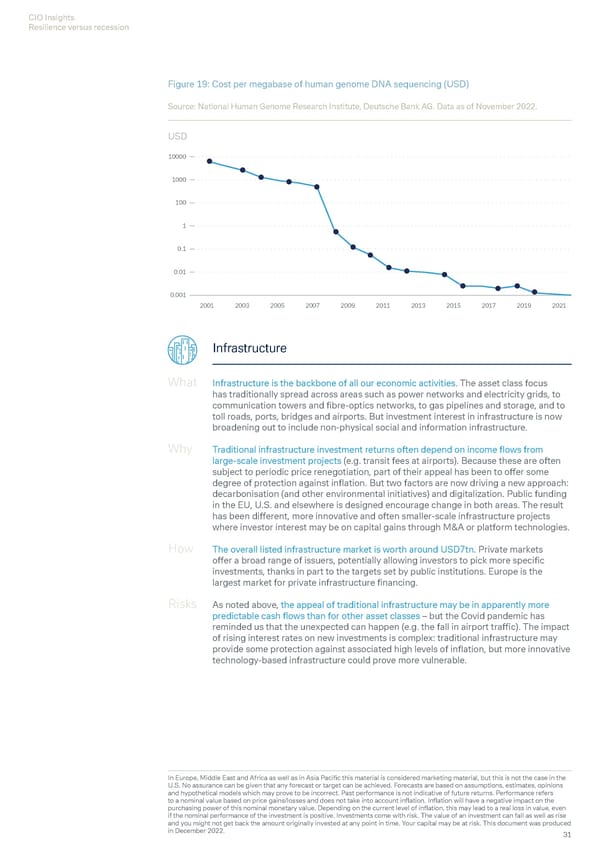

CIO Insights Resilience versus recession Figure 19: Cost per megabase of human genome DNA sequencing (USD) Source: National Human Genome Research Institute, Deutsche Bank AG. Data as of November 2022. USD 10000 1000 100 1 0.1 0.01 0.001 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 2021 Infrastructure What Infrastructure is the backbone of all our economic activities. The asset class focus has traditionally spread across areas such as power networks and electricity grids, to communication towers and fibre-optics networks, to gas pipelines and storage, and to toll roads, ports, bridges and airports. But investment interest in infrastructure is now broadening out to include non-physical social and information infrastructure. Why Traditional infrastructure investment returns often depend on income flows from large-scale investment projects (e.g. transit fees at airports). Because these are often subject to periodic price renegotiation, part of their appeal has been to offer some degree of protection against inflation. But two factors are now driving a new approach: decarbonisation (and other environmental initiatives) and digitalization. Public funding in the EU, U.S. and elsewhere is designed encourage change in both areas. The result has been different, more innovative and often smaller-scale infrastructure projects where investor interest may be on capital gains through M&A or platform technologies. How The overall listed infrastructure market is worth around USD7tn. Private markets offer a broad range of issuers, potentially allowing investors to pick more specific investments, thanks in part to the targets set by public institutions. Europe is the largest market for private infrastructure financing. Risks As noted above, the appeal of traditional infrastructure may be in apparently more predictable cash flows than for other asset classes – but the Covid pandemic has reminded us that the unexpected can happen (e.g. the fall in airport traffic). The impact of rising interest rates on new investments is complex: traditional infrastructure may provide some protection against associated high levels of inflation, but more innovative technology-based infrastructure could prove more vulnerable. In Europe, Middle East and Africa as well as in Asia Pacific this material is considered marketing material, but this is not the case in the U.S. No assurance can be given that any forecast or target can be achieved. Forecasts are based on assumptions, estimates, opinions and hypothetical models which may prove to be incorrect. Past performance is not indicative of future returns. Performance refers to a nominal value based on price gains/losses and does not take into account inflation. Inflation will have a negative impact on the purchasing power of this nominal monetary value. Depending on the current level of inflation, this may lead to a real loss in value, even if the nominal performance of the investment is positive. Investments come with risk. The value of an investment can fall as well as rise and you might not get back the amount originally invested at any point in time. Your capital may be at risk. This document was produced in December 2022. 31

Deutsche Bank Economic and Investment Outlook Page 32 Page 34

Deutsche Bank Economic and Investment Outlook Page 32 Page 34