Open Enrollment Flipbook

Plan Year: 2023

Pick the best benefits for you and your family. ABC Company strives to provide you and your family with a comprehensive and valuable benefits package. We want to make sure you’re getting the most out of our benefits—that’s why we’ve put together this Guide. Open enrollment is a short period each year when you can make changes to your benefits. This guide will outline all of the different benefits offered, so you can identify which offerings are best for you and your family. Elections you make during open enrollment will become effective on January 1, 2023. If you have questions about any of the benefits mentioned in this guide, please don’t hesitate to reach out to HR. Table of Contents Overview of the Benefit Program ------------------------------------------------------------------------ 4 Health Insurance --------------------------------------------------------------------------------------------- 5 Additional Benefits through Empire --------------------------------------------------------------------- 6 Health Savings Account ------------------------------------------------------------------------------------- 7 Flexible Spending Account, Commuter and Transit -------------------------------------------------- 8 Introducing Alex! --------------------------------------------------------------------------------------------- 9 Sydney Health Mobile App --------------------------------------------------------------------------------- 10 24/7 Nurse Line ---------------------------------------------------------------------------------------------- 11 Find-a-Doctor Tool ------------------------------------------------------------------------------------------- 12 Covid 19 Resource Center and GoodRx ----------------------------------------------------------------- 13 Dental Insurance --------------------------------------------------------------------------------------------- 14 Vision Insurance ---------------------------------------------------------------------------------------------- 15 Supplemental Life Insurance ------------------------------------------------------------------------------ 16 Disability Income Benefits ---------------------------------------------------------------------------------- 17 Questions and Answers ------------------------------------------------------------------------------------- 20

Who Is Eligible? If you are a full-time employee working at least 30 hours a week, you are eligible to enroll in the benefits found in this guide. Eligible dependents include your legal spouse, domestic partner, children up to age 26, and/or unmarried children over age 26 who are incapable of self- support. How to Enroll Are you ready to enroll? The first step is to review your current benefits. Did you move recently or get married? Verify all of your personal information and make any necessary changes. Once all your information is up to date, it’s time to make your benefit elections. We will be utilizing Paycom for Open Enrollment, and instructions on how to log in will be provided to you. When to Enroll Open enrollment begins on November 10th and runs through November 29th. The benefits you choose during open enrollment will become effective on January 1, 2023. How to Make Changes Unless you experience a life-changing qualifying event, you cannot make changes to your benefits until the next open enrollment period. Qualifying events include things like: • Marriage, divorce, or legal separation • Birth or adoption of a child • Change in child’s dependent status. • Death of a spouse, child, or qualified dependent • Change in residence. • Change in employment status or a change in coverage under another employer-sponsored plan 3

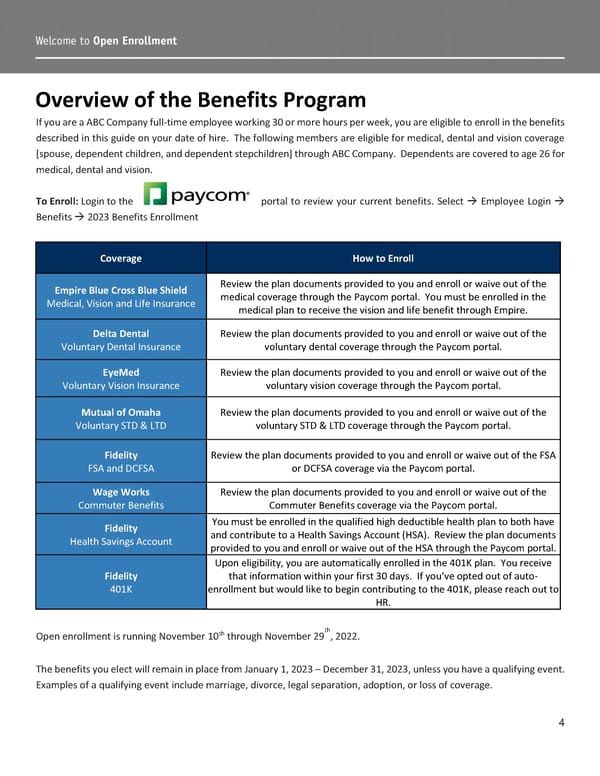

Overview of the Benefits Program If you are a ABC Company full-time employee working 30 or more hours per week, you are eligible to enroll in the benefits described in this guide on your date of hire. The following members are eligible for medical, dental and vision coverage [spouse, dependent children, and dependent stepchildren] through ABC Company. Dependents are covered to age 26 for medical, dental and vision. To Enroll: Login to the portal to review your current benefits. Select → Employee Login → Benefits → 2023 Benefits Enrollment Coverage How to Enroll Empire Blue Cross Blue Shield Review the plan documents provided to you and enroll or waive out of the Medical, Vision and Life Insurance medical coverage through the Paycom portal. You must be enrolled in the medical plan to receive the vision and life benefit through Empire. Delta Dental Review the plan documents provided to you and enroll or waive out of the Voluntary Dental Insurance voluntary dental coverage through the Paycom portal. EyeMed Review the plan documents provided to you and enroll or waive out of the Voluntary Vision Insurance voluntary vision coverage through the Paycom portal. Mutual of Omaha Review the plan documents provided to you and enroll or waive out of the Voluntary STD & LTD voluntary STD & LTD coverage through the Paycom portal. Fidelity Review the plan documents provided to you and enroll or waive out of the FSA FSA and DCFSA or DCFSA coverage via the Paycom portal. Wage Works Review the plan documents provided to you and enroll or waive out of the Commuter Benefits Commuter Benefits coverage via the Paycom portal. Fidelity You must be enrolled in the qualified high deductible health plan to both have Health Savings Account and contribute to a Health Savings Account (HSA). Review the plan documents provided to you and enroll or waive out of the HSA through the Paycom portal. Upon eligibility, you are automatically enrolled in the 401K plan. You receive Fidelity that information within your first 30 days. If you’ve opted out of auto- 401K enrollment but would like to begin contributing to the 401K, please reach out to HR. Open enrollment is running November 10th through November 29th, 2022. The benefits you elect will remain in place from January 1, 2023 – December 31, 2023, unless you have a qualifying event. Examples of a qualifying event include marriage, divorce, legal separation, adoption, or loss of coverage. 4

Health Insurance ABC Company is happy to report that there are no changes to the Medical Plans for 2023. We will continue to offer Medical & Prescription Drug insurance though Empire Blue Cross Blue Shield. You will have the choice between two plans, one HSA eligible and one traditional deductible first plan. Both plans are EPO which offer Empire’s National Network, but no out-of-network coverage. st The table below summarizes the medical plans available January 1, 2023 – December 31 , 2023. Services Total Blue HSA Deductible First In Network In Network Deductible – Individual / Family $3,000 / $6,000 (A) $1,500 / $3,750 (E) Coinsurance 70% / 30% 100% / 0% Out of Pocket Maximum – Individual / Family $4,275 / $8,550 (A) $5,000 / $12,000 (E) Preventive Care No Charge No Charge Physician / Specialist Visit Copay 30% after Deductible $35 / $50 after Deductible Inpatient Hospitalization 30% after Deductible $500 after Deductible Outpatient Surgery 30% after Deductible $200 after Deductible Lab / X-Ray 30% after Deductible $35 or $50 after Deductible High-Cost Diagnostics 30% after Deductible $35 or $50 after Deductible Emergency Room Visit 30% after Deductible $150 after Deductible Urgent Care 30% after Deductible $25 after Deductible Services Out-of-Network Out-of-Network Deductible – Individual / Family N/A N/A Coinsurance N/A N/A Out of Pocket Maximum – Individual / Family N/A N/A Services Out-of-Network Out-of-Network Prescription Drugs- Retail/Mail Order Deductible Then: Tier 1 $15 / $30 $10 / $20 Tier 2 $35 / $70 $35 / $70 Tier 3 $75 / $150 $70 / $140 5

Additional Benefits Through Empire Life Insurance: If you enroll in one of the Empire BCBS plans, ABC Company will offer you basic Life/AD&D Insurance. The coverage is a flat $25,000 benefit payable to your designated beneficiary. New for 2023 – Supplemental Life Insurance! All full-time employees have access to purchase supplement life insurance at a discounted rate. Please refer to the supplement life insurance section on page 16. Please make sure that your beneficiary is up to date. Vision Insurance: If you enroll in the Empire BCBS plans, Mitchell Martin will offer you vision coverage. The plan allows for one vision exam every 24 months. The coverage is provided to you and any eligible dependents that are covered under your medical plan. You will be responsible for a $15 copayment, if you choose an in-network provider and up to a $40 reimbursement if you choose an out-of-network provider. Empire “Be Active” & Gym Reimbursement Program: If you enroll in one of the Empire BCBS plans, you are eligible for the Be Active and Gym Reimbursement program. Be Active gives members access to wellness features, such as, a fitness coach and chances to win dollar awards. To qualify for gym reimbursement, you must work out at least 35 times at a qualifying fitness center every 6 months. Members can be reimbursed up to $400 per member per year. You can claim your reimbursement by submitting the Empire gym reimbursement form, a copy of the fitness facility member verification form, proof of your fitness center payment and a record of your workout sessions. Your workout record can be an electronic gym printout or a fitness log. 6

Health Savings Accounts Health savings accounts (HSAs) are a great way to save money and budget for qualified medical expenses. HSAs are tax- advantaged savings accounts that accompany high deductible health plans (HDHPs). HDHPs offer lower monthly premiums in exchange for a higher deductible (the amount you pay before insurance kicks in). You are only eligible to enroll and contribute to an HSA account if you enroll in the Empire Total Blue HSA Plan. What Are the Benefits of an HSA? There are many benefits of using an HSA, including the following: • It saves you money. HDHPs have lower monthly premiums, meaning less money is being taken out of your paycheck. • It is portable. The money in your HSA is carried over from year to year and is yours to keep, even if you leave the company. • It is a tax-saver. HSA contributions are made with pre-tax dollars. Since your taxable income is decreased by your contributions, you’ll pay less in taxes. The maximum amount that you can contribute to an HSA in 2022 is $3,650 for individual coverage and $7,300 for family coverage. In 2023, it increases to $3,850 for individual coverage and $7,750 for family coverage. Additionally, if you are age 55 or older, you may make an additional “catch-up” contribution of $1,000. You may change your contribution amount at any time throughout the year if you don’t exceed the annual maximum. HSA Case Study Justin is a healthy 28-year-old single man who contributes $1,000 each year to his HSA. His plan’s annual deductible is $1,500 for individual coverage. Here is a look at the first two years of Justin’s HSA plan: Year 1 Year 2 HSA Balance $1,000 HSA Balance $1,850 Total Expenses: (-$150) Total Expenses: (-$300) - Prescription drugs: $150 - Office visits: $100 - Prescription drugs: $200 - Preventive care services: $0 (covered by insurance) HSA Rollover to Year 2 $850 HSA Rollover to Year 3 $1,550 Since Justin did not spend all his HSA dollars, he did Once again, since Justin did not spend all of his HSA not need to pay any additional amounts out-of-pocket dollars, he did not need to pay any additional this year. amounts out-of-pocket this year. 7

Flexible Spending Account (FSA) Starting January 1, 2023 – the Flexible Spending Account (FSA) will be offered through Fidelity. Once you have completed 2 years of service at 1,000 hours per year, Mitchell Martin provides you the opportunity to pay for out-of-pocket medical, dental, vision and dependent care expenses with pre-tax dollars through a Flexible Spending Account (FSA). This is how an FSA works: › You set aside money for your FSA from your paycheck before taxes are taken out. › Then use your pre-tax FSA funds throughout the plan year to pay for eligible health care or dependent care expenses. › The maximum you can contribute to the Health Care FSA is set by IRS regulations. The maximum contribution limit for the Heath Care FSA in 2023 is $3,050. › Your full annual election of the Health Care FSA is available to you on the first day of the plan year. › The maximum contribution limit for the Dependent Care FSA in 2023 is $5,000 for single or married subscribers. Please note: if you are married but filing your taxes separately, your contribution limit is $2,500. › You can only spend Dependent Care FSA dollars as you accrue them in your account. › Please note: Once you determine what your pre-tax elections will be for the Health Care and Dependent Care contributions, you cannot change those elections unless you have a qualifying event. Without a qualifying event, you will have to wait until the next enrollment period to make changes to your contribution amounts. › At the end of the year, you may rollover all unused funds to the next plan year for your Health Care FSA & your Dependent Care FSA. Make sure to calculate your medical and dependent care expenses accurately. All st services must be done by December 31 of each year. Commuter Benefits – Parking & Transit ABC Company offers a commuter benefit program for parking and transportation provided by WageWorks. You may contribute up to $300 per month pre-tax. Funds are loaded on to a debit card for use for your parking and transit expenses. For your transit account, you may schedule recurring orders through WageWorks and they will mail you a monthly transit pass. For parking, you may schedule recurring orders through WageWorks for reimbursement for out-of- pocket expenses. 8

Introducing Alex! Do you need help selecting the best plans for you and your family’s needs? If so, check out ALEX, your digital benefits counselor. 9

This is a modal window.

Sydney Health Mobile App The Sydney app is a convenient way for you to access a wide variety of information you may need including digital ID cards, find a provider tool, treatement cost calculators and much more. Check out the video below for how Sydney may be able to help you! 10

24/7 Nurse Line 11

Empire Find a doctor Tool Navigate to www.empireblue.com/find-care. If you are currently a member, you may click member and enter your information. If you have not signed up yet, select “Guests”. Fill out the remaining questions based on the screen shot below: 12

Covid-19 Resource Center GoodRx You can compare prescription drug prices across multiple pharmacies directly from your phone, often at a reduced cost. Please note that this program typically operates outside of your insurance plan, so they may not track toward your deductible or out-of-pocket maximum. Visit www.goodrx.com to learn more: 13

Dental Insurance In addition to protecting your smile, dental insurance helps pay for dental care and usually includes regular checkups, cleanings, and X-rays. Several studies suggest that oral diseases, such as periodontitis (gum disease), can affect other areas of your body—including your heart. Receiving regular dental care can protect you and your family from the high cost of dental disease and surgery. ABC Company will continue to offer Dental Insurance through Delta Dental. Below is a cart outlining the benefits available to you: Type of Service Dental PPO: In-Network Dental PPO Out-of-Network DHMO Plan Deductible Waived for Preventive Waived for Preventive See Schedule for Cost $50 / $150 $50 / $150 Annual Benefit Max $1,500 $1,500 See Schedule for Cost Diagnostic & Preventive You pay 0% Coinsurance You pay 20% Coinsurance Cleanings, X-Rays, Oral Exams, See Covered Benefit Schedule Space Maintainers, Sealants, Plan pays 100% Plan pays 80% Flouride Diagnostic & Preventive You pay 20% Coinsurance You pay 40% Coinsurance See Covered Benefit Schedule Fillings, Simple Extractions, Plan pays 80% Plan pays 60% Emergency Treatment, X-Rays Major Services Crowns, Bridges and Dentures, You pay 50% Coinsurance You pay 50% Coinsurance Inlays, Onlys, Veneers, Root Canal See Covered Benefit Schedule Treatment, Gum Disease Plan pays 50% Plan pays 50% Treatment, General Anesthesia, Oral Surgeries Orthodontia No Deductible. You pay 50%. Plan pays 50%. See Covered Benefit Schedule Dependent Children $1000 Lifetime Maximum 14

Vision Insurance Driving to work, reading a news article, and watching TV are all activities you likely perform every day. Your ability to do all these activities, though, depends on your vision and eye health. Vision insurance can help you maintain your vision as well as detect various health problems. ABC Company’s vision insurance entitles you to specific eye care benefits. Our policy covers routine eye exams and other procedures, and provides specified dollar amounts or discounts for the purchase of eyeglasses and contact lenses. ABC Company will continue to offer Vision Insurance through EyeMed. Type of Service In-Network Out-of-Network Well Vision Exam $20 Copay $40 Allowance Materials Copay $20 Copay $20 Copay Frame Allowance $150 + 20% off Balance $75 Allowance Lenses Single 100% after $20 Copayment $30 Allowance Bifocal 100% after $20 Copayment $50 Allowance Trifocal 100% after $20 Copayment $70 Allowance Contact Lenses $100 + 15% off Balance $100 Allowance Frequency 12 Months Exams 12 Months (in lieu of frames) Lenses or Contacts 24 Months Frames Through EyeMed, you have access to additional benefits: • 40% off additional glasses • 15% off Laser or PPK Vision Correction Surgery • 40% off hearing exams from Apmlifon Hearing Health Care Network • Discounts on Hearing Aids 15

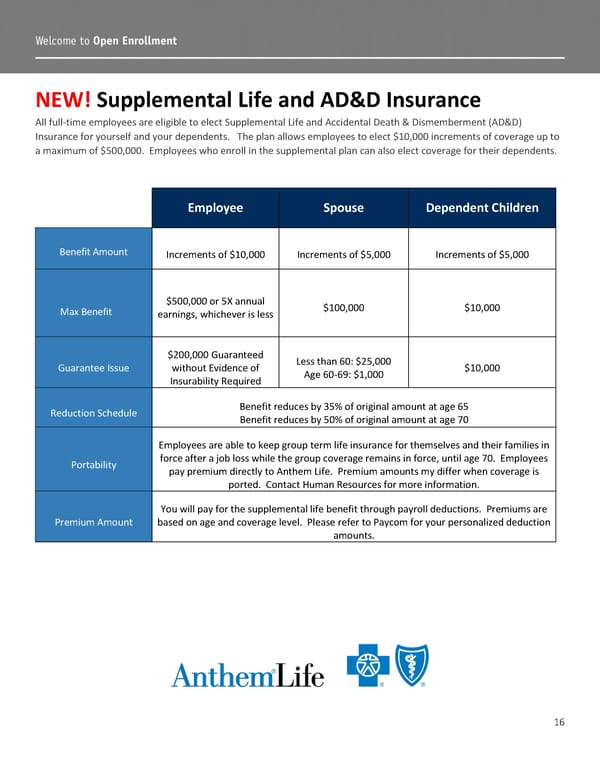

NEW! Supplemental Life and AD&D Insurance All full-time employees are eligible to elect Supplemental Life and Accidental Death & Dismemberment (AD&D) Insurance for yourself and your dependents. The plan allows employees to elect $10,000 increments of coverage up to a maximum of $500,000. Employees who enroll in the supplemental plan can also elect coverage for their dependents. Employee Spouse Dependent Children Benefit Amount Increments of $10,000 Increments of $5,000 Increments of $5,000 Max Benefit $500,000 or 5X annual $100,000 $10,000 earnings, whichever is less $200,000 Guaranteed Less than 60: $25,000 Guarantee Issue without Evidence of Age 60-69: $1,000 $10,000 Insurability Required Reduction Schedule Benefit reduces by 35% of original amount at age 65 Benefit reduces by 50% of original amount at age 70 Employees are able to keep group term life insurance for themselves and their families in Portability force after a job loss while the group coverage remains in force, until age 70. Employees pay premium directly to Anthem Life. Premium amounts my differ when coverage is ported. Contact Human Resources for more information. You will pay for the supplemental life benefit through payroll deductions. Premiums are Premium Amount based on age and coverage level. Please refer to Paycom for your personalized deduction amounts. 16

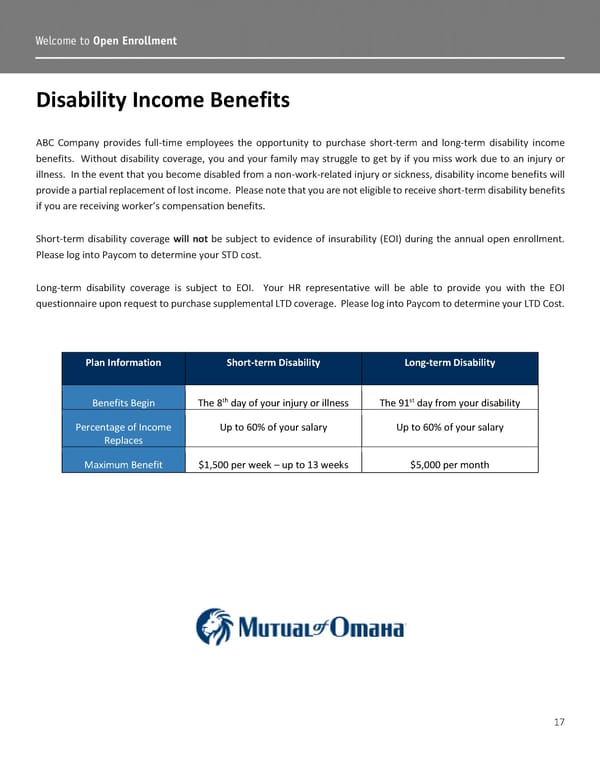

Disability Income Benefits ABC Company provides full-time employees the opportunity to purchase short-term and long-term disability income benefits. Without disability coverage, you and your family may struggle to get by if you miss work due to an injury or illness. In the event that you become disabled from a non-work-related injury or sickness, disability income benefits will provide a partial replacement of lost income. Please note that you are not eligible to receive short-term disability benefits if you are receiving worker’s compensation benefits. Short-term disability coverage will not be subject to evidence of insurability (EOI) during the annual open enrollment. Please log into Paycom to determine your STD cost. Long-term disability coverage is subject to EOI. Your HR representative will be able to provide you with the EOI questionnaire upon request to purchase supplemental LTD coverage. Please log into Paycom to determine your LTD Cost. Plan Information Short-term Disability Long-term Disability th st Benefits Begin The 8 day of your injury or illness The 91 day from your disability Percentage of Income Up to 60% of your salary Up to 60% of your salary Replaces Maximum Benefit $1,500 per week – up to 13 weeks $5,000 per month 17

401K Retirement Plan ABC Company offers a 401K program provided through Fidelity. You may contribute to the 401K account on a pre-tax basis. The maximum amount you can contribute for 2023 is $22,500. If you are aged 50 or older you can make up to a $7,500 catch up contribution for 2023. Upon eligibility, you are automatically enrolled in the 401K plan. You receive that information within your first 30 days. If you’ve opted out of auto-enrollment but would like to begin contributing to the 401K, please reach out to HR. Perks at Work! As part of employment at ABC Company you are offered the opportunity to participate in the Perks at Work program. Perks at Work allows you access to discounts on your favorite shopping categories such as: travel, electronics, apparel, home, tickets, gifts and auto. In addition to discounts, you can also earn rewards points that can be used for future purchases, also known as WOWPoints. Registration for Perks at Work is free at the www.perksatwork.com website. In addition, you can also invite up to 5 friends or family members to join the program. You can use your WOWPoints just like cash and they never expire. All purchases are eligible for WOWPoints and you can earn 1 WOWPoints for every dollar spent. When it comes time to redeem your points 100 WOWPoints equals $1. If you earn 5,000 WOWPoints in 1 year, you become a 5 STAR user. 5 STAR users can earn up to 50% more WOWPoints on each purchase. Perks at Work is similar to any online marketplace where you can browse through multiple categories and complete your purchases through one site. Discounts and WOWPoints are automatically tracked and applied to your account. 18

Your Cost in 2023 Below is a summary of your 2023 deductions for the Medical, Dental and Vision plans. Empire Blue Cross Blue Shield Costs: Below are your semi-monthly medical and Rx contributions based on the plan you choose to enroll in for the 2023 plan year: Medical Plans Employee Employee + Employee + Employee + Only Spouse Children Family Total Blue HSA $40.00 $230.00 $187.50 $380.00 Deductible First $85.00 $367.50 $310.00 $600.00 Delta Dental Costs: Below are your semi-monthly dental contributions based on the plan you choose to enroll in for the 2023 plan year: Dental Plan Employee Employee + Employee + Employee + Only Spouse Child(ren) Family Dental PPO $21.50 $42.38 $37.47 $53.81 DHMO $9.12 $15.37 $17.32 $25.49 EyeMed Vision Costs: Below are your semi-monthly vision contributions based on the plan you choose to enroll in for the 2023 plan year: Vision Plan Employee Employee + Employee + Employee + Only Spouse Child(ren) Family DHMO $1.87 $3.55 $3.73 $5.49 19

Questions & Answers What changes are effective Jan. 1, 2023? • Enrollment or termination of individual and/or dependent coverage in a Health Plan • Changes to your 2023 HSA contribution amount • Changes to your 2023 FSA contribution amount • Enrollment in the new Voluntary Life Insurance Plan through Anthem Life Where do I go to enroll? • Log into the Paycom portal to review your options. Visit www.paycom.com → Employee Login → Benefits → 2023 Benefit Enrollment When are elections due? th • All elections are due by November 29 , 2022 Who I contact with questions? • Joseph Marino, Director of Account Management– Meridian Risk Management • [email protected] 914-368-1291 • ABC Company Human Resources Department Other Information: • All benefit elections will be effective January 1, 2023 through December 31, 2023. 20