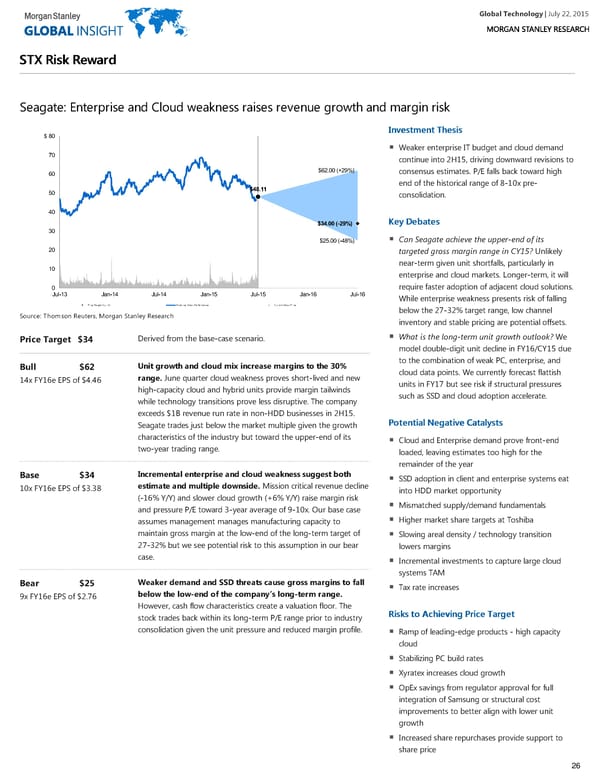

Global Technology| July 22, 2015 SSTTXX RRiisskk RReewwaarrdd Seagate: Enterprise and Cloud weakness raises revenue growth and margin risk IInnvveessttmmeenntt TThheessiiss $ 80 Weaker enterprise IT budget and cloud demand 70 continue into 2H15, driving downward revisions to $62.00 (+29%) consensus estimates. P/E falls back toward high 60 end of the historical range of 8-10x pre- $48.11 50 consolidation. 40 KKeeyy DDeebbaatteess $34.00 (-29%) 30 Can Seagate achieve the upper-end of its $25.00 (-48%) 20 targeted gross margin range in CY15? Unlikely near-term given unit shortfalls, particularly in 10 enterprise and cloud markets. Longer-term, it will require faster adoption of adjacent cloud solutions. 0 Jul-13 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16 While enterprise weakness presents risk of falling Price Target (Jul-16) Historical Stock Performance Current Stock Price WARNINGDONOTEDIT_RRS4RL~STX.O~ below the 27-32% target range, low channel Source: Thomson Reuters, Morgan Stanley Research inventory and stable pricing are potential offsets. What is the long-term unit growth outlook? We Derived from the base-case scenario. Price Target $34 model double-digit unit decline in FY16/CY15 due to the combination of weak PC, enterprise, and Unit growth and cloud mix increase margins to the 30% Bull $62 cloud data points. We currently forecast flattish range. June quarter cloud weakness proves short-lived and new 14x FY16e EPS of $4.46 units in FY17 but see risk if structural pressures high-capacity cloud and hybrid units provide margin tailwinds such as SSD and cloud adoption accelerate. while technology transitions prove less disruptive. The company exceeds $1B revenue run rate in non-HDD businesses in 2H15. PPootteennttiiaall NNeeggaattiivvee CCaattaallyyssttss Seagate trades just below the market multiple given the growth characteristics of the industry but toward the upper-end of its Cloud and Enterprise demand prove front-end two-year trading range. loaded, leaving estimates too high for the remainder of the year Incremental enterprise and cloud weakness suggest both Base $34 SSD adoption in client and enterprise systems eat estimate and multiple downside. Mission critical revenue decline 10x FY16e EPS of $3.38 into HDD market opportunity (-16% Y/Y) and slower cloud growth (+6% Y/Y) raise margin risk Mismatched supply/demand fundamentals and pressure P/E toward 3-year average of 9-10x. Our base case Higher market share targets at Toshiba assumes management manages manufacturing capacity to maintain gross margin at the low-end of the long-term target of Slowing areal density / technology transition 27-32% but we see potential risk to this assumption in our bear lowers margins case. Incremental investments to capture large cloud systems TAM Weaker demand and SSD threats cause gross margins to fall Bear $25 Tax rate increases below the low-end of the company’s long-term range. 9x FY16e EPS of $2.76 However, cash flow characteristics create a valuation floor. The RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett stock trades back within its long-term P/E range prior to industry consolidation given the unit pressure and reduced margin profile. Ramp of leading-edge products - high capacity cloud Stabilizing PC build rates Xyratex increases cloud growth OpEx savings from regulator approval for full integration of Samsung or structural cost improvements to better align with lower unit growth Increased share repurchases provide support to share price 26

Global Technology Page 25 Page 27

Global Technology Page 25 Page 27