Jacobs Engineering Group ESG Disclosures

FY 2021 ESG Disclosures Boldly moving forward

FY21 ESG Disclosures July 2022 Unaudited 1 Introduction This document is intended to provide supplementary information to stakeholders of Jacobs Engineering Group Inc. (Jacobs or the Company) regarding our Environmental, Social and Governance (ESG) performance. In addition to the information herein, we strongly encourage review of additional company materials for a more comprehensive view of our ESG commitments and performance, including but not limited to our: Investor Relations ESG microsite FY2022-2024 Company Strategy Presentation PlanBeyond 2.0 TM Sustainability Strategy Climate Action Plan (2022) Climate Risk Assessment FY21 Climate Risk Assessment FY22 2021 CDP Submission Approved Science-Based Targets 2021 Integrated Annual Report FY21 10-K Report 2022 Proxy Statement This document is an annual update to our reporting and reflects activity through fiscal year 2021 (FY21). We may provide periodic updates as stakeholder ESG data requirements change. Document History and Status Revision Date Description 1 March 3, 2022 Initial release 2 July 12, 2022 Broad update to reflect additional data and developments since initial release

FY21 ESG Disclosures July 2022 Unaudited 2 Contents Introduction ........................................................................................................................................................................ 1 GENERAL .............................................................................................................................................................................. 5 GEN.1 Jacobs ESG Reporting .......................................................................................................................................... 5 GEN.2 Assurances and Verification ............................................................................................................................... 5 GEN.3 General Information.............................................................................................................................................. 6 GEN.4 Services and Markets ............................................................................................................................................ 6 GEN.5 External Engagement ........................................................................................................................................... 6 ENVIRONMENTAL .............................................................................................................................................................. 7 ENV.1 Introduction.............................................................................................................................................................. 7 ENV.2 Environmental Reporting.................................................................................................................................... 7 ENV.3 Greenhouse Gas Emissions ................................................................................................................................ 7 ENV.4 Greenhouse Gas Emissions - Scope 1 (Direct) ........................................................................................ 10 ENV.5 Greenhouse Gas Emissions - Scope 2 (Indirect) ..................................................................................... 10 ENV.6 Greenhouse Gas Emissions - Scope 3 (Indirect) ..................................................................................... 12 ENV.7 GHG Emissions Intensity Metrics .................................................................................................................. 14 ENV.8 Renewable Electricity and Carbon Offsets ................................................................................................ 14 ENV.9 Energy Consumption and Energy Intensity Metrics .............................................................................. 15 ENV.10 Water Consumption ........................................................................................................................................... 16 ENV.11 Biodiversity and Natural Capital .................................................................................................................... 16 ENV.12 Waste ....................................................................................................................................................................... 17 ENV.13 Hazardous Waste ................................................................................................................................................. 18 ENV.14 Environmental Management System (EMS) ............................................................................................ 18 ENV.15 Climate Change ................................................................................................................................................... 18 ENV.16 Carbon Pricing ...................................................................................................................................................... 20 ENV.17 Low-Carbon Transition Plan, Products and Services............................................................................. 21 ENV.18 Environmental Impact in Project Design and Delivery......................................................................... 25 SOCIAL ...............................................................................................................................................................................27 SOC.1 Introduction........................................................................................................................................................... 27 SOC.2 Employee Engagement .................................................................................................................................... 27 SOC.3 Inclusion and Diversity – Strategy ................................................................................................................ 28 SOC.4 Inclusion and Diversity – Workforce Metrics ............................................................................................ 30 SOC.5 Pay Equity and Pay Gap .................................................................................................................................... 32 SOC.6 Collective Bargaining ......................................................................................................................................... 33 SOC.7 Employee Wellbeing and Support Programs ........................................................................................... 33

FY21 ESG Disclosures July 2022 Unaudited 3 SOC.8 Hiring and Retention ......................................................................................................................................... 35 SOC.9 Training and Development ............................................................................................................................. 35 SOC.10 Human Rights ....................................................................................................................................................... 36 SOC.11 Community Investment .................................................................................................................................... 38 SOC.12 Health, Safety and Environment – Management ................................................................................... 40 SOC.13 HSE – Products and Services .......................................................................................................................... 48 SOC.14 Health and Safety – Metrics ............................................................................................................................ 49 SOC.15 Client Satisfaction ............................................................................................................................................... 50 GOVERNANCE ...................................................................................................................................................................52 GOV.1 Values, Ethics and Code of Conduct ............................................................................................................ 52 GOV.2 Supply Chain ......................................................................................................................................................... 53 GOV.3 Board Structure .................................................................................................................................................... 53 GOV.4 Board Composition and Diversity ................................................................................................................. 54 GOV.5 Board Nominations and Conflict of Interest ............................................................................................. 54 GOV.6 Board Roles and Effectiveness ....................................................................................................................... 55 GOV.7 Remuneration ....................................................................................................................................................... 55 GOV.8 Management Incentives (Non-Financial Metrics) .................................................................................. 56 GOV.9 Materiality Assessment and Sustainability Strategy ............................................................................. 56 GOV.10 ESG Governance .................................................................................................................................................. 62 GOV.11 Risk Governance .................................................................................................................................................. 63 GOV.12 Corruption .............................................................................................................................................................. 65 GOV.13 Cybersecurity and Data Privacy ..................................................................................................................... 65 SUSTAINABILITY ACCOUNTING STANDARDS BOARD (SASB) .............................................................................67 SASB.1 Professional and Commercial Services (PRO) ......................................................................................... 67 SASB.2 Engineering and Construction Services (E&C) ......................................................................................... 68 Tables 1 Science-based Target Progress ....................................................................................................................................... 8 2 DGHG Scope 1 Emissions ............................................................................................................................................... 10 3 GHG Scope 2 Emissions .................................................................................................................................................. 11 4 Renewable Energy by Region........................................................................................................................................ 11 5 Scope 3 Indirect GHG Emissions Estimates ............................................................................................................. 12 6 GHG Intensity Metrics ...................................................................................................................................................... 14 7 Annual Renewable Electricity and Carbon Offset Purchases ............................................................................ 14 8 Energy Consumption ........................................................................................................................................................ 15 9 Energy Intensity .................................................................................................................................................................. 15

FY21 ESG Disclosures July 2022 Unaudited 4 10 Water Consumption .......................................................................................................................................................... 16 11 Waste Disposed .................................................................................................................................................................. 17 12 Hazardous Waste Generation ........................................................................................................................................ 18 13 Employee Engagement ................................................................................................................................................... 28 14 Workforce Composition by Geography ..................................................................................................................... 30 15 Gender Diversity by Management Level (Global) ................................................................................................. 30 16 Gender Diversity by Management Level and Job Type (Global) .................................................................... 31 17 Racial/Ethnic Diversity (US Only) ................................................................................................................................ 31 18 Racial/Ethnic Diversity by Management Level (US Only) .................................................................................. 31 19 Diversity by Age Group (Global) .................................................................................................................................. 31 20 Average Employee Age by Gender (Global) ........................................................................................................... 32 21 Distribution of Gender by Age Group (Global) ...................................................................................................... 32 22 Employee Turnover (Global) ......................................................................................................................................... 35 23 Hiring (Global) .................................................................................................................................................................... 35 24 Training and Development Metrics ............................................................................................................................ 36 25 Contributions Via Collectively Platform .................................................................................................................... 39 26 Contributions Summary by Type of Contribution ................................................................................................. 39 27 Fatalities ................................................................................................................................................................................ 49 28 Total Recordable Incident Rates .................................................................................................................................. 49 29 Contractor Total Recordable Incident Rates ........................................................................................................... 49 30 Lost-time Injury Frequency Rate ................................................................................................................................. 49 31 Contractor Lost-time Injury Frequency Rate ........................................................................................................... 50 32 Occupational Illness Frequency Rate ......................................................................................................................... 50 33 Absentee Rate (Non-US Only) ...................................................................................................................................... 50 34 Client Satisfaction Rate ................................................................................................................................................... 51 35 Compensation ..................................................................................................................................................................... 55 36 Jacobs’ Core SDGs, Material Topics, Strategy and Performance .................................................................... 59 37 Emerging Risks ................................................................................................................................................................... 64 38 Sustainability Disclosure Topics and Accounting Metrics (PRO) .................................................................... 67 39 Activity Metrics (PRO) ...................................................................................................................................................... 68 40 Sustainability Disclosure Topics and Accounting Metrics (E&C) ..................................................................... 68 Figures 1 Renewable Electricity by Region (MWh) ...................................................................................................................... 8 2 2022 Materiality Assessment: Priority Issues ......................................................................................................... 57 3 PlanBeyond 2.0 Sustainable Business Objectives ................................................................................................. 58 4 ESG Governance Structure ............................................................................................................................................. 62

FY21 ESG Disclosures July 2022 Unaudited 5 GENERAL GEN.1 Jacobs ESG Reporting Jacobs has reported on a wide range of Environmental, Social and Governance (ESG) issues through our annual ESG Disclosures since 2019. We have also reported on ESG issues via our Integrated Annual Report, Form 10-K, Proxy Statement, and other public materials. This report is focused on our priority ESG data that we believe is the most relevant to our business and important to our stakeholders. This report is aligned to the Sustainability Accounting Standards Board ( SASB ) framework and informed by Global Reporting Initiative ( GRI ) standards. Annually, we disclose to CDP (formerly the Carbon Disclosure Project) and the S&P Global Corporate Sustainability Assessment, ( CSA ), which is the basis for the S&P Global ESG Score and a key factor for inclusion in the Dow Jones Sustainability Indices . We disclose our climate risk data in line with the Task Force on Climate-related Financial Disclosures ( TCFD ) recommendations. We also regularly engage with leading ESG rating and ranking organizations to review and improve the accuracy of their data regarding our ESG performance. We understand and champion the increasing appetite for ESG metrics and transparency. We take a pragmatic approach to our disclosures, focusing on what is material, what is a risk or opportunity, and what makes sense for our business. We look forward to a consistent, industry-wide reporting framework that serves the investor community and reduces reliance on lagging indicators—allowing companies to be more efficient and focused on improving ESG performance. This document covers activities in fiscal year 2021 (FY21) for Jacobs from October 3, 2020, to October 1, 2021. Our FY20 report was released in January of 2021 and was last updated in July 2021. Jacobs meets current Securities and Exchange Commission (SEC) climate change related disclosure obligations in our Annual Report on Form 10-K. Jacobs will release an ESG disclosure document annually and will make periodic updates as required by new SEC rules and regulations and as additional information is obtained or to fulfill stakeholder requests for disclosures. We apply an operational control approach as the boundary for our ESG reporting. On March 3, 2021, Jacobs acquired a 65% stake in PA Consulting. In alignment with the greenhouse gas (GHG) Protocol, our investment in PA Consulting is included within our scope 3 GHG emissions data for FY21, which includes GHG emissions outside of our operational control. PA Consulting is otherwise excluded from our ESG reporting in this document. For more information on our approach to integrating PA Consulting into our GHG emissions inventory, see section ENV.6 GHG Emissions - Scope 3 (Indirect) . We also acquired BlackLynx, Inc. in November 2021 and Street Light Data, Inc. in February 2022. These acquisitions are not included in this report because they were consummated in FY22. Additionally, ESG and GHG data from our Joint Ventures are not within the reporting boundary of this report. For questions regarding this document, please contact: [email protected] . GEN.2 Assurances and Verification This document has gone through internal review by subject matter experts, legal experts and internal auditors to confirm accuracy of the contents as of the time of publication, but only our GHG emissions data reported here was externally verified, with limited assurance. In the future, we intend to obtain independent assurance of additional data, including social indicators. This document and the data within should be considered unaudited. Certain information reported herein contains estimates or is based on assumptions. Furthermore, forward-looking information in the report, including our goals, plans and expectations, involve risks and uncertainties that may result in our not achieving goals or cause actual results to differ materially from those expressed or implied. Our FY21 Form 10-K (pp. 21–46) contains a discussion of some of the risks and uncertainties that could cause our actual results to differ from our plans and expectations.

FY21 ESG Disclosures July 2022 Unaudited 6 Our FY21 GHG emissions were externally verified by a third party, Cameron-Cole, LLC. on February 24, 2022. Our limited assurance verification statements are published on the Jacobs Investor Relations ESG microsite, including both our FY19-20 and FY21 verification statements. GEN.3 General Information Jacobs Engineering Group Inc. is a publicly held corporation, incorporated in the State of Delaware. Jacobs shares trade on the New York Stock Exchange (Ticker: J). Jacobs is headquartered in Dallas, Texas (TX): 1999 Bryan Street, Suite 1200, Dallas, TX 75201 Exhibit 21 to our FY21 Form10-K contains a list of all of Jacobs’ material subsidiaries. GEN.4 Services and Markets Jacobs provides services in two lines of business (LOB): Critical Mission Solutions (CMS) and People & Places Solutions (P&PS), and holds a majority investment in PA Consulting, which are also the Company’s financial reportable segments. As stated in GEN.1 Jacobs ESG Reporting , our investment in PA Consulting is included within our scope 3 GHG emissions for FY21, but PA Consulting is otherwise excluded from our ESG reporting in this document. Detailed descriptions of the LOBs can be found in our FY21 Form 10-K (pp. 11–15). Jacobs’ operations are located primarily in North America, Europe, Middle East and Asia Pacific, with detailed locations available on Jacobs.com . For FY21, Jacobs had revenues of $14.1 billion and approximately 55,000 people worldwide, including a contingent workforce of approximately 3,000 people. Excluding PA Consulting, Jacobs had FY21 revenues of $13.5 billion. Detailed financial information is included in our FY21 Form 10-K . GEN.5 External Engagement Jacobs is involved in various external organizations and initiatives dedicated to advancing our ESG and sustainability priorities, including but not limited to: United Nations (U.N.) Global Compact – Participant level U.N. Race to Zero Campaign Supporter U.N. Global Compact Chief Financial Officer (CFO) Coalition for the Sustainable Development Goals (SDGs) – Founding Member World Economic Forum (WEF) Infrastructure and Urban Development Governors Committee WEF Alliance of Chief Executive Officer (CEO) Climate Leaders Science Based Targets Initiative (SBTi) – Business Ambition for 1.5°C SBTi Technical Advisory Group (TAG) U.S. Environmental Protection Agency (EPA) Green Power Partnership Business in the Community United Kingdom (U.K.) Net Zero Taskforce World Environment Center BSR (Businesses for Social Responsibility) Environmental Analyst – Sustainable Delivery Group Task Force on Climate-Related Financial Disclosures (TCFD) Supporter CDP Supply Chain Member Pledge to Net Zero Alliance Catalyst CEO Champions for Change

FY21 ESG Disclosures July 2022 Unaudited 7 ENVIRONMENTAL ENV.1 Introduction As a recognized global leader in environmental and sustainability professional services, Jacobs holds environmental protection as a core value, as expressed in the Jacobs Global Environmental Management Commitment Statement and as the cornerstone of our PlanBeyond ℠ Sustainability and BeyondZero ℠ Health, Safety and Environment (HSE) approaches. Our Office of Global Climate Response & ESG was established in October 2021 and reports to our President and Chief Operations Officer (COO), Bob Pragada. The office acts as a connecting point for Jacobs’ go-to-market solutions within the framework of energy transition, decarbonization, adaptation and resilience, and natural resource stewardship, along with ESG advisory. Globally, in FY20 and FY21 we achieved 100% renewable electricity for our operations and carbon neutrality for our operations and business travel, as further described under ENV.3 Greenhouse Gas Emissions . We are committed to continuing these achievements. ENV.2 Environmental Reporting We report on environmental issues and Key Performance Indicators (KPIs) in the public domain and provide targets linked to these indicators. All environmental indicators reported in this document, unless otherwise noted, cover 100% of Jacobs’ business locations. Carbon emissions were third-party verified with limited assurance for all years reported. Other relevant information is available in our Integrated Annual Report, PlanBeyond 2.0 sustainable business approach, and Environmental Performance Reports for locations certified to ISO14001. ENV.3 Greenhouse Gas Emissions Our deep commitment to environmental protection and concern regarding the climate crisis led to aggressive carbon emission commitments that are set forth in our Climate Action Plan , first published on April 22, 2020. Detailed in our Carbon Neutrality Commitment included in the Climate Action Plan, we achieved 100% low-carbon electricity and became carbon neutral for our operations and business travel in 2020 and continue to maintain these commitments. Joining over 300 companies worldwide in November 2020, Jacobs became a signatory to the U.N. Business Ambition for 1.5°C , an urgent request for action from the global coalition of U.N. agencies, business and industry leaders, calling on businesses to set ambitious science-based emissions reduction targets aligned with limiting global temperature rise to 1.5°C above pre-industrial levels. Our 2020 climate commitments were a major milestone in our drive to address the climate crisis. In keeping with our core value of “We Aim Higher” and the continually evolving guidance and best practices for climate response, we revised our plan and targets. In our updated Climate Action Plan , published in April 2022, we commit to the following: 1. Ensure every project becomes a climate response opportunity. 2. Achieve net-zero greenhouse gas emissions across the value chain by 2040. 3. Maintain carbon neutrality status and 100% low-carbon electricity for our operations. As a member of the Science Based Target initiative (SBTi) Technical Advisory Group (TAG) since 2020 and a participant in the Net-Zero Road Test in 2021, we committed to setting net-zero targets in line with the SBTi Corporate Net-Zero Standard. Key requirements of the Net-Zero Standard include focusing on rapid, deep emissions cuts; setting near- and long-term targets; claiming achievement of net zero only after long-term targets are met; and investing in mitigation within and outside the value chain.

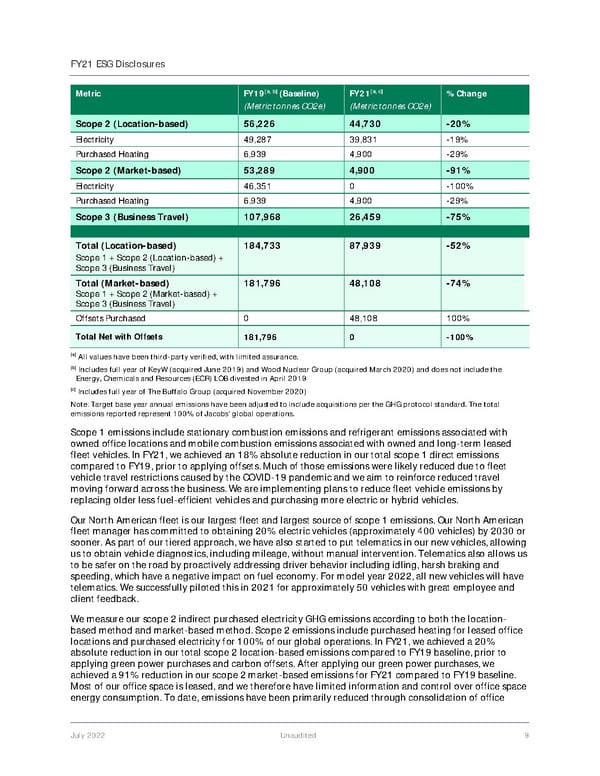

FY21 ESG Disclosures July 2022 Unaudited 8 We have approved near- and long-term science-based emissions reduction targets with the SBTi. This means our emissions reduction targets are consistent with the aim of the Paris Agreement to limit average global warming to 1.5°C by the end of the century, compared to pre-industrial temperatures. They are also consistent with the Net-Zero Standard. Our near-term targets are approved by the SBTi as follows: We commit to reduce absolute scope 1 and 2 GHG emissions 50% by 2030 from a 2019 base year and we commit to reduce absolute scope 3 GHG emissions from business travel and employee commuting by 50% over the same timeframe. We commit that 65% of our suppliers by spend covering purchased goods and services will have science-based targets by 2025. Our long-term targets are approved by the SBTi as follows: We commit to reduce absolute scopes 1, 2 & 3 GHG emissions 90% by 2040 from a 2019 base year. In January 2021, we made a three-year commitment to CDP – an international non-profit organization that runs a global disclosure system focused on environmental impact – as a supply chain member to engage our suppliers, pinpoint risks and identify opportunities to support our suppliers in reducing emissions and strengthening their climate resiliency. Jacobs was recognized on CDP’s 2021 Supplier Engagement Leaderboard for engaging our suppliers on climate change and playing a crucial role in the transition towards the net-zero sustainable economy. We continue to be a member of the U.S. EPA Green Power Partnership, a voluntary program that supports the development of new renewable generation capacity in the U.S. and requires annual use of green power at a level that meets or exceeds partnership benchmark requirements. Thanks to our industry-leading commitments and achievement, we are now proud to be one of the Top Partner Rankings as a U.S. EPA Green Power Partnership 100% Green Power User . We use the GHG Protocol Corporate Accounting and Reporting standard to calculate emissions using Intergovernmental Panel on Climate Change (IPCC) Fifth Assessment Report emission factors. All GHGs, including CO2, CH4, N20, HFCs, PFCs, SF6 and NF3, are included in calculations of metric tonnes of carbon dioxide equivalents (C02e). We use an operational control approach as the boundary for consolidation of emissions. We are using 2019 as our baseline year for all carbon reporting and carbon reduction target- setting, and we are committed to publishing our GHG inventory (carbon footprint), which is verified by an accredited third party each year with limited assurance. In FY19, we completed the acquisition of KeyW. In FY20, we completed the acquisition of John Wood Group’s nuclear business, Wood Nuclear Group. FY19 base year values have been updated to reflect these acquisitions, as well as improvements to data collection and a better understanding of boundaries. In FY21, we completed the acquisition of Buffalo Group. The emissions from The Buffalo Group have been added to the FY21 inventory but have not been added to the FY19 baseline values because they are not materially significant, comprising less than 1% of our total FY21 inventory. Table 1 summarizes our commitment to carbon neutrality for our operations and business travel and reflects progress against our science-based targets prior to and after the application of renewable electricity and carbon offsets: Table 1. Science-based Target Progress Metric FY19 [a, b] (Baseline) (Metric tonnes CO2e) FY21 [a, c] (Metric tonnes CO2e) % Change Scope 1 20,539 16,749 -18% Mobile Combustion 20,033 16,312 -19% Stationary Combustion 506 393 -22% HFC Fugitive Emissions Not Reported 44 n/a

FY21 ESG Disclosures July 2022 Unaudited 9 Metric FY19 [a, b] (Baseline) (Metric tonnes CO2e) FY21 [a, c] (Metric tonnes CO2e) % Change Scope 2 (Location-based) 56,226 44,730 -20% Electricity 49,287 39,831 -19% Purchased Heating 6,939 4,900 -29% Scope 2 (Market-based) 53,289 4,900 -91% Electricity 46,351 0 -100% Purchased Heating 6,939 4,900 -29% Scope 3 (Business Travel) 107,968 26,459 -75% Total (Location-based) Scope 1 + Scope 2 (Location-based) + Scope 3 (Business Travel) 184,733 87,939 -52% Total (Market-based) Scope 1 + Scope 2 (Market-based) + Scope 3 (Business Travel) 181,796 48,108 -74% Offsets Purchased 0 48,108 100% Total Net with Offsets 181,796 0 -100% [a] All values have been third-party verified, with limited assurance. [b] Includes full year of KeyW (acquired June 2019) and Wood Nuclear Group (acquired March 2020) and does not include the Energy, Chemicals and Resources (ECR) LOB divested in April 2019 [c] Includes full year of The Buffalo Group (acquired November 2020) Note: Target base year annual emissions have been adjusted to include acquisitions per the GHG protocol standard. The total emissions reported represent 100% of Jacobs' global operations. Scope 1 emissions include stationary combustion emissions and refrigerant emissions associated with owned office locations and mobile combustion emissions associated with owned and long-term leased fleet vehicles. In FY21, we achieved an 18% absolute reduction in our total scope 1 direct emissions compared to FY19, prior to applying offsets. Much of those emissions were likely reduced due to fleet vehicle travel restrictions caused by the COVID-19 pandemic and we aim to reinforce reduced travel moving forward across the business. We are implementing plans to reduce fleet vehicle emissions by replacing older less fuel-efficient vehicles and purchasing more electric or hybrid vehicles. Our North American fleet is our largest fleet and largest source of scope 1 emissions. Our North American fleet manager has committed to obtaining 20% electric vehicles (approximately 400 vehicles) by 2030 or sooner. As part of our tiered approach, we have also started to put telematics in our new vehicles, allowing us to obtain vehicle diagnostics, including mileage, without manual intervention. Telematics also allows us to be safer on the road by proactively addressing driver behavior including idling, harsh braking and speeding, which have a negative impact on fuel economy. For model year 2022, all new vehicles will have telematics. We successfully piloted this in 2021 for approximately 50 vehicles with great employee and client feedback. We measure our scope 2 indirect purchased electricity GHG emissions according to both the location- based method and market-based method. Scope 2 emissions include purchased heating for leased office locations and purchased electricity for 100% of our global operations. In FY21, we achieved a 20% absolute reduction in our total scope 2 location-based emissions compared to FY19 baseline, prior to applying green power purchases and carbon offsets. After applying our green power purchases, we achieved a 91% reduction in our scope 2 market-based emissions for FY21 compared to FY19 baseline. Most of our office space is leased, and we therefore have limited information and control over office space energy consumption. To date, emissions have been primarily reduced through consolidation of office

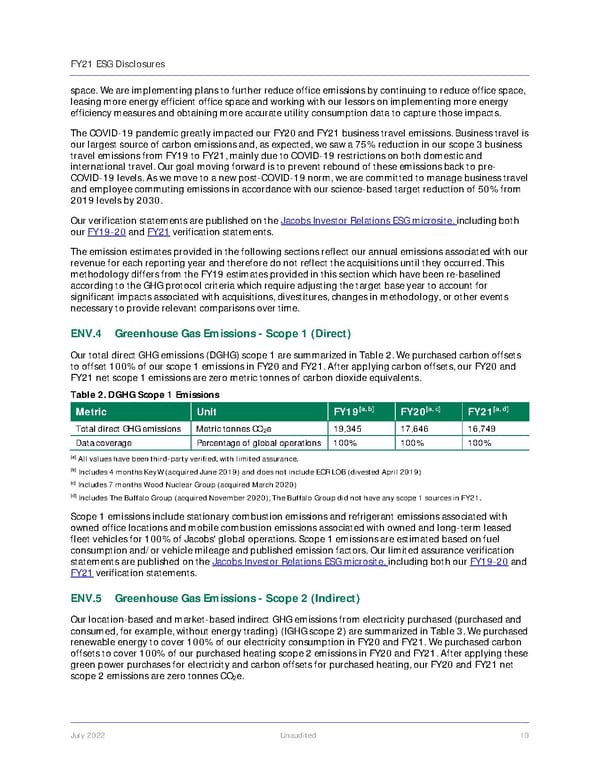

FY21 ESG Disclosures July 2022 Unaudited 10 space. We are implementing plans to further reduce office emissions by continuing to reduce office space, leasing more energy efficient office space and working with our lessors on implementing more energy efficiency measures and obtaining more accurate utility consumption data to capture those impacts. The COVID-19 pandemic greatly impacted our FY20 and FY21 business travel emissions. Business travel is our largest source of carbon emissions and, as expected, we saw a 75% reduction in our scope 3 business travel emissions from FY19 to FY21, mainly due to COVID-19 restrictions on both domestic and international travel. Our goal moving forward is to prevent rebound of these emissions back to pre- COVID-19 levels. As we move to a new post-COVID-19 norm, we are committed to manage business travel and employee commuting emissions in accordance with our science-based target reduction of 50% from 2019 levels by 2030. Our verification statements are published on the Jacobs Investor Relations ESG microsite, including both our FY19-20 and FY21 verification statements. The emission estimates provided in the following sections reflect our annual emissions associated with our revenue for each reporting year and therefore do not reflect the acquisitions until they occurred. This methodology differs from the FY19 estimates provided in this section which have been re-baselined according to the GHG protocol criteria which require adjusting the target base year to account for significant impacts associated with acquisitions, divestitures, changes in methodology, or other events necessary to provide relevant comparisons over time. ENV.4 Greenhouse Gas Emissions - Scope 1 (Direct) Our total direct GHG emissions (DGHG) scope 1 are summarized in Table 2. We purchased carbon offsets to offset 100% of our scope 1 emissions in FY20 and FY21. After applying carbon offsets, our FY20 and FY21 net scope 1 emissions are zero metric tonnes of carbon dioxide equivalents. Table 2. DGHG Scope 1 Emissions Metric Unit FY19 [a, b] FY20 [a, c] FY21 [a, d] Total direct GHG emissions Metric tonnes CO 2 e 19,345 17,646 16,749 Data coverage Percentage of global operations 100% 100% 100% [a] All values have been third-party verified, with limited assurance. [b] Includes 4 months KeyW (acquired June 2019) and does not include ECR LOB (divested April 2019) [c] Includes 7 months Wood Nuclear Group (acquired March 2020) [d] Includes The Buffalo Group (acquired November 2020); The Buffalo Group did not have any scope 1 sources in FY21. Scope 1 emissions include stationary combustion emissions and refrigerant emissions associated with owned office locations and mobile combustion emissions associated with owned and long-term leased fleet vehicles for 100% of Jacobs' global operations. Scope 1 emissions are estimated based on fuel consumption and/or vehicle mileage and published emission factors. Our limited assurance verification statements are published on the Jacobs Investor Relations ESG microsite, including both our FY19-20 and FY21 verification statements. ENV.5 Greenhouse Gas Emissions - Scope 2 (Indirect) Our location-based and market-based indirect GHG emissions from electricity purchased (purchased and consumed, for example, without energy trading) (IGHG scope 2) are summarized in Table 3. We purchased renewable energy to cover 100% of our electricity consumption in FY20 and FY21. We purchased carbon offsets to cover 100% of our purchased heating scope 2 emissions in FY20 and FY21. After applying these green power purchases for electricity and carbon offsets for purchased heating, our FY20 and FY21 net scope 2 emissions are zero tonnes CO 2 e.

FY21 ESG Disclosures July 2022 Unaudited 11 Table 3. IGHG Scope 2 Emissions Metric Unit FY19 [a, b] FY20 [a, c] FY21 [a, d] Total indirect GHG emissions (Location-based) Metric tonnes CO 2 e 53,275 52,984 44,730 Electricity Metric tonnes CO 2 e 46,912 46,301 39,831 Purchased Heating Metric tonnes CO 2 e 6,363 6,683 4,900 Total indirect GHG emissions (Market- Based) Metric tonnes CO 2 e 43,581 6,683 4,900 Data coverage Percentage of global operations 100% 100% 100% [a] All values have been third-party verified, with limited assurance. [b] Includes 4 months KeyW (acquired June 2019) & does not include ECR Line of Business (divested April 2019) [c] Includes 7 months Wood Nuclear Group (acquired March 2020) [d] Includes Buffalo Group (acquired November 2020) We measure our scope 2 indirect purchased electricity GHG emissions according to both the location-based method and market-based method. Scope 2 emissions include comfort heating for leased office locations and purchased electricity for 100% of our global operations. Our commitment to 100% low carbon electricity means that our electricity needs are expected to be supplied through a variety of sources globally such as green tariffs, renewable energy certificates (RECs), energy attribute certificates (EACs) and virtual purchase power agreements (VPPAs). We are a partner in the U.S. EPA’s Green Power Partnership , a voluntary program, where the goal is to increase the use of green power among organizations in the U.S. as a way to reduce the environmental impacts associated with conventional electricity use. In the U.K., we purchase 100% renewable electricity through Renewable Energy Guarantees Origin (REGO) certificates for all offices where we are directly responsible for procuring energy. This accounts for over half of our U.K. offices. In FY21, we began purchasing 100% renewable electricity through our utility energy providers in Australia and New Zealand for offices where we are directly responsible for procuring energy and where certified renewable energy was available. We purchased the remainder of our FY20 and FY21 global renewable electricity through third-party providers of RECs or EACs to cover 100% of our electricity consumption globally. FY21 renewable electricity purchases were sourced according to where our electricity consumption occurs globally, as shown by megawatt hour (MWh) in Table 4 and Figure 1. Table 4. Renewable Energy by Region We do not have access to actual energy consumption associated with the majority of our 350+ leased locations. We estimate energy consumption for most of our leased locations by using Commercial Buildings Energy Consumption Survey (CBECS) data published by the U.S. Energy Information Administration. CBECS provides average energy intensity use for various types of buildings in various climate zones. This data, combined with the office size, is used to estimate energy consumption and is subsequently combined with published energy emission factors to estimate associated energy emissions for each office location. Including this data in our carbon inventory helps us develop strategies to better Region MWh of Renewable Electricity Asia-Pacific 9,053 Europe 19,662 North America 70,400 Middle East and Africa 1,093 Total 100,208 Asia-Pacific 9% Europe 20% ME&A 1% North America 70% Figure 1. Renewable Electricity by Region (MWh)

FY21 ESG Disclosures July 2022 Unaudited 12 understand and manage energy consumption and emissions in our leased offices. For example, we have used this data to identify our locations with the greatest energy consumption and carbon emissions for which we have begun or will start collecting utility invoice data or installing submeters, where feasible, to better understand our ability to facilitate improvements in energy efficiency. Our limited assurance verification statements are published on the Jacobs Investor Relations ESG microsite, including both our FY19-20 and FY21 verification statements. ENV.6 Greenhouse Gas Emissions - Scope 3 (Indirect) We completed a scope 3 screening evaluation in 2020 using FY19 data to identify scope 3 sources that are material to Jacobs and assess where we can make impactful changes. Based on screening level estimates for employee commuting and purchased goods and services and our calculated emissions for business travel, our four largest scope 3 sources include business travel, employee commuting, purchased goods and services and upstream fuel and energy-related activities not already included in scope 1 and scope 2. On March 3, 2021, we acquired a 65% stake in PA Consulting. PA Consulting was therefore not included in our scope 3 sources when this assessment was initially completed based on FY19 data. However, in alignment with the GHG Protocol, our investment in PA Consulting is included within our scope 3 GHG emissions data for FY21. Once PA Consulting emissions are finalized and verified, we expect to update our FY19 baseline to include PA Consulting and track progress against our SBTi net-zero target. During the SBTi net-zero targets approval process, we added emissions associated with upstream fuel to our scope 3 business travel and employee commuting, known as well-to-tank (WTT) emissions, to reflect changes in the SBTi Net-Zero standard which differs from the GHG Protocol scope 3 standard. Our scope 3 indirect GHG emission estimates from business travel, business travel WTT, employee commuting, employee commuting WTT, fuel and energy-related activities, purchased goods and services and investments are summarized in Table 5. Our final limited assurance verification statements are published to the Jacobs Investor Relations ESG microsite, including both our FY19-20 and FY21 verification statements. Table 5. Scope 3 Indirect GHG Emissions Estimates Metric Unit FY19 [a] (estimated) FY20 [b] (estimated) FY21 [c] (estimated) Business Travel [d] Metric tonnes CO2e 105,245 53,533 26,459 Business Travel WTT [e] Metric tonnes CO2e 14,043 7,122 4,174 Employee Commuting [d] Metric tonnes CO2e 78,247 46,434 21,351 Employee Commuting WTT [e] Metric tonnes CO2e 15,583 9,238 4,232 Purchased Goods and Services [f] Metric tonnes CO2e 25,823 25,823 25,823 Upstream Fuel and Energy Related Activities for scope 1 and scope 2 [g] Metric tonnes CO2e 15,793 4,412 4,187 Investments [h] Metric tonnes CO2e N/A N/A 2,017 Data coverage Percentage of global operations 100% 100% 100% [a] Includes 4 months KeyW (acquired June 2019) and does not include ECR Line of Business (divested April 2019) [b] Includes 7 months Wood Nuclear Group (acquired March 2020) [c] Includes The Buffalo Group (acquired November 2020) [d] Jacobs has externally verified business travel for FY19, FY20, and FY21, and employee commuting for FY19 and FY21, with limited assurance. [e] Jacobs has externally verified WTT emissions for both business travel and employee commuting for FY19 and FY21, with limited assurance.

FY21 ESG Disclosures July 2022 Unaudited 13 [f] Emissions associated with purchased goods and services are estimated using annual spend combined with emissions factors from the CEDA6 database, which provides industry average emissions factors for economic product and service categories. As of the date of this document’s publication, third party validation of these estimates is in process. [g] Estimates for upstream fuel and energy-related activities were completed using U.K. Department of Environment, Food & Rural Affairs (DEFRA) guidance and emission factors. As of the date of this document’s publication, third party validation of these estimates is in process. [h] Based on 65% ownership in PA Consulting acquired on March 3, 2021. Data represents 65% of the PA Consulting emissions reported in 2021, not including its purchased goods and services that are undergoing review. The COVID-19 pandemic greatly impacted our FY20 and FY21 business travel and employee commuting emissions. Business travel is our largest source of carbon emissions, and as expected, we saw a 75% reduction in our scope 3 business travel emissions from FY19 to FY21, mainly due to COVID-19 restrictions on both domestic and international travel. Our goal moving forward is to prevent a rebound of these emissions back to pre-COVID levels. As we move to a new post-COVID norm we are committed to manage business travel and employee commuting emissions in accordance with our science-based target reduction of 50% from 2019 levels by 2030. Efforts to reduce our business travel carbon emissions were previously underway prior to the COVID-19 pandemic. For example, we created an employee dashboard so our people can view their travel carbon footprint and be empowered individually to help us meet our global emissions reduction goals by reducing their own travel and using less carbon-intensive meeting methods. Business Units are accountable for tracking, monitoring and reporting business travel in alignment with this new reporting tool. As announced on December 13, 2021, effective January 1, 2022, we established an internal carbon price of $50 per ton for all non-billable business travel to influence sustainable decision-making around travel reduction and further help reduce our carbon footprint. The carbon cost calculated for every non-billable business trip will be added to the overall cost of travel and charged to the applicable business unit. Proceeds will be used to fund carbon reduction and removal initiatives. Employee commuting estimates are based on Jacobs’ Human Resources data, including employee numbers, worker location, worker type and worker status. Commuting estimates account for duration and frequency of employees working from home due to COVID-19 based on generalized office count information. Employee commuting numbers include all company acquisitions to the end of the fiscal year. Estimates account for employee commuting mode (for example, passenger car, truck or bus) and round-trip travel distances. Both are estimated using average data sources, as recommended by the GHG Protocol Technical Guidance for Calculating scope 3 Emissions, since no employee commuting surveys with this type of data were performed by us during FY19, FY20 or FY21. Employee commuting estimates are then multiplied by the appropriate emission factors to obtain total employee commuting emissions. Emission factors come from the U.S. EPA Center for Corporate Climate Leadership GHG Emission Factors Hub (April 2021) for U.S. data, the U.K. Government GHG Conversion Factors for Company Reporting (July 2020) for U.K. data, and the WRI GHG Emission Factors Compilation (March 2017) for all other countries’ data. We saw a 73% reduction in our scope 3 emissions for employee commuting from FY19 to FY21, mainly due to COVID-19 restrictions on our employees for commuting to our offices, requiring most of our employees to work from home. We are currently collecting survey data from our employees to account for actual commuting patterns and encourage continued reductions post-COVID. We anticipate our science-based targets for business travel and employee commuting will be met through the following: Increased use of video conferencing for internal and external business meetings Online versus in-person trainings Virtual professional and industry association conferences Reduced transportation vehicle emissions Alternative, cleaner transportation methods

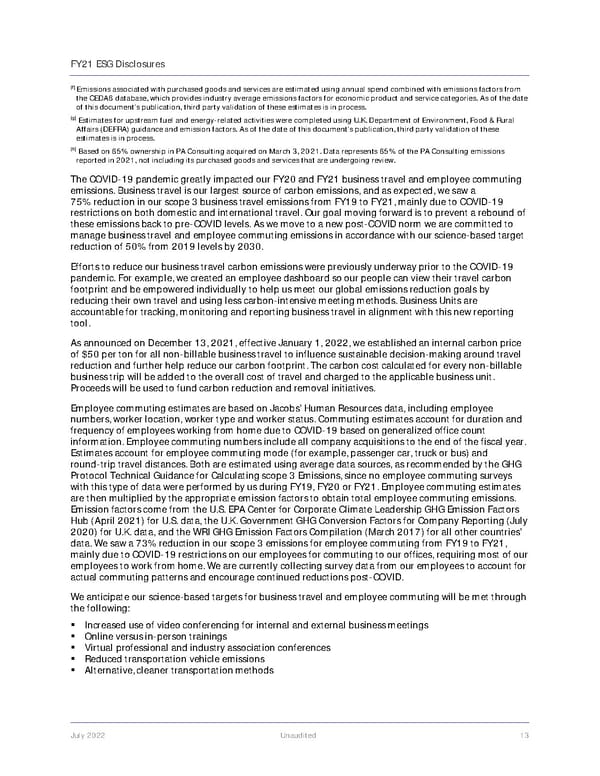

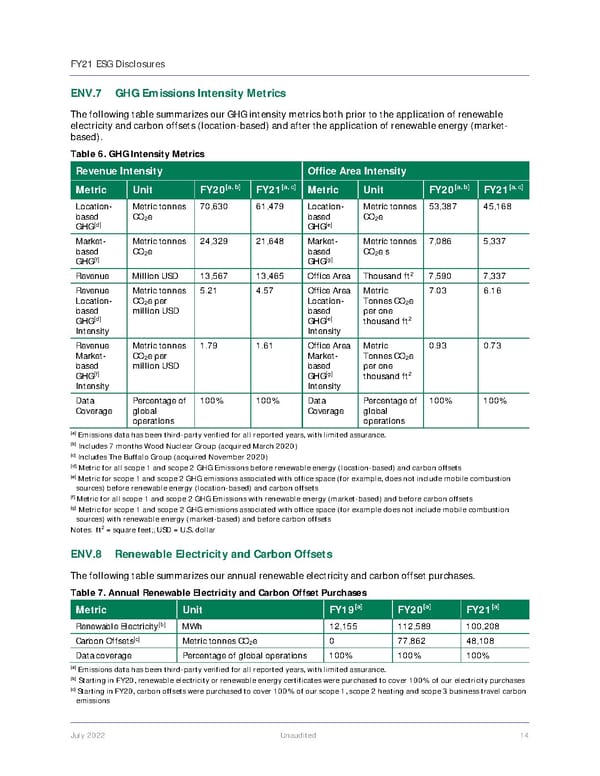

FY21 ESG Disclosures July 2022 Unaudited 14 ENV.7 GHG Emissions Intensity Metrics The following table summarizes our GHG intensity metrics both prior to the application of renewable electricity and carbon offsets (location-based) and after the application of renewable energy (market- based). Table 6. GHG Intensity Metrics Revenue Intensity Office Area Intensity Metric Unit FY20 [a, b] FY21 [a, c] Metric Unit FY20 [a, b] FY21 [a, c] Location- based GHG [d] Metric tonnes CO 2 e 70,630 61,479 Location- based GHG [e] Metric tonnes CO 2 e 53,387 45,168 Market- based GHG [f] Metric tonnes CO 2 e 24,329 21,648 Market- based GHG [g] Metric tonnes CO 2 e s 7,086 5,337 Revenue Million USD 13,567 13,465 Office Area Thousand ft 2 7,590 7,337 Revenue Location- based GHG [d] Intensity Metric tonnes CO 2 e per million USD 5.21 4.57 Office Area Location- based GHG [e] Intensity Metric Tonnes CO 2 e per one thousand ft 2 7.03 6.16 Revenue Market- based GHG [f] Intensity Metric tonnes CO 2 e per million USD 1.79 1.61 Office Area Market- based GHG [g] Intensity Metric Tonnes CO 2 e per one thousand ft 2 0.93 0.73 Data Coverage Percentage of global operations 100% 100% Data Coverage Percentage of global operations 100% 100% [a] Emissions data has been third-party verified for all reported years, with limited assurance. [b] Includes 7 months Wood Nuclear Group (acquired March 2020) [c] Includes The Buffalo Group (acquired November 2020) [d] Metric for all scope 1 and scope 2 GHG Emissions before renewable energy (location-based) and carbon offsets [e] Metric for scope 1 and scope 2 GHG emissions associated with office space (for example, does not include mobile combustion sources) before renewable energy (location-based) and carbon offsets [f] Metric for all scope 1 and scope 2 GHG Emissions with renewable energy (market-based) and before carbon offsets [g] Metric for scope 1 and scope 2 GHG emissions associated with office space (for example does not include mobile combustion sources) with renewable energy (market-based) and before carbon offsets Notes: ft 2 = square feet;; USD = U.S. dollar ENV.8 Renewable Electricity and Carbon Offsets The following table summarizes our annual renewable electricity and carbon offset purchases. Table 7. Annual Renewable Electricity and Carbon Offset Purchases Metric Unit FY19 [a] FY20 [a] FY21 [a] Renewable Electricity [b] MWh 12,155 112,589 100,208 Carbon Offsets [c] Metric tonnes CO 2 e 0 77,862 48,108 Data coverage Percentage of global operations 100% 100% 100% [a] Emissions data has been third-party verified for all reported years, with limited assurance. [b] Starting in FY20, renewable electricity or renewable energy certificates were purchased to cover 100% of our electricity purchases [c] Starting in FY20, carbon offsets were purchased to cover 100% of our scope 1, scope 2 heating and scope 3 business travel carbon emissions

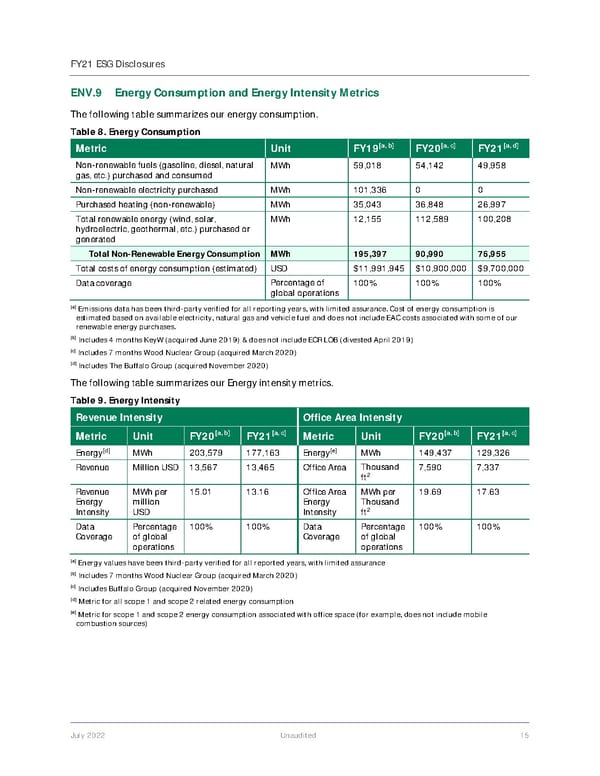

FY21 ESG Disclosures July 2022 Unaudited 15 ENV.9 Energy Consumption and Energy Intensity Metrics The following table summarizes our energy consumption. Table 8. Energy Consumption Metric Unit FY19 [a, b] FY20 [a, c] FY21 [a, d] Non-renewable fuels (gasoline, diesel, natural gas, etc.) purchased and consumed MWh 59,018 54,142 49,958 Non-renewable electricity purchased MWh 101,336 0 0 Purchased heating (non-renewable) MWh 35,043 36,848 26,997 Total renewable energy (wind, solar, hydroelectric, geothermal, etc.) purchased or generated MWh 12,155 112,589 100,208 Total Non-Renewable Energy Consumption MWh 195,397 90,990 76,955 Total costs of energy consumption (estimated) USD $11,991,945 $10,900,000 $9,700,000 Data coverage Percentage of global operations 100% 100% 100% [a] Emissions data has been third-party verified for all reporting years, with limited assurance. Cost of energy consumption is estimated based on available electricity, natural gas and vehicle fuel and does not include EAC costs associated with some of our renewable energy purchases. [b] Includes 4 months KeyW (acquired June 2019) & does not include ECR LOB (divested April 2019) [c] Includes 7 months Wood Nuclear Group (acquired March 2020) [d] Includes The Buffalo Group (acquired November 2020) The following table summarizes our Energy intensity metrics. Table 9. Energy Intensity Revenue Intensity Office Area Intensity Metric Unit FY20 [a, b] FY21 [a, c] Metric Unit FY20 [a, b] FY21 [a, c] Energy [d] MWh 203,579 177,163 Energy [e] MWh 149,437 129,326 Revenue Million USD 13,567 13,465 Office Area Thousand ft 2 7,590 7,337 Revenue Energy Intensity MWh per million USD 15.01 13.16 Office Area Energy Intensity MWh per Thousand ft 2 19.69 17.63 Data Coverage Percentage of global operations 100% 100% Data Coverage Percentage of global operations 100% 100% [a] Energy values have been third-party verified for all reported years, with limited assurance [b] Includes 7 months Wood Nuclear Group (acquired March 2020) [c] Includes Buffalo Group (acquired November 2020) [d] Metric for all scope 1 and scope 2 related energy consumption [e] Metric for scope 1 and scope 2 energy consumption associated with office space (for example, does not include mobile combustion sources)

FY21 ESG Disclosures July 2022 Unaudited 16 ENV.10 Water Consumption The following table summarizes our water consumption. Table 10. Water Consumption Water Consumption Unit FY19 (estimated) FY20 (estimated) FY21 (estimated) Total water consumption Million cubic meters 0.295 0.171 0.076 Data Coverage (as % of denominator) Percentage of global operations 100% 100% 100% Jacobs consumes and discharges water through municipal water and sewer systems to support our office operations. Water consumption and discharge is not regarded as a significant environmental impact; therefore, water-related goals and targets have not been established. In addition, very little data is available, as water consumption is included within service charges from lessors. Total water consumption is estimated using employee headcount data of those commuting into the office for each year reported. Water consumption while teleworking is excluded. For FY20 and FY21, while the total number of Jacobs employees increased, the COVID-19 pandemic reduced the number of employees commuting into the office and thus total office water consumption decreased. Our water consumption estimates and planning are informed by the Resource Efficient Scotland Green Office Guide and the WRAP Green Office Guide . We are working to collect more information from our offices to ascertain actual water consumption so we can determine what is needed to reduce our consumption in line with best practices. ENV.11 Biodiversity and Natural Capital All companies use natural capital, directly or indirectly, to support operations and growth. While our activities at existing office locations may have an indirect impact on biodiversity and heritage resources, they are not considered significant impacts regarding our own business operations. We have greater opportunity to drive positive impact through the projects and services we deliver. Our Global Environmental Management Commitment Statement includes a goal to protect species and habitat biodiversity, heritage resources and wildlife. Potential significant impacts on biodiversity and heritage from project design and delivery, depending upon the nature and scope of services provided, are mitigated by our HSE processes, systems and subject matter experts as described in section SOC.12 Health, Safety and Environment - Management of this document. An internal Environmental Screening Checklist was developed for use by Jacobs staff during field project or construction site visits where we have responsibility for the work performed. Activities that present a potential significant environmental impact or concern must be reviewed by a Jacobs Environmental Manager. This checklist includes screening for previous audits, incident notification and reporting, site housekeeping, pollution prevention, protected species and habitat, air emissions, land disturbance/excavation/stockpiling, stormwater management, water/wastewater discharges, waterways and wetlands, and material and waste management. We also protect biodiversity in our services by promoting green infrastructure solutions, which harness the power of natural capital to provide ecosystem services, including biodiversity consultation, to address resource constraints and challenges. Furthering our positive impact, we engage in various external initiatives to advance nature-based solutions and broader natural resilience. For example, we have a strategic partnership with Biomimicry 3.8, providing “Project Positive” design solutions for clients. For more information on this and other thought leadership contributions, see the “ Nature as a Solution ” section of our Climate Action Plan . Jacobs understands the importance of nature-based solutions and broader natural resilience in managing societal challenges, which has been accelerated by the Taskforce on Nature-related Financial

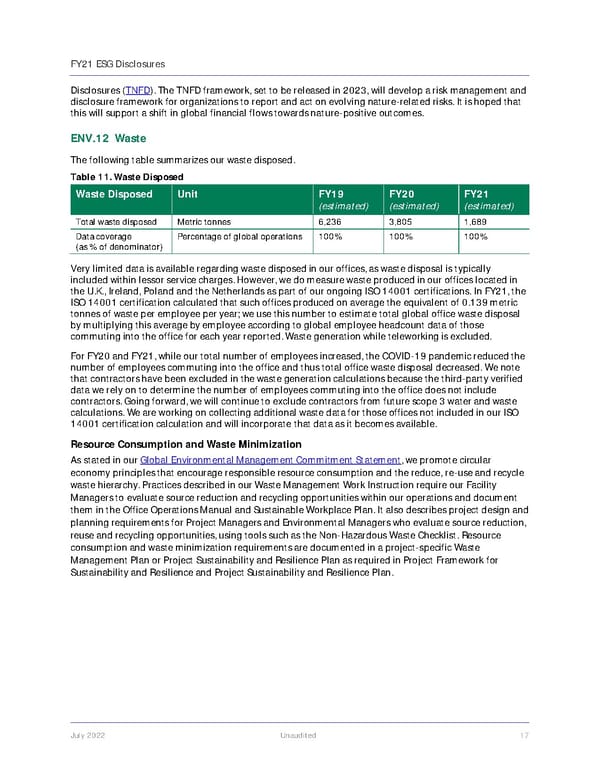

FY21 ESG Disclosures July 2022 Unaudited 17 Disclosures ( TNFD ). The TNFD framework, set to be released in 2023, will develop a risk management and disclosure framework for organizations to report and act on evolving nature-related risks. It is hoped that this will support a shift in global financial flows towards nature-positive outcomes. ENV.12 Waste The following table summarizes our waste disposed. Table 11. Waste Disposed Waste Disposed Unit FY19 (estimated) FY20 (estimated) FY21 (estimated) Total waste disposed Metric tonnes 6,236 3,805 1,689 Data coverage (as % of denominator) Percentage of global operations 100% 100% 100% Very limited data is available regarding waste disposed in our offices, as waste disposal is typically included within lessor service charges. However, we do measure waste produced in our offices located in the U.K., Ireland, Poland and the Netherlands as part of our ongoing ISO 14001 certifications. In FY21, the ISO 14001 certification calculated that such offices produced on average the equivalent of 0.139 metric tonnes of waste per employee per year; we use this number to estimate total global office waste disposal by multiplying this average by employee according to global employee headcount data of those commuting into the office for each year reported. Waste generation while teleworking is excluded. For FY20 and FY21, while our total number of employees increased, the COVID-19 pandemic reduced the number of employees commuting into the office and thus total office waste disposal decreased. We note that contractors have been excluded in the waste generation calculations because the third-party verified data we rely on to determine the number of employees commuting into the office does not include contractors. Going forward, we will continue to exclude contractors from future scope 3 water and waste calculations. We are working on collecting additional waste data for those offices not included in our ISO 14001 certification calculation and will incorporate that data as it becomes available. Resource Consumption and Waste Minimization As stated in our Global Environmental Management Commitment Statement , we promote circular economy principles that encourage responsible resource consumption and the reduce, re-use and recycle waste hierarchy. Practices described in our Waste Management Work Instruction require our Facility Managers to evaluate source reduction and recycling opportunities within our operations and document them in the Office Operations Manual and Sustainable Workplace Plan. It also describes project design and planning requirements for Project Managers and Environmental Managers who evaluate source reduction, reuse and recycling opportunities, using tools such as the Non-Hazardous Waste Checklist. Resource consumption and waste minimization requirements are documented in a project-specific Waste Management Plan or Project Sustainability and Resilience Plan as required in Project Framework for Sustainability and Resilience and Project Sustainability and Resilience Plan.

FY21 ESG Disclosures July 2022 Unaudited 18 ENV.13 Hazardous Waste The following table summarizes our hazardous waste generation. Table 12. Hazardous Waste Generation Hazardous Waste Unit FY19 (estimated) FY20 (estimated) FY21 (estimated) Hazardous Waste Generated Metric tonnes N/A N/A N/A Data coverage (as % of denominator) Percentage of global operations 100% 100% 100% There is no significant or measurable hazardous waste generation and disposal from Jacobs' office operations. Other regulated materials used in office operations (for example, batteries and light bulbs) are either the landlord's responsibility or recycled. ENV.14 Environmental Management System (EMS) Our Environmental Management System (EMS) is integrated in our HSE Management System (HSEMS) and conforms to ISO 14001:2015. While the HSEMS applies to all locations, select office and project locations are certified to ISO 14001 as necessary to meet contract or local requirements. We are currently certified in Australia, Canada, Hong Kong, Indonesia, Italy, Malaysia, Qatar and the U.K., among others. Our environmental management policy is integrated in our HSE Policy and is expressed in our Global Environmental Management Commitment Statement . Our HSEMS process is described in Health, Safety, Environment and Wellbeing - Management . We had no significant fines or non-monetary sanctions for non-compliance with environmental laws or regulations in the past four fiscal years. ENV.15 Climate Change Climate Change Strategy We place the climate emergency and our response at the heart of our company’s FY22-FY24 strategy “Boldly Moving Forward ” and have established a central Office of Global Climate Response and ESG. This corporate function acts as the connecting point for our go-to-market solutions in which our projects now become a climate response opportunity within the framework of energy transition, decarbonization, adaptation, mitigation and natural resource stewardship. Additionally, we are coupling climate response with ESG, which is taking on heightened significance, both within our organization and externally as companies around the globe rise to the climate challenge and address urgent social issues. Our Climate Action Plan includes the headline commitments: Ensure every project becomes a climate response opportunity. Achieve net-zero greenhouse gas emissions across the value chain by 2040. Maintain carbon neutrality and 100% low-carbon electricity for our operations. Our Climate Action Plan also includes commitments relative to climate justice, climate risk, nature and biodiversity, and includes information and guidance on how our employees can take impactful climate action. We are committed to ensuring our people are aware of the risks and opportunities related to climate change, so that along with our clients, we continue to mitigate risks from climate change, facilitate the transition to a low carbon future and adapt our business to be more resilient and to thrive. In partnership with the Royal Scottish Geographical Society, we launched the Climate Solutions Accelerator online course

FY21 ESG Disclosures July 2022 Unaudited 19 to all employees to help them understand the role they can play in climate change action and continue to develop the critical green skills and solutions needed for our continually evolving world. Climate Risk and the Taskforce on Climate-related Financial Disclosures (TCFD) Climate risk and resilience pose an urgent and important risk factor for us and our clients, and our investors have confirmed their increased focus on the recommendations of the TCFD. As a supporter of the recommendations, we have made four commitments in our Climate Action Plan , that we continue to meet: Integrate climate risk analysis into company strategy and planning. Deploy climate risk technology on all pursuits and projects where climate risk is considered material. Support our clients and suppliers to undertake their own climate risk assessments, in line with the TCFD recommendations. Integrate by 2025 climate risk and adaptation considerations into each of our market sector strategies. For more information on our climate change strategy, including our approach, risk and opportunity findings and next steps, see our FY21 and FY22 Climate Risk Assessments. Since 2020 we have conducted specific climate change risk and opportunities assessments in line with TCFD recommendations. Our assessments in 2020 and 2021 explored climate-related risks and opportunities to which we are exposed through our operations and the projects and programs we deliver globally. The approach to the assessment conformed with the international standard on risk management, ISO 31000:2018 Risk Management Guidelines and follows methods that are used by our climate risk specialists in our work with our clients. Scope and context: The assessment focused on projects across the main market segments of our People & Places Solutions (P&PS) line of business. These were from five of our major geographies: Australia, Canada, India, U.K. and the U.S. The risk framework was specially developed for the assessment. It enabled risk to be assessed with respect to a range of objectives, including health and safety, client relationships, regulatory compliance, reputation, and service delivery. Scenario analysis: Recognized and described risks that may prevent Jacobs and our clients from achieving our objectives under our 1.5°C and 4°C scenarios – (RCP [Representative Concentration Pathway] 2.6 and 8.5, respectively). Risk analysis: The characteristics of the risks were established, including their potential impacts, consequences and the likelihood of the climate-related events that cause these. Controls that were applied to reduce the climate risks, including those accounting for the effects of projected climate change, were captured and risk was assessed with these in place. Risk evaluation: The combination of likelihood and most severe consequence were used to assess risk severity. Disruption to business for environmental end markets is a case study of a transitional risk we have identified, assessed and are responding to. We could see business risks ($10 million to $100 million per year) from disruption to major client revenue streams, and a similar loss of revenue from reduced services for fossil fuel related projects. However, this is offset by greater opportunities such as emergency management and national security ($10 million to $100 million per year), environmental planning and permitting for extreme weather impacts ($10 million to $100 million per year) and civil works including circular economy, waste management, clean energy and natural treatment systems ($10 million to $100 million per year). Analyzing our markets revealed common themes and specific insights allowing us to estimate the value of financial impacts to Jacobs.

FY21 ESG Disclosures July 2022 Unaudited 20 Because we did not anticipate any material updates to the assessment conducted in 2021, we focused our 2022 assessment more on physical and transitional risks and opportunities, and on adaptation measures in the water market specifically. In 2021, we identified the water market as having the greatest net financial opportunity of all our market areas. Adaptation planning is also most strongly established in the solutions we deliver within the water market, making this market well-placed to extend this proven approach to our business planning. Specific goals of the assessment were to: Pilot a collaborative approach to applying scientific and strategic insights into climate change and the low carbon transition to understand key risks and opportunities for our clients and their implications for our own business. Develop a proof of concept that can be repeated across other markets. Integrate our OneWater thought leadership with an adaptive planning approach to define the water management challenges that are unique to our clients, communities and our watersheds in regions across the world. Develop a refined TCFD assessment that: - Serves as a global example of best practice for understanding and managing climate risks and standardizing climate disclosures in the water sector - Strengthens our ability to support our global water clients with understanding the complexities and importance of climate disclosures - Guides development of TCFD assessment across all Jacobs’ markets Our 2022 assessment further expanded on our IPCC scenario analysis used in 2020 and 2021, and we adopted the Network for Greening the Financial System’s (NGFS) climate scenarios framework to map out risks and opportunities specific to a rapid and orderly, and a delayed and disorderly transition to a net-zero future. ENV.16 Carbon Pricing Carbon pricing is a way of recognizing that carbon emissions create a cost to society (for example, in the form of climate change and air pollution), providing a financial incentive for businesses to transition to a low carbon future. Governments implement carbon pricing through carbon taxes or regulatory schemes such as emissions trading systems, and an increasing number of businesses are adopting an internal carbon price to acknowledge the cost of carbon to society and help guide decision-making and investment. On January 1, 2022, we introduced an internal carbon price of $50 USD per metric ton of CO2e applied to non-billable business travel at Jacobs. The carbon cost is charged to the applicable business unit. A proprietary travel booking tool provides estimated carbon emissions and price for employee-planned travel to influence travel behaviors. The revenue generated by carbon pricing is directed into a Carbon Reduction Fund and will be used to invest in initiatives, technologies and projects at the local, regional and global levels that address the climate emergency, reduce greenhouse gas emissions, and enable Jacobs to reduce its carbon emissions. The Carbon Reduction Fund will be administered by the Office of Global Climate Response & ESG, and recommendations for investment will be reviewed and approved by the PlanBeyond Executive Steering Committee.

FY21 ESG Disclosures July 2022 Unaudited 21 ENV.17 Low-Carbon Transition Plan, Products and Services Since the release of our initial Climate Action Plan on the 50th Anniversary of Earth Day in 2020, we are proud of our progress and achievements, including: We are the first consultancy and one of the world’s first companies with net-zero targets approved by SBTi. We reduced our carbon emissions by 52% between FY19 and FY21, including scope 1, scope 2 (location-based) and scope 3 (business travel). We procure the equivalent of 100% low-carbon electricity for our operations. We are a carbon neutral organization. We also recognize that much more must be done across our industry and our clients’ industries. Our latest Climate Action Plan lays out our next phase of climate mitigation and adaptation commitments, which build on the progress we have made. We are committed to continue driving the rapid decarbonization of our operations and value chain, while also accelerating the essential shift to a zero-carbon economy through the solutions we deliver to clients every day, worldwide. In parallel, we want to continue to improve our and our clients’ business resilience by embedding adaptive measures across all our end markets, considering climate risks and opportunities in alignment with the TCFD. Our Low-Carbon Transition Plan (LCTP) is summarized in the following paragraphs with links to relevant detail. It includes our strategy for delivering this transition as well as the measures, key performance indicators and levels of accountability integrated into our business to ensure success. LCTP Governance Our Office of Global Climate Response & ESG leads on delivering our climate commitments for our business and clients, including overseeing our climate-related disclosures. Our PlanBeyond Executive Steering Committee is the governance body with oversight for climate risk and the delivery of our Climate Action Plan . This committee includes all members of the Executive Leadership Team, plus our Senior Vice President for Global Climate Response & ESG, Head of Investor Relations, Head of Enterprise Risk Management and Corporate Secretary. Climate-related risks and opportunities and ESG are integrated into our Enterprise Risk Management processes. Regular updates are reported to the Board of Directors by our Office of Global Climate Response & ESG. We established a dedicated Board ESG & Risk Committee in April 2021; the committee charter provides an overview of the group’s purpose and responsibilities. Our Board Audit Committee provides oversight of the controls and processes related to material public climate disclosures. LCTP Scenario Analysis To ensure we are fully considering physical and transitional risks and opportunities from climate change, we have applied two different types of scenario analysis. Our FY21 Climate Risk Assessment was based on scenarios derived from the United Nations Framework Convention on Climate Change and the IPCC. We considered risks and opportunities associated with: Successful implementation of the Paris Agreement on climate change to limit global temperature change during this century to 1.5°C above pre-industrial levels. Continued high growth in GHG emissions leading to average global warming of around 4°C by 2100. This scenario broadly coincides with the IPCC’s RCP8.5 scenario (from its Fifth Assessment Report, AR5). To further explore potential transitional risks from climate change for our FY22 Climate Risk Assessment, we adopted the Network for Greening the Financial System’s (NGFS) climate scenarios framework . The