Deal Terms to Raise Money for a Growing Company

M&A Healthcare Example

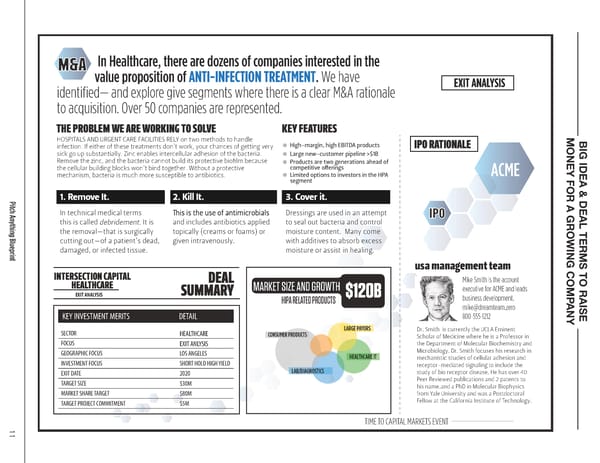

IPO In Healthcare, there are dozens of companies interested in the M&A value proposition of ANTI-INFECTION TREATMENT. We have identified— and explore give segments where there is a clear M&A rationale EXIT ANALYSIS to acquisition. Over 50 companies are represented. THE PROBLEM WE ARE WORKING TO SOLVE KEY FEATURES HOSPITALS AND URGENT CARE FACILITIES RELY on two methods to handle High-margin, high EBITDA products IPO RATIONALE MONEY FOR A GROWING COMPBIG IDEA & DEAL TERMS TO RAISE infection. If either of these treatments don’t work, your chances of getting very sick go up substantially. Zinc enables intercellular adhesion of the bacteria. Large new-customer pipeline >$1B Remove the zinc, and the bacteria cannot build its protective biofilm because Products are two generations ahead of the cellular building blocks won’t bind together. Without a protective competitive offerings ACME mechanism, bacteria is much more susceptible to antibiotics. Limited options to investors in the HPA segment 1. Remove It. 2. Kill It. 3. Cover it. Pit ch An In technical medical terms Dressings are used in an attempt IPO ything Blueprin this is called It is and includes antibiotics applied to seal out bacteria and control debridement. the removal—that is surgically topically (creams or foams) or moisture content. Many come cutting out—of a patient’s dead, given intravenously. with additives to absorb excess damaged, or infected tissue. moisture or assist in healing. t usa management team INTERSECTION CAPITAL DEAL Mike Smith is the account HEALTHCARE SUMMARY MARKET SIZE AND GROWTH executive for ACME and leads EXIT ANALYSIS $120B business development. HIPA RELATED PRODUCTS [email protected] ANY KEY INVESTMENT MERITS DETAIL 800-555-1212 SECTOR HEALTHCARE CONSUMER PRODUCTS LARGE PAYORS Dr. Smith is currently the UCLA Eminent Scholar of Medicine where he is a Professor in FOCUS EXIT ANLYSIS the Department of Molecular Biochemistry and GEOGRAPHIC FOCUS LOS ANGELES Microbiology. Dr. Smith focuses his research in HEALTHCARE IT mechanistic studies of cellular adhesion and INVESTMENT FOCUS SHORT HOLD HIGH YIELD receptor-mediated signaling to include the EXIT DATE 2020 LAB/DIAGNOSTICS study of bio receptor disease. He has over 40 TARGET SIZE $30M Peer Reviewed publications and 2 patents to his name.and a PhD in Molecular Biophysics MARKET SHARE TARGET $80M from Yale University and was a Postdoctoral TARGET PROJECT COMMITMENT $5M Fellow at the California Institute of Technology. TIME TO CAPITAL MARKETS EVENT 11

Deal Terms to Raise Money for a Growing Company

Deal Terms to Raise Money for a Growing Company