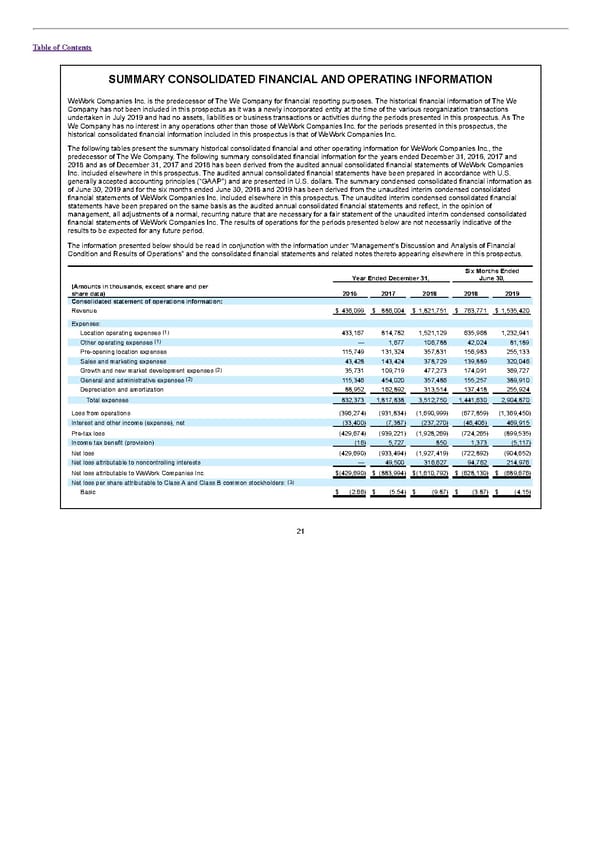

Table of Contents SUMMARY CONSOLIDATED FINANCIAL AND OPERATING INFORMATION WeWork Companies Inc. is the predecessor of The We Company for financial reporting purposes. The historical financial information of The We Company has not been included in this prospectus as it was a newly incorporated entity at the time of the various reorganization transactions undertaken in July 2019 and had no assets, liabilities or business transactions or activities during the periods presented in this prospectus. As The We Company has no interest in any operations other than those of WeWork Companies Inc. for the periods presented in this prospectus, the historical consolidated financial information included in this prospectus is that of WeWork Companies Inc. The following tables present the summary historical consolidated financial and other operating information for WeWork Companies Inc., the predecessor of The We Company. The following summary consolidated financial information for the years ended December 31, 2016, 2017 and 2018 and as of December 31, 2017 and 2018 has been derived from the audited annual consolidated financial statements of WeWork Companies Inc. included elsewhere in this prospectus. The audited annual consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and are presented in U.S. dollars. The summary condensed consolidated financial information as of June 30, 2019 and for the six months ended June 30, 2018 and 2019 has been derived from the unaudited interim condensed consolidated financial statements of WeWork Companies Inc. included elsewhere in this prospectus. The unaudited interim condensed consolidated financial statements have been prepared on the same basis as the audited annual consolidated financial statements and reflect, in the opinion of management, all adjustments of a normal, recurring nature that are necessary for a fair statement of the unaudited interim condensed consolidated financial statements of WeWork Companies Inc. The results of operations for the periods presented below are not necessarily indicative of the results to be expected for any future period. The information presented below should be read in conjunction with the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes thereto appearing elsewhere in this prospectus. Six Months Ended Year Ended December 31, June 30, (Amounts in thousands, except share and per share data) 2016 2017 2018 2018 2019 Consolidated statement of operations information: Revenue $ 436,099 $ 886,004 $ 1,821,751 $ 763,771 $ 1,535,420 Expenses: (1) Location operating expenses 433,167 814,782 1,521,129 635,968 1,232,941 (1) Other operating expenses — 1,677 106,788 42,024 81,189 Pre-opening location expenses 115,749 131,324 357,831 156,983 255,133 Sales and marketing expenses 43,428 143,424 378,729 139,889 320,046 (2) Growth and new market development expenses 35,731 109,719 477,273 174,091 369,727 (2) General and administrative expenses 115,346 454,020 357,486 155,257 389,910 Depreciation and amortization 88,952 162,892 313,514 137,418 255,924 Total expenses 832,373 1,817,838 3,512,750 1,441,630 2,904,870 Loss from operations (396,274) (931,834) (1,690,999) (677,859) (1,369,450) Interest and other income (expense), net (33,400) (7,387) (237,270) (46,406) 469,915 Pre-tax loss (429,674) (939,221) (1,928,269) (724,265) (899,535) Income tax benefit (provision) (16) 5,727 850 1,373 (5,117) Net loss (429,690) (933,494) (1,927,419) (722,892) (904,652) Net loss attributable to noncontrolling interests — 49,500 316,627 94,762 214,976 Net loss attributable to WeWork Companies Inc. $(429,690) $ (883,994) $(1,610,792) $ (628,130) $ (689,676) (3) Net loss per share attributable to Class A and Class B common stockholders: Basic $ (2.66) $ (5.54) $ (9.87) $ (3.87) $ (4.15) 21

S1 - WeWork Prospectus Page 25 Page 27

S1 - WeWork Prospectus Page 25 Page 27