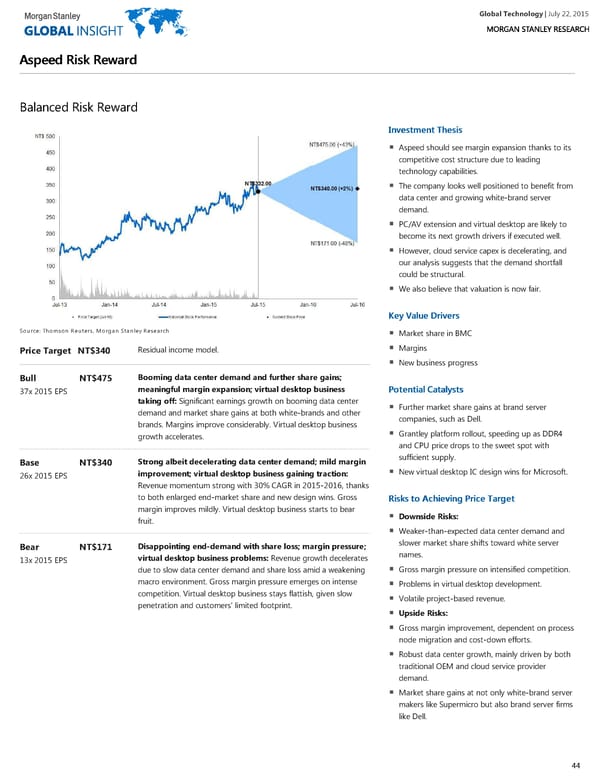

Global Technology| July 22, 2015 AAssppeeeedd RRiisskk RReewwaarrdd Balanced Risk Reward IInnvveessttmmeenntt TThheessiiss Aspeed should see margin expansion thanks to its competitive cost structure due to leading technology capabilities. The company looks well positioned to benefit from data center and growing white-brand server demand. PC/AV extension and virtual desktop are likely to become its next growth drivers if executed well. However, cloud service capex is decelerating, and our analysis suggests that the demand shortfall could be structural. We also believe that valuation is now fair. KKeeyy VVaalluuee DDrriivveerrss Source: Thomson Reuters, Morgan Stanley Research Market share in BMC Margins Residual income model. Price Target NT$340 New business progress Booming data center demand and further share gains; Bull NT$475 meaningful margin expansion; virtual desktop business PPootteennttiiaall CCaattaallyyssttss 37x 2015 EPS taking off: Significant earnings growth on booming data center Further market share gains at brand server demand and market share gains at both white-brands and other companies, such as Dell. brands. Margins improve considerably. Virtual desktop business Grantley platform rollout, speeding up as DDR4 growth accelerates. and CPU price drops to the sweet spot with sufficient supply. Strong albeit decelerating data center demand; mild margin Base NT$340 New virtual desktop IC design wins for Microsoft. improvement; virtual desktop business gaining traction: 26x 2015 EPS Revenue momentum strong with 30% CAGR in 2015-2016, thanks to both enlarged end-market share and new design wins. Gross RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett margin improves mildly. Virtual desktop business starts to bear Downside Risks: fruit. Weaker-than-expected data center demand and slower market share shifts toward white server Disappointing end-demand with share loss; margin pressure; Bear NT$171 names. virtual desktop business problems: Revenue growth decelerates 13x 2015 EPS Gross margin pressure on intensified competition. due to slow data center demand and share loss amid a weakening macro environment. Gross margin pressure emerges on intense Problems in virtual desktop development. competition. Virtual desktop business stays flattish, given slow Volatile project-based revenue. penetration and customers’ limited footprint. Upside Risks: Gross margin improvement, dependent on process node migration and cost-down efforts. Robust data center growth, mainly driven by both traditional OEM and cloud service provider demand. Market share gains at not only white-brand server makers like Supermicro but also brand server firms like Dell. 44

Global Technology Page 43 Page 45

Global Technology Page 43 Page 45