Series A

Rippling Pitch Deck & Investor Memo

Rippling Memo Rippling’s premise is that businesses should have a single system for employee information across every department within the company. That’s not the way it works today.

Introduction Rippling’s premise is that businesses should have a single system for employee information across every department within the company. That’s not the way it works today. OVERVIEW OUR STRATEGY Most businesses have dozens of systems that main- Our strategy, in a nutshell, has 3 parts: tain a list of their employees, and for the most part, none of these systems talk to each other or to any Part I: If you can be the system of record for central system about who these employees are. employee data, you can build a really successful business. Sometimes, these business systems only need to know a little bit about each employee — maybe just Being the system of record for employee data is lucra- each employee’s username, and a password, so that tive because this system has platform power that the system can authenticate employees when they can be used in other business software and services log in. Other systems go deeper, and need to know categories that need to access this underlying em- each employee’s department, manager, salary, home ployee data. address, and more. At one extreme, if you’re the system of record for employee data, you can build adjacent products with Whenever something changes about an employee, exclusive access to your system. That’s what we did at many (and sometimes, all) of these systems need my last company, Zene昀椀ts. Zene昀椀ts was a system of to be updated, and because they don’t point to any record for employee data within the HR department, central authority, they each need to be updated sepa- and in order for clients to connect their insurance rately and by hand. up to Zene昀椀ts, they had to make us their insurance We believe that the e昀昀ort to maintain this fragmented broker. employee data across all of a company’s business Because this connectivity made life easier for the systems is, secretly, the root cause of almost all the client, most Zene昀椀ts clients chose to make us their administrative work of running a company. broker. But we could have arbitrarily done this in any There should be a single system of employee data number of other areas with a strong tie to the em- that sits underneath every other business system. ployee record, besides insurance. Companies and their employees could come to this And, you can take a di昀昀erent approach, which we pre- one place, and make changes to employees in this one fer at Rippling — you can partner broadly with other system, and that system would handle the propaga- companies and be a reseller: you can allow other tion out to every other business system. companies to operate in your system, you can bring That’s what Rippling is, and that’s what we do. them new clients, and in exchange, they pay you a cut of their revenue. This belief — that the system of record for employee data is valuable — is the least unique, and probably the least controversial, part of our strategy. 2 Rippling Memo

Almost every other HRIS and payroll company views Stated slightly di昀昀erently: if a new hire were to mis- the world this way. ADP is the largest payroll company enter their Social Security Number into Rippling, it in the US by market cap, and they make most of their would be wrong everywhere — in payroll, with insur- revenue not selling payroll — but by selling a host of ance carriers, with the 401k provider, etc. ADP add-on services (time tracking, performance management, benadmin, etc) that happen to plug in As a result of this, we are uniquely fanatical about to the core ADP payroll system. Certainly Zene昀椀ts, employee onboarding software. For our competitors, Gusto, and Namely also count this as a part of their employee onboarding tools may be useful features, strategy. helpful to clients. But for us, onboarding software is the only thing that matters, because if you win at Outside of HR, this is also Microsoft’s strategy in onboarding, you win everything else. their enterprise business segment. Microsoft’s Active Directory is also a system of record for employee data Eventually, though, if we’re successful, other compa- — just one that happens to be used by the IT depart- nies will come around to our point of view on the cen- ment instead of the HR department. Microsoft brings tral role this software will play in the B2B ecosystem, Active Directory into a company, and then upsells the and will refocus their own e昀昀orts to develop employee company on other Microsoft services — Exchange onboarding software. The question then becomes, Server, Sharepoint, Windows PCs — that plug cleanly “how do you win at employee onboarding software?” in to Active Directory. Part III - To win at employee onboarding, you can’t So, many companies agree that being the system of be monogamous to any single department or record for employee data is valuable, and Rippling functional area. is not the only company gunning for this prize. The question then becomes, how do you “win” at being the Many companies maintain informal checklists of the system of record for employee data? tasks they need to complete when hiring a new em- ployee. To win at onboarding, you need to automate more of a company’s new hire checklist than anyone Part II - Onboarding Software makes you the else. system of record for employee data. But, these onboarding tasks cut across many di昀昀er- There is a button you click in Rippling to hire an ent departments — it’s our experience that about employee. As a hiring manager, you tell us the new 30% of a company’s onboarding tasks are HR-related. employee’s Salary, Manager, Department, Work Loca- About 40% are IT-related. And there’s a smattering of tion, and a few other things. Finance, Legal, and Facilities-related tasks that need to be completed for every new hire, as well. Rippling then reaches out to the new hire, generates their paperwork for electronic signature, and then If your company’s mission is to make HR software, or asks the employee for details like their Social Security to build software for the Finance department, or the Number, Home Address, and Bank Account Number. IT organization, you can only solve a portion of this onboarding problem — because the onboarding pain These hiring and onboarding 昀氀ows are the way this that businesses have isn’t speci昀椀c to one department new employee object is assembled. Rippling is collect- or functional area. ing each of the employee attributes that make up this employee record, we are writing them to our data- To e昀昀ectively solve employee onboarding, you have to base, and then we are metering them out to all of our orient your product around employee lifecycle events clients’ downstream business systems. — getting hired, getting a new job or role, moving to a new address, getting promoted, leaving the company By virtue of being the ingestion point for this employ- — and follow the downstream implications of these ee data, and because we are upstream of everyone lifecycle events wherever they lead. else in this process, Rippling is the system of record by de昀椀nition. Because every other business system is receiving its information about the company’s employees from us, we become the de facto source of truth. 3 Rippling Memo

This means you need to have tentacles into all of these di昀昀erent departments and functional areas, and all the di昀昀erent 3rd party systems they use. If you build your software for one particular buyer or depart- ment, you will eventually lose to the company that solves the whole problem. Onboarding Sidebar It’s worth noting that the term “onboarding software” is used to mean di昀昀erent things by di昀昀erent compa- nies. Some companies have built project management apps for HR that assign out tasks and track comple- tion whenever someone joins the company. These apps are sometimes called “onboarding software,” but they bear no relation to the product we have built, because they lack any downstream systems connec- tivity. As a result, they’re both less useful to the employer (these apps can assign you work, but they can’t do it for you), and strategically less interesting (without downstream systems connectivity, they are no longer a source of truth for employee data). . 4 Rippling Memo

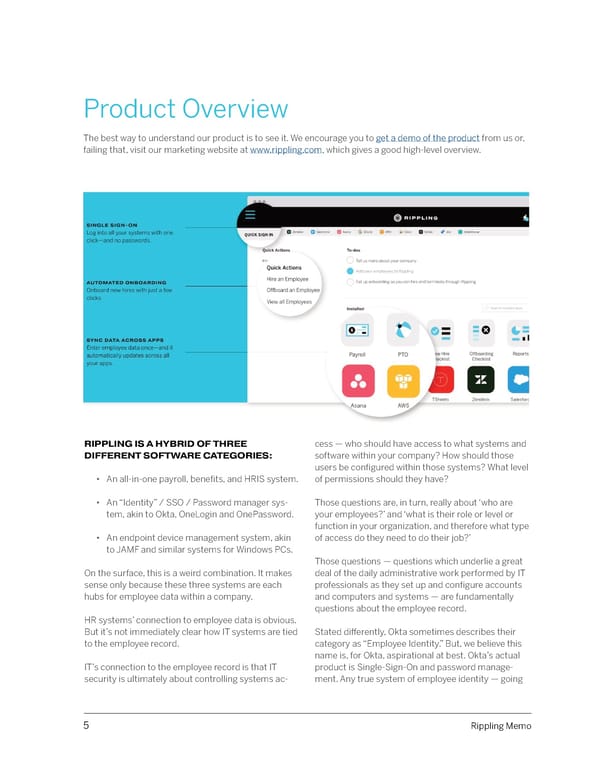

Product Overview The best way to understand our product is to see it. We encourage you to get a demo of the product from us or, failing that, visit our marketing website at www.rippling.com, which gives a good high-level overview. RIPPLING IS A HYBRID OF THREE cess — who should have access to what systems and DIFFERENT SOFTWARE CATEGORIES: software within your company? How should those users be con昀椀gured within those systems? What level • An all-in-one payroll, bene昀椀ts, and HRIS system. of permissions should they have? • An “Identity” / SSO / Password manager sys- Those questions are, in turn, really about ‘who are tem, akin to Okta, OneLogin and OnePassword. your employees?’ and ‘what is their role or level or function in your organization, and therefore what type • An endpoint device management system, akin of access do they need to do their job?’ to JAMF and similar systems for Windows PCs. Those questions — questions which underlie a great On the surface, this is a weird combination. It makes deal of the daily administrative work performed by IT sense only because these three systems are each professionals as they set up and con昀椀gure accounts hubs for employee data within a company. and computers and systems — are fundamentally questions about the employee record. HR systems’ connection to employee data is obvious. But it’s not immediately clear how IT systems are tied Stated di昀昀erently, Okta sometimes describes their to the employee record. category as “Employee Identity.” But, we believe this name is, for Okta, aspirational at best. Okta’s actual IT’s connection to the employee record is that IT product is Single-Sign-On and password manage- security is ultimately about controlling systems ac- ment. Any true system of employee identity — going 5 Rippling Memo

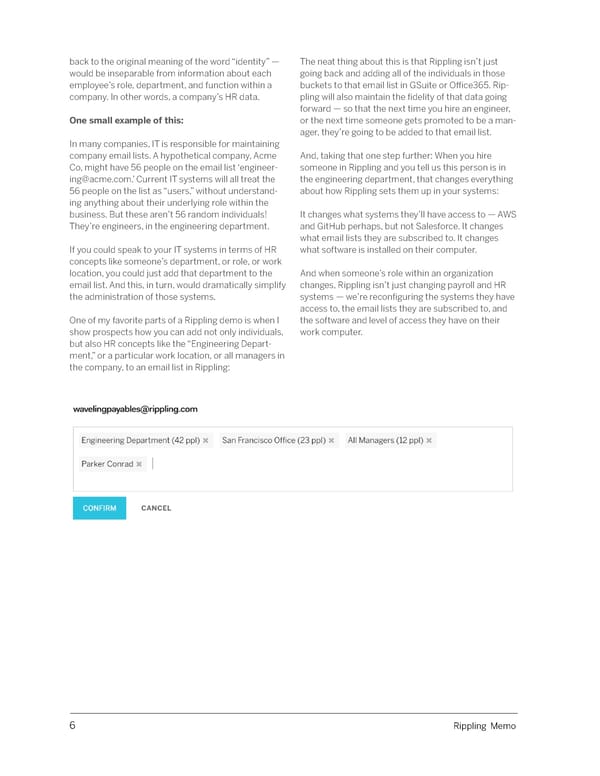

back to the original meaning of the word “identity” — The neat thing about this is that Rippling isn’t just would be inseparable from information about each going back and adding all of the individuals in those employee’s role, department, and function within a buckets to that email list in GSuite or O昀케ce365. Rip- company. In other words, a company’s HR data. pling will also maintain the 昀椀delity of that data going forward — so that the next time you hire an engineer, One small example of this: or the next time someone gets promoted to be a man- ager, they’re going to be added to that email list. In many companies, IT is responsible for maintaining company email lists. A hypothetical company, Acme And, taking that one step further: When you hire Co, might have 56 people on the email list ‘engineer- someone in Rippling and you tell us this person is in [email protected].’ Current IT systems will all treat the the engineering department, that changes everything 56 people on the list as “users,” without understand- about how Rippling sets them up in your systems: ing anything about their underlying role within the business. But these aren’t 56 random individuals! It changes what systems they’ll have access to — AWS They’re engineers, in the engineering department. and GitHub perhaps, but not Salesforce. It changes what email lists they are subscribed to. It changes If you could speak to your IT systems in terms of HR what software is installed on their computer. concepts like someone’s department, or role, or work location, you could just add that department to the And when someone’s role within an organization email list. And this, in turn, would dramatically simplify changes, Rippling isn’t just changing payroll and HR the administration of those systems. systems — we’re recon昀椀guring the systems they have access to, the email lists they are subscribed to, and One of my favorite parts of a Rippling demo is when I the software and level of access they have on their show prospects how you can add not only individuals, work computer. but also HR concepts like the “Engineering Depart- ment,” or a particular work location, or all managers in the company, to an email list in Rippling: 6 Rippling Memo

Competition OVERVIEW There are ways in which Rippling wins or loses going head to head against any individual one of these As mentioned previously, Rippling is a hybrid of three competitors (for what it’s worth, on the HR side, we di昀昀erent software categories: believe our product is superior to every other system on the market). • An all-in-one payroll, bene昀椀ts, and HRIS system But the larger dynamic is that each of these competi- • An “identity” / access management system tors thinks of themselves far more narrowly than Rippling does: they make HR software, or Identity • An endpoint device management system software, or device management software. It’s em- bedded in their culture and mission statements and This also means that Rippling competes with three taglines. These companies are going to stay in their very di昀昀erent types of companies. Not every deal in- swim lanes. volves all three components — some deals are IT only, some deals are HR-only and of course many deals are They might partner — but these partnership will both. always be thin tethers connecting otherwise unrelated systems. COMPETITOR BREAKDOWN • On the payroll and HR side, we compete against Gusto, Zene昀椀ts, Namely, ADP, Paychex, and other similar companies. If a client chooses to use Rippling on the payroll and HR side, we are almost always replacing one of these systems. • On the identity side, we compete against Okta, OneLogin, LastPass, OnePassword, and similar companies. We’re much less likely to be replac- ing one of these systems — most companies we sell to haven’t purchased them yet. • On the device management side, we compete against JAMF (for mac), Microsoft (for PC man- agement), and a few newer, but smaller, com- petitors. As with Identity systems, we’re much less likely to be replacing one of these systems — most companies we sell to haven’t purchased them yet. 7 Rippling Memo

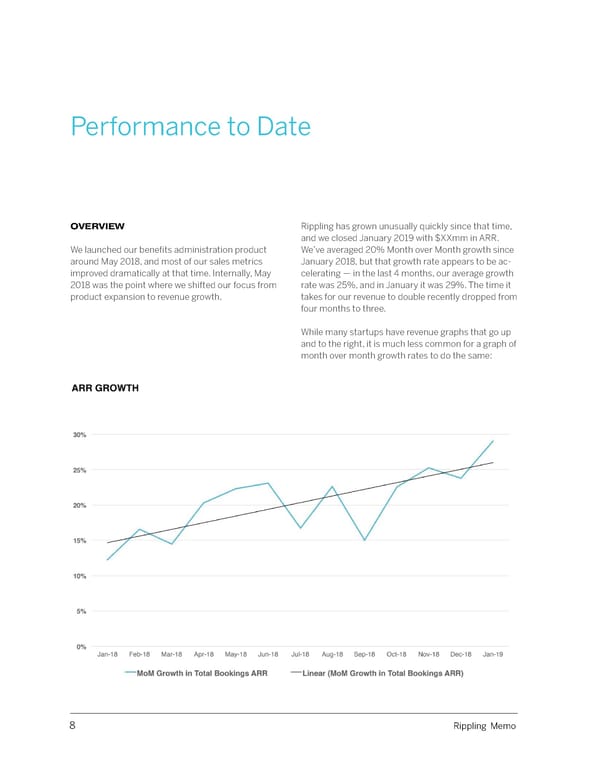

Performance to Date OVERVIEW Rippling has grown unusually quickly since that time, and we closed January 2019 with $XXmm in ARR. We launched our bene昀椀ts administration product We’ve averaged 20% Month over Month growth since around May 2018, and most of our sales metrics January 2018, but that growth rate appears to be ac- improved dramatically at that time. Internally, May celerating — in the last 4 months, our average growth 2018 was the point where we shifted our focus from rate was 25%, and in January it was 29%. The time it product expansion to revenue growth. takes for our revenue to double recently dropped from four months to three. While many startups have revenue graphs that go up and to the right, it is much less common for a graph of month over month growth rates to do the same: 8 Rippling Memo

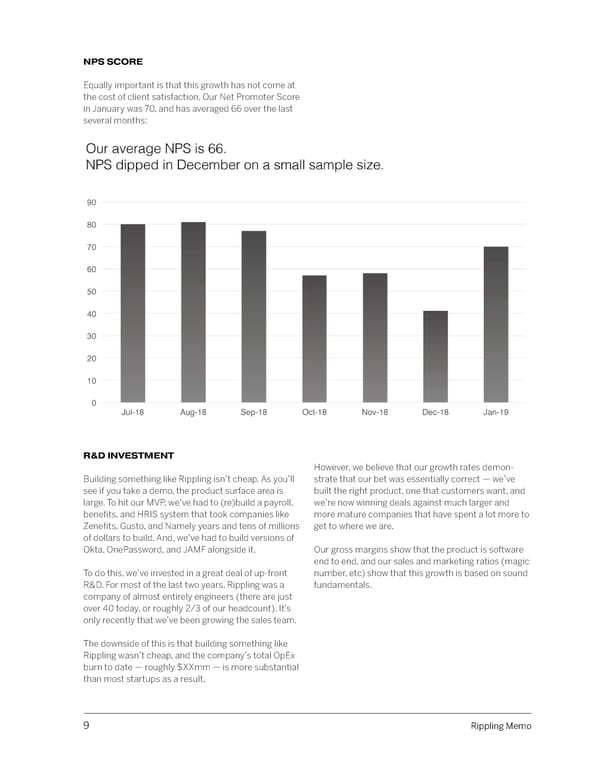

NPS SCORE Equally important is that this growth has not come at the cost of client satisfaction. Our Net Promoter Score in January was 70, and has averaged 66 over the last several months: R&D INVESTMENT However, we believe that our growth rates demon- Building something like Rippling isn’t cheap. As you’ll strate that our bet was essentially correct — we’ve see if you take a demo, the product surface area is built the right product, one that customers want, and large. To hit our MVP, we’ve had to (re)build a payroll, we’re now winning deals against much larger and bene昀椀ts, and HRIS system that took companies like more mature companies that have spent a lot more to Zene昀椀ts, Gusto, and Namely years and tens of millions get to where we are. of dollars to build. And, we’ve had to build versions of Okta, OnePassword, and JAMF alongside it. Our gross margins show that the product is software end to end, and our sales and marketing ratios (magic To do this, we’ve invested in a great deal of up-front number, etc) show that this growth is based on sound R&D. For most of the last two years, Rippling was a fundamentals. company of almost entirely engineers (there are just over 40 today, or roughly 2/3 of our headcount). It’s only recently that we’ve been growing the sales team. The downside of this is that building something like Rippling wasn’t cheap, and the company’s total OpEx burn to date — roughly $XXmm — is more substantial than most startups as a result. 9 Rippling Memo

Why Now? I know this is a popular question for some 昀椀rms so I’m including answers below, but the simple truth is that I think Rippling could have been, and should have been, built seven years ago. But it wasn’t. So, we’re building it now. With that caveat, here are some reasons it’s a bit easier today: THE PAIN IS INCREASING themselves as “All in one HR.” But the pain point that Zene昀椀ts solved (the single Five years ago, the sales organization at Zene昀椀ts onboarding 昀氀ow for all your HR systems) isn’t unique mostly used just one system: Salesforce. Today, most to the HR department. Now that everyone is All-in- SaaS sales organizations are probably closing in on one-HR, the logical next step is to extend this con- 10. Internally at Rippling, we use Salesforce, but also cept across the entire company, pushing outside the Zoom, Calendly, Outreach, Gong, Intercom, and Mar- boundaries of the HR department. keto. Add in the marketing team, and there’s probably another dozen or so. SOME MARKET EVOLUTION MADE As a result, there’s now a systems administration RIPPLING’S PRODUCT EASIER TO BUILD headache in the sales department that didn’t exist previously. Someone in the sales department — the • Okta’s success in the enterprise market has led VP of sales, or sales ops — needs to add new hires to many companies building SAML and user to each of these systems. If someone gets promoted API endpoints we were able to plug in to, to get from SDR to Account Executive, their access needs hundreds of integrations live without the need to be recon昀椀gured across these systems. And if you for slow-moving partnerships. don’t shut o昀昀 access immediately when someone leaves, you risk leaking sensitive customer informa- • It’s easier to build a payroll system than it was tion. 5 years ago because you can use o昀昀-the-shelf In some ways, the deadweight loss from the SaaS tax engines sold by XX and outsource tax-昀椀ling revolution is this increasing systems complexity. and payment to vendors such as XX. It’s also The more new services there are, the more you need easier to build bene昀椀ts administration software something like Rippling to sit underneath them and tie because of vendors like XX and XX. (At Zene昀椀ts, them together. we had to essentially build XX and XX in order to manage insurance — now those pieces can be THIS IS THE LOGICAL NEXT LEAP vendor relationships). IN HR TECHNOLOGY • Very high bar for MVP—you need to build a lot of product for Rippling V1. You need to hire a Zene昀椀ts was the 昀椀rst company to market “All-in-one lot of engineers, and raise a lot of seed money HR.” By combining previously-disconnected systems up-front for the build stage. I would not have for payroll, bene昀椀ts, and HR, Zene昀椀ts gave you a but- been able to 昀椀nance this company the 昀椀rst time ton to hire someone, and they were automagically around. Additionally, given this product-surface- set up in all your di昀昀erent HR systems. Regardless area problem, React and API-昀椀rst development of Zene昀椀ts’ ultimate outcome, we were right about make it easier to build a large-surface-area prod- the market. This market positioning (and to a lesser uct and scale the engineering team horizontally extent the product) was largely copied by others — with less overhead. Gusto, Namely, ADP, and Paychex all now describe 10 Rippling Memo

Network E昀昀ects & the ‘Supermarket for SaaS’ RIPPLING IS NOT AN HR SYSTEM But an employee management system has many more adjacencies than a payroll system — probably Rippling is not an HR system — we call it an Employee 70 or 80 thousand of them. Management System to distinguish it from HRIS This introduces a di昀昀erent dynamic — one where any systems, precisely because we think the problem we market leader has swiftly compounding advantages solve is much broader than HR, and the right system over the other competitors in the space. The company to solve this problem is a level down in the stack from with the most integrations will get the most custom- an HR system, or even the HR department itself. ers, because clients will naturally choose the product We think every company that currently has a pay- that can connect with the most of their current and roll system would be better served by an Employee future business systems, and the company with the Management System, instead — one that integrates most clients will get the most integrations — because broadly to manage employee data across the com- 3rd-party engineers can only build and support apps pany. Over time, if we’re right, perhaps markets will in a limited number of systems and will naturally let shift in this direction. market share guide their decisions on where to build. It’s worth asking: “How will the market for employee The e昀昀ect of this shift is similar to how the introduc- management systems be di昀昀erent than the one for tion of smartphone app stores led to rapid concen- payroll and HR software?” tration of market share in the handset industry. This new market for Employee Management Systems will One key di昀昀erence is network e昀昀ects. be much more concentrated than the one for payroll software: perhaps the market leader has 60% market Today, ADP is the largest payroll company in the share, and the number two player has 30% market United States. But the market is fragmented. ADP share, and everyone else is 昀椀ghting of the remaining only has about 15% - 20% market share, and there 10%. are tens of thousands of payroll service bureaus. As a result, the market leaders for employee manage- That’s because there’s no self-reinforcing advantage ment systems could be successful on a much larger to being the market leader — nothing about ADP’s scale than even the most successful of today’s payroll position as the market leader makes my experience and HRIS companies. as their client any better. That is, in part, because ADP views their world nar- The bull case for Rippling is that we could be one of rowly. In ADP’s world, there are only 7 or 8 systems them. that abutt payroll and HRIS — things like time track- ing, performance management, bene昀椀ts administra- tion, and retirement. 11 Rippling Memo