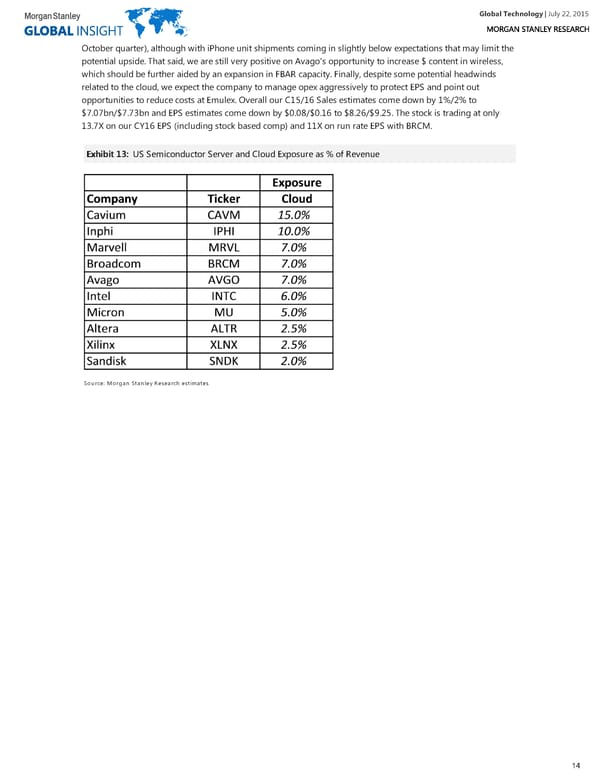

Global Technology| July 22, 2015 October quarter), although with iPhone unit shipments coming in slightly below expectations that may limit the potential upside. That said, we are still very positive on Avago's opportunity to increase $ content in wireless, which should be further aided by an expansion in FBAR capacity. Finally, despite some potential headwinds related to the cloud, we expect the company to manage opex aggressively to protect EPS and point out opportunities to reduce costs at Emulex. Overall our C15/16 Sales estimates come down by 1%/2% to $7.07bn/$7.73bn and EPS estimates come down by $0.08/$0.16 to $8.26/$9.25. The stock is trading at only 13.7X on our CY16 EPS (including stock based comp) and 11X on run rate EPS with BRCM. EExxhhiibbiitt 1133:: US Semiconductor Server and Cloud Exposure as % of Revenue Source: Morgan Stanley Research estimates 14

Global Technology Page 13 Page 15

Global Technology Page 13 Page 15