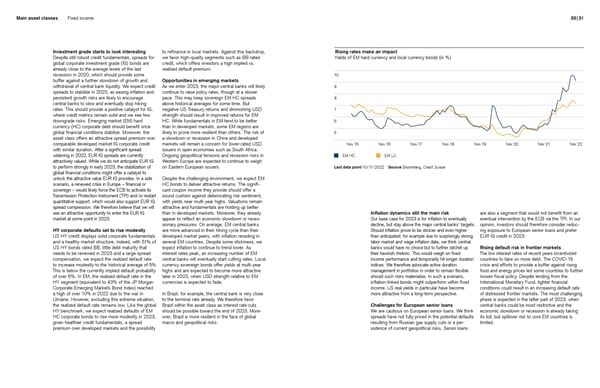

Main asset classes Fixed income 30 | 31 Investment grade starts to look interesting to refinance in local markets. Against this backdrop, Rising rates make an impact Despite still robust credit fundamentals, spreads for we favor high-quality segments such as BB rated Yields of EM hard currency and local currency bonds (in %) global corporate investment grade (IG) bonds are credit, which offers investors a high implied vs. already close to the average levels of the last realized default premium. recession in 2020, which should provide some 10 buffer against a further slowdown of growth and Opportunities in emerging markets withdrawal of central bank liquidity. We expect credit As we enter 2023, the major central banks will likely 9 spreads to stabilize in 2023, as easing inflation and continue to raise policy rates, though at a slower persistent growth risks are likely to encourage pace. This may keep sovereign EM HC spreads 8 central banks to slow and eventually stop hiking above historical averages for some time. But rates. This should provide a positive catalyst for IG, negative US Treasury returns and diminishing USD 7 where credit metrics remain solid and we see few strength should result in improved returns for EM downgrade risks. Emerging market (EM) hard HC. While fundamentals in EM tend to be better 6 currency (HC) corporate debt should benefit once than in developed markets, some EM regions are global financial conditions stabilize. Moreover, the likely to prove more resilient than others. The risk of 5 asset class offers an attractive spread premium over a slowdown or recession in China and developed comparable developed market IG corporate credit markets will remain a concern for lower-rated USD Nov 15 Nov 16 Nov 17 Nov 18 Nov 19 Nov 20 Nov 21 Nov 22 with similar duration. After a significant spread issuers in open economies such as South Africa. widening in 2022, EUR IG spreads are currently Ongoing geopolitical tensions and recession risks in EM HC EM LC attractively valued. While we do not anticipate EUR IG Western Europe are expected to continue to weigh to perform strongly in early 2023, the stabilization of on Eastern European issuers. Last data point 10/11/2022 Source Bloomberg, Credit Suisse global financial conditions might offer a catalyst to unlock the attractive value EUR IG provides. In a side Despite the challenging environment, we expect EM scenario, a renewed crisis in Europe – financial or HC bonds to deliver attractive returns. The signifi- sovereign – would likely force the ECB to activate its cant coupon income they provide should offer a Transmission Protection Instrument (TPI) and/or restart sound cushion against deteriorating risk sentiment, quantitative support, which would also support EUR IG with yields near multi-year highs. Valuations remain spread compression. We therefore believe that we will attractive and fundamentals are holding up better see an attractive opportunity to enter the EUR IG than in developed markets. Moreover, they already Inflation dynamics still the main risk are also a segment that would not benefit from an market at some point in 2023. appear to reflect an economic slowdown or reces- Our base case for 2023 is for inflation to eventually eventual intervention by the ECB via the TPI. In our sionary pressures. On average, EM central banks decline, but stay above the major central banks’ targets. opinion, investors should therefore consider reduc- HY corporate defaults set to rise modestly are more advanced in their hiking cycle than their Should inflation prove to be stickier and even higher ing exposure to European senior loans and prefer US HY credit displays solid corporate fundamentals developed market peers, with inflation receding in than anticipated, for example due to surprisingly strong EUR IG credit in 2023. and a healthy market structure. Indeed, with 51% of several EM countries. Despite some stickiness, we labor market and wage inflation data, we think central US HY bonds rated BB, little debt maturity that expect inflation to continue to trend lower. As banks would have no choice but to further ratchet up Rising default risk in frontier markets needs to be renewed in 2023 and a large spread interest rates peak, an increasing number of EM their hawkish rhetoric. This would weigh on fixed The low interest rates of recent years incentivized compensation, we expect the realized default rate central banks will eventually start cutting rates. Local income performance and temporarily hit longer duration countries to take on more debt. The COVID-19 to increase modestly to the historical average of 5%. currency sovereign bonds offer yields at multi-year indices. We therefore advocate active duration crisis and efforts to provide a buffer against rising This is below the currently implied default probability highs and are expected to become more attractive management in portfolios in order to remain flexible food and energy prices led some countries to further of over 6%. In EM, the realized default rate in the later in 2023, when USD strength relative to EM should such risks materialize. In such a scenario, loosen fiscal policy. Despite lending from the HY segment (equivalent to 43% of the JP Morgan currencies is expected to fade. inflation-linked bonds might outperform within fixed International Monetary Fund, tighter financial Corporate Emerging Markets Bond Index) reached income. US real yields in particular have become conditions could result in an increasing default rate a high of over 10% in 2022 due to the war in In Brazil, for example, the central bank is very close more attractive from a long-term perspective. of distressed frontier markets. The most challenging Ukraine. However, excluding this extreme situation, to the terminal rate already. We therefore favor phase is expected in the latter part of 2023, when the realized default rate remains low. Like the global Brazil within the asset class as interest rate cuts Challenges for European senior loans central banks could be most restrictive and the HY benchmark, we expect realized defaults of EM should be possible toward the end of 2023. More- We are cautious on European senior loans. We think economic slowdown or recession is already taking HC corporate bonds to rise more modestly in 2023, over, Brazil is more resilient in the face of global spreads have not fully priced in the potential defaults its toll, but spillover risk to core EM countries is given healthier credit fundamentals, a spread macro and geopolitical risks. resulting from Russian gas supply cuts or a per- limited. premium over developed markets and the possibility sistence of current geopolitical risks. Senior loans

Credit Suisse Investment Outlook 2023 Page 15 Page 17

Credit Suisse Investment Outlook 2023 Page 15 Page 17