climate tech startups and scaleups. The investor appetite towards agriculture is weak due to the fragmented, and low-profit nature of the market. In addition to this, 2022 saw a sharp decline in investment into farming and food production (a decrease of $8.26bn).

Investment 2021 was a record year for climate tech investment, with over $111bn raised by startups and scaleups globally, of which $4bn was raised by UK companies, and just under $39bn by US based companies. Climate tech investment, as presented here, cuts across a range of tech areas, so a comparison to areas like fintech and healthtech is not without some duplication. However, for context, in 2021 climate tech companies globally raised more than enterprise software at $103.7bn, and in the footsteps of healthtech and fintech - companies in which sectors raised $119bn and $129.4bn respectively. Overall, climate tech represented 15.3% of all investment into tech startups and scaleups in 2021 ($111bn of $726.4bn raised in total). 2022 is set to be another record year for investment. Already at $73.86bn (compared with $111.24 in 2021), investment is being driven by large rounds ($185mn +) into later stage companies. Rounds like these skyrocketed in 2021 and confirm the maturity of the market.

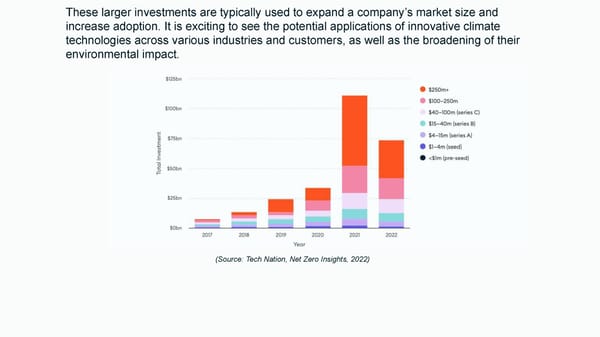

These larger investments are typically used to expand a company’s market size and increase adoption. It is exciting to see the potential applications of innovative climate technologies across various industries and customers, as well as the broadening of their environmental impact. (Source: Tech Nation, Net Zero Insights, 2022)

Stages of investment The global climate tech ecosystem is maturing, with 53% of total investment in 2021 in deals of over $250mn, compared to just 10.5% in 2017.

Stages of investment The global climate tech ecosystem is maturing, with 53% of total investment in 2021 in deals of over $250mn, compared to just 10.5% in 2017.

(Source: Tech Nation, Net Zero Insights, 2022) Trends seen in climate tech over the last five years, from 2017 mirror other rapid maturing sectors such as deeptech, and in the early 2010s, fintech. In the first five years of progressive emerging tech evolution, there tends to be an increase in the largest late stage rounds, often including a small number of deals over $250mn, which make up a high proportion of the total investment figure. This trend then tends to even out - with a proliferation of mid-stage investments, between Series B and C; those companies, perhaps, whose business model, or market has been validated by the liquidity event of a later stage firm with similar characteristics. Climate tech is arguably between the last two stages of maturity - between the noisy, large deal landscape of the teen years of an emerging sector, and the even keel established with heightened investor appetite, and the beginning of exit activity. This trend, though synchronous with maturity, is one to watch and prospectively take action to address. Across the UK tech sector as a whole, in 2011 seed and pre-seed VC investment made up over 15% of the total investment mix in UK tech, by 2021 that proportion had dropped to 4.8%. This downward trend has been seen over the last four years. If seed and pre-seed tech firms are to grow into the scaling engines of the UK economy, the supply of capital that sustains

their early growth must be prioritised, or the UK runs the risk of stifling future stars of the global tech stage. There is an opportunity, in climate tech, to ensure this trend is not realised, with the pipeline inhibiting consequences it represents.

(Source: Tech Nation, Net Zero Insights, 2022) What can we expect next? Based on our research of emerging tech investments, the final stage, if not a steady state, will resemble a more uniform set of investments and exit activity. In the next five years, we would expect to see a sector with larger players reinforcing their hold on markets, or product groups, and new firms creating satellite products or services around it. However, with climate tech startups and scaleups representing economic opportunity alongside a public good - the preservation of our environment - it may be hard to tell what the trajectory will look like for this essential sector. Global climate tech investment dynamics The UK is second in the world in 2021 and 2022 for climate tech investment, behind only the US

Nevertheless, the US dwarfs other countries when it comes to climate tech raises - at over 4x investment raised by these pioneering firms than the UK, in second place. Notably, France and Germany have seen some of the highest increases in climate tech investment over recent years (Germany registering a 344% increase in investment from 2020-2021, for example) eclipsing Sweden, which was second only to the UK for climate investment in Europe in 2020. Country 2017 2018 2019 2020 2021 2022 United $5.132bn $9.516bn $15.763bn $17.692bn $38.991bn $36.852b States n United $0.404bn $0.878bn $1.259bn $2.813bn $4.055bn $7.455bn Kingdom Germany $0.325bn $0.507bn $0.951bn $1.796bn $8.051bn $3.593bn France $0.441bn $0.680bn $0.662bn $1.508bn $2.140bn $3.348bn Canada $0.115bn $0.489bn $0.870bn $0.584bn $1.589bn $2.560bn Sweden $0.119bn $0.302bn $1.795bn $2.861bn $4.627bn $2.454bn Netherlands $0.143bn $0.289bn $0.528bn $0.396bn $1.443bn $1.198bn

Ireland $0.037bn $0.114bn $0.848bn $0.336bn $0.441bn $1.105bn Estonia $0.017bn $0.181bn $0.084bn $0.420bn $0.922bn $1.020bn Switzerland $0.017bn $0.108bn $0.247bn $0.315bn $0.397bn $0.886bn Croatia $0.039bn $0.034bn $0.091bn $0.000bn $0.084bn $0.659bn Finland $0.083bn $0.092bn $0.122bn $0.302bn $0.364bn $0.497bn Spain $0.193bn $0.109bn $0.148bn $0.288bn $0.503bn $0.435bn Denmark $0.033bn $0.079bn $0.117bn $0.146bn $0.426bn $0.415bn Norway $0.022bn $0.024bn $0.138bn $0.270bn $0.260bn $0.376bn Italy $0.019bn $0.041bn $0.064bn $0.073bn $0.293bn $0.216bn Portugal $0.004bn $0.009bn $0.061bn $0.035bn $0.035bn $0.212bn Belgium $0.026bn $0.033bn $0.061bn $0.112bn $0.722bn $0.139bn Austria $0.002bn $0.009bn $0.014bn $0.044bn $0.134bn $0.112bn Luxembourg $0.000bn $0.003bn $0.003bn $0.003bn $0.005bn $0.043bn

(Source: Tech Nation, Net Zero Insights, 2022) The rising tide of tech investment has not been the sole cause of spiking climate tech deals, climate tech investment as a proportion of all investment has increased from just over 3% in 2017 up to 16.88% in 2022 The chart below may well symbolise the extent to which our climate, and the need to act has become more embedded in the public psyche. Two trends have arguably influenced the recent trajectory of climate tech more than any others, they are: 1) investor appetite has ballooned for climate tech related activity, as consumer demand is proven, and market readiness is established, and 2) increased public awareness, private activity, and political will has been applied to climate tech over the last three years - moving this nascent area of tech away from a niche social interest to a mainstream movement.

(Source: Tech Nation, Net Zero Insights, 2022) In Sweden, Ireland, and the Netherlands, climate tech investment is beginning to dominate the tech investment landscape

This year so far, over 50% of tech investment in Sweden has gone to climate tech firms, that figure is over 75% in Ireland, over 40% in the Netherlands, and for the first time has reached over 35% in Germany.

(Source: Tech Nation, Net Zero Insights, 2022) Since 2018 Estonia has seen the highest proportions of all investment made into climate tech firms, consistently reaching over 80% for the last four years, including this one. Unicorns and exits Globally there are 160 climate tech unicorns, companies valued at over $1bn, of which 6% are based in the UK The UK has 9 climate tech ‘unicorns’ (companies valued at $1bn+); Octopus Energy, Britishvolt, Newcleo, Depop, ITM Power, Ceres, OVO Energy, Smart Metering Systems (SMS plc) and Vertical Aerospace. These make up just under

7% of the UK’s total number of tech unicorns. The UK has a further 19 future climate tech unicorns, currently valued between $250mn - $800mn, showing a healthy pipeline of climate pioneers in the UK. The US is home to the majority of high value climate tech firms, with 91 unicorns, including the likes of Rivian Automotive, creating emissions-free Electric Adventure Vehicles, Impossible Foods, and Tesla Motors - valued currently at $694.1bn. Exits through acquisition are proving the more popular path for founders in climate tech as of 2022, but it is expected that with maturity, more companies will begin listing on public markets Alongside the large late rounds documented, climate tech companies are starting to display a healthy exit rate. The largest proportion of liquidity events is in acquisitions where acquirers may be looking to add a new technology or capability to their product offering, expand into different markets, or utilise the talent of the acquired business.

(Source: Tech Nation, Net Zero Insights, 2022)

Climate Impact

As part of the Paris Agreement 194 countries have the shared responsibility of limiting global warming to well below 2 degrees Celsius (preferably to 1.5). To achieve this, emissions must be reduced to net zero by 2050. The World Bank placed 2019’s global emissions at 34,300 MMtCO2 (million metric tons of carbon dioxide) – setting the most up to date target for technology to counterbalance emissions to zero. 44,000+ climate tech firms globally are contributing to achieving net zero emissions in a range of innovative and impactful ways. Amongst these CRANE, Prime Coalition, and Rho Impact have identified 191 different technologies and calculated their individual emission reduction potential. On the assumption that even a fraction of these technologies reach their full potential and completely penetrate their target markets, the combined annual emissions reduction potential of the winning solutions appears likely to surpass 2019 emissions levels. Emissions will continue to grow beyond 2019 levels. Regardless of this, the

contribution climate tech companies must play to help the planet reach net zero emissions is undeniable. Climate technology impact index Energy oriented climate technologies have the greatest potential impact on carbon emissions reduction by 2050 Looking at the cumulative emission reduction potential of the top 4 technologies (from 6 climate tech areas of focus), 2 technologies stand out above the rest. The first is CO2-based enhanced geothermal systems (EGS), which has the capacity to significantly reduce emissions. This technology injects supercritical CO2 (CO2 at such a low temperature it is a fluid) into a man-made reservoir in hot rock It then evaporates, and the pressure of the gas is used to drive a steam turbine and generate electricity. Some CO2 would remain underground to maintain the human-made reservoir. Scientists estimate that 0.1% of the heat potential of earth could supply humanity’s energy needs for 2 millions years. The issue has historically been

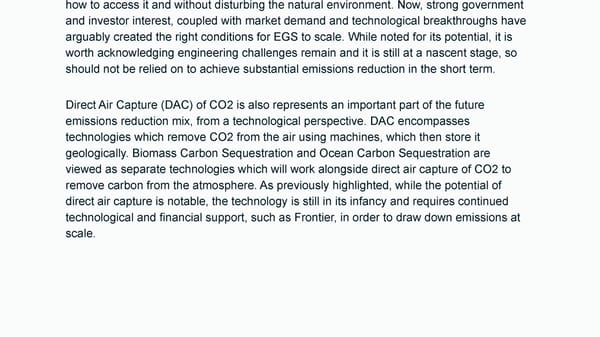

how to access it and without disturbing the natural environment. Now, strong government and investor interest, coupled with market demand and technological breakthroughs have arguably created the right conditions for EGS to scale. While noted for its potential, it is worth acknowledging engineering challenges remain and it is still at a nascent stage, so should not be relied on to achieve substantial emissions reduction in the short term. Direct Air Capture (DAC) of CO2 is also represents an important part of the future emissions reduction mix, from a technological perspective. DAC encompasses technologies which remove CO2 from the air using machines, which then store it geologically. Biomass Carbon Sequestration and Ocean Carbon Sequestration are viewed as separate technologies which will work alongside direct air capture of CO2 to remove carbon from the atmosphere. As previously highlighted, while the potential of direct air capture is notable, the technology is still in its infancy and requires continued technological and financial support, such as Frontier, in order to draw down emissions at scale.

Amongst the 24 technologies outlined, four of the top five technologies are targeted at the energy climate action area of focus. Whether it is harvesting energy from the ocean (through thermal energy and tidal energy) or working to reduce emissions by storing energy more efficiently, it is vital that the public, private and scientific community work together to leverage the key technologies across the energy system to reduce emissions, and identify and resolve any and all indirect consequences. Noticeable exceptions in this table include wind and solar energy, which will be the foundation of a sustainable energy system. The technologies identified are the ones which hold the most amount of impact at scale, opposed to the ones which are commercially viable right now, which we should also be wholly focusing on. Estonia, a country with a strong startup and scaleup sector, outperforms all other countries for investment per tonne of CO2 emitted ($79). Total investment in climate tech companies in Estonia reached over $1bn for the rst time in 2022 and Estonian emissions are low (12 MMtCO2e or 0.04% of global emissions), in part, due to

its small population. Sweden invests $53 per tonne of CO2 emitted, placing it second. The nation is a leader in this space because of its climate innovation strategy. It promises to invest SEK 100 million per year towards climate strategies, and technological innovations in energy intensive industries. (Source: Tech Nation, Net Zero Insights, 2022)

The UK sits in a group of three countries investing $17-19 per tonne of CO2 emitted. It is second only to the US in terms of 2022 investment and number of climate tech companies but has an opportunity to lead the field for future growth in climate tech. The impact of climate tech startups and scaleups stretches beyond climate action to 9 of the 17 UN Sustainable Development Goals.

(Source: Tech Nation, Net Zero Insights, 2022) Climate tech companies by their very nature are impact tech companies. They are developing a business which will better society and the planet, and are all contributing to Sustainable Development Goal (SDG) 13, Climate Action. Affordable & Clean Energy (28%), and Responsible Consumption & Production (25%) also feature highly. Russia’s invasion into Ukraine has led to extraordinary turbulence in the energy sector and triggered a world energy crisis, reinforcing the need for Affordable & Clean Energy. Climate tech startups and scaleups have an important role to play in this global crisis. 9 of 17 UN SDGs feature, displaying that the impact of these companies is not limited to benefitting the planet but also benefiting society. 18% of businesses working towards UN SDG 2, Zero Hunger is testament to this. It is an example showing that embarking on more environmentally sustainable food & agriculture practices also benefits the sustainability of food & agriculture for humans.

Scaling Support

Tech Nation's Net Zero Programme Our Net Zero programme is designed for high impact climate tech companies which are helping the UK reduce greenhouse gas emissions. Companies may work in the digital, hardware and life science sectors. From Food and Agriculture to The Built Environment, and an eclectic mix of sub-sectors in between, the companies present some of the most exciting and innovative technology, which is speeding up progress to the UK’s tech ecosystem.

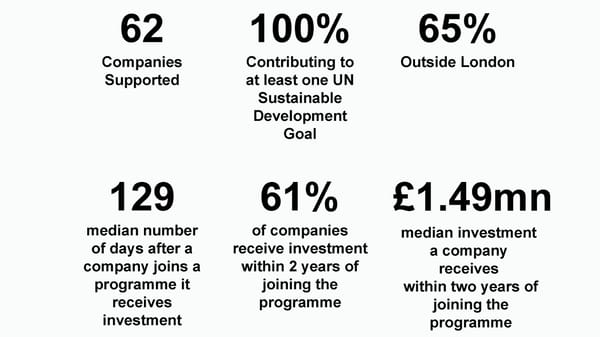

62 100% 65% Companies Contributing to Outside London Supported at least one UN Sustainable Development Goal 129 61% £1.49mn median number of companies median investment of days after a receive investment a company company joins a within 2 years of receives programme it joining the within two years of receives programme joining the investment programme

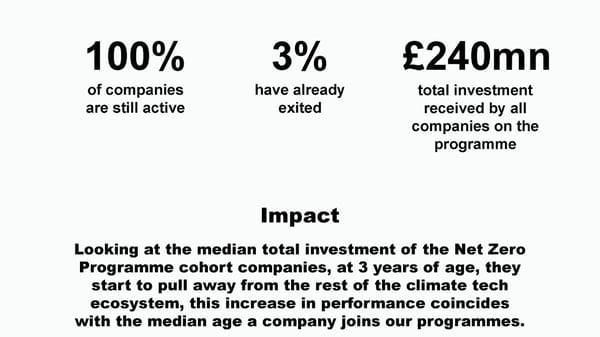

£240mn 100% 3% of companies have already total investment are still active exited received by all companies on the programme Impact Looking at the median total investment of the Net Zero Programme cohort companies, at 3 years of age, they start to pull away from the rest of the climate tech ecosystem, this increase in performance coincides with the median age a company joins our programmes.

(Source: Tech Nation, Net Zero Insights, 2022) Whether it is the Net Zero programme’s ability to raise the profile of a company, provide peer-to-peer support for senior leadership teams, or transform the company’s operations through founder-focused workshops, the impact on growth is clear.

Introduction to the Net Zero X Programme Our Net Zero X programme was launched in October this year. It is designed to support the growth of climate tech companies with high-emissions reduction potential within the most impactful and underfunded sectors. The aim of the programme is to reduce the carbon funding gap, counter the climate tech ‘valley of death’, experienced by many R&D-intensive companies due to longer times before commercialisation and to connect climate tech founders to investors, corporates, partners, policy-makers and other stakeholders. This will help shape the ecosystem founders need to succeed. With only 25% of total funding raised in climate tech being channelled into the technologies that hold 81% of the total emissions reduction potential required to achieve net zero, it is imperative to increase the UK’s support and resources towards every key sector of climate tech.

Future Growth

Creating and growing partnerships, especially establishing effective supply chains, is the top scaling challenge outlined by companies applying to Tech Nation Net Zero programmes, with 73% highlighting the importance of this growth initiative Founders of climate tech startups and scaleups are not immune to the scaling challenges all startups and scaleups face. Growth initiatives, hiring talent, access to finance, scaling operations and leadership all have an important part to play in building a successful climate tech company fit for the future.

Analysing the scaling challenges from 162 applicants to our 2022 Net Zero programmes (Net Zero 3.0 and Net Zero X), and contrasting these with 471 applicants to all programmes in 2022, we can see that the challenges climate tech startups and scaleups match that of all scaling startups and scaleups. Amongst the top three challenges for both, business development related growth initiatives (Partnerships and Sales) are core, with over 70% of startups

and scaleups identifying these as a scaling challenge. These challenges are heightened for climate tech startups and scaleups. They need to seek out customers who are environmentally conscious and understand the benefits of working sustainably.

(Source: Tech Nation, Net Zero Insights, 2022) Expanding into Europe, setting a business strategy, hiring talent to scale, and raising Series A investment are all more challenging and require more focus for climate tech startups and scaleups. For all identified, a minimum of 4% more climate tech applicants cite this as a scaling challenge. Access to talent is heightened due to the unique skill set needed to build these innovative

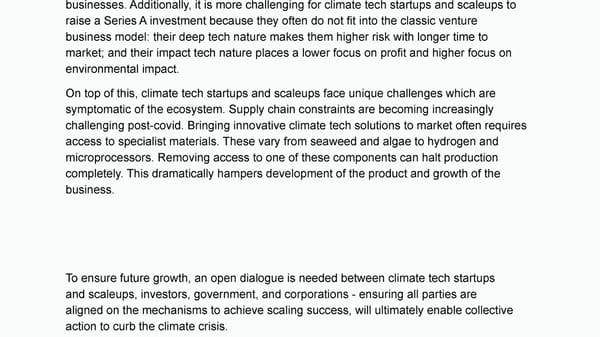

businesses. Additionally, it is more challenging for climate tech startups and scaleups to raise a Series A investment because they often do not fit into the classic venture business model: their deep tech nature makes them higher risk with longer time to market; and their impact tech nature places a lower focus on profit and higher focus on environmental impact. On top of this, climate tech startups and scaleups face unique challenges which are symptomatic of the ecosystem. Supply chain constraints are becoming increasingly challenging post-covid. Bringing innovative climate tech solutions to market often requires access to specialist materials. These vary from seaweed and algae to hydrogen and microprocessors. Removing access to one of these components can halt production completely. This dramatically hampers development of the product and growth of the business. To ensure future growth, an open dialogue is needed between climate tech startups and scaleups, investors, government, and corporations - ensuring all parties are aligned on the mechanisms to achieve scaling success, will ultimately enable collective action to curb the climate crisis.

businesses. Additionally, it is more challenging for climate tech startups and scaleups to raise a Series A investment because they often do not fit into the classic venture business model: their deep tech nature makes them higher risk with longer time to market; and their impact tech nature places a lower focus on profit and higher focus on environmental impact. On top of this, climate tech startups and scaleups face unique challenges which are symptomatic of the ecosystem. Supply chain constraints are becoming increasingly challenging post-covid. Bringing innovative climate tech solutions to market often requires access to specialist materials. These vary from seaweed and algae to hydrogen and microprocessors. Removing access to one of these components can halt production completely. This dramatically hampers development of the product and growth of the business. To ensure future growth, an open dialogue is needed between climate tech startups and scaleups, investors, government, and corporations - ensuring all parties are aligned on the mechanisms to achieve scaling success, will ultimately enable collective action to curb the climate crisis.

Conclusions COP27 will bring people, companies, and nations together with a view to building on previous activity, and to determine future interventions to tackle the global challenge of climate change. Technology will inevitably play a pivotal role in alleviating the global strains we are already seeing as a result of climate change, and enabling us to curb trends indicative of further exacerbation. Previous studies have assessed the health of climate tech through an evaluation of the finances of emerging tech companies, focusing on investment as a primary measure of success. Of course, access to finance to fuel growth is essential as an input to any high potential firm, but an overemphasis on inputs, or at best outputs of tech firms in financial terms may sometimes preclude the true, impact driven purpose of these

companies. As such, in this report, we explore companies who are creating technologies explicitly focused on reducing greenhouse gas emissions or addressing the impacts of global warming, and attempt to assess not just the economic drivers of change, but also determine the carbon emissions reduction potential of climate tech pioneers by 2050. In taking this focus, we hope to shed light on climate tech companies at the forefront of innovation; those businesses that are tackling the climate challenge head on, and helping the UK, and the world to hit the Net Zero target. The UK is second only to the United States for the number of firms working to address the climate crisis - with over 5,200 climate tech pioneers now operating, compared to the US’ 14,300, and second also for investment - which has reached the heady heights of $7.5bn this year so far, yet there is far more to be won than has already been achieved. But, confirming findings from A decade of UK tech, which we produced earlier this year with Google for Startups, the impact sector’s future growth and success is being threatened by dwindling funding for early stage start-ups. This issue particularly affects UK tech businesses when compared to their US and European counterparts because of ecosystem maturity,

valuation boosts from large scale US investment, and greater levels of retail investor certainty in later stage, venture capital backed firms. Trends seen in climate tech over the last five years, from 2017 mirror other rapid maturing sectors such as deeptech, and in the early 2010s, fintech. In the first five years of progressive emerging tech evolution, there tends to be an increase in the largest late stage rounds, often including a small number of deals over $250mn, which make up a high proportion of the total investment figure. This trend then tends to even out - with a proliferation of mid-stage investments, between Series B and C; those companies, perhaps, whose business model, or market has been validated by the liquidity event of a later stage firm with similar characteristics. Climate tech is arguably between the last two stages of maturity - between the noisy, large deal landscape of the teen years of an emerging sector, and the even keel established with heightened investor appetite, and the beginning of exit activity. This trend, though synchronous with maturity, is one to watch and prospectively take action to address. Across the UK tech sector as a whole, in 2011 seed and pre-seed VC investment made up over 15% of the total investment mix in UK tech, by 2021 that proportion had dropped to 4.8%. This

downward trend has been seen over the last four years. If seed and pre-seed tech firms are to grow into the scaling engines of the UK economy, the supply of capital that sustains their early growth must be prioritised, or the UK runs the risk of stifling future stars of the global tech stage. There is an opportunity, in climate tech, to ensure this trend is not realised, with the pipeline inhibiting consequences it represents. The report has dived into the world's top climate tech nations - the UK's allies in addressing the climate challenge - as well as the individual firms leading the charge, because to truly solve this crisis we continue to need a global effort, and an elite force of climate tech pioneers to lead the way.