Deutsche Bank Non Financial Report

This annual Non-Financial Report 2022, which covers the reporting period from January 1, 2022, to December 31, 2022, communicates Deutsche Bank’s group-wide management approaches for a set of non-financial topics, major activities, and the related progress made in 2022. It also describes Deutsche Bank’s governance, policies, and set-up for these topics.

Deutsche Bank Non-Financial Report

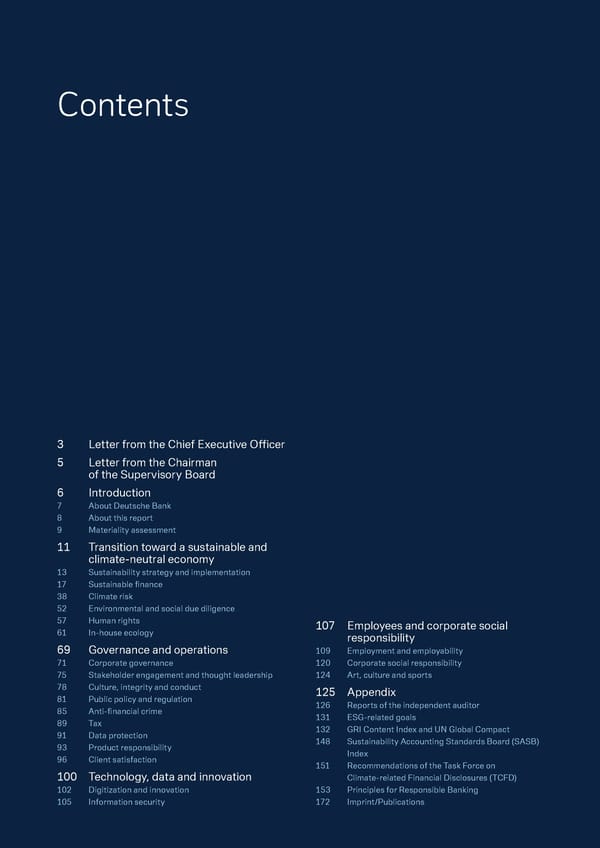

Contents 3 Letter from the Chief Executive O昀케cer 5 Letter from the Chairman of the Supervisory Board 6 Introduction 7 About Deutsche Bank 8 About this report 9 Materiality assessment 11 Transition toward a sustainable and climate-neutral economy 13 Sustainability strategy and implementation 17 Sustainable 昀椀nance 38 Climate risk 52 Environmental and social due diligence 57 Human rights 107 Employees and corporate social 61 In-house ecology responsibility 69 Governance and operations 109 Employment and employability 71 Corporate governance 120 Corporate social responsibility 75 Stakeholder engagement and thought leadership 124 Art, culture and sports 78 Culture, integrity and conduct 125 Appendix 81 Public policy and regulation 126 Reports of the independent auditor 85 Anti-昀椀nancial crime 131 ESG-related goals 89 Tax 132 GRI Content Index and UN Global Compact 91 Data protection 148 Sustainability Accounting Standards Board (SASB) 93 Product responsibility Index 96 Client satisfaction 151 Recommendations of the Task Force on 100 Technology, data and innovation Climate-related Financial Disclosures (TCFD) 102 Digitization and innovation 153 Principles for Responsible Banking 105 Information security 172 Imprint/Publications

Letter from the Chief Executive O昀케cer Letter from the Chairman of the Supervisory Board

Dear Readers, The Russian war of aggression in Ukraine, the energy crisis and the rapid rise in inflation have dominated the year 2022. All of these developments have once again made us aware of the wide range of risks we are exposed to – as an economy and society as a whole, but also each company individually. For us at Deutsche Bank, robust and comprehensive risk management is a cornerstone of our business. This has long since encompassed more than credit, market and other financial risks. Non-financial risks have become an integral part of our risk management. If we do not systematically address the threats posed by climate change or increasing financial crime, we are putting the very basis of our business at risk. It is essential that we do everything in our power to further tighten our controls. This is also a key element in living up to our claim to be at the center of society. It is equally essential that we engage with the communities in which we operate, and that we promote diversity, equity and inclusion inside and outside the bank. We want to be a bank that contributes to a greener (E), more socially responsible (S) and better managed (G) economy, and that is more committed than ever to the Ten Principles of the UN Global Compact. I am delighted that in 2022 we once again made great progress in all these areas. To tackle climate change and enable our economy to transform, we have set ourselves concrete targets in the area of sustainability. At the beginning of 2020, we expected to reach € 200 billion in sustainable finance and investments in six years. By the end of 2022, we already achieved € 215 billion, excluding DWS. The fact that we reached our goal in only half the time clearly demonstrates how our businesses prioritize ESG considerations and have made it an integral part of their strategy. We have now set a new goal; to achieve a sustainable business volume of € 500 billion by 2025 for the years 2020 to 2025. This is an ambitious goal given that the criteria for measuring sustainability continue to evolve. Our regulators are driving this development, but we, too, strive for criteria that are as impact-oriented and transparent as possible, and we are continually improving here. We have continued to develop in all areas of our sustainability strategy, with a focus on implementation. Having moved our Sustainability unit out of the Communications department in 2021, we created a new standalone Chief Sustainability Office in 2022 with new areas of strategy and implementation, appointing Jörg Eigendorf as Chief Sustainability Officer, reporting directly to me. At the same time, we further strengthened Group Sustainability, which, as part of the Chief Sustainability Office, primarily comprises policies and controls. This further sharpened focus means that we can develop and implement our strategy even faster; we demonstrated our progress at our second Sustainability Deep Dive in March this year. Our roadmap to a climate-neutral banking business is key here. As a founding member of the Net-Zero Banking Alliance, in March 2022, for the first time, we fulfilled our voluntary commitment by publishing the carbon footprint of our corporate loan portfolio, which comprises around a quarter of our total loan book. In October 2022, we defined target paths for the four most energy-intensive sectors – oil and gas (upstream); power generation; automotives (light vehicles); steel – with interim targets for 2030. By gradually integrating CO considerations into 2 our decision-making processes, we can actively steer our progress here. Our goal is to make our credit portfolio climate- neutral by 2050. At the same time, we believe that we have a responsibility to support our clients on this transition and that this is the right approach with regard to the global climate. We would only consider ending a client relationship as a last resort if we fail to agree on a common approach to fighting climate change. It does not help anyone if we as a bank reduce our own carbon footprint but fail to make the world any cleaner as a result. There is more progress to report. This includes the fact that, since mid-2022, in order to continue doing business with us, our suppliers with an annual contract volume of more than € 500,000 are required to have an ESG rating. By doing so, we are designing our entire value chain according to strict environmental and social criteria – with a focus on human rights. Accordingly, we have implemented all obligations under the German Supply Chain Due Diligence Act on time and will continue to do so consistently. As a bank with a global network, we are aware of our responsibility for fighting financial crime on the front lines. That is why we have stepped up our commitment to anti-financial crime by focusing more people on these issues, improving processes and establishing external partnerships. In 2022, for example, we increased our Anti-Financial Crime department by more than 340 to over 1,900 employees, and in mid-2022 Management Board member Stefan Simon took over as a member of the Board of the Anti-Financial Crime Alliance (AFCA). 3

However, this alone is not enough. To entrench a strong risk culture, Deutsche Bank encourages everyone to speak out when something doesn't seem right. This “Speak-Up Culture” is what we expect. Another important aspect of a strong risk culture is that our bank can meet the requirement to record business-related communications. As such, our employees are only permitted to use approved communication channels, and Deutsche Bank has further strengthened its processes and controls here. Although we understand we have work to do to deliver our controls remediation program and adapt it to increasing regulatory requirements, the progress so far across all elements has made our bank safer. We also see the value of our investments in exceptional times. Strong controls and good corporate governance have contributed to our ability to adapt to evolving sanctions and help clients deal with key market challenges. Our bank is represented in 58 countries and home to 157 nationalities. Actively promoting diversity, equity and inclusion remains a priority and we continue to equip our people to fulfill this. We have made our goal of improving gender balance transparent, especially at our most senior management levels, and continue to make progress towards our 2025 targets. In the Human Rights Campaign's annual Corporate Equality Index, we received the highest score of 100 for 19 consecutive years. In order to further embed diversity, equity and inclusion in the bank’s culture, we rely on our managers; they must lead diverse teams, behave inclusively and support their employees in their careers. To support our leaders, we have created our Leadership Kompass, a set of eight behaviors that we expect from all of our leaders. These include sustainable business practices, the development and well-being of our employees, and the way we put clients and employees at the heart of all decisions, in line with our values and beliefs. When it comes to social responsibility, our bank has a long and impressive history. This is deeply rooted in our culture, even and especially in difficult times. In response to the humanitarian plight of refugees from Ukraine, Deutsche Bank donated € 1 million in 2022. Our employees donated a further € 500,000+ and many were involved in Ukraine aid projects. With the launch of the How We Live environmental projects in 2022, the bank is aligning its social responsibility strategy even more closely with its ESG objectives. These projects contribute towards the protection and regeneration of nature worldwide. We are also proud to report that, by the end of 2022, more than 1,000 of our employees in Germany had registered for the financial education project “So geht Geld”, which provides students with practical financial knowledge. This is far beyond our goal of recruiting 700 colleagues for the project by the end of the reporting year. In total, we invested more than € 55 million as part of our social commitment as well as in art, culture and sports projects. More than 3 million people worldwide benefited from this. In addition, more than 18,700 employees volunteered on our social projects giving a total of almost 190,000 hours. This commitment is remarkable. It underpins that we are at the heart of society and act responsibly. Progress on all of our non-financial targets is only possible if we are successful in business. We were able to meet this requirement in 2022 and achieved the best result in 15 years. We can look to the future with confidence; our bank is once again sustainably profitable. It is more efficient and has four strong, mutually-reinforcing, well-balanced business divisions. Our clients, our shareholders and our employees play a significant role in this success. Our special thanks therefore go to them. Yours sincerely, Christian Sewing 4

Dear Readers, With its 2019 transformation, Deutsche Bank adopted a clear strategy and substantially improved its financial results. This transformation, which the Supervisory Board has continuously supported, has been successfully executed. As a result of the realignment, the bank has regained credibility and confidence, as I learned from numerous discussions with clients, employees, investors, supervisors and politicians since I took office. To be successful in the long term it is not just the results that need to be right: the bank must meet its needs and those of all relevant stakeholders for important non-financial factors. This is why the Supervisory Board has been working intensively last year on the topics raised in this report. Our focus has been on strengthening corporate governance through further reinforced controls and processes, supporting the transition to a more sustainable economy, and promoting the use of technology. In particular, effective controls and processes are essential for a global financial institution. By meeting regulatory requirements and making a significant contribution to the fight against financial crime, we will strengthen our resilience. At the same time, this is the basis for the social acceptance of our bank. Deutsche Bank has made significant remediation progress in recent years, but does not meet all of its own and its regulators’ expectations in certain areas yet. That is why, in July last year, we refocused the existing Integrity Committee. As a Regulatory Oversight Committee, it oversees the Management Board’s actions with regard to complying with legislation, administrative regulations and internal policies. The committee also supports the Supervisory Board in monitoring the litigation cases which are most relevant from a risk perspective. In addition, the Committee regularly reviews the bank’s codes of ethics and conduct to encourage exemplary behavior by our employees in every respect, in addition to their legal obligations. It also remains a key objective for the bank to promote diversity and inclusion. We also attach great importance to this principle in the composition of the Supervisory Board and the Management Board. Sustainable action and thinking are an integral part of Deutsche Bank’s strategy. Consequently, the task of advising the Management Board on environmental (E), social responsibility (S) and corporate governance (G) matters has been transferred from the former Integrity Committee to the Strategy and Sustainability Committee, while the related financial and non-financial risks are supervised by the Risk Committee. Sustainability is a top priority for the Supervisory Board. As a Global Hausbank, we support the transition to a sustainable and climate-neutral economy by enabling sustainable financing and investments and providing advice and support to clients in their transformation. In 2022, the Management Board also reported regularly on the bank’s progress in implementing the bank’s sustainability strategy. In addition to the path to a sustainable economy, technological innovations will shape banking in the years to come. Our goal is to make the best use of artificial intelligence, machine learning and data to serve our clients. In addition to effective data management and cloud transformation, security in 2022 was the defining topic in the Committee on Technology, Data and Integration. The impact of the war in Ukraine on our cyber and information security was discussed regularly. A more detailed report on the work of the Supervisory Board on these and other issues can be found in Deutsche Bank’s Annual Report. In recent years, Deutsche Bank has fundamentally transformed its business model. It is once again profitable and has re- connected closely to society and its stakeholders. We will continue along this path and the Supervisory Board will continue to support the Management Board in implementing its strategy, strengthening controls and fulfilling Deutsche Bank’s social responsibilities. Yours, Alexander Wynaendts Chairman of the Supervisory Board Deutsche Bank AG 5

Introduction 7 About Deutsche Bank 8 About this report 9 Materiality assessment

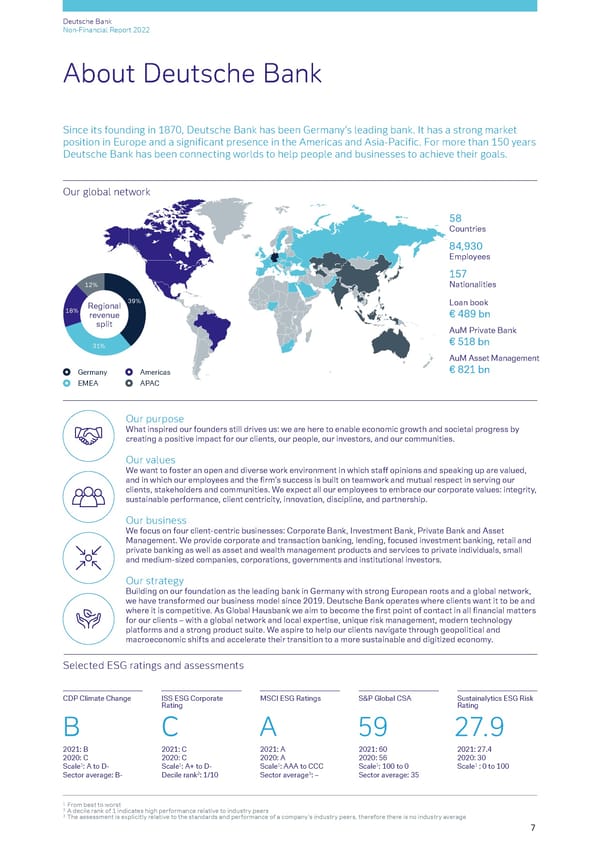

Deutsche Bank Non-Financial Report 2022 About Deutsche Bank Since its founding in 1870, Deutsche Bank has been Germany’s leading bank. It has a strong market position in Europe and a signi昀椀cant presence in the Americas and Asia-Paci昀椀c. For more than 150 years Deutsche Bank has been connecting worlds to help people and businesses to achieve their goals. Our global network 58 Countries 84,930 Employees 157 12% Nationalities Regional 39% Loan book 18% revenue € 489 bn split AuM Private Bank 31% € 518 bn AuM Asset Management Germany Americas € 821 bn EMEA APAC Our purpose What inspired our founders still drives us: we are here to enable economic growth and societal progress by creating a positive impact for our clients, our people, our investors, and our communities. Our values We want to foster an open and diverse work environment in which sta昀昀 opinions and speaking up are valued, and in which our employees and the 昀椀rm’s success is built on teamwork and mutual respect in serving our clients, stakeholders and communities. We expect all our employees to embrace our corporate values: integrity, sustainable performance, client centricity, innovation, discipline, and partnership. Our business We focus on four client-centric businesses: Corporate Bank, Investment Bank, Private Bank and Asset Management. We provide corporate and transaction banking, lending, focused investment banking, retail and private banking as well as asset and wealth management products and services to private individuals, small and medium-sized companies, corporations, governments and institutional investors. Our strategy Building on our foundation as the leading bank in Germany with strong European roots and a global network, we have transformed our business model since 2019. Deutsche Bank operates where clients want it to be and where it is competitive. As Global Hausbank we aim to become the 昀椀rst point of contact in all 昀椀nancial matters for our clients – with a global network and local expertise, unique risk management, modern technology platforms and a strong product suite. We aspire to help our clients navigate through geopolitical and macroeconomic shifts and accelerate their transition to a more sustainable and digitized economy. Selected ESG ratings and assessments CDP Climate Change ISS ESG Corporate MSCI ESG Ratings S&P Global CSA Sustainalytics ESG Risk Rating Rating B C A 59 27.9 2021: B 2021: C 2021: A 2021: 60 2021: 27.4 2020: C 2020: C 2020: A 2020: 56 2020: 30 1 1 1 1 1 Scale : A to D- Scale : A+ to D- Scale : AAA to CCC Scale : 100 to 0 Scale : 0 to 100 Sector average: B- Decile rank2: 1/10 Sector average3: – Sector average: 35 1 From best to worst 2 A decile rank of 1 indicates high performance relative to industry peers 3 The assessment is explicitly relative to the standards and performance of a company’s industry peers, therefore there is no industry average 7

Deutsche Bank Introduction Non-Financial Report 2022 About this report About this report GRI 2-3 This annual Non-Financial Report 2022, which covers the reporting period from January 1, 2022, to December 31, 2022, communicates Deutsche Bank’s group-wide management approaches for a set of non-financial topics, major activities, and the related progress made in 2022. It also describes Deutsche Bank’s governance, policies, and set-up for these topics. Content within the report marked by a line in the margin corresponds to the mandatory “Non-Financial Statement” within the meaning of Section 315b German Commercial Code (Handelsgesetzbuch, HGB). The “Non-Financial Statement” complies with Section 315c (1) HGB in conjunction with Section 289c HGB. The mandatory description of the business model to which this report refers is found in the Annual Report – Combined Management Report – Operating and Financial Review – Deutsche Bank Group. This section of the Annual Report and the Non-Financial Report are prepared in accordance with the Global Reporting Initiative (GRI) Sustainability Reporting Standards. References to show compliance with GRI Standards are indicated in the respective chapter and/or sub-chapter heading. In addition, a GRI table is published in the Appendix. Certain information required by GRI 207 Tax is part of the Country-By-Country Reporting in the Notes to the Annual Report of Deutsche Bank Group to which this report refers. Furthermore, the “Non-Financial Statement” complies with the disclosure obligations under Article 8 (1) and (3) of the Taxonomy Regulation and the respective specifications in Articles 4 and 10 (2) of the associated Delegated Act. The Non-Financial Report 2022 is subject to a limited assurance engagement as seen in the Reports of the Independent Auditor. Disclosures for prior years and references to additional information beyond the scope of the Non-Financial Report (for example, external websites) are not subject to the limited assurance procedures for the 2022 reporting period. References to websites or other publications of Deutsche Bank are not subject to independent verification and are indicated by an asterisk (*). The Non-Financial Report 2022 uses reporting metrics of the Sustainability Accounting Standards Board (SASB) Standards and includes a table that indicates which of its chapters and sub-chapters contain disclosures recommended by the Task Force on Climate-related Financial Disclosures (TCFD). The report discusses the topics required for Deutsche Bank’s communication on progress for the UN Global Compact (see GRI Content Index and UN Global Compact in the Appendix). 8

Deutsche Bank Introduction Non-Financial Report 2022 Materiality assessment Materiality assessment GRI 2-12, 3-1/3 The Non-Financial Report discloses material non-financial information for Deutsche Bank and its stakeholders, determined through the bank’s materiality assessment. The assessment, which is based on GRI standards, considers external stakeholder expectations and internal perception of the business relevance of non-financial topics. To ensure that the bank’s reporting conforms with the German Commercial Code, Deutsche Bank supplements its assessment by prioritizing topics based on its relevance to understand the bank’s current or future development, financial position, performance, or cash flows in accordance with Section 315c (2) HGB. The materiality assessment performed in 2021 served as the basis for the material topics in this Non-Financial Report. In 2022, Deutsche Bank focused on reviewing its materiality process and the approach of incorporating impacts of the bank’s business activities and operations more specifically. This was agreed upon by the bank’s ESG Disclosures Steering Group. The steering group is composed of experts from: Finance, Investor Relations, Risk, Communications and Chief Sustainability Office. As of year end 2022, Deutsche Bank did not identify any business activities, relationships, products, or services that would be associated with potentially significant risks that were very likely to have or will in future have a severe negative impact on the material non-financial topics. 9

Deutsche Bank Introduction Non-Financial Report 2022 Materiality assessment Material non-financial topics 2022 GRI 3-1/2 The results of the materiality assessment are shown in the matrix below. The topics in the top right grey area of the matrix meet the materiality requirements of Section 315c in conjunction with Section 289c (3) HGB and form Deutsche Bank’s “Non- Financial Statement”. Throughout the report, each material topic of the “Non-Financial Statement” is marked by a line in the margin. All non-financial topics shown in the matrix below are relevant to Deutsche Bank and its stakeholders and managed across the bank to ensure its ability to generate value. The topics marked blue are covered by the bank’s sustainability strategy. 10

Transition toward a sustainable and climate-neutral economy 13 Sustainability strategy and implementation 17 Sustainable 昀椀nance 38 Climate risk 52 Environmental and social due diligence 57 Human rights 61 In-house ecology

Deutsche Bank Non-Financial Report 2022 Transition toward a sustainable and climate-neutral economy at a glance k n C a o Deutsche Bank supports the transition toward a B nt rp e or sustainable and climate-friendly economy m a t te s B e nv a I n k Exceeding the € 200 billion target in sustainable 昀椀nancing and investments between 2020 and year end 2022 with a cumulative total of € 215 billion Deutsche Bank aligns the carbon intensity of its sA kn s lending portfolio to Paris Agreement‘s targets aB te et aM avi an rP meg tne Founding member of the Net Zero Banking Alliance and Net Zero Asset Managers initiatives Facts and 昀椀gures 2022 € 215billion By 2025 Zero sustainable 昀椀nancing reached end 昀椀nancing of 昀椀nancing of new oil and gas by the end of 2022 thermal coal mining projects in the Arctic, as well as new oil sand projects Sustainable 昀椀nance progress since 2020 Progress in GHG emissions and energy onsumption reduction in own operations and c business travel 2022 2,601,837 2020 2,397,381 Assets under Management 2,078,060 € 46 € 1 bn bn € 58 bn Financing 132,927 2021 € 30 bn 72,897 74,300 € 112 Issuance bn € 27 bn 2020 2021 2022 2020 2021 2022 Total GHG emissions Total energy consumption (in t of CO2e) (in GJ) 12

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainability strategy and implementation Sustainability strategy and implementation – Sustainability embedded in corporate strategy – Adapted governance to ensure effective implementation of sustainability strategy – Establishment of Chief Sustainability Office Economies and societies worldwide are striving to become sustainable and socially inclusive. A vital aspect of this is tackling climate change which is one of humanity’s biggest challenges. Negative spillovers from the war in Ukraine as well as disruptions of supply chains, including energy supply shortages, could have the potential to fast-track Europe’s goals of carbon footprint reduction and energy independence by accelerating the transformation towards renewable energies (refer e.g. to REPowerEU initiative). Being a global financial institution with a loan book of € 489 billion and assets under management of € 1.3 trillion, Deutsche Bank believes that it is part of its responsibility to support and where possible, accelerate this historic transformation towards a more sustainable society and economy. This transformation affects the bank’s relationship with all its stakeholders. Clients need advice, products, and services to make progress on their transformation journeys. Investors increasingly want to entrust their capital to companies with a credible sustainability strategy. Following clear guidance for sustainability is also one cornerstone of attracting people who expect their employer to act decisively and to be purpose driven. Finally, society values businesses that act as responsible corporate citizens. While the transition towards a sustainable society and economy requires huge investments, sustainability goes beyond pure business. Deutsche Bank has seen sustainability as an opportunity for many years. Consequently sustainability, which encompasses environmental, social and governance (ESG) aspects, is a central component of the “Global Hausbank” strategy. In 2022, the bank continued to embed sustainability into its products, policies and processes, focusing on the following four pillars: Sustainable Finance, Policies & Commitments, People & Own Operations as well as Thought Leadership & Stakeholder Engagement. Making progress along these four pillars is aimed to enable the bank to maximize its contribution to the achievement of the Paris Climate Agreement’s targets and the United Nations (UN) Sustainable Development Goals. Although the bank strives to contribute indirectly to all 17 UN Sustainable Development Goals, as part of its sustainability strategy the focus is in particular on the sustainability targets shown below, which are particularly close to its business activity. Sustainability strategy To underpin its long-standing commitment to sustainability, Deutsche Bank formally endorsed universal sustainability frameworks and initiatives. The bank is a member of the UN’s Environment Programme Finance Initiative (1992) and signatory to the ten principles of the UN Global Compact (2000), the Principles for Responsible Investment (through DWS, 2008), the Principles for Responsible Banking (2019) and the Net-Zero Banking Alliance (2021). This chapter does not cover DWS which sets its own sustainability strategy. For details regarding DWS’ sustainability strategy please refer to the “Sustainable finance/Asset Management” chapter in this report. 13

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainability strategy and implementation Sustainability targets To implement the Group’s sustainability strategy, Deutsche Bank has set the following sustainability targets to: – Achieve cumulative sustainable financing and investment volumes since January 2020 of over € 200 billion by the end of 2022 and a cumulative € 500 billion by the end of 2025 (excluding DWS) – Fulfill Deutsche Bank’s net-zero commitments for key carbon intensive sectors by accompanying clients in their transformation (Transition Dialogue) – Strengthen policies and controls to guide the bank’s actions and ensure compliance – Sourcing of external ESG data, automation, and standardization of reporting – Empower employees and establish sustainability as core value of the bank’s culture Achievements In 2022, the bank continued to deliver on its sustainability strategy. Key achievements along the four pillars are: Sustainable Finance Deutsche Bank has achieved a cumulative sustainable financing and investments volume of € 215 billion in 2022 (excluding DWS), thus outperforming its target of at least € 200 billion within three years. All business areas (excluding DWS) contributed to Deutsche Bank meeting this target. When this target was first announced in May 2020, it was planned to be achieved by the end of 2025. Policies & Commitments Deutsche Bank published the carbon footprint of its corporate loan exposure to, and financed emissions of, key carbon- intensive industries as well as quantitative 2030 (interim) and 2050 decarbonization targets for four carbon intensive sectors in the Group’s corporate lending book on its website. These targets cover the sectors of Oil and Gas (upstream), Power Generation, Automotive (light duty vehicles) and Steel and aim to significantly reduce the amount of financed emissions (Scope 3) by 2030, reflecting the bank’s commitments as a founding member of the Net-Zero Banking Alliance (NZBA) (for further details see the “Climate risk” chapter). To achieve this target, Deutsche Bank has founded a Net-Zero Forum with participation of the businesses as well as Risk and the Chief Sustainability Office. In addition, Deutsche Bank joined the EP100 initiative, committing to net-zero operational carbon at owned occupied assets globally by 2030 and the RE100 initiative under The Climate Group, committing to 100% of renewable energy used for own operations by the end of 2025. People & Own Operations The bank received 95.7% of its own global electricity consumption from renewable sources, exceeding its 2022 target by 10.7%. Further achievements include the reduction of total energy consumption by 13.3% year-to-year. For its new building at Columbus Circle in New York, Deutsche Bank received the Leadership in Energy and Environmental Design (LEED) Gold certification. Moreover, in December 2022, a new “Sustainability Hub” went live internally as single point to go to for ESG activities in Deutsche Bank. The bank also launched “How we live”, the Group’s new Corporate Social Responsibility program for environmental impact, aiming to address nature conservation and environmental protection as well as related social issues in collaboration with environmental and non-profit organizations. Thought Leadership & Stakeholder Engagement As part of their cooperation, Deutsche Bank and the European School of Management and Technology (ESMT) in Berlin announced the new endowed professorship for Sustainable Finance. Prof. Dr. Jörg Rocholl has taken over the chair as of September 1, 2022. From February 28 to March 2, 2022, Deutsche Bank hosted the second Annual dbAccess Global ESG Conference. Over 60 companies participated, as well as a number of focused presentations and panels were held. The conference was intended to be an engagement forum for all companies to address relevant environmental, social and governance considerations that are important to stakeholders. 14

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainability strategy and implementation Sustainability governance GRI 2-9/12/13/17 In 2022, Deutsche Bank further enhanced its sustainability governance. This helps to manage, measure and control sustainability activities across divisions and regions and allows for compliance with relevant environmental and social regulations. Deutsche Bank appointed a Chief Sustainability Officer and broadened its sustainability governance by establishing a Sustainability Strategy Steering Committee responsible for sustainability transformation management and oversight. The Chief Sustainability Officer reports to the Chief Executive Officer. He has the mandate to develop the bank’s sustainability strategy and advance its implementation. He also coordinates the work of the Group Sustainability Committee as Vice Chairman of the CEO, the Sustainability Strategy Steering Committee as Chairman, and the Sustainability Council as Co- Chairman. Besides, he reports progress to the Management Board and Supervisory Board. The bank supplemented its existing Group Sustainability team with a dedicated Strategy & Regional Governance team, responsible for the development of the corporate sustainability strategy, as well as an Execution, Data & Regulatory team, responsible for managing the transformation at a day-to-day basis as well as the identification and assessment of relevant regulations. All these three teams form the Deutsche Bank’s new Chief Sustainability Office. Group Sustainability retains its responsibility for advancing the bank’s sustainability framework, overseeing adherence to group-wide sustainability policies and commitments, and providing transparency to the bank’s stakeholders. In addition to the Chief Sustainability Office, the bank’s business divisions and infrastructure functions each have their own ESG experts to ensure a swift response to business opportunities and potential risks. The bank has three fora entirely devoted to sustainability. The most senior forum is the Group Sustainability Committee, which was created in 2020 and acts as the main governance body for sustainability related matters across Deutsche Bank Group. The Management Board has delegated sustainability related decisions to this committee, which is chaired by the Chief Executive Officer and the Chief Sustainability Officer (Vice Chair). It consists of Management Board members and the heads of the bank’s business divisions (GMC members) as well as senior representatives of the relevant infrastructure functions. The committee acts as senior decision-making body for sustainability-related matters on group level. Its “run the bank”- mandate has oversight of sustainability strategy implementation across divisions and ensures alignment of the sustainability strategy with the client centric pillar of the bank’s corporate strategy. 15

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainability strategy and implementation The Group Sustainability Committee met five times in 2022. Topics that were discussed among others were sustainability strategy, financed emissions and carbon disclosure. The second forum is the new Sustainability Strategy Steering Committee. It is chaired by the Chief Sustainability Officer, Vice- Chair is the Chief Financial Officer Investment Bank, Corporate Bank & ESG. The Sustainability Strategy Steering Committee meets on a monthly basis and consists of divisional and regional ESG specialists of the business divisions and certain infrastructure functions. Created in September 2022, the Sustainability Strategy Steering Committee met three times in 2022. It has been delegated by the CEO and is responsible for overseeing the implementation of the sustainability strategy as one of the bank’s “Key Deliverables” (“change the bank”-responsibility). The members of the committee collaborate across organizational boundaries. The "Key Deliverable Sustainability Strategy" is implemented in working groups that work on these goals: – Business Coordination, Enablement & Investment: aligns Deutsche Bank Group’s sustainability strategy with business strategies and incubates cross-divisional business opportunities – ESG Financing: conceptualizes and implements the Asset and Liability Management in the ESG space – Empowerment & Training: ensures the alignment and training of staff worldwide – Data & Technology: builds the data foundation to support reporting such as disclosures in accordance with Article 8 of the Taxonomy Regulation or Pillar 3 disclosures on ESG risks as well as climate risk related disclosures and business needs for ESG data – ESG Regulations: develops a comprehensive overview of current and upcoming regulations linked to sustainability and oversees implementation by affected business divisions and infrastructure functions – Risk, Governance & Controls: designs the sustainability control framework and oversees its implementation – Net-Zero Alignment Strategy: develops net-zero targets and client transition dialogue approaches in close collaboration of Risk, business divisions and Chief Sustainability Officer – German Supply Chain Due Diligence Act: ensures compliance with German Supply Chain Due Diligence Act by establishing risk management and due diligence processes to prevent and remediate human rights adverse impacts in Deutsche Bank’s operations and upstream supply chain All of these work streams have charters, measurable targets and detailed implementation plans, which are centrally tracked and supervised by the Sustainability Strategy Steering Committee. Escalations are reported into the Group Operating Committee, which is responsible to most effectively support the delivery of the bank’s strategy. Besides this, the program progress is as well reported to the Group Sustainability Committee on a regular basis. Deutsche Bank achieved all key deliverable milestones set by year end 2022. The third forum is the Sustainability Council, which Deutsche Bank formed in 2018. The Sustainability Council’s mandate is to foster knowledge exchange in the bank, in order to stimulate bank-wide change and to identify new topics. The council is co-chaired by the Chief Sustainability Officer and the Chief Financial Officer Investment Bank, Corporate Bank & ESG. The council met four times in 2022, discussing new internal developments, business highlights, and market trends. The Supervisory Board as well as the Management Board have been explicitly informed about the implementation of the sustainability strategy. In 2022, the Supervisory Board has been informed and involved twice, the Management Board three times. Other committees, such as the Group Reputational Risk Committee and the Enterprise Risk Committee, are informed about current sustainability issues and developments on a regular basis. To ensure that climate and environmental risks are considered in strategic sustainability decisions and respective goals and action plans are achieved, the Chief Sustainability Office and the Chief Risk Office follow an integrated governance approach. For more details, see the “Climate Risk/Governance” chapter of this report. The degree to which ESG targets are met is among the assessment criteria used to calculate the bank’s top executives’ performance-based compensation. For additional details refer to “Compensation of the Management Board” in the Annual Report 2022 and the Compensation Report 2022. Sustainability principles and policies GRI FS1 Deutsche Bank’s sustainability principles are anchored in the bank’s Code of Conduct, which it expects all employees to adhere to. In 2022, the bank developed a dedicated Sustainable Finance Policy aimed at strengthening the bank’s internal processes around Sustainable Finance which supplements the Sustainable Finance Framework. Where appropriate, the policies of the business divisions and infrastructure functions address additional sustainability aspects, which are specific to their function. Deutsche Bank’s sustainability related targets and measures as well as the progress made in implementing the bank’s sustainability strategy in the 2022 are summarized in the table “ESG-related goals” in the Appendix. 16

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance Sustainable finance – Exceeding the € 200 billion target in sustainable financing and investments between 2020 and year end 2022 with a cumulative total of € 215 billion – Sustainable financing and investments of € 58 billion in 2022, despite a challenging macroeconomic environment – Target to achieve cumulative sustainable financing and investment volumes of € 500 billion since January 2020 to year end 2025 GRI 201-2 As a global bank, Deutsche Bank acknowledges its role in facilitating the transition toward sustainable growth and a low- carbon economy. As a financial intermediary, the bank aspires to support its clients in their transformation with its financial expertise and product offerings on their path to a more sustainable and climate-neutral way of conducting business. Thus, the bank supports the European Commission’s Action Plan on sustainable finance as a crucial contribution toward the European Union’s achievement of its Paris Agreement climate targets and its wider sustainability agenda. This is in line with Deutsche Bank having signed the Paris Pledge for Action in 2015. In May 2020, Deutsche Bank published its intention to achieve at least € 200 billion in sustainable financing and investments by year end 2025, as defined in the Group’s Sustainable Finance Framework (*). In order to achieve more tangible progress in the shorter term, the bank first announced the acceleration of this target from year end 2025 to year end 2023 and later to year end 2022. The bank exceeded its year end 2022 target in sustainable financing and investments with a cumulative total of € 215 billion and is committed to achieve cumulative sustainable financing and investment volumes of € 500 billion since 2020 to year end 2025. The ESG assets managed by the Asset Management division, which operates under the brand DWS, are not included in these figures as DWS operates as a separate legal entity that sets its own sustainability strategy. The graphic below shows the milestones in sustainable finance since May 2020 focusing on the achievements made in 2022. 17

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance Governance GRI 2-9/23/24, 3-3, FS1, FS3 Deutsche Bank’s Sustainable Finance Framework (*), established in 2020, outlines the methodology and associated procedures for classifying financial products and services offered by Deutsche Bank as sustainable financing and investments. The framework specifies the classification logic, the eligibility parameter criteria, the applicable environmental and social due diligence requirements, the verification and monitoring process and is complemented by other policies, providing additional information on specific topics. A robust framework for defining sustainable financing and investments is essential for target- setting, decision-making, enforcement and credibility with stakeholders. In the Corporate Bank and the Investment Bank, the validation against the framework is conducted on a deal-by-deal basis and according to a 6-eyes-principle. As a first step, coverage teams screen client’s sustainability profile and map transactions in scope against the framework. Initial due diligence prior to deal closing is conducted in cooperation with product teams and ESG product champions. After that, ESG product champions review the classification rationale, proof points and conduct plausibility checks. Finally, Group Sustainability performs its due diligence, reviewing the classification rationale, proof points and any additional information required. Only after successful completion of these validation steps, a deal can be classified as compliant with the Sustainable Finance Framework, and the transaction can be counted towards the sustainable finance target. The validation statistics for Corporate Bank and Investment Bank are presented in the following table. Transactions assessed under the Sustainable Finance Framework (Corporate Bank and Investment Bank) Dec 31, 2022 Dec 31, 2021 Number of transactions on which final decisions have been made 885 1,036 Thereof approved 719 979 Parameter 1 - Use of proceeds 471 605 Parameter 2 - Company profile 69 73 Parameter 3 - Sustainability linked products 179 301 Thereof declined 159 48 Thereof referred to the respective committees 7 9 Thereof approved 3 4 Thereof declined 4 5 To support the decision making of those conducting transactions and performing validation under the framework and as part of the bank’s overall sustainability governance, the Sustainable Finance Governance Forum was established in February 2021. The forum is chaired by the Chief Sustainability Officer. The forum's members are tasked with the interpretation and methods of applying the Sustainable Finance Framework's definitions and product classifications. For instance, the members’ view may be consulted regarding specific sustainable finance transactions as well as clients, general or product-specific sustainable finance criteria for selected activities or industries. If appropriate, the forum’s recommendations are submitted to either the Group Sustainability Committee or through the Reputational Risk Framework (for more information on the Group Sustainability Committee, see the chapter entitled “Sustainability strategy and implementation”). In the Private Bank, the “Sustainable Investment Classification Criteria Framework” was introduced in 2021. Based on Deutsche Bank’s Sustainable Finance Framework, it outlines the sustainable investment criteria to be considered within the process of discretionary portfolio management services and mandates, for mutual funds and exchange-traded funds, bonds and structured products. Based on the development of the regulatory environment, the framework was refined in 2022 taking into consideration sustainability criteria as defined under the amended Markets in Financial Instruments Directive (MiFID II). It will be further reviewed and updated on a regular basis to reflect the emerging regulations and related guidelines. Training and awareness GRI 2-12/24/29, 3-3, 404-2 Deutsche Bank aims to develop expertise across all its employees, in particular by building awareness and engagement. The bank believes it is vital that everyone understands the financial implications of ESG issues and is aware of the steps governments and regulators are taking to address these problems and how they will impact business and clients. The Chief Sustainability Office plays a key role in reinforcing the businesses’ awareness of the bank’s sustainability strategy. In 2022 front-office staff continued to receive live video-training to enable them to understand the Sustainable Finance Framework and to identify opportunities for clients to transition to more sustainable and low-carbon business models. In line with the target to offer training on the bank’s Sustainable Finance Framework to all of the relevant front-office staff in its divisions (Investment Bank, Corporate Bank and Private Bank) by the end of 2022, sustainable finance training has been integrated into the bank’s internal training platform “LearningHub”. In addition, the businesses set up the following division specific ESG training programs in 2022: 18

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance – Corporate Bank continued its program to ensure that its coverage and product teams are familiar with client and sector specific ESG knowledge; Corporate Bank also provided ESG case studies, deal alerts, newsletters, deep dives on individual topics, and other information on a regular basis – Investment Bank’s Fixed Income and Currencies continued a program of training for all product risk and client facing staff covering key aspects of ESG and sustainable finance, including Deutsche Bank’s ESG Ratings, Client Transition Dialogue, Equator Principles and Net Zero Alignment – Investment Bank’s Origination and Advisory continued to providing teaching and training of ESG topics to help facilitate client dialogue on investing, financing and net-zero; furthermore, Origination and Advisory regularly provided newsletters, deal alerts, case studies, and other information with the aim that the staff was kept up-to-date on evolving ESG topics and regulations – Private Bank Germany trained its employees via different formats to meet the sustainability preferences of its clients as well as the ESG specific requirements for its products and services; all investment advisors were required to conduct an ESG specific training as part of their annual qualification with respect to the regulatory requirements of an integrated advisory process compliant to Markets in Financial Instruments Directive II; furthermore, approximately 3,200 employees from different business areas participated in digital trainings focusing on sustainability; Private Bank Germany continued its offerings for all staff through digital workshops, net meetings and newsletters – International Private Bank continued its program for its product experts to be ESG certified extending the timeline to end 2023 to allow for changing guidelines to be reflected; until the end of 2022, more than 150 product experts have completed the Certified Environmental Social Governance Analyst examination and the majority of product experts are now certified ESG analysts; online introductory ESG training called “From Purpose to Impact” was made available to all of around 7,000 IPB’s staff end of 2021 with more than 77% of staff having completed the training to date; in addition, International Private Bank provided a tailor-made training to more than 2,000 Investment Managers to complement the implementation of sustainability preferences under MiFID II in 2022 and the focus of ESG in the client suitability processes – For Asset Management, ESG-related training was a core area of focus, offering a wide range of solutions, from online training to certification; as of December 31, 2022, DWS had 330 active employees who are Certified Environmental Social Governance Analyst certified; DWS also launched an ESG Educational Framework series open to all employees on ESG- related topics Disclosures in accordance with Article 8 of the Taxonomy Regulation GRI FS8 The EU Taxonomy Regulation is aimed to allocate funding to sustainable sectors and support the transition towards a sustainable economy, setting out the guidelines for economic activities which financial and non-financial undertakings can classify as sustainable. Deutsche Bank was among the first international banks to explicitly refer to the EU Taxonomy Regulation in its group-level sustainability policy. In particular, the bank considers the EU Taxonomy’s technical screening criteria for the classification of activities as environmentally sustainable and specifically those related to the climate change mitigation and adaptation objectives. As the overall understanding of environmental and social matters and the EU Taxonomy are evolving, these criteria may be modified. Similarly to “Do No Significant Harm” and “Minimum social safeguards” checks of client performance against environmental and social objectives required by the EU Taxonomy, Deutsche Bank already conducts reviews of clients’ overall management approach and performance towards environmental and social challenges common to the industries in which the client operates ahead of their implementation for the purpose of Taxonomy alignment reporting next year (for more information on these reviews, see the chapter “Environmental and Social Due Diligence”). To support sustainable activities of its clients and to facilitate their sustainability transition, the bank also offers and continuously develops different dedicated products as well as client engagement processes all of which seek to embed the Taxonomy-related considerations. At the same time, the bank intends to build up internal expertise and capabilities, e.g., by training the relevant business units on sustainable finance. In accordance with Article 8 of the EU Taxonomy Regulation and the related Climate Disclosures Delegated Act, starting from year end 2021, financial undertakings have to disclose the proportion of exposures to Taxonomy-eligible and Taxonomy non- eligible economic activities in their covered assets (i.e., total assets less exposures towards central governments, central banks, supranational issuers and the trading portfolio). Taxonomy eligibility indicates that an activity is in scope for screening under the EU Taxonomy Regulation. Eligible activities will be tested against the Technical Screening Criteria, starting 2023, in order to determine alignment with the Taxonomy. The clarification to use covered assets instead of total assets in the denominator of the eligibility ratios was issued in course of 2022. Prior period reporting was adjusted accordingly. 19

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance The identification of the taxonomy eligible economic activities is performed for in-scope counterparties and products defined in the Article 8 of the Taxonomy Regulation and the related Climate Disclosures Delegated Act. Where the use of proceeds is known at a transaction level, banks can consider relevant exposures to the extent the underlying transaction is financing a Taxonomy-eligible activity. For general purpose lending, banks can consider exposures weighted by capital expenditure and turnover key performance indicators provided or disclosed by their clients. Residential real estate loans against households collateralized by residential immovable property are also considered as Taxonomy-eligible. Deutsche Bank’s Taxonomy eligibility disclosure is based on the capital expenditure and turnover key performance indicators of its non-financial counterparties as well as Taxonomy eligibility key performance indicators of its financial counterparties and also includes residential real estate loans against households collateralized by residential immovable property. Identification of corporations with obligation to report under the Non-Financial Reporting Directive and their respective Taxonomy key performance indicators was performed in data collection project based on materiality of the in-scope exposures. The calculation of Deutsche Bank’s key performance indicators presented in the following table is based on the prudential consolidation circle and FINREP balance sheet. Mandatory disclosure in accordance with Article 8 of the Taxonomy Regulation in % of total in % of covered Dec 31, 2022 in € m. assets assets Total assets 1,339,157 100.00 Exposures to central governments, central banks and supranational issuers 301,900 22.54 Exposures in the trading portfolio (excluding exposures to central governments, central banks and supernational issuers) 144,381 10.78 Covered assets 892,876 66.67 100.00 Exposures in derivatives 299,834 33.58 Exposures to corporations with no obligation to report under the Non-Financial Reporting Directive 309,631 34.68 Exposures in on demand inter-bank loans 7,029 0.79 Exposures to Taxonomy eligible economic activities based on capital expenditure key performance indicators 164,495 18.42 Exposures to Taxonomy non-eligible economic activities based on capital expenditure key performance indicators 111,887 12.53 Exposures to Taxonomy eligible economic activities based on turnover key performance indicators 165,103 18.49 Exposures to Taxonomy non-eligible economic activities based on turnover key performance indicators 111,279 12.46 in % of total in % of covered 1 Dec 31, 2021 in € mn. assets assets Total assets 1,323,993 100.00 Exposures to central governments, central banks and supranational issuers 303,929 22.96 Exposures in the trading portfolio (excluding exposures to central governments, central banks and supernational issuers) 144,132 10.89 Covered assets 875,932 66.16 100.00 Exposures in derivatives 299,956 34.24 Exposures to corporations with no obligation to report under the Non-Financial Reporting Directive 237,806 27.15 Exposures in on demand inter-bank loans 7,087 0.81 Exposures to Taxonomy eligible economic activities 156,092 17.82 Exposures to Taxonomy non-eligible economic activities 174,991 19.98 1 Disclosure for year end 2021 was amended in line with the EU Commission’s frequently asked questions issued in course of 2022, clarifying the use of covered assets instead of total assets in the denominator of the eligibility ratios. Additionally, individual key performance indicators were amended to become additive and not independent from each other, in line with the approach taken for year end 2022 disclosure. In 2023, Deutsche Bank will work towards disclosing taxonomy alignment of the bank’s portfolio, expressed by the Green Asset Ratio. This will include improving data quality, in particular for the transaction-level use of proceeds assessments, and acquisition of the data required to determine the alignment of eligible clients. 20

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance Progress toward target GRI FS8 In 2022, Deutsche Bank achieved a cumulative sustainable financing and investments volume of € 215 billion (excluding DWS), thus outperforming its target of at least € 200 billion by year end 2022. The volume includes financing, bond issuance and sustainable assets under management in the Private Bank which have been facilitated since January 1, 2020. The ESG assets managed by DWS are not included in this figure as DWS operates as a separate legal entity that set its own sustainability strategy. In 2022, Deutsche Bank achieved an incremental sustainable financing and investments volume of € 58 billion (excluding DWS), compared to incremental € 112 billion in 2021 and € 46 billion in 2020. Decrease of the financing volumes compared to the prior year reflects lower levels of sustainability activities as companies prioritized their responses to the macro-economic and geo-political uncertainty and reduced lending and refinancing in a rising interest rate environment. Lower issuance volumes compared to the prior year reflect reduced primary issuance activity and volatile conditions in the global capital markets in 2022. Assets under management reported in the Private Bank include a net negative adjustment reflecting regulatory and market driven classification and advisory changes which came into force in August 2022. The contributions of Corporate Bank, Investment Bank including Fixed Income and Currencies and Origination and Advisory, Private Bank including Private Bank Germany and International Private Bank are summarized in the graphic and the tables below. Further details on the progress of individual businesses are provided in their respective chapters. 1 Numbers may not add up due to rounding Sustainable financing and investments – cumulative volumes per business Dec 31, 2022 Assets under 1 2 in € bn. Financing Issuance Management Total Corporate Bank 40 0 0 40 Investment Bank 38 90 0 128 Fixed Income and Currencies 31 27 0 58 Origination and Advisory 6 64 0 70 Private Bank 10 0 37 48 Private Bank Germany 9 0 23 32 International Private Bank 1 0 15 16 Total 88 90 37 215 1 Numbers may not add up due to rounding 2 Stock value at period end Dec 31, 2021 Assets under 1 2 in € bn. Financing Issuance Management Total Corporate Bank 26 0 0 26 Investment Bank 24 63 0 87 Fixed Income and Currencies 21 18 0 39 Origination and Advisory 3 45 0 48 Private Bank 8 0 36 44 Private Bank Germany 7 0 17 24 International Private Bank 0 0 20 20 Total 58 63 36 157 1 Numbers may not add up due to rounding 2 Stock value at period end 21

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance Dec 31, 2020 Assets under 1 in € bn. Financing Issuance Management Total Corporate Bank 6 0 0 6 Investment Bank 6 19 0 25 Fixed Income and Currencies 6 2 0 8 Origination and Advisory 0 17 0 17 Private Bank 4 0 11 15 Private Bank Germany 4 0 5 9 International Private Bank 0 0 6 6 Total 16 19 11 46 1 Stock value at period end In addition to the breakdown of the cumulated sustainable financing and investment volumes by business, the bank splits its 2022 contribution of € 58 billion in sustainable financing and investments by category (sustainability-linked, environmental, social and environmental and social) and by client type (corporates, sovereigns, supranational organizations and agencies, private and institutional). 1 Numbers may not add up due to rounding Contribution to the United Nations Sustainable Development Goals Deutsche Bank considers verifiable external reference points to be essential in its journey from ambition to environmental impact and links its progress to recognized external frameworks, like the United Nations’ Sustainable Development Goals. Therefore, the bank continues to assess how its financing and issuance activities contribute to the’ Sustainable Development Goals. Given the aforementioned MiFID II negative adjustment to assets under management in the Private Bank, financing and issuance comprised € 57 billion of the total € 58 billion incremental volumes in 2022. The bank maps them to the Sustainable Development Goals, whereby, in some cases, one transaction can be assigned to more than one goal as some categories overlap with each other and are not clearly segregated. 22

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance 1 Numbers may not add up due to rounding Corporate Bank Overview GRI 201-2, FS3, FS14 Corporate Bank’s ESG ambition is to be the strategic financing partner of choice for corporates on their ESG journey, helping them to navigate the challenges and benefits from the long-term opportunities of the transition towards a low-carbon economy. Corporate Bank is servicing the entire corporate client universe with strong relationships to its multinational corporations and a unique proposition in the MidCorp and Business Banking client segment. Through a global network of ESG champions across coverage and products, Corporate Bank is supporting its clients with ESG advice and a comprehensive suite of sustainable financing solutions and services. The champions work in collaboration with the central Corporate Bank ESG Client Solutions team to engage with clients and assist them on their long-term business strategies with a focus on transition financing. The team further provides guidance and industry specific expertise, develops materials and training, and drives the implementation of the ESG strategy in close coordination with other businesses and functions. The Global Head of ESG Corporate Bank is a member of the Corporate Bank executive committee and is mandated to drive ESG across the entire Corporate Bank franchise. In 2022, Corporate Bank provided sustainable financing solutions of € 13 billion, conducted training of its client facing staff and provided continuous ESG news flow. Furthermore, Corporate Bank extended its ESG-enabled product suite and service for its MidCorp and Business Banking clients and established a sustainable supply chain finance program, which enables clients to improve ESG accountability and transparency across their supply chain. 23

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance Transition dialogue and financing is part of Corporate Bank’s strategic client engagement and will continue to be the focus of helping its clients across sectors to achieve their strategic goals and enable the development and integration of sustainable business practices. Corporate Bank offers a comprehensive suite of sustainable finance products and services which includes different types of lending across Strategic Corporate Lending, Lending, Structured Trade and Export Finance, Natural Resource Finance, and Trade Flow, including supply chain finance programs. Corporate Bank’s Strategic Corporate Lending unit serves multinational corporate clients whose business models and financing strategies are increasingly oriented towards ESG. The loan portfolio includes sustainability-linked revolving credit facilities aligned with the United Nations Sustainable Development Goals. Strategic Corporate Lending contributed a total of € 8 billion towards Corporate Bank’s sustainable finance volumes in 2022. Corporate Bank’s Lending team supports its clients on their sustainability journey by offering sustainable lending solutions such as green loans and sustainability-linked credit facilities. In 2022, Lending showed growth of € 3 billion in sustainable lending transactions and volumes. Further, Lending launched an environmental loan program (“Umweltkredit”) to support its clients‘ investments in climate change mitigation measures such as environmentally friendly production technologies, renewable energy or energy efficiency. The Trade Flow unit offers sustainability banking services and advice to support clients to drive ESG accountability and transparency across their supply chain. In 2022, Deutsche Bank linked the Henkel AG & Co. KGaA (Henkel) supply chain finance program to the ESG ratings of its suppliers and is the first bank in Europe to convert an existing supply chain finance program for its client. Through this program, Henkel creates incentives for its suppliers to be more sustainable. By improving their ESG rating, suppliers can further reduce financing costs. The business unit ended the year 2022 with € 2 billion in sustainable financing. The Structured Trade and Export Finance unit provides long-term financing for essential infrastructure, such as railways and public transport, water infrastructure, offshore wind farms, market facilities, education facilities and healthcare projects. With a focus on emerging markets, projects have a direct positive impact on the local population and contribute to achieving environmental and social Sustainable Development Goals. Structured Trade and Export Finance contributed a total of € 252 million towards Corporate Bank’s sustainable finance volumes in 2022. As an example of Corporate Bank’s commitment to access and inclusion, Structured Trade and Export Finance supported emerging markets clients with structuring financings for critical infrastructure such as water management, healthcare, and transportation, for instance by improving access to passenger and freight transportation via railways. The Natural Resource Finance unit offers ESG-linked loans to finance energy transition investments and to contribute to energy security via financing of energy flows including biofuels, and strategic metals. In 2022, Natural Resource Finance structured its first ESG-linked uncommitted transactional commodity finance facility for a commodity trader to finance Renewable Energy Directive II certified biofuels. Additionally, Natural Resource Finance has financed several renewable energy projects as lender in syndicates, and partially as mandated lead arranger. In 2022, Natural Resource Finance contributed € 447 million in sustainable financing. The Community Development Finance Group supports economic opportunities that benefit low- and moderate-income communities in the United States of America. This portfolio includes loans that support the creation and preservation of affordable housing, loans that help small businesses with limited access to capital, and investments in funds seeking to generate both a financial return and positive social impact in low-income communities. Other funding goes towards initiatives that address complex social issues with the aim of reducing the racial wealth gap. The business unit contributed a total of € 117 million towards Corporate Bank’s sustainable finance volumes in 2022. The Corporate Bank’s Trust and Agency Services unit is a leading service provider for sustainable finance transactions in capital markets, with a focus on conventional and structured debt, project finance, syndicated loans and escrows. The offering includes administrative and trustee services for multiple asset classes and instrument types throughout the transaction lifecycle. Services include monitoring of covenants, administration of cash flows, taking and holding of security, and acting as a conduit between parties. Trust and Agency Services solutions are not contributing towards Deutsche Bank’s sustainable finance volumes but are a key component in supporting Deutsche Bank’s global offering in sustainable finance. In 2022, Trust and Agency Services expanded its service offering by acting as sustainable agent for sustainability-linked loans, and environmental and social agent for transactions with ESG-specific deliverables. In these roles, coordination and monitoring services that are critical to the performance of transactions with a high ESG due diligence profile are provided. 24

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance Progress toward target GRI FS8 Sustainable financing and investments – Corporate Bank (cumulative volumes) Contribution in 1 in € bn. Dec 31, 2022 2022 Dec 31, 2021 Dec 31, 2020 Financing 40 13 26 6 Issuance 0 0 0 0 2 Assets under Management 0 0 0 0 Total 40 13 26 6 1 Numbers may not add up due to rounding 2 Stock value at period end Corporate Bank’s cumulated sustainable financing totaled € 40 billion at year end 2022. Incremental financing volumes in 2022 reduced to € 13 billion, all of which were loans and facilities, compared to € 20 billion in the prior year. Decrease of the volumes compared to the prior year reflects lower levels of sustainability activities due to the macro-economic and geo-political uncertainty and reduced lending and refinancing in a rising interest rate environment. Highlights Corporate Bank facilitated numerous transactions in 2022 that underscore its position as a strategic partner for its clients and evidencing its expertise and capabilities to structure a broad range of sustainable finance solutions with the following selected highlights. Deutsche Bank acted as mandated lead arranger for the financing of a project which involved the construction of a high-speed railway between Ankara and Izmir in the Republic of Turkey. The financing for the project included a € 2.1 billion facility backed by United Kingdom Export Finance, the export credit agency in the United Kingdom. The new high speed railway line will provide a low-carbon method of transportation, it will improve efficiency of transport between Ankara and Izmir, creating job opportunities and improve economic conditions of the surrounding population. Deutsche Bank closed an up to € 5 million equity investment in Blackstar Stability Distressed Debt Fund LLC (Blackstar). Blackstar is an African American-led, social impact private equity fund whose mission is to support affordable and equitable homeownership, wealth creation, and financial stability for low- to moderate-income families in the United States by converting predatory contracts for deeds into traditional mortgages. This transaction is a new relationship for Deutsche Bank and signifies a commitment to supporting interventions that intentionally address racial inequity in the United States. Deutsche Bank participated as a lender with € 76 million in Tricon International’s € 1 billion uncommitted ESG-linked borrowing base facility and acted as joint lead arranger with a € 96 million ticket in Tricon Dry Chemical’s € 881 million uncommitted ESG-linked borrowing base facility. In both facilities, the borrowers must meet three sustainability key performance indicators in order to realize a pricing benefit or pay additional fees if they are missed. The key performance indicators to be satisfied reflect a 100% implementation of an outlined responsible sourcing plan, increase trading volumes of circular products over a 12-month period, and enter a new market regarding renewable products. Deutsche Bank acted as coordinator, mandated lead arranger, bookrunner and ESG coordinator in a € 400 million syndicated loan to Hirschvogel Group. Hirschvogel is one of the largest international automotive suppliers in the area of steel and aluminum forging as well as subsequent machining. The pricing of the facility is linked to the Group’s CO emissions and lost 2 time incident rate and thus supports the client in achieving its strategic sustainability goals. 25

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance Deutsche Bank participated in Alstom’s sustainability-linked € 12.7 billion committed guarantee facility agreement. Reflecting Alstom’s ambitious commitment to sustainable mobility, four sustainability-linked key performance indicators were introduced into this facility agreement. These ambitious key performance indicators highlight Alstom’s goals of reducing company and product carbon emissions and increasing presence of women in senior management and engineering positions. This transaction demonstrates Deutsche Bank’s commitment in facilitating the transition of economies towards sustainable and low-carbon growth. In a syndicate of nine banks, Deutsche Bank acted as mandated lead arranger and hedge provider for the € 466 million financing of Nebras Power Australia’s, Palisade Investment’s, and Goldwind Australia’s Stockyard Hill wind farm in the state of Victoria, Australia. The 528 megawatt wind farm is the largest operating wind farm in the east coast of Australia, includes 149 Goldwind wind turbines, and produces green electricity to power 425,000 homes annually. Investment Bank Fixed Income and Currencies Overview GRI 201-2, FS8, FS14 Fixed Income and Currencies leverages its expertise in product innovation to structure, originate and distribute assets that meet clients’ rapidly evolving ESG needs. The four main objectives for Fixed Income and Currencies are to support clients by connecting investors and issuers, to increase its sustainable lending, to support the client’s energy transition journey, and to innovate and expand its product range. The business is led by the Global Head of ESG and Sustainable Finance for Fixed Income and Currencies whose responsibilities include oversight of ESG practices within Fixed Income and Currencies and for growing the sustainable finance product suite, client engagement, and strategy including the steering of the business activities to achieve its decarbonization targets. The Head of the Fixed Income and Currencies ESG Competence & Solutions Center is responsible for the ESG integration in the businesses, interface with the group and business level control functions and supporting the clients with development of green, social, sustainable and sustainability linked transactions and fixed income products. These positions are further supported by a network of ESG champions in each of the respective Fixed Income and Currencies business areas. Sustainable finance origination in the Global Financing and Credit Trading business cumulatively increased from € 23 billion in 2021 to € 33 billion in 2022. This growth was propelled mainly by demand for renewable energy and energy-efficient assets, especially in the commercial real estate and information communications technology sectors. Social financing grew as well, including SME lending. Global Financing and Credit Trading contributed € 1.7 billion in 2021 and € 1.2 billion in 2022 towards sustainability linked deals. Global Financing and Credit Trading continued to lead in sustainable finance securitization, with multiples deals included in the highlights section below. The Rates business provides risk management solutions for sustainable bonds and loans issuers. It also issues and invests in affordable housing loans and bonds in the United States and Europe and intends to further expand this business in the future. In 2022, Rates contributed € 9 billion towards Deutsche bank’s sustainable financing and investments volumes. Rates also facilitated more than 84 structured green bond issuances and launched the DB Global Equity Long/Short ESG Screened Index, designed to capture returns of “ESG” as a factor. This means stocks are ranked according to an ESG score, and the index goes long the top quintile and short the bottom quintile subject to market cap, sector, region and market neutrality. The index is used for two purposes: (1) providing investment access to ESG as a market factor through index linked certificates and (2) as a monitoring tool of returns of the ESG factor and as a way of assessing macro risks that may be introduced to portfolios through the introduction of ESG. 26