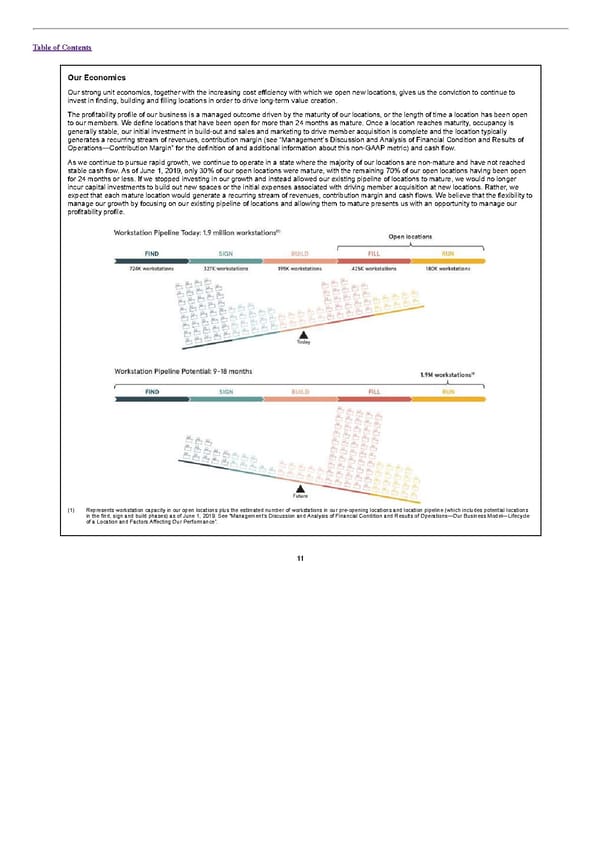

Table of Contents Our Economics Our strong unit economics, together with the increasing cost efficiency with which we open new locations, gives us the conviction to continue to invest in finding, building and filling locations in order to drive long-term value creation. The profitability profile of our business is a managed outcome driven by the maturity of our locations, or the length of time a location has been open to our members. We define locations that have been open for more than 24 months as mature. Once a location reaches maturity, occupancy is generally stable, our initial investment in build-out and sales and marketing to drive member acquisition is complete and the location typically generates a recurring stream of revenues, contribution margin (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Contribution Margin” for the definition of and additional information about this non-GAAP metric) and cash flow. As we continue to pursue rapid growth, we continue to operate in a state where the majority of our locations are non-mature and have not reached stable cash flow. As of June 1, 2019, only 30% of our open locations were mature, with the remaining 70% of our open locations having been open for 24 months or less. If we stopped investing in our growth and instead allowed our existing pipeline of locations to mature, we would no longer incur capital investments to build out new spaces or the initial expenses associated with driving member acquisition at new locations. Rather, we expect that each mature location would generate a recurring stream of revenues, contribution margin and cash flows. We believe that the flexibility to manage our growth by focusing on our existing pipeline of locations and allowing them to mature presents us with an opportunity to manage our profitability profile. (1) Represents workstation capacity in our open locations plus the estimated number of workstations in our pre-opening locations and location pipeline (which includes potential locations in the find, sign and build phases) as of June 1, 2019. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Our Business Model—Lifecycle of a Location and Factors Affecting Our Performance”. 11

S1 - WeWork Prospectus Page 15 Page 17

S1 - WeWork Prospectus Page 15 Page 17