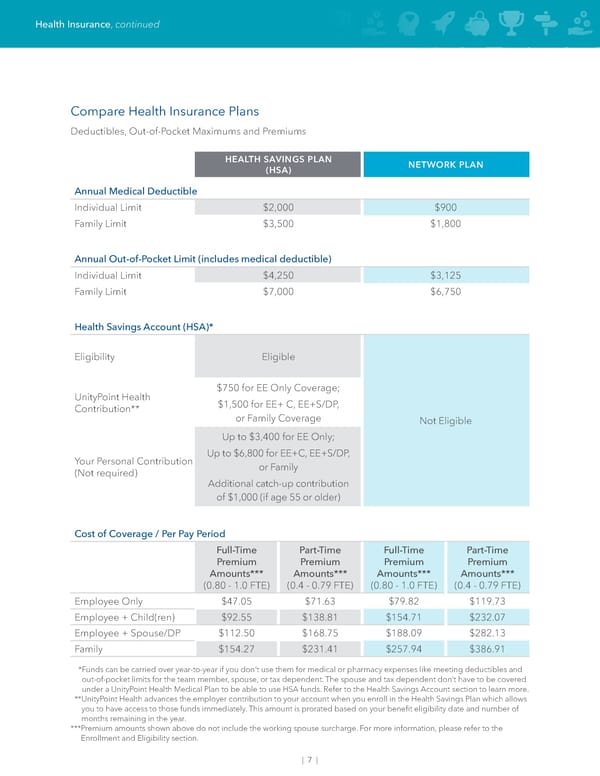

Health Insurance, continued Compare Health Insurance Plans Deductibles, Out-of-Pocket Maximums and Premiums HEALTH SAVINGS PLAN NETWORK PLAN (HSA) Annual Medical Deductible Individual Limit $2,000 $900 Family Limit $3,500 $1,800 Annual Out-of-Pocket Limit (includes medical deductible) Individual Limit $4,250 $3,125 Family Limit $7,000 $6,750 Health Savings Account (HSA)* Eligibility Eligible $750 for EE Only Coverage; UnityPoint Health $1,500 for EE+ C, EE+S/DP, Contribution** or Family Coverage Not Eligible Up to $3,400 for EE Only; Your Personal Contribution Up to $6,800 for EE+C, EE+S/DP, (Not required) or Family Additional catch-up contribution of $1,000 (if age 55 or older) Cost of Coverage / Per Pay Period Full-Time Part-Time Full-Time Part-Time Premium Premium Premium Premium Amounts*** Amounts*** Amounts*** Amounts*** (0.80 - 1.0 FTE) (0.4 - 0.79 FTE) (0.80 - 1.0 FTE) (0.4 - 0.79 FTE) Employee Only $47.05 $71.63 $79.82 $119.73 Employee + Child(ren) $92.55 $138.81 $154.71 $232.07 Employee + Spouse/DP $112.50 $168.75 $188.09 $282.13 Family $154.27 $231.41 $257.94 $386.91 * Funds can be carried over year-to-year if you don’t use them for medical or pharmacy expenses like meeting deductibles and out-of-pocket limits for the team member, spouse, or tax dependent. The spouse and tax dependent don’t have to be covered under a UnityPoint Health Medical Plan to be able to use HSA funds. Refer to the Health Savings Account section to learn more. ** UnityPoint Health advances the employer contribution to your account when you enroll in the Health Savings Plan which allows you to have access to those funds immediately. This amount is prorated based on your bene昀椀t eligibility date and number of months remaining in the year. *** Premium amounts shown above do not include the working spouse surcharge. For more information, please refer to the Enrollment and Eligibility section. | 7 |

May 2024 | Dubuque Union Team Members Benefit Guide Page 8 Page 10

May 2024 | Dubuque Union Team Members Benefit Guide Page 8 Page 10