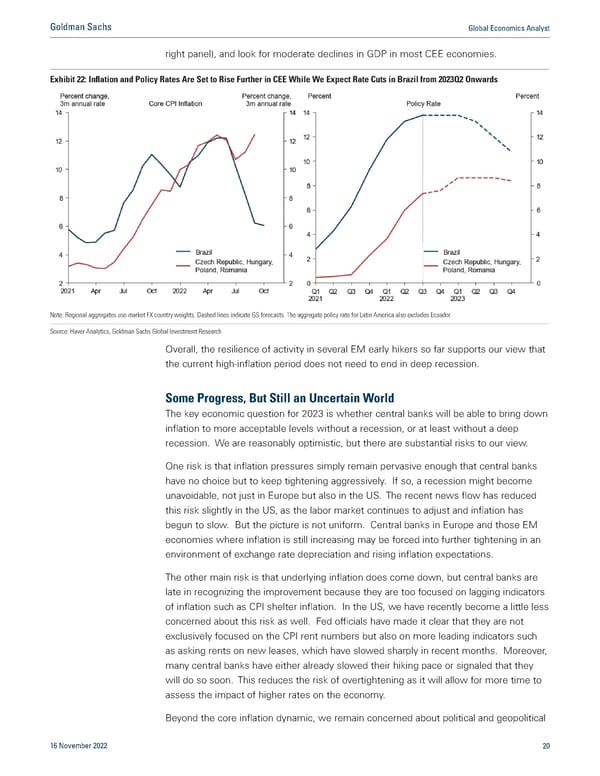

Goldman Sachs Global Economics Analyst right panel), and look for moderate declines in GDP in most CEE economies. Exhibit 22: Inflation and Policy Rates Are Set to Rise Further in CEE While We Expect Rate Cuts in Brazil from 2023Q2 Onwards Note: Regional aggregates use market FX country weights. Dashed lines indicate GS forecasts. The aggregate policy rate for Latin America also excludes Ecuador. Source: Haver Analytics, Goldman Sachs Global Investment Research Overall, the resilience of activity in several EM early hikers so far supports our view that the current high-inflation period does not need to end in deep recession. Some Progress, But Still an Uncertain World The key economic question for 2023 is whether central banks will be able to bring down inflation to more acceptable levels without a recession, or at least without a deep recession. We are reasonably optimistic, but there are substantial risks to our view. One risk is that inflation pressures simply remain pervasive enough that central banks have no choice but to keep tightening aggressively. If so, a recession might become unavoidable, not just in Europe but also in the US. The recent news flow has reduced this risk slightly in the US, as the labor market continues to adjust and inflation has begun to slow. But the picture is not uniform. Central banks in Europe and those EM economies where inflation is still increasing may be forced into further tightening in an environment of exchange rate depreciation and rising inflation expectations. The other main risk is that underlying inflation does come down, but central banks are late in recognizing the improvement because they are too focused on lagging indicators of inflation such as CPI shelter inflation. In the US, we have recently become a little less concerned about this risk as well. Fed officials have made it clear that they are not exclusively focused on the CPI rent numbers but also on more leading indicators such as asking rents on new leases, which have slowed sharply in recent months. Moreover, many central banks have either already slowed their hiking pace or signaled that they will do so soon. This reduces the risk of overtightening as it will allow for more time to assess the impact of higher rates on the economy. Beyond the core inflation dynamic, we remain concerned about political and geopolitical 16 November 2022 20

Goldman Sachs Global Economics Analyst Macro Outlook 2023 Page 19 Page 21

Goldman Sachs Global Economics Analyst Macro Outlook 2023 Page 19 Page 21