LHD Benefit Advisors 2024 Employee Benefits

Employee Benefits PLAN YEAR 2024

Your 2024 Benefits We’re pleased to announce that there are no major changes in our benefit plans, no pricing changes to our medical and vision plans, and only a slight increase in dental premiums for 2024. This year’s Open Enrollment will be active, all employees must Watch Welcome Video enter their elections into PlanSource. When entering your elections, please ensure your personal details are accurate and any dependents are added. Thanks for another great year! Amanda Guimont HR MANAGER

Eligibility Employees Spouse & Legal Qualifying Dependents Events All employees working 30 hours or more per week, or Your children are eligible for medical, dental, and You may make a change to your benefits if you have more are eligible for the benefits program. vision to age 26. Your children of any age are also a qualified status change such as: marriage eligible if you support them, and they are incapable of divorce, birth/adoption, death, changes in spouse’s self-support due to disability. benefits, and more.

Employee Cost Coverage Through Anthem Cost Per Pay Period Exam Only Coverage Through Anthem Coverage Through Delta Dental Exam + Materials Through Delta Vision Cost Per Pay Period MEDICAL Cost Per Pay Period DENTAL VISION HDHP PPO Employee Only $47.26 $86.73 Exam Exam + Employee Only $8.74 Materials Employee + Spouse $18.38 Employee + Spouse $251.50 $334.38 Employee Only $0 $1.43 Employee + Child(ren) $21.76 Employee + Spouse $0 $2.85 Employee + Child(ren) $195.80 $266.84 Employee + $0 $3.06 Family $32.43 Child(ren) Family $400.03 $514.49 Family $0 $4.88 SEE THIS PLAN SEE THIS PLAN SEE THIS PLAN

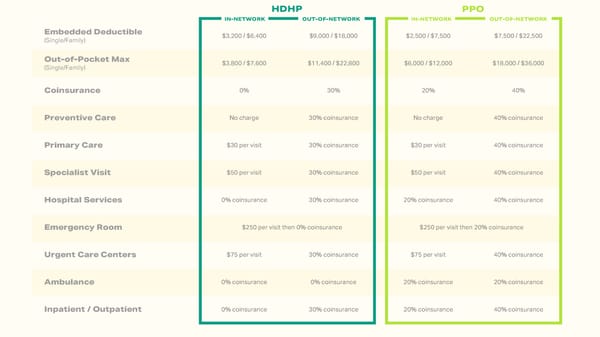

Medical Benefits For 2024 our Anthem HDHP plan is updated to meet the IRS mandated deductibles, there are no other changes. The PPO plan will remain the same. To view the Anthem portal or register for a new account, click below. VIEW YOUR ANTHEM PORTAL

HDHP PPO IN-NETWORK OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK Embedded Deductible $3,200 / $6,400 $9,000 / $18,000 $2,500 / $7,500 $7,500 / $22,500 (Single/Family) Out-of-Pocket Max $3,800 / $7,600 $11,400 / $22,800 $6,000 / $12,000 $18,000 / $36,000 (Single/Family) Coinsurance 0% 30% 20% 40% Preventive Care No charge 30% coinsurance No charge 40% coinsurance Primary Care $30 per visit 30% coinsurance $30 per visit 40% coinsurance Specialist Visit $50 per visit 30% coinsurance $50 per visit 40% coinsurance Hospital Services 0% coinsurance 30% coinsurance 20% coinsurance 40% coinsurance Emergency Room $250 per visit then 0% coinsurance $250 per visit then 20% coinsurance Urgent Care Centers $75 per visit 30% coinsurance $75 per visit 40% coinsurance Ambulance 0% coinsurance 0% coinsurance 20% coinsurance 20% coinsurance Inpatient / Outpatient 0% coinsurance 30% coinsurance 20% coinsurance 40% coinsurance

Marathon Health Primary Care Plus & Lab Services Onsite health centers have multiple convenient locations across Indianapolis. Schedule an appointment to address sick care, preventive services, physicals, wellness exams, and more. Take a Virtual Tour Condition Management & Wellness Marathon Health addresses behavioral health issues, creates incentive programs, support for chronic condition, health advocacy and more. Virtual Care Download the Marathon Health Anywhere app for virtual care. Like all Marathon Health services, this is free to ALL LHD employees. DOWNLOAD THE APP

Anthem’s Sydney Health App Manage Claims & Access ID Card With Sydney Health, you can submit and track your claims, anytime, anywhere. Your digital ID card is always with you when you need it. Watch Sydney Health App Video Compare Care & Costs Our digital tools can help you find doctors in your plan’s network and compare care costs up front. Telehealth Virtual appointments are available on demand, no appointment needed, weekends and evenings. The cost to you is $59 per appointment for the HDHP plan and $10 copay for the PPO plan. DOWNLOAD THE APP

Sydney’s $200 Wellness Incentive Earn up to $200 by participating and completing a 1 Download the Sydney variety of preventive care, condition management, Health App. and wellness activities. 2 Navigate to the “Menu” Annual eye exam, wellness $25 on your mobile device exam, colorectal cancer and select “My Health screening, and mammogram Dashboard”. Cholesterol test and flu shot $20 3 Scroll down to see the Condition care $50 “Ways to Earn” and the “Incentives” sections. Health Assessment and $20 well-being coach digital 4 Track your progress Track steps $60 and redeem rewards. Log into the website or app $5 or connect a device DOWNLOAD THE APP Update contact information $10 Action plans $25

Prescription Drugs LHD utilizes Anthem for pharmacy support. Click the link below to view the PreventiveRx Plus and Essentials Drug List. View the Pharmacy tab on the Sydney app to price medications, find a pharmacy, and more. PREVENTIVERX PLUS DRUG LIST ESSENTIAL DRUG LIST

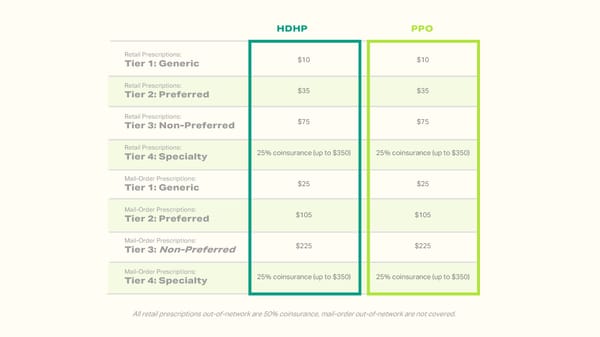

HDHP PPO Retail Prescriptions: $10 $10 Tier 1: Generic Retail Prescriptions: $35 $35 Tier 2: Preferred Retail Prescriptions: $75 $75 Tier 3: Non-Preferred Retail Prescriptions: 25% coinsurance (up to $350) 25% coinsurance (up to $350) Tier 4: Specialty Mail-Order Prescriptions: $25 $25 Tier 1: Generic Mail-Order Prescriptions: $105 $105 Tier 2: Preferred Mail-Order Prescriptions: $225 $225 Tier 3: Non-Preferred Mail-Order Prescriptions: 25% coinsurance (up to $350) 25% coinsurance (up to $350) Tier 4: Specialty All retail prescriptions out-of-network are 50% coinsurance, mail-order out-of-network are not covered.

Health Savings COMPLETE THE RISK ASSESSMENT Account A Health Savings Account (HSA) is available to those enrolled in a High Company contribution up to Deductible Health Plan. HSA funds can be used for a wide variety of qualified medical expenses all tax-free. Any unused earnings rollover from year-to- $500 year. When you enroll in the LHD HDHP plan, LHD will add $250 to your HSA. After completion of your annual physical, biometric screening, and health risk assessment questionnaire, LHD will add an additional $250.

Employee LHD Wellness Annual Total Contribution Contribution Incentive in Employee HSA $200 + $250 + $250 = $700 $1,000 + $250 + $250 = $1,500 Watch This HSA Video to $3,000 + $250 + $250 = $3,500 Learn More The IRS contribution maximum is $4,150 for individuals and $8,300 for families. VIEW QUALIFIED EXPENSES

HDHP and HSA Consumer Experience 1 2 3 4 5 Doctor Visit Amount Owed EOB Bill Received Pay with HSA Visit your healthcare provider and The health plan will share the The health plan send you the Your doctor will then send You can use your HSA funds the office will submit the claim to amount you owe with your Explanation of Benefits (EOB). you a bill. to pay the bill from your your health plan. doctor. doctor.

Built on a foundation of unparalleled expertise, LHD fosters growth and delivers unmatched creativity designed to elevate well-being for the people, businesses, and communities we serve. VALUE PEOPLE FIRST DO THE RIGHT THING ACHIEVE TOGETHER NEVER STOP IMPROVING PROVIDE THE BEST SERVICE

Dental DELTA DENTAL OF INDIANA 225 S East St Indianapolis, IN 46202 Coverage with Delta Dental 317-842-4022 KRISTEN JONES Group Delta Dental PPO Find providers, view your ID card, and more online or using the mobile app. ONLINE PORTAL DOWNLOAD THE APP

Deductible $0 Annual Plan Maximum $1,000 (per person) Preventive Services 100% Covered Exams, Cleanings, Fluoride, X-Rays Basic Services 80% Covered Fillings, Extractions, Endodontics, Crown Repairs Major Services 50% Covered Crowns, Dentures, In/Onlays, Periodontics Orthodontia Services 50% Covered For child(ren) up to age 19 Orthodontia Lifetime Maximum $1,000

VISION Delta Vision through the VSP Network Those covered under the Anthem medical plan have access to exam-only cover through Anthem Vision network at NO COST. For additional exams and materials, employees can utilize the Delta Vision plan through the VSP network. ONLINE PORTAL

Exam + Materials with DeltaVision IN-NETWORK OUT-OF-NETWORK Exam $10 copay Up to $45 reimbursement Glasses Lenses $25 copay Up to $65 reimbursement Glasses Frames $150 allowance Up to $70 reimbursement Necessary Contacts 100% covered Up to $210 reimbursement Elective Contacts $150 allowance Up to $105 reimbursement Each material benefit is paid out once per calendar year.

Additional BENEFITS LHD provides several FSA options, employer-paid basic life insurance and disability income protection at no cost, voluntary life insurance, and retirement benefits.

Flexible 1 Healthcare FSA 1 An FSA is an alternative to an HSA. FSAs are typically paired Spending with a PPO plan while an HSA is paired with an HDHP. HSA HEALTHCARE funds can be used on various medical, dental, and vision Accounts FSA related expenses. The IRS contribution maximum is $3,200. VIEW ELIGIBLE EXPENSES Flexible Spending Accounts (FSA) are set up to pay for many of out-of-pocket medical expenses with tax-free dollars. The FSA account holder sets aside a pre-tax dollar amount Limited Purpose FSA for the year used to pay for medical expenses. Unused FSA 2 2 A limited purpose FSA is only for dental and vision funds can expire at the end of the year. expenses. If you elect to participate in the High Deductible Health Plan and contribute to a Health LIMITED Savings Account (HSA), you qualify for this FSA, not the PURPOSE FSA full healthcare FSA. The IRS contribution maximum is $3,200. Watch This FSA Video to 3 Dependent Care Account (DCA) FSA Learn More A DCA is a tax-free spending account for dependent care 3 expenses such as daycare, preschool, or day camps for any dependent under the age of 13 or who is physically or mentally incapable of self-care. The IRS contribution DEPENDENT maximum is $5,000 for families and $2,500 for individuals. CARE FSA LEARN MORE ABOUT YOUR DCA

Basic Life Voluntary Life The LHD employer-paid basic life insurance policy is Employee Benefit: Increments of $10,000 up to $500,000 or up to available to all full-time employees. In the event of your 5x your salary. Guarantee issue of $100,000. death, your beneficiaries will receive $50,000. Coverage Spouse Benefit: Increments of $5,000 up to $500,000. decrease to 35% at age 65 and 50% at age 70. Guarantee issue of $25,000. Child(ren) Benefit: Up to $10,000, guarantee issue is face-value. Short-Term Disability Long-Term Disability LHD employer-paid short-term disability protects your LHD employer-paid long-term disability protects your income during a short period of time due to illness or an income for an extended period of time. accident not related to your job. Benefits begin on the 8th st st day after an illness or the 1 day after and accident. The Benefits begin on the 91 day after the date of the incident policy will pay a tiered percentage of your weekly salary and will cover 60% of your earnings (up to $10,000/month). for 90 days at 100% / 85% / 75%.

Retirement Plan entry for new employees occurs quarterly. LHD automatically 401(k) enrolls all employees working 1,000+ hours and 20+ years of age in the 401(k) retirement plan at 6% of pay unless opted out. Employer Match Vesting 3% of pay each pay period under Nonelective Safe Employee deferrals & safe harbor contributions are 100% Harbor and 25% on the first 6% of your salary. If vested. Employer match & profit sharing are vested at 0% you contribute 6% or more of your salary, we will through your first year of employment, 33% in year two, contribute 1.5%. 66% in year three, and 100% in your fourth year of service. IRS Contribution Limits Profit Sharing 100% of your pay up to the IRS 2024 limits: Discretionary [0-3% of your pay] and deposited • Elective Deferrals $23,000 annually. • Catch-Up (50+) $7,500

Paid Holidays New Year’s Day JANUARY FEBRUARY MARCH APRIL st January 1 1 2 3 4 5 6 1 2 3 1 2 1 2 3 4 5 6 Martin Luther King Jr. Day 7 8 9 10 11 12 13 4 5 6 7 8 9 10 3 4 5 6 7 8 9 7 8 9 10 11 12 13 th January 15 14 15 16 17 18 19 20 11 12 13 14 15 16 17 10 11 12 13 14 15 16 14 15 16 17 18 19 20 Memorial Day th May 27 21 22 23 24 25 26 27 18 19 20 21 22 23 24 17 18 19 20 21 22 23 21 22 23 24 25 26 27 Juneteenth 29 30 31 25 26 27 28 29 24/ 25 26 27 28 29 30 28 29 30 June 19th 31 Independence Day MAY JUNE JULY AUGUST th July 4 1 2 3 4 1 1 2 3 4 5 6 1 2 3 Labor Day nd 5 6 7 8 9 10 11 2 3 4 5 6 7 8 7 8 9 10 11 12 13 4 5 6 7 8 9 10 September 2 12 13 14 15 16 17 18 9 10 11 12 13 14 15 14 15 16 17 18 19 20 11 12 13 14 15 16 17 Thanksgiving November 28th 19 20 21 22 23 24 25 16 17 18 19 20 21 22 21 22 23 24 25 26 27 18 19 20 21 22 23 24 Day After Thanksgiving 26 27 28 29 30 31 23/ 24 25 26 27 28 29 28 29 30 31 25 26 27 28 29 30 31 November 29th 30 Christmas Eve SEPTEMBER OCTOBER NOVEMBER DECEMBER December 24th 1 2 3 4 5 6 7 1 2 3 4 5 1 2 1 2 3 4 5 6 7 Christmas Day 8 9 10 11 12 13 14 6 7 8 9 10 11 12 3 4 5 6 7 8 9 8 9 10 11 12 13 14 December 25th 15 16 17 18 19 20 21 13 14 15 16 17 18 19 10 11 12 13 14 15 16 15 16 17 18 19 20 21 1 Floating Holiday 22 23 24 25 26 27 28 20 21 22 23 24 25 26 17 18 19 20 21 22 23 22 23 24 25 26 27 28 To be used at any time 29 30 27 28 29 30 31 24 25 26 27 28 29 30 29 30 31

Employee Assistance Clinical Confidential assistance for a range of concerns Program including addictions, depression, anxiety, stress, relationships, and parenting. All full-time employees are automatically (even if you are not enrolled in medical benefits) provided access to Supportlinc Wellness Employee Assistance Program. The EAP is a confidential Telephone based wellness coaching for tobacco resource available 24/7/365 to help you deal with a variety of cessation, weight loss management, fitness and life stages and concerns. The program includes up to 6 exercise, stress management, parenting, and confidential consultations a year. relationship support. 1-888-881-LINC (5462) Work-Life Supportlinc.com Assistance for daily challenges at home and work Register with Web ID: lhdbenefits including financial, legal, child/elder care, and GET HELP identity theft.

PlanSource Get Enrolled Today! st User: Fname Initial + 1 6 letters of Lname + last 4 digits of SSN Password: Birthday in format of YYYYMMDD ENROLL ONLINE