StartUp Tools: Must Read Blogs

This is the 4th edition of the Venture Capital Blog Directory ( 1st edition, 2nd edition, 3rd edition). This directory includes 149 venture capital, microVC/seed, and growth equity blogs. The imperfect statistic used to rank these blogs is their average monthly uniques in Q410 from Compete (more methodology info below). Blogs that have seen increased traffic over Q409 by 1,000+ uniques/month are highlighted in . There is an additional list below of VC blogs below that had insufficient Compete data. To subscribe to the top 15 VC blogs through Google Reader, click here: Top 15 VC Blogs. As always, if there is any information missing or incorrect, please leave it in the comment field. Many thanks to my colleagues at Volition Capital for their assistance with this directory - we hope it's a useful service for everyone.

The Global VC Blog Directory (Q410 Avg. Monthly Uniques)

- Fred Wilson (@fredwilson), Union Square Ventures, A VC (81,483)

- Brad Feld (@bradfeld), Foundry Group, Feld Thoughts (38,821)

- Charlie O'Donnell (@ceonyc), First Round Capital, This is Going to be Big (13,970)

- Dave McClure (@davemcclure), 500 Startups, Master of 500 Hats (11,127)

- Jeremy Liew (@jeremysliew), Lightspeed Ventures Partners, LSVP (9,344)

- Bijan Sabet (@bijan), Spark Capital, Bijan Sabet (8,256)

- Ryan Spoon (@ryanspoon), Polaris Venture Partners, ryanspoon.com (7,828)

- Rob Go (@robgo), NextView Ventures, robgo.org (6,934)

- Bill Gurley (@bgurley), Benchmark Capital, Above The Crowd (5,428)

- David Hornik (@davidhornik), August Capital, VentureBlog (5,157)

- Seth Levine (@sether), Foundry Group, VC Adventure (4,858)

- Eric Friedman (@ericfriedman), Union Square Ventures, Marketing.fm (4,706)

- Andrew Parker (@andrewparker), Union Square Ventures, The Gong Show (3,854)

- Mark Peter Davis(@markpeterdavis), DFJ Gotham Ventures, Venture Made Transparent (3,602)

- Lee Hower (@leehower), NextView Ventures, AgileVC (3,459)

- Will Price, Hummer Winblad, Will Price (2,348)

- Matt McCall, DFJ Portage Venture Partners, VC Confidential (1,430)

- Multiple Authors, Highway 12 Ventures, Highway 12 Ventures Group (780)

- Baris Karadogan, ComVentures, From Istanbul to Sand Hill Road (615)

- Dan Grossman, Venrock Associates, A Venture Forth (614)

- Mike Speiser, SutterHill Ventures, Laserlike (490)

Other VC Blogs

This list includes other VC blogs that didn't make the primary directory for one of the following reasons: (1) They don't have any Q410 Compete data due to insufficient traffic, (2) There was insufficient data on the blog subdomain, or (3) They are a hybrid blog/corporate website meaning the actual blog traffic is hard to decipher. They are in no particular order.

- Multiple Authors, Union Square Ventures, Union Square Ventures Blog

- Multiple Authors, Foundry Group, Foundry Group

- Multiple Authors, True Ventures, Early Stage Capital

- Multiple Authors (@volitioncapital), Volition Capital, Ask Volition

- Multiple Authors, Brightspark Ventures, Let the Sparks Fly!

- Multiple Authors, Golden Horn Ventures, Golden Horn Ventures

- Multiple Authors, OpenView Venture Partners, OpenView Blog

- Christine Tsai (@500startups), 500 Startups, 500 Startups Blog

- Lisa Suennen, Psilos Group Managers, Venture Valkyrie

- Scott Maxwell, OpenView Venture Partners, Now What?

- Tony Tjan (@anthonytjan), CueBall Capital, Anthony Tjan

- Stewart Alsop (@salsop), Alsop-Louie Partners, Alsop's Small Thoughts

- Matt Winn (@mattwinn), Chrysalis Ventures, Punctuative!

- Marc Averitt (@ocvc), Okapi Venture Capital, OC VC

- James Chen (@cxo), CXO Ventures, PureVC

- David Pakman, Venrock Associates, A Venture Forth

- Rachel Strate (@wasatchgirl), EPIC Ventures, Wasatch Girl

- Max Niederhofer (@maxniederhofer), Atlas Venture, Life In The J Curve, baby

- Jason Ball, Qualcomm Ventures Europe, TechBytes

- Tim Oren, Pacifica Fund, Due Diligence

- Jeff Clavier (@jeff), SoftTech VC, Software Only

- Stu Phillips, Ridgelift Ventures, Soaring on Ridgelift

- Raj Kapoor (@rajil), Mayfield Fund, The VC In Me

- Rob Day (@cleantechvc), @Ventures, Cleantech Investing

- Steve Jurvetson, DFJ, The J-Curve

- Philippe Botteri, Bessemer Venture Partners, Cracking the Code

- Marc Goldberg (@marcgoldberg), Occam Capital, Occam's Razor

- Allen Morgan, Mayfield Fund, Allen's Blog

- Daniel Cohen (@coheda), Gemini Israel Funds, Israel Venture Capital 2.0

- Max Bleyleben (@mbleyleben), Kennet Partners, Technofile Europe

- Jeremy Levine (@jeremyl), Bessemer Venture Partners, Nothing Venture, Nothing Gained

- Michael Eisenberg (@mikeeisenberg), Benchmark Capital, Six Kids and a Full Time Job

- Sagi Rubin (@sagirubin), Virgin Green Fund, The Grass is Greener

- Vineet Buch (@vineetbuch), BlueRun Ventures, Venture Explorer

- Richard Dale (@rdale), Sigma Partners, Venture Cyclist

- Steve Brotman (@stevebrotman), Silicon Alley Venture Partners, VC Ball

- Ho Name, Altos Ventures, Altos Ventures Musings

- George Zachary (@georgezachary), Charles River Ventures, Sense and Cents

- Jacob Ner-David, Jerusalem Capital, VC In Jerusalem

- Ed Mlavsky, Gemini Israel Funds, GOLB: Is This Israel?

- Michael Greeley, Flybridge Capital Partners, On The Flying Bridge

- Sid Mohasseb (@sidmohasseb), Tech Coast Angels, Sid Mohasseb

- Peter Lee, Baroda Ventures, Seeing Eye To Eye

- Ted Driscoll (@easydjr), Claremont Creek Ventures, Evolving VC

- Justin Label, Bessemer Venture Partners, Venture Again

- Adam Fisher, Bessemer Venture Partners, Savants in the Levant

- Gregoire Aladjidi, Techfund Europe, Investing In What's Next

- Todd Dagres (@todddowl), Spark Capital, Todd Dagres Tumblelog

- Santo Politi (@santopoliti), Spark Capital, This and That

- Robert Goldberg, Ridgelift Ventures, Tahoe VC

- John Abraham, Arrowpoint Ventures, JMA's Views On Everything

- Brad Burnham, Union Square Ventures, Unfinished Work

- Brian Hirsch, Greenhill SAVP, New York VC

- Charles Curran, Valhalla Partners, VC Blog

- Jon Seeber, Updata Partners, Jon's Ventures

- Adi Pundak-Mintz, Gemini Israel Funds, Adisababa's Weblog

- Don Rainey, Grotech Ventures, VC in DC

- Art Marks, Valhalla Partners, Entrepreneurial Quest

- Rob Schultz, IllinoisVENTURES, Go Big or Go Home

- Cem Sertoglu, Golden Horn Ventures, SortiPreneur

- Larry Marcus, Walden Venture Capital, Walden Venture Capital

- Steve Jurvetson, DFJ, Uploads from Jurvetson

- Gil Debner, Genesis Partners, TechTLV

- Multiple Authors, Tech Capital Partners, Tech Capital Partners Blog

- Simon Olson, FIR Capital Partners, Venture Capital Thoughts and Reflections

- Josh Sookman, RBC Ventures, Startup Life

- Vishy Venugopalan, Longworth Venture Partners, Longworth Venture Partners Blog

- Ed French, Enterprise Ventures, TechGain.net

- David Stern, Clearstone Venture Partners, The Raging Insterno

- Jonathan Tower, Citron Capital, Adventure Capitalist

- Dan Parkman, Venrock, Disruption

- Charlie Kemper, Steelpoint Capital Partners, Opine Online

- Boris Wertz, w media ventures, w media ventures

- Charlie Federman, Crossbar Capital, CosmicVC

(Methodology: We aggregated the unique visitors for each blog on Compete.com for Oct-Dec 2010, and then divided by three to get a monthly unique traffic score. If blogs only had data for one or two of the months, it was presumed that the missing months had no traffic and the aggregate number was still divided by three.)

I noticed a few weeks ago that Marc Andreessen had deleted virtually everything off his blog. The only thing that's left is the post announcing the formation of his VC firm, Andreessen Horowitz.

I've been such a huge fan of Marc's writing, and hated to see so many brilliant and incredibly helpful posts lost. So I went to the Internet Wayback Machine and copy/pasted all the posts they had (through March 2008). I had also subscribed to Marc's blog via Feedburner e-mail, so grabbed all of the e-mails I had saved to fill in the gaps.

To be clear, I have no ulterior motives other than making sure that Marc's posts can be found and useful to entrepreneurs everywhere. (And if Marc wants me to take it down, I would reluctantly do so... hopefully he won't!)

blog.pmarca.com was like a meteor from June 2007 through the spring of 2008. Here are a bunch of my favorite posts:

- The Pmarca Guide to Startups, part 1: Why not to do a startup

- The Pmarca Guide to Startups, part 2: When the VCs say "no"

- The Pmarca Guide to Startups, part 3: "But I don't know any VCs!"

- The Pmarca Guide to Startups, part 4: The only thing that matters

- The Pmarca Guide to Startups, part 5: The Moby Dick theory of big companies

- The Pmarca Guide to Startups, part 6: How much funding is too little? Too much?

- The Pmarca Guide to Startups, part 7: Why a startup's initial business plan doesn't matter that much

- The Pmarca Guide to Startups, part 8: Hiring, managing, promoting, and firing executives

- The Pmarca Guide to Startups, part 9: How to hire a professional CEO

- The truth about venture capitalists, Part 1

- The truth about venture capitalists, Part 2

- The truth about venture capitalists, Part 3

- The Pmarca Guide to Career Planning, part 0: Introduction

- The Pmarca Guide to Career Planning, part 1: Opportunity

- The Pmarca Guide to Career Planning, part 2: Skills and education

- The Pmarca Guide to Career Planning, part 3: Where to go and why

- The Pmarca Guide to Big Companies, part 1: Turnaround!

- The Pmarca Guide to Big Companies, part 2: Retaining great people

- Luck and the entrepreneur, part 1: The four kinds of luck

- Counterpoint: Ben Horowitz on micromanagement

- CEO Crime & Punishment

- The three kinds of platforms you meet on the Internet

- Age and the entrepreneur, part 1: Some data

- The Pmarca Guide to Personal Productivity

- How to hire the best people you've ever worked with

Some quick cautions and warnings!

- The link addresses aren't changed, which mean they're prefaced by the Internet Wayback Machine archive link. If you look at the link you'll figure out which part to delete to go to the right address.

- Some videos have been taken down, or I couldn't find the embed code.

- I tried to include every post he made and not filter anything. However, I may have missed a few. Please let me know (via comment below) if you have any that aren't in the archive.

I hope this is useful to some of you out there. And Marc, if you read this, I'm a big fan and only mean for this to help the millions of entrepreneurs you've inspired.

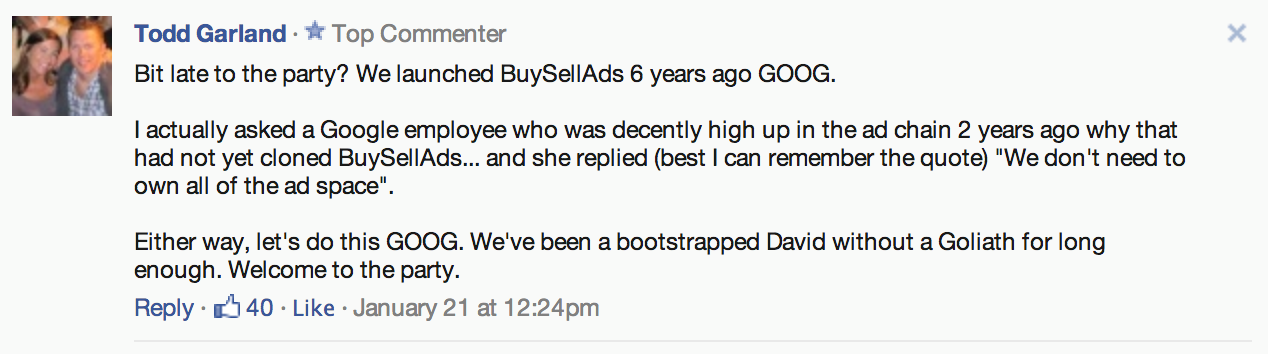

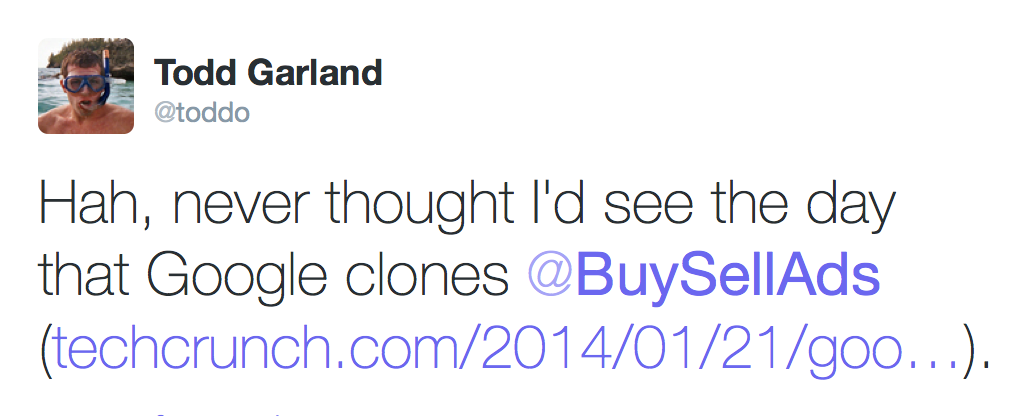

A few week's ago, Google launched a service that directly competes with what our business has been doing (very successfully) for 6 years now, a service that helps publishers sell ads directly to advertisers. While I have thought about the "what if's" and the scenarios surrounding a goliath competitor taking us on before, I never thought this day would actually come.

The first hour

I was numb - not in a bad way, but just numb; uncertain what to think, what to do, while attempting to make sense of, and digest, what had just happened. I scrambled a defensive comment together to post on TechCrunch who covered Google's product release.

Then, I composed an equally haphazard tweet:

... to which our supporters rallied around (ever so slightly) with support in the form of likes and re-tweets. "Ha", I thought to myself, "don't mess with us Google", and the kind of bravado Google ad execs celebrating the release likely got a kick out of (if they even noticed...).

My team and I continued to talk about this, attempting to understand what it meant for our business. As a startup CEO, it's times like this when the pressure is on. You have to sharpen your thoughts quickly and be able to articulate to your team how this might affect everything.

I'm uber-competitive, like most people trying to build big businesses, but sometimes being "uber-competitive" also means you venture into the "uber-defensive" state of mind. Lucky for me, I have a co-founder who helps me keep a cool head. All this to say: during the first hour you really just need to keep your cool and give yourself time, and some space, to let your thoughts process.

Knee-jerk reactions like those I made don't actually do much for you, or the business. It's best to just stay quite and give yourself time.

As the first hour came to a close it started to become evident that the BuySellAds world as we knew it wasn't actually going to implode upon us. The following are my key takeaways from the 900-pound gorilla entering the ring with us:

Be pragmatic

The truth is that if Google actually wants to compete with your business, there is a decent chance you will lose. Google wins everything. Sure, there are outliers... Facebook, Twitter, et al who became so large that it was too late by the time Google entered the ring. The point is that most businesses the size of mine will get crushed if Google truly wants to compete... especially in the ad space. While the direct ad sales space is interesting, Google crushing my business will have an infinitesimally small impact on their balance sheet.

For the last 6 years, they've had bigger fish to fry (until now)I discovered that they had actually started working on this product about 4 years ago (two years after BuySellAds first launched). Which means one of two things:

1. It could be that the direct ad sales landscape is just starting to mature enough to the point where they think it's worth making a play.

2. Perhaps they are just closing off one of their flanks as this space starts to gain traction.

Competition from Google is a blessing in disguise

There are many reasons for this:

1. There's no better way to get the most out of life, than knowing that one-day you will die. The very threat of a larger competitor will help us sharpen our product and our pitch to customers.

2. We have learned quite a bit that they have yet to learn about the direct ad sales space. Believe it or not, we have a hand up in experience in this specific space.

3. We've had a series of competitors over the last 6 years who haven't seemed to achieve blazing success (despite raising large sums of money), which always worried me. Sure, it's fun to think that you're doing such a great job that you are beating them, but the truth is that they aren't blazing a trail by us because the market just isn't there. Trust me, our balance sheet, while showing signs of "success", doesn't have a hockey stick (yet). Any competitive market that is worth being in usually has at least a few solid competitors duking it out.

4. Smart people work at Google, and smart people typically like to work on things that are interesting with the hopes of achieving some level of success. Sure, not every product Google launches turns to gold; however, somebody smart at Google got the concept for this product past the $100 Million Dollar Man, who gave it his blessing to be worked on. That's a positive signal for our space in general.

5. A teeny-tiny wee bit of added validation. Similar to my previous point, anything a company the size of Google does is noticed. They have far greater reach than BuySellAds, and there's a good chance that they will end up sending us a decent amount of business simply because we have one of the best competitive solutions in the space.

Nothing actually changes

This is the most important takeaway. Sitting here a few weeks since Google's launch, I can tell you with absolute certainty that nothing has actually changed. Looking back at the 6 years we've spent building BuySellAds, it's clear that any time we spent thinking, researching, or reacting to our would-be competitors was a complete waste of time. In fact, there's no better way to waste time than to think about (or even follow) what your competitors are doing. The only thing that truly matters are YOUR customers. I can't tell you how hard it has been to get this engrained into my mind.It is by far the most important thing in building a business (to focus on your customers), yet so hard to practice when you see other activity and the glorious tech-headline touting presumed (or actual) success. They call it "customer driven development" not "competitor driven development" for a reason.

I must say, 6 years feels like a very long time looking back. We've written a ton of code, been through hell and back, and are still here. We're bootstrapped, have been profitable, grown quarter over quarter, made the Inc500 (the only popularity contest that involves your balance sheet...), and while it certainly would be fun to coast off into the sunset, I feel like we're just getting started. There is no better way to reinforce this feeling than welcoming the 900-pound gorilla into the ring. Everybody loves an underdog, and for us, it's time to get to work.

Article has 8 comments. Click To Read/Write Comments

In early meetings, if a VC ever asks you what your exit strategy is, you should run, not walk to your nearest...um...exit.

You want your investors to be more curious about how you're going to enter a market than how they're going to exit their investment.

Thankfully, I hear much less talk about exit "strategies" in the startup world than I used to. Back in the day, no business plan was complete without a discussion of exit strategies. And, they almost invariably came down to the same two options: Here are the list of companies that might buy us...and we could go public! ![]()

Today, most tech entrepreneurs don't even write business plans (which is good, because nobody reads them), let alone have a detailed discussion on potential exit strategies.

Here's why I think an exit strategy is an oxymoron.

The purpose of a business is to build something of value for customers - which in turn creates value for stakeholders. When you're walking out onto the field, you should be asking yourself "how do I best play this game?" not "Hey, once the game is over, how do I exit the arena?"

Planning your exit is a good thing when entering airplanes, theaters and bar brawls (of which I have no clue, I've just been watching too much Banshee) - not when entering a market.

My advice: Spend your calories crafting strategies for how you will build value, how you will connect to potential customers - and how you will differentiate yourself from everyone else. Leave the exit planning for when you actually need to figure out an exit.

By the way, I have no problems with startups exiting. Happens all the time, and is part of the circle of life in the startup world. I've been on both sides of the table (sold a startup, acquired some startups). My problem is when entrepreneurs are forced to unnaturally focus on the exit -- and mistakenly calling such things a "strategy".

Article has 25 comments. Click To Read/Write Comments

There are many articles and blogs claiming to have THE list of things to do to find the perfect technical cofounder - as if it's that easy to find a cofounder in general. From my purview at FounderDating, however, one of the most important and least-discussed (in the press, at least) questions is from technical entrepreneurs. For the last year the longest- running trending topic on FD:Discuss (the Q/A section of the site) is: how do technical cofounders evaluate non-technical cofounders?

When you're technical and interviewing or planning to work with other people who are technical, you're used to giving them objective "tests" that help you determine their abilities, white board problems, coding projects, pair-programming sessions. Even if you're not technical and you have someone do a coding project, you can easily show it to technical friends and advisors and quickly get their expert opinions. Of course, this isn't enough to decide whether you should work with someone -- especially as a cofounder -- but it's at least cutting to the core of the skills question. (You also need to address the chemistry/personality question.)

Unfortunately, there isn't a white board test equivalent for business folks that really mimics these (if anyone has one please share). You can get a rough idea of how they think, but there isn't a concrete "result" to help you figure out if they are any good e.g. can they acquire customers, can they recruit someone, etc.

The Most Common MistakesYou don't know what you don't know. And that leads many potential technical cofounders to fall back on criteria that seem important but are typically false positives. A few of the most popular characteristics people tell us they look for that aren't good indicators on their own:

1. Expert in the field you're interested in - I guess this is nice if there is no chance that the idea will change industries (read: almost never). But some of the most successful companies were started by people that had no experience in their industry, and that's precisely why they were able to change it. Kevin Hartz didn't have a background in ticketing nor did Max Levchin in payments. Often times having spent a career in an industry means you can't re-think it.

2. Top schools or top companies on their resume - It's nice to tout, but if you joined Facebook as the 4000th employee this just doesn't tell you much - good or bad.

3. Built a prototype - This is helpful but only in that it shows they can DO and not just talk. But it's unlikely you'll want to inherit that code or that the idea will remain the same.

What To Look For and HowAs a non-technical cofounder your job ranges from product to hiring to taking out the trash. There isn't one test or one white board problem to give, but here are the characteristics you should be looking for:

1. High FSO (Figure.Sh*t.Out) quotient - When you start a company or a side project there are few guarantees. Pretty much the only one I can make is that there will be a large body of work that comes your way that neither you nor your cofounder(s) have ever faced before. This heap of work will far outnumber the portion you have actually encountered. Can your cofounder figure sh*t out? And can they do it quickly? Being amazing at one thing is nice, but honestly not what you should optimize for in a cofounder. Founders are typically just "good enough" at a slew of things: fundraising, product, partnerships, etc. You can hire for the very specific positions later, right now you need an all around athlete -calls plays and executes at different positions

2. His GSD (Get.Sh*t.Done) quotient - The sheer volume of work that needs to get done when you start a company is, well, never ending. It's great to be able to talk to crowds and VCs but given a list of 20 things that you need to do, can they prioritize and knock them off at an impressive rate (especially the ones they haven't done before - see #1)? You should feel totally confident that when they say they are going to do something it will get done -- and done exceptionally well.

3. High Determination Quotient - OK, so I lied: There are two guarantees I can make about starting a company - the second is that you will get rejected (over and over again). Can this person handle that kind of negative feedback? How long does it take them to get back up? This is the reason having previously been a cofounder or joined a startup as an early employee is important. It shows that they've been to battle, have scars and are opting back in. It's less the industry and more the psychological experience that matters. Paul Graham has a famous essay on Determination. Cliff notes version: "We learned quickly that the most important predictor of success is determination." This means you need to work on something together long enough to hit a road block (or four) and see how they react.

4. High Communication Quotient - There are actually two parts to this requirement.

i) Can they speak your language? You can't expect them to know as much about engineering as you do. But do they make an effort to understand? Have they worked with engineers before and comprehend the questions to ask? If you don't know the answer, ask to talk some of these previous co-workers. A non-technical cofounder learning to code is an encouraging sign - not necessarily because they'll be contributing meaningfully on the engineering side, but more as a helpful signal that this person is curious and wants to understand your language.

ii) Can they communicate with others effectively? This means investors, potential employees, customers. If you have a SaaS product, can they sell the first customer? If you have a consumer-focused product, can they go get an alpha group to test and then gather their feedback and work off of it? Can they present to a crowd and get them excited? That could mean a startup weekend crowd or a group of students; you don't have to wait until you're pitching investors to figure this out.

You may have noticed that you can't figure out #s 1-4 in just a few meetings. The best way to figure all of this out is -- to work together first. Start a side-project. These quotients are exponentially easier to calculate when you're working on something real together. It doesn't matter if it's the idea you actually end up working on, you'll see far more revealed doing this than you will over 10 coffees or hypothetical white board sessions. Yes, that also means you can't find the right partner in just a few weeks. So be constantly putting yourself out there.

These aren't the only things to look for -- there are big questions around motivation and alignment and of course personality fit -- but these are much more telling characteristics than a resume-based checklist.

This was a guest post by Jessica Alter. Jessica is the co-founder & CEO of FounderDating, the premiere online network for entrepreneurs to connect, share, and find co-founders. Previously, she led Business Development and was GM of Platforms at Bebo (before it was acquired by AOL). She is also a mentor at 500 Startups and Extreme Startups.

Article has 18 comments. Click To Read/Write Comments

There is an unspoken rule: to launch a startup, you need to build a product, and to do that you need someone that can write code.

Whether that means chasing down a technical co-founder, learning to code, or even building that "Lean MVP" - the conventional wisdom is that without tech abilities you're nothing more than a dude (or dudette) with a Powerpoint.

A growing number of startups, however, are quietly disproving this assumption.

They're getting their first customers with minimal technology, and often no code at all. Instead of building fancy technology from the outset, they're hacking together inexpensive online tools such as online forms, drag-and-drop site builders, advanced Wordpress plugins, and eCommerce providers.

They're jumping right in to serve customers in any way possible - heading right for their first paying customers.

Most importantly, unlike the majority of their peers, by the time they start building a product, they already have a humming business.

How are they doing it?

Focus on Serving Customers Instead of Building a ProductSuccessful founders all know one thing: it's more important to serve a customer than it is to build a product.

This is the mindset you must get into when you start out. Most entrepreneurs are narrowly set on building a product that they lose sight of the real goal - to solve a problem for a customer.

Or, as Ben Yoskovitz eloquently put it,

"Customers don't care how you get things done - just that you get it done and solve their pain."

Replace Technology with PeopleThink about the hardest part of the business you want to build. The part that would require the most complex development - the true innovation that no one else does.

Can a real person perform these tasks manually?

For many startups, this was the secret to massive success:

David Quail is a super talented software engineer, with one exit already under his belt. He wanted to solve his ultimate annoyance: scheduling meetings over email.

David's original idea was to build an artificial intelligence tool that could read an email chain and automatically schedule the event. But this would take months if not years.

His shortcut to launching a business ASAP? He simply set up an email address for his customers to "CC" that forwarded to him, and did the work manually at first to prove that customers were willing to pay.

Over time he automated more of the service - but not before he already knew there was clear demand and was making revenues.

Another example - a marketplace:

Tastemaker is a marketplace connecting interior designers with homeowners for small design gigs. They started by contacting interior designers and building a physical list of those interested in extra work.

They then asked their network who needed help with interior design - and made the connection, processing payment themselves.

The Tastemaker founders used pen and paper to solve their customer's needs and prove the market. They then built their online platform in parallel (which eventually became their core business).

You've probably heard many famous stories like ZenLike and Tastemaker. They range all the way from companies like Groupon or Yipit (raised $7.3M), to Aardvark (acquired by Google) and Diapers.com (acquired by Amazon).

What did they have in common starting out? At the core of many businesses, instead of fancy algorithms, you would have found the founders themselves, like the "man behind the curtain" in the Wizard of Oz, working hard, acting as the secret sauce.

Use These Off the Shelf SolutionsWhile your core tech might in fact be a service starting out, you can wrap it with an online presence, digital interactions, and the administration of a true technology business.

In short, you can act, look, and smell like a fully automated online company that employs a posse of software developers and an in-house graphic designer.

* Use e-commerce services to accept payments and even subscriptions using "hosted payment pages" - requiring zero code.

* Let your customers interact with you through sophisticated online forms you can publish (and brand) using drag-and-drop editors.

* Build a support knowledge base and community forum with Zendesk, Uservoice, or GetSatisfaction

* Use copy-paste widgets from around the web like contact forms, Skype buttons, live chat, etc.

* Use simple-yet-sophisticated website creators to publish your central website and glue together all the tools into one presence. Strikingly and Unbounce are great for beautifully designed landing pages.

I could go on listing these forever (well, I did here). As you can see, the web is full of tools that let you conjure entire features with the click of a mouse.

The key is to always search for what you want before reinventing the wheel. Chances are someone has already thought of how to make your life easier.

The Hidden Treasures of WordpressTo most of us, the Wordpress brand connotes a free blog, or a simple way to create a content website for non-technical folks.

But the true magic of Wordpress is the ability to extend its functionality to create many kinds of web platforms - while keeping your hands (mostly) free of code.

Wordpress itself is free, and you can purchase inexpensive plugins that automatically transform your website into a membership site, ecommerce portal, social network, and even daily deals site.

Instead of spending thousands on a designer, you can buy a high-end theme for around $40 and customize it to your brand. If you have a bit more saved up, you can hire a local Wordpress expert for a few hours of their time for small custom tweaks and a personal tutorial. And, if you don't want hosting headaches, you can use WPEngine (hi, Jason!).

Wordpress is one of the most incredible tools on the web for non-technical entrepreneurs. There's a bit of a learning curve, depending on how you want to use it, but definitely a faster option than finding a developer or learning to code.

It puts fate into your own hands.

Put It All TogetherGo back to that core customer need, and think of how to satisfy it by any means. Now how can you make that solution accessible? What would the process be for finding you and reaching out? How can you charge and provide support?

Chances are good that you can pull it all off yourself. If not, consider starting a bit smaller than you originally imagined, if only to start generating revenues today and fund your development.

Once you have your first few customers, you'll have a very good picture of where your business is going, and what technology you absolutely need to build - and very clear motivation.

Does working this way pay off?

Tech companies started this way have sold for between $50-$540 million, or have gone public. They are growing at double digit rates. And they launched in a matter of weeks or months - not years.

If this approach makes you uncomfortable - that's great. It's a sign that you're learning to think differently. However, entrepreneurs presented with this approach often have similar gut feelings:

What Will Investors Think?They will think you are clever, resourceful, flexible, persistent - and know how to focus on the right things.

To quote one of our investors, Len Brody, on his portfolio: "I call them the workaround culture... [they] just work around anything - and you have to."

If for any reason they are put off by your creativity and resourcefulness, then you're not talking to the right investors.

What About Scaling?This is a very understandable fear. It's a scary situation to think, "Great, we got our customers, and now we're going to disappoint them."

Don't let that thought paralyze you. Growth is rarely if ever a black and white, rocket-ship-spike. It's a steady process that leaves you plenty of time to transition between solutions.

In other words, there's a spectrum between do-it-yourself and full-robot-revolution. You might hire a few people in the meantime (with the revenue that their hire would naturally generate) while also developing a scalable technology.

As most entrepreneurs will tell you the way you get your first 50 customers certainly won't be the way you get your first 5,000.

For those of you feeling held back by your lack of technical skills - or deep in development muck - ask yourself, what can you do *today* to get your first customer.

Give it a shot. In contrast to paying a developer, you don't have a lot to lose. Do whatever you need to do to get your business going.

Remember: you're not here to build a product - you're here to solve a problem. And you certainly have the skills to do that.

***

Want more specifics, examples, and tools? Check out my newest Skillshare course, How to Launch Your Startup Without Any Code (use code ONSTRTPS for %15 off)

This is a guest post by Tal Raviv. He is the co-founder of Ecquire.

Article has 49 comments. Click To Read/Write Comments

tl;dr: If you work in the business of software the one must-attend event is the Business of Software (Boston, Oct 28 th - 30th 2013)

Note from Dharmesh: This is a guest post from Patrick Foley. I normally don't post articles that promote an event - but Business of Software is not a normal event. It's the ONLY conference that I've spoken at 5 years in a row (an am speaking again this year). It's the only conference for which I stay at a hotel in Boston (5 miles from where I live) just so I can hang out with the people attending the conference as much as possible. It's that good. You should attend. (Note: I am not affiliated with the organizers, my selfish reason for convincing you to go is so I can meet more awesome people).

ABSTRACT: If you're not satisfied with some aspect of your career, go to a great conference like Business of Software. The best conferences can dramatically alter your perspective and ultimately change you.

Four years ago, I attended my first Business of Software conference. Back then, I was a technical evangelist for Microsoft, and since my customers were other software companies, I thought I knew all I needed to know about this "business of software."

Obviously, I was wrong. For three days I listened to amazing speakers like Jason Cohen (founder, WPEngine) explain how the different personal goals of founders have an enormous impact on their business actions - meaning you should pay more attention to advice from founders with similar personal goals. I was inspired to hear Peldi Guillizoni (founder, Balsamiq) explain how he built his business - and how his journey actually started while working for a big company (hey, just like me!). I was shocked to hear Joel Spolsky's very intimate description of how funding really works. I learned measurement concepts from Dharmesh Shah (founder, HubSpot) that I didn't even know were knowable. I was genuinely moved by the stories from these founders and all the other brilliant speakers. And that was just the first year for me (more great speaker videos from 2010, 2011 and 2012).

At a great conference, the attendees are as important as the speakers. Many of the people I've met at Business of Software have become my friends and advisors. One became my cofounder in my first effort at a building a software company (a story for another day). There's a bond that develops among Business of Software attendees that's hard to describe. Part of it is that the speakers are highly engaged attendees themselves - something you don't see often - this is their community, their tribe, and the speakers clearly look forward to being a part of the event from both sides of the stage.

There was something about attending that conference in person that shook me to my core and sparked a passion for learning how software companies really work and what makes them successful (spoiler alert: it's freaking hard). Yes, I already worked for one, but Microsoft is HUGE - I was a deckhand on a battleship. Although I was working with other software companies, I was ultimately selling to them ... you don't learn how things really work in that situation. I even had a podcast that allowed me to speak with some brilliant founders ... but it took being in a room with all these people at once to change me. BoS changed me. (I wrote about that special year and even have a manic podcast episode describing it.)

Great conferences like Business of Software aren't cheap, but they're a great investment. Microsoft paid my way to a couple of conferences a year - that's a HUGE perk of working for an established company! If you work for a company that has multiple layers of management, then they probably have a conference budget already. Use it! I attended Business of Software on Microsoft's dime in 2010 and 2011. Last year, I took vacation time and paid my own way, because I was preparing to leave my job.

This year took me in another direction. When it became clear that my product company wasn't going to work, it was still time to leave Microsoft, so I reluctantly returned to consulting. I was a consultant for 14 years before joining Microsoft, and I'm pretty good at it - but I still felt defeated. Sometimes you just gotta lick your wounds, recover, and figure out a new path. I figured I'd build up my financial resources for a few years as a consultant and then try again to build a software company.

But then a crazy thing happened ... a few weeks ago, a couple of friends that I met at Business of Software contacted me about a job. They have a small, very successful software company, and they think I could help with their next stage of growth. WOW! I didn't see that coming. I'll have my hands in all parts of the business, improving anything I can and learning everything I can. It's not a startup (they've already found product/market fit), but it's actually a better fit for me at this point in my life, because it provides greater financial stability, and it will allow me to experience how a successful company operates. A while back, I asked Jason Cohen for life/career advice, and this was exactly the sort of situation he said I should be looking for. It's PERFECT.

I'm sure you can guess the call-to-action of this post by now ... sign up for Business of Software and GO. It just might change your life. The best work I did for Microsoft stemmed from Business of Software. Then it inspired me to leave Microsoft and pursue work that I like even better. And now my dream job FOUND ME because I went to Business of Software.

My new company and I haven't actually finalized my role or my start date yet ... we're going to formalize things in 2 weeks at Business of Software ... I hope to see you there! It's going to sell out, so you need to jump online and order your ticket now. My understanding is that it's going to be several hundred dollars more expensive next week (if you can get in at all). If you're on the fence about going, feel free to contact me ( [email protected]) to talk about it.

Article has 6 comments. Click To Read/Write Comments

Every company has ideas that come up (sometimes frequently). And, based on the stage of the startup and the degree to which the idea is unconventional, there are always good, rational reasons why the given idea can't possibly work. There are also bad, irrational reasons too. The problem is, it's hard to tell the difference.

Here are some of common reasons why something won't work:

1) We've debated this several times before and have decided it wouldn't work.

2) We've tried this before, it didn't work.

3) Doesn't really fit our sales model.

4) It's not appropriate for our industry.

5) It might work for tiny/small/large/huge companies, but we sell to tiny/small/large/huge companies, and it won't work for them.

6) Our investors/board would never agree to it.

7) It might work, but we can't afford the risk that it won't. (Note: When someone says "it might work...but..." they're almost always thinking: It won't work)

8) Our team/plan/pitch-deck is not really setup for that.

9) We could try it, but it's a distraction. (Note: This often means "I've already decided it's not going to work, but I can tell I need to convince you we shouldn't try it...")

There are many, many more reasons why any given idea won't work, but the above are a sufficient sample for this article. Oh, and by the way, I have at various points in time made all of these very same arguments myself ("I have met the enemy" and all that)

2 Mental Exercises To TryNow, here are a couple of mental exercises to try when you or you or your team is stuck.

Exercise #1: What if I told you that it's working really, really well for XYZ Company? How do you think they made it work?The idea here is to assume the idea is good and has worked for a company very similar to yours. Then, ask yourself (or your team): Now that we know it worked for them, what do we think they did to make it work?

What this does is mentally nudge you to think about how to work through whatever the obvious limitations to the idea already are.

Example: I know that nobody in our industry uses a freemium model because the infrastructure/support costs are just too high. But, we just learned that XYZ Company is launching a free version. What do we think they did to make it work?

Exercise #2: What if we had the proverbial gun held to our heads and we had to do [x]?The idea here is to assume/accept that the decision to implement the idea has already been made - presumably by some higher authority. Now, assuming that, what would you do to make the best of it?

Example: Our major investors just told us that before they can agree to funding our next round, we need to build an inside sales team. They think inside sales teams are the bomb. We can't afford not to listen to them - what do we do to make the best of the situation? If we had to build an inside sales team, how would we go about doing it?

Note: In neither case am I suggesting that you mislead your team (or yourself, in case you're like me and have conversations with yourself late at night). These are meant to be mental exercises, just to help drive discussion and analysis. Though I'll confess, there is a small part of me that wonders what would happen if one did make the hypothetical seem real (at least for a short period of time).

What do you think? Any mental tricks or tactics you've used (or thought of using) to help break-through conventional thinking?

Article has 22 comments. Click To Read/Write Comments

After conducting nearly 100 interviews with some of the world's best growth hackers on Growth Hacker TV , I have become keenly aware of a certain tension that is in the growth hacking ecosystem. Some growth hackers choose to emphasize the process of growth hacking while others choose to see growth hacking as a set of tactics that can be applied to various scenarios.

First, let me define the growth hacker's process. There is no one single agreed upon order of operations, but a growth hacker's process is based loosely on the scientific method. If you can remember high school, the scientific method is basically the following:

-

Question - Why do visitors leave our registration flow after the first page?

-

Hypothesis - They might be leaving because page two has too many form fields present and this scares them away.

-

Prediction - If we have more registration pages, but less form fields on each page, then our completed registrations will increase in statistically significant ways that could not be the product of chance.

-

Testing - For the first 2 weeks of September we will run an A/B test, showing 50% of new visitors our current registration flow, and showing the other 50% our new registration flow which increases the number pages but decreases the fields per page.

-

Analysis - The results show that our new registration flow had 27% more completions than our current registration flow, and this is statistically significant enough to conclude that we should implement our new registration flow.

Here is where things get interesting. Some startups will actually use this scientific method (or something similar) as a means of gaining insights about their product, thereby enabling them to make progress. Others, however, will not have a rigorous process like that listed above, but they will instead use the results of other people's experiments. Put another way, some startups have a process, other startups just implement the tactics (best practices) that are the results of someone else's process. If someone read about the above experiment on Quora then they might adapt their registration flow without a scientific process in place to support such a move.

The question is, which kind of startup should be applauded and which should be reprimanded? It might seem obvious to celebrate the rigors of the scientific method and side with any startup that uses such a process. However, I think there is a case to be made for both kinds of companies. Obviously, if someone doesn't run the experiments then we will never arrive at the tactics in the first place. The tactics are the byproduct of someone's hard work and that should be appreciated, but think about how the scientific community actually operates. The scientific method is a tool that serves the entire scientific community, and the results of that tool are often fair game for the community. Scientists don't expect each other to run every relevant experiment for their personal endeavors. Newton said, "If I have seen further it is by standing on the shoulders of giants." Why can't a startup simply use the results, as discovered by their fellow entrepreneurs in lab coats, as a benefit of the community?

The truth is, there are pros to both ways of thinking, which I'll list below, but I don't want us to view growth hacking as only a process or only a set of tactics and simultaneously miss the community aspect of our enterprise. Here is how I see things:

So, what is the answer to the dilemma? Is growth hacking a process or a set of tactics? Well, both, and here is what that means practically. If you are in an organization that has a growth hacking process in place then see yourself as a part of a larger community. We are grateful for your work, but you don't need to be pompous about your place in the universe. Share what you find, grow our collective knowledge base, and understand that not every company will imitate you, and that's ok. If you are in a non-process oriented startup that is still trying to use growth hacking principles then be extremely appreciative of the companies that are supplying these best practices, and consider creating your own process so that you can give back to the community as much as you take from it.

Startups aren't going anywhere, and growth hacking is here to stay as a robust methodology for growing them. Whether you are in the lab, or reading the research paper that was spawned from someone else's lab, understand that this is a community, not a zero sum game.

This article was a guest post by Bronson Taylor who is the host and co-founder of Growth Hacker TV , where the experts on startup growth reveal their secrets.

Article has 23 comments. Click To Read/Write Comments

Kathy Sierra was once among the world's most popular tech bloggers. On her smart, funny, and vivid blog Creating Passionate Users, she tackled neuroscience, presentations, and how to build software that makes users kick ass. She helped develop the reader-centric Head First series of books for O'Reilly Publishing, and traveled the world giving speeches at tech events.

Kathy Sierra was once among the world's most popular tech bloggers. On her smart, funny, and vivid blog Creating Passionate Users, she tackled neuroscience, presentations, and how to build software that makes users kick ass. She helped develop the reader-centric Head First series of books for O'Reilly Publishing, and traveled the world giving speeches at tech events.

But in 2007, just as I took my first tentative steps into the world of social media, that all came to a screeching halt. Sierra became the target of a campaign of online harassment so severe that both Sierra and blogger Chris Locke ended up on CNN discussing the case.

Since then, she's lingered in almost total obscurity online. She threw her considerable passion and drive into learning to ride Icelandic horses as an experiment in better understanding how people learn and what it takes to achieve mastery.

But she stayed off the internet. For a while she was on Twitter -- then she left even that behind.

Over the course of my startup and social media adventures for the last few years, I took heart knowing she was still out there. She would pop up anonymously to comment on blog posts I had linked to via Twitter. I would email to see how things were going.

I went to see her in California in January 2012. We rode her horses and talked about the impact of gamification on learning and productivity. It was invigorating to see her mind in full swing, albeit privately.

But she didn't blog again; not for more than 6 years.

But Now, Kathy's Back!

As of this week, one of my all time favorite bloggers has returned to the world of blogging and the internet at a new site she playfully calls Serious Pony, in a salute to some of her favorites: The Oatmeal, Commander Taco, and Lonely Sandwich.

"I missed blogging," she says. "For the past couple of years I kept telling myself that I was going to start up again."

On her new blog, Sierra will write about a few topics that have become important to her during her hiatus. One is exploring new research on how to develop skills and knowledge, which Sierra calls "how to be bad-ass."

Another topic is what Sierra calls "the API of you," which is about the ways companies use gamification and other techniques to manipulate consumers, and how to spot those techniques and resist them.

"There are a huge pile of books that have been published in just the past few years about how to manipulate, seduce, and make things addictive -- how to work on people's brains," she says. "But the number of books designed to help you fight back, as a human, as a consumer? It's like one book," she says.

Her first post -- " Your app makes me fat" -- playfully digs into the topic of products that drain cognitive resources.

We're looking forward to hearing much more. We're especially excited about her return to blogging because Sierra, who inspired our founders so much we have a conference room named after her in our newest expansion, has agreed to speak at HubSpot's INBOUND conference in August. This will be her first public appearance since her return. We can't wait to hear her talk on Word of Obvious: competing in a post-word of mouth world.

Want to hear firsthand what makes us such big fans of Kathy? Attend her talk and many others at INBOUND 2013. Fans can save 30% off the ticket price with offer code KATHYSIERRA. This was a guest post by Laura Fitton (@pistachio), inbound marketing evangelist at HubSpot. Dan Lyons contributed to the reporting for this post.Article has 14 comments. Click To Read/Write Comments

Do your colleagues have a choice word for you? If not, here's why you want them to...

Sometimes one word can make all the difference.

I was at a conference and a friend who runs a startup introduced me to one of his friends, who was looking for a new opportunity. "I'd like you to meet Joe," he said. "He's great."

I'm sure Joe is talented. I'm sure Joe is skilled. I'm sure Joe is, in fact, great.

But I only remember Joe because of something that happened a few minutes later. Another friend introduced me to one of his product managers. "This is Michelle," he said. "She's relentless."

In the dictionary, "great" means remarkable in degree or effectiveness. "Great" is a wonderful word, especially when used to describe someone... but like "awesome" and "outstanding," "great" is used so often to describe people that it has lost much of its meaning. When just about everyone is great... no one is great. Great is no longer impactful or memorable.

When described as "great, however remarkable in degree or effectiveness he may be, Joe seems like - however unfairly - just one of many. He doesn't standout.

But "relentless" - who can forget relentless? Hear the word and you instantly think of someone so determined, so persevering, so persistent and tenacious that nothing, absolutely nothing, can stand in her way.

A "great" product manager you might forget. A "relentless " product manager you remember for a long, long time.

Authentic Positioning Matters - Especially for IndividualsMany companies, as Al Ries describes in his classic marketing book Positioning, try to own a single word or phrase in the minds of customers. For Mercedes it's "luxury." For Volvo it's "safety". At my company HubSpot it's "inbound".

The goal of positioning is to create an immediate and direct connection in the minds of consumers; that's what branding is all about.

Individuals need to think about positioning, too. Where Tony Hsieh is concerned, that word is "culture." Where Eric Ries is concerned it's "lean."

So imagine you ask a colleague or a boss or a customer for to pick one word that describes you and they aren't allowed to use words like awesome, fantastic, great, terrific, etc. They have to pick a specific, non-generic word. What word would they choose?

The word they choose - for better or worse and, where you're concerned, intentional or unintentional - is your positioning in the minds of the people you work with. That's how they see you. That's how they think of you.

That is how they remember you.

What is Your Most Important Word?The cool thing is, you get to choose how people view you. As long as your actions constantly and consistently match your positioning, as long as you are intentional in thought and action, you can determine the immediate and direct connection people make when they see, hear, or think about you.

What one word best describes you? Better yet, what one word do you want to describe you?

Here are a few possibilities - in the right circumstances these are all wonderful qualities:

· Insightful

· Shrewd

· Ferocious (hopefully in a good way)

· Unflinching

· Indomitable

· Irreverent

· Scrupulous

· Relatable

· Determined

So, back to the original question: What is the one word that can transform your career? As you've probably guessed - it's different for everyone. But, if you can find yours, it can have a profound impact on your person brand, and hence your career.

A short, powerful exercise...Make a list of the adjectives you want people to repeat after they meet you, talk to you, see or read about you... what do you want other people to think of when they think of you?

Make your list. Then boil it down to the one word you want to encapsulate you - and, in effect, your personal brand. (If you don't, other people will definitely decide it for you.)

Decide how you want to be defined.Now, share your one word in the comments below. If you can't quite get it down to just one word, that's OK (I'm an easy going guy) - pick 2 or 3 words. But, leave them in the comments. We're not going to hold you to it, but the simple act of writing them down and sharing them is super-helpful. And, it will help others come up with their words.

I'll kick things off with the words I'd like people to associate with me: creative.

Read, think, GO!

Leave your one (or two) words in the comments.

Article has 64 comments. Click To Read/Write Comments

As many of you may know, MIT is near and dear to my heart. As my co-founder, Brian Halligan likes to say, "HubSpot was born out of the loins of MIT". As such, I like to stay in touch and speak at MIT as often as I can. Over the years, I've built up a relationship with many of the people there. The leader of the entrepreneurial efforts at MIT for the past four years has been my friend the energetic and successful entrepreneur himself, Bill Aulet. While my "geek center of gravity" style is different than Bill's ("business center of gravity" but loves technology), I have come to really appreciate what he has been accomplishing at taking MIT's entrepreneurial education/training efforts to a new level. Recently I got a pre-release copy of his book, " Disciplined Entrepreneurship: 24 Steps to a Successful Startup" and my appreciation was taken to a whole new level. There is an art and science to entrepreneurship in that there is a body of knowledge that can improve entrepreneurs' odds of success significantly, and it definitely involves discipline.

While it would have been more appropriately titled "Disciplined Entrepreneurship: 24 Steps to getting the Product-Market fit right when launching your high growth new venture as a standalone or inside a large company but also relevant to existing entrepreneurs who want to revitalize their startups" I realize that would have been a bit too long so I accept the shorter version. It really is a breakthrough guide on how to launch new products for entrepreneurs in a systematic manner. It is very complementary to what is already out there by Eric Ries, Steve Blank, Alex Osterwalder while deftly incorporating classics such as Crossing the Chasm, Blue Ocean Strategy, Innovator's Dilemma, Democratizing Innovation and many more - as well as (humbly) Inbound Marketing. It pulls many different elements together very nicely in what Bill appropriately calls a "toolbox approach".

The book is not only an invaluable framework (make sure to order early & sign up to get the poster - it is super helpful and very complementary with the book) but also has many interesting insights. The following are thirty five short highlights from Bill with convenient tweetable links so you can let your friends know about this and spread the good word of disciplined entrepreneurship.

31 Tweetable Insights from "Disciplined Entrepreneurship: 24 Steps to a Successful Startup":

1) Entrepreneurship Education Crisis: Demand soaring yet high quality supply does not scale; gap filled by storytelling [tweet]

2) To build scalable eship education, we need frameworks that are flexible yet rigorous; valuable yet not constraining [tweet]

3) Hypothesis testing is unquestionably great but the question is which hypotheses do you test & in what order [tweet]

4) 1st Law of Eship: The single necessary & sufficient condition for a business is a paying customer [tweet]

5) 2nd Law of Eship: WOM (Word of Mouth) is critical to success of a high growth startup [tweet]

6) 3rd Law of Eship: We are an attacker w/ dramatically less resources than the defender so have 2 b much more efficient [tweet]

7) 4th Law of Eship: We have to have the unit economics work in a reasonable period of time [tweet]

8) 5th Law of Eship: We have to have a core (something that will be unique & very hard to duplicate) to be great [tweet]

9) 24 Steps are grouped into 6 themes & starts not with your technology or product but with "Who is your customer?" [tweet]

10) The 1st hypothesis 2 test is whether you have a well defined target customer who has a problem & money 2 pay 2 fix it [tweet]

11) Disciplined Entrepreneurs r not driven by 1 customer nor by spreadsheets but by a well defined target customer group [tweet]

12) Once mkt is selected, must deselect rest. Deselect = discipline. Every1 loves to select; no1 likes 2 deselect [tweet]

13) Q: Is deselection important? Steve Jobs: "I'm as proud of what we don't do as I am of what we do." - Ans: Hell yes! [tweet]

14) Build the company from the customer back & not from what you want out. Target Customer 1st, Product 2nd [tweet]

15) Primary Customer Research is essential: Walk in your customers' shoes - economically, emotionally & socially [tweet]

16) In eship, specificity wins & generalities don't - hence eship is about the quest for the holy grail of specificity [tweet]

17) Don't make your persona a composite, make it real person. This ends debates much faster & more effectively [tweet]

18) Validate your persona by listing 1st 10 customers & check to persona; also derisks & gives team confidence & focus [tweet]

19) "What can you do for your target customer?" - it must be specific, compelling & unique [tweet]

20) "How does your customer acquire your product?" maybe boring but essential - often overlooked [tweet]

21) "How do you make money off your product?" - unit economics of COCA vs. LTV must work [tweet]

22) "How do you scale your business?" - b/c limited resources, must start small & plan 2 grow big [tweet]

23) We need to train our entrepreneurs to have the spirit of a pirate & the execution skills of a Navy Seal Team [tweet]

24) "It is more fun to be a pirate than to join the navy" - Steve Jobs & embraced by MIT entrepreneurs [tweet]

25) MIT has spirit of a pirate ("creative irreverence" = hacking) but also enormous discipline hence success in eship [tweet]

26) Entrepreneurial Myth: "Entrprnrs are undisciplined" Wrong, great ones have enormous self-discipline [tweet]

27) Gr8 entrprnrs derisk risk & only bet when they know the odds are in their favor & there is a big payoff [tweet]

28) Fake it B4 U Bake It: Don't build until u have derisk market w/ real customers; build a site & market test 1st [tweet]

29) Don't build a plant to produce dog food until you prove the dogs will eat it. Logic is not enough, u need real proof [tweet]

30) Wisdom is scar tissue & scar tissue comes from failing & learning in the process. @24StepsofEship is based on wisdom [tweet]

31) "Truth will set you free" rather "Action will set you free" [tweet]

Which is your favorite? Which do you disagree with? Would love to hear your thoughts in the comments.

Article has 9 comments. Click To Read/Write Comments

Mark. You disappeared? What the fork happened to you?

And what's up with this crazy new blog design? Well ... more on that next week. I will tell more.

But for now. Every year we run a big VC, LP & Tech Summit in Los Angeles to showcase the best of our community and invite others from around the country. Our event this year will feature many portfolio companies and also LA emerging tech companies such as Tinder & Whisper. It is a CEO & founder gathering.

The Mayor will come and talk about LA innovation. And every year it seems a celebrity or two sneaks in.

I look forward to being back to blogging next week. And maybe sleeping, too.

Have a quick view below for what is in store.

Read MoreI often talk about what I'm looking for when I meet with an entrepreneur. Above all else I'm looking for a genuine passion for what the entrepreneur is doing. It's even a direct quote in my Twitter bio.

Of course passion isn't enough. You need a set of innate skills that differentiate you from the thousands of others who set out on your similar journey. You need a great concept in which you will build something that is truly unique and that will be valued by your customers. But without a passion for what you do I am dubious about your chances for success.

If I had to put a number on it I'd say 1 in 20 pitches - maybe 1 in 30 - are by an entrepreneur who comes across as truly passionate about her project. You can sense when it is a "mission" for this entrepreneur to succeed and she will continue the journey even if success isn't easy or immediate. It is in her blood to see this journey through and try to launch her product or service to the world.

Read MoreI wrote this on my flight home from f.ounders & web summit in Dublin, Ireland late last year. I think I was too hung over to finish it, hit publish and move on. So here is attempt two now that the alcohol is mostly out of me.

The Magic of the Irish.

Scenes from my counter-top on my last night in Dublin. I recently returned from a 5-day visit to Ireland, my first time back in 10 years and the start of what I hope will be a more regular travel schedule there. Between 1995-2002 I visited often - especially since I founded my first company there.

My trip was scheduled around the annual Web Summit and the f.ounders conference, both of which have become the hottest must-attend event in Europe and rivaling any great conference in the US.

Read MoreTom Perkins is one of the founding members of the venerable venture capitalist firm Kleiner Perkins. He just had his Mitt Romney moment and his name will forever be etched in the collective consciousness of the tech community for this terribly insensitive and tone deaf letter to the Wall Street Journal.

The headline of Mr. Perkins letter to the WSJ?

Progressive Kristallnacht Coming?

"I would call attention to the parallels of Nazi Germany to its war on its "one percent," namely its Jews, to the progressive war on the American one percent, namely the "rich.""

Um.

Read MorePicking a VC is hard. You don't really have much to go on to decide who would make a good fit. Reputation of firm? Of partner? Deals done in your industry? It's a bit of all of these.

I had an enjoyable conversation this morning with a young team straight out of college this morning and they were calling to ask advice on how to approach fund raising (angels vs. VCs, how to select a VC, etc.) and I realized that without years of experience it is tough to answer this question.

So I thought I'd write about out with what I would look for in a VC knowing what I know now and why.

Brains?

Most VCs are book smart. It's insanely competitive to get into our industry so most have degrees from institutions like Stanford, Harvard, Wharton and University of Chicago (blatant plug ;-). Smart is simply not a differentiator. In fact, book smart can be a negative. The last thing you want is a know-it-all telling you what to do when they are at 50,000 and haven't had to deal with your exact circumstances.

I call them " VCs Seagulls." (you know ... fly in, shit on you and then fly away).

Read MoreThe last company I worked for was huge - roughly 550x the size of Basecamp! Not surprisingly, we had every "enterprise" app in the book. You know, the ones with features that make the procurement department happy, but make actual users miserable.

I'd been a longtime Basecamp user before I got there, so I was keen to get our team using it. I knew from experience that a small team, even in a huge company, could do great work together by using it.

So I ...continue reading

All software developers want to get good ratings in the app store. That's how customers judge the quality of your app. The other desirable metric is quantity of ratings-the number of people who have reviewed the app. It's hard enough to get good ratings, it's even harder to get a lot of people to review your app.

Here's the mystery.

Basecamp for iOS has b ...continue reading

We're looking to add another product designer to our team! We don't hire for this position often, so we really savor moments like these. We're eagerly anticipating hearing from you.

Besides design, your job is to make an undeniably positive impact on our company, our culture, our products, and our customers. As long as you make your best effort, and you love to learn, we will do everything we can to support you creatively and help you do the best ...continue reading

Get my newsletter, usually once a week - it features long-form essays on what's going on here in Silicon Valley.

I've written 550+ essays which have been featured and quoted in The New York Times, Fortune, Wired, and WSJ. The topics range from mobile product design to fundraising to "growth hacking."

Here's one message you want. Chen's weekly newsletter offers thoughtful essays on startups and marketing from a true Silicon Valley insider.

- Wired Magazine

Andrew is one of the smartest geeks in Silicon Valley, and a brilliant and comprehensive virtuoso on a broad array of tech and non-tech topics including internet advertising, viral marketing, web analytics, social networks, online games, and all kinds of web glitter. He is a veritable Glenn Gould of startup blogging, and every chance i get i rip off his ideas and try to pass them off as my own. Respect.

- Dave McClure, 500 Startups, Paypal

I go to Andrew to learn more about the latest methods for building and retaining web audiences. There's no one who knows more about it.

- Mitchell Kapor, Kapor Capital, Lotus Development

PS. Looking for recent essays? Look here.

PPS. Or, check out some of my best essays below or see the full list of featured essays.

I breathe startups. Most of my closest friends are my business partners and a day painting a whiteboard is only second to a day with my family.

I'm addicted. I'm a serial founder & investor. I'm the Founder of Interplay Ventures, a co-founder of DevSpark, Founder Shield, Nomad Financial, TwentyPine, Venwise and a Venture Partner at High Peaks Venture Partners.

If you're interested in using the same startup service providers that we use, we setup a site that will introduce you to them - check it out: Venture Juice.

Here are some mottos I live by:

I think I'm having an impact. My blog has reached enough folks to garner the attention and Business Insider who listed me as one of the 100 Most Influential Digital NYers. I've also been included in the CVC30 - a list of the 30 most interesting members of the Columbia University startup community. This blog has been syndicated or cited on Inc.com, Mashable, Business Insider, OPENForum, AlwaysOn, PEHub, ReadWriteWeb, The Wall Street Journal and others.

As for interests, I really enjoy brainstorming new ideas, tinkering with new technology, listening to pandora, boxing, documentaries and an occasional game of rock band.

I am married to my college sweetheart Laurie and have a daughter named Avery.

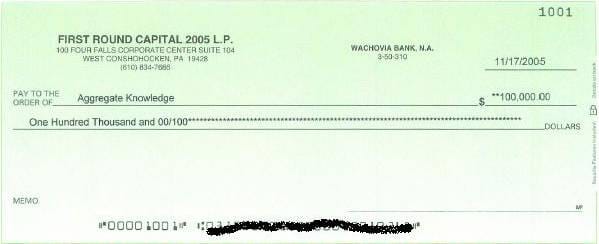

A great deal has been written about angel investing in recent years. Angel investing has become the sport of choice for many successful entrepreneurs in Silicon Valley (e.g., Dave Morin, Chris Michel, Ariel Poler, etc.). What's more, it has spawned a whole new class of venture funds -- once called Super Angels, now called Micro VCs (e.g., First Round Capital, True Ventures, SoftTech VC, etc.). And now traditional venture investors (e.g., Greylock Capital, Andreessen Horowitz, CRV, etc.) have created programs to invest small amounts of money in large numbers of startups. Unfortunately, as seed investing moves from a boutique practice to more mass market, its value is diminished dramatically.

As a general matter, I think that more seed funding is a great thing. It is certainly beneficial -- often times essential -- for small companies to raise a little bit of money to help validate an idea or market. But historically one of the most valuable things about angel investment was that it was accompanied by an angel. That angel wouldn't just invest in the company, he or she would serve as an indispensable advisor to the company as well. Not only did you get money to propel your business forward, you also got the help of someone who had run the startup gauntlet before you.

Regrettably, what once was a boutique business has in many instances become mass market. While there are some angels and Micro VCs can provide meaningful time and attention to their entrepreneurs, there are a number of folks out there who think that angel investing is a volume business. Needless to say, as the number of companies financed by any given investor grows, the amount of help that investor can give to each company diminishes proportionally. These investments become more about the placing of bets than they do about helping entrepreneurs succeed.

Sure, some of these stock pickers will make some good bets and even make some money. But it won't be any thanks to them. As a general matter, early stage entrepreneurs don't just need money, they need help and advice. And if help is no longer part of what you get from your seed investors, I believe the likely success of those investments will diminish.

Worse yet, taking seed investment from traditional venture investors can be counter-productive. It is impossible to imagine how a VC firm that is investing in dozens of early stage startups can find the time to be helpful while also working with their more traditional portfolio. You may get a little of their money and a little of their reputation, but you will get it at the expense of any real help in building your business.

So why have VC funds started investing in seed rounds? They do it because they think it gives them an option on future financings. By putting a little bit of money into a company's seed round, they get a seat at the table. And from that seat, in theory, they can keep track of how well it is going and preemptively finance the "best" companies that they've seed funded. The only problem with the theory is that these traditional VCs don't have the time or capacity to actually keep track of all the companies they've seed funded. So they aren't capable of being pre-emptive. Instead, they expect an early look at any Series A financing, despite the fact that they haven't earned the right by actually being helpful to the companies they have seeded.

More importantly, traditional VCs are incapable of providing one of the most important and valuable angel services -- introductions to future investors. As is becoming increasingly clear, investment is the life blood of the startup world. The problem that companies seed funded by traditional VCs have is that there is a natural assumption that any company that does not receive follow-on funding from its earlier VC investor is fundamentally broken. There is virtually nothing that a VC can say in his or her introduction to other investors that won't raise eyebrows. So taking angel money from a traditional venture investor is a bet on that firm funding your Series A. Unfortunately, if that doesn't work out, you're back is up against the wall. [1]

It is true that money is fungible. But investors are not. The choices you make when raising seed capital can have a meaningful impact on the long-term success of your startup. So find investors who will bring you value beyond the dollars in your bank account. Find investors with the time and inclination to help you. Find investors who will increase your chances of raising additional capital, not diminish those chances. Great angel investors are invaluable. So pick your partners well.

[1] On the rare occasion that my partners and I seed fund a startup, we work hard to alleviate the concerns I've described above. We only invest in a very small number of seed stage opportunities and we commit meaningful time and attention to those businesses, often going on the board (for example, I was the earliest investor in the likes of WePay and Splunk). Moreover, we take a substantial lead role in the seed financing, so there is no negative presumption when we introduce the company to our VC friends for the next round of financing. We will invest along side the new VC, but have no need to lead the Series A ourselves. Needless to say, this approach won't scale to dozens of startups. But it will increase the likelihood that those business we seed fund are successful.

3. Everything I give away is summarized here.

___________

Syllabi, Student Presentations & My Presentations/Lectures

- Over 500 presentations and videos (mine and my students class finals) on Slideshare

- Harvard Business Review article on Lean here

- My free online Lean LaunchPad class is here.

All the Lectures and their subtitles can be download for free here. Creative Commons license applies.

- All my blog posts can be listened to as podcasts here

- I also share all my syllabi, student presentations and my class lectures slides as well.

- Educators Training Guide is here

- Course for Educators is here

- Udacity on-line class is here

- Teachable moments videos for the Lean Launchpad class here

- How do Customer Discovery videos here