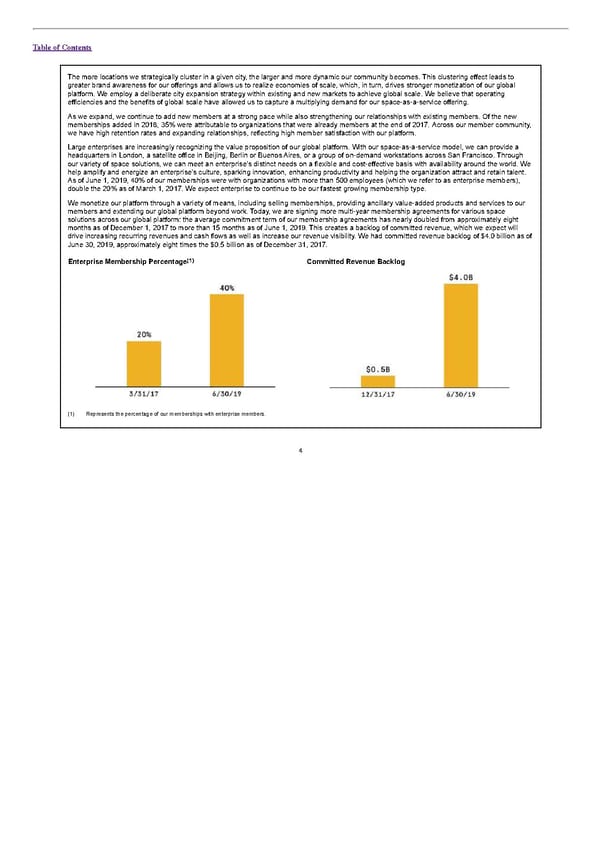

Table of Contents The more locations we strategically cluster in a given city, the larger and more dynamic our community becomes. This clustering effect leads to greater brand awareness for our offerings and allows us to realize economies of scale, which, in turn, drives stronger monetization of our global platform. We employ a deliberate city expansion strategy within existing and new markets to achieve global scale. We believe that operating efficiencies and the benefits of global scale have allowed us to capture a multiplying demand for our space-as-a-service offering. As we expand, we continue to add new members at a strong pace while also strengthening our relationships with existing members. Of the new memberships added in 2018, 35% were attributable to organizations that were already members at the end of 2017. Across our member community, we have high retention rates and expanding relationships, reflecting high member satisfaction with our platform. Large enterprises are increasingly recognizing the value proposition of our global platform. With our space-as-a-service model, we can provide a headquarters in London, a satellite office in Beijing, Berlin or Buenos Aires, or a group of on-demand workstations across San Francisco. Through our variety of space solutions, we can meet an enterprise’s distinct needs on a flexible and cost-effective basis with availability around the world. We help amplify and energize an enterprise’s culture, sparking innovation, enhancing productivity and helping the organization attract and retain talent. As of June 1, 2019, 40% of our memberships were with organizations with more than 500 employees (which we refer to as enterprise members), double the 20% as of March 1, 2017. We expect enterprise to continue to be our fastest growing membership type. We monetize our platform through a variety of means, including selling memberships, providing ancillary value-added products and services to our members and extending our global platform beyond work. Today, we are signing more multi-year membership agreements for various space solutions across our global platform: the average commitment term of our membership agreements has nearly doubled from approximately eight months as of December 1, 2017 to more than 15 months as of June 1, 2019. This creates a backlog of committed revenue, which we expect will drive increasing recurring revenues and cash flows as well as increase our revenue visibility. We had committed revenue backlog of $4.0 billion as of June 30, 2019, approximately eight times the $0.5 billion as of December 31, 2017. (1) Enterprise Membership Percentage Committed Revenue Backlog (1) Represents the percentage of our memberships with enterprise members. 4

S1 - WeWork Prospectus Page 8 Page 10

S1 - WeWork Prospectus Page 8 Page 10