Sustainability Report

Siemens | 2023

Sustainability report 2023

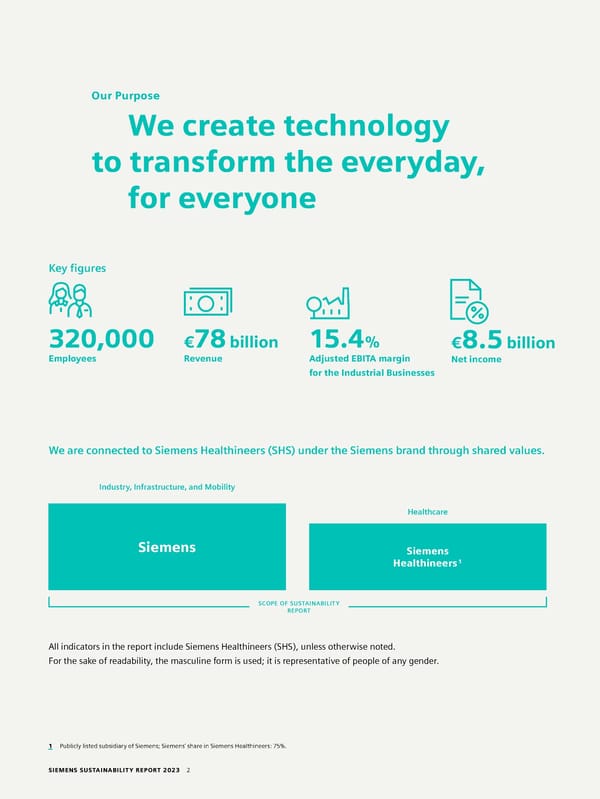

Our Purpose We create technology to transform the everyday, for everyone Key figures 320,000 €78 billion 15.4% €8.5 billion Employees Revenue Adjusted EBITA margin Net income for the Industrial Businesses We are connected to Siemens Healthineers (SHS) under the Siemens brand through shared values. Industry, Infrastructure, and Mobility Healthcare Siemens Siemens Healthineers1 SCOPE OF SUSTAINABILITY REPORT All indicators in the report include Siemens Healthineers (SHS), unless otherwise noted. For the sake of readability, the masculine form is used; it is representative of people of any gender. 1 Publicly listed subsidiary of Siemens; Siemens’ share in Siemens Healthineers: 75%. SIEMENS SUSTAINABILITY REPORT 2023 2

Contents Contents Contents 3 Foreword 4 1 5 Siemens at a glance 7 Social 81 1.1 Our DEGREE sus tainability framework 5.1 Working at Siemens 82 sets measurable ambitions 8 5.2 Div ersity, Equity & Inclusion 89 1.2 Company profile 10 5.3 Pr ofessional education and lifelong learning 93 1.3 Strategy 17 5.4 Occupational healt h and safety management 97 5.5 Corporate citizenship 102 2 Our sustainability management 20 6 2.1 Materiality assessment 21 Our sustainability indicators 106 2.2 Sustainability governance and organization 23 2.3 Partnerships and collaborations for sustainability 26 7 2.4 Sustainability ratings reflect our performance 29 Annex 124 3 7.1 Reporting methodology 125 7.2 Repor ting principles for Customer Governance 31 Avoided Emissions 128 3.1 Compliance and Ethics 32 7.3 Our contr ibution to sustainable development 3.2 Human rights 40 of societies 132 3.3 Sustainable supply chain practices 44 7.4 T ask Force on Climate-Related 3.4 Cybersecurity and data privacy 49 Financial Disclosure (TCFD) 136 7.5 GRI S tandards – key topics and boundaries 144 4 7.6 WEF IBC Metric 146 7.7 S ASB – Electrical Electronic Equipment Index 150 Environment 54 7.8 United Nations CEO Water Mandate 152 Holistic environmental protection 55 7.9 Independent audit or’s report on a limited assurance engagement 154 4.1 Climate action 58 7.10 Notes and forward-looking statements 156 4.2 Conserving resources 65 7.11 F urther information and 4.3 Product stewardship 71 information resources 157 4.4 EU taxonomy 76 SIEMENS SUSTAINABILITY REPORT 2023 3

Foreword Foreword Scaling sustainability impact Our purpose – which has guided us for 176 years – is to In a tumultuous year of record-shattering heatwaves, wild- create technology to transform the everyday, for everyone. fires and floods, and despite rising energy prices, inflation, This technology with purpose touches the lives of customers, supply chain challenges, labor shortages, plus the impact of partners, and consumers everywhere – improving the quality growing geopolitical tensions, we remain optimistic about of life for billions of people worldwide. Technology with technology as the answer to some of the world’s biggest purpose is about leveraging digitalization for optimized challenges. Our technology empowers our customers and resource usage and circularity readiness and accelerating the partners to scale their sustainability impact faster across the energy transition through renewable integration, energy backbone of our economies. As we approach a critical tipping efficiency, and electrification. It is about societal impact point for our planet, the demand to accelerate the digital by designing and operating the most efficient train and and sustainability transformations has never been greater. e-mobility solutions within sustainable communities, built upon decarbonized building technologies. And it is about As a leading technology company, Siemens supports cus- pioneering breakthroughs in healthcare to improve the lives tomers all over the world to become more competitive, of patients and their families. esilient, and, above all, more sustainable. Our portfolio r enables a positive impact on our planet and society at scale. Combining the real and digital worlds Today, it is about more than just managing negative foot- Our strategy is to combine the real and digital worlds – prints; it is about a company’s handprint and increasingly harnessing the power of hardware and software, or OT and xpanding businesses’ net-positive impact on the world. IT. More than 90% of Siemens AG’s business enables positive e That is why Siemens has integrated its sustainability strategy sustainability outcomes for our customers. Worth highlight- in our business activities, technology roadmap, investment ing is that our products sold to customers in fiscal 2023 will, decisions, own operations, and governance. We empower over the course of their lifetime, avoid around 190 million our customers to accelerate their sustainability goals along metric tons of CO equivalent emissions – a significant 2 three impact areas: decarbonization & energy efficiency, increase in avoided emissions over the prior year. This resource efficiency & circularity, people centricity & societal represents more than the equivalent emissions of the impact. Netherlands. In contrast, our own operations and supply chain accounted for around 12 million tons of greenhouse gas emissions. SIEMENS SUSTAINABILITY REPORT 2023 4

Foreword To help our customers and partners accelerate their transfor- We have a clear position on responsible business conduct. mation, we recently introduced Siemens Xcelerator, an open And our DEGREE commitments are based on that. Ethical digital business platform that makes digital transformation behavior, integrity and compliance are nonnegotiable. They easier, faster, and more scalable for companies of all sizes. A go beyond strict adherence to rules by firmly placing respon- key element of this platform is a growing ecosystem of sible action sustainably at the core of our culture and busi- partners. The sustainability impact we create is more powerful ness conduct. when all partners pool their strengths and work together toward a common goal. We are also focused on our own environmental footprint: In 2015, as one of the first global companies to do so, we We are able to empower our customers to scale sustainability committed to becoming carbon neutral by 2030. Today, we impact because we address challenges across the entire are on track, and we have already accelerated. We are proud value chain – with deep domain know-how across many to have reduced our CO footprint from our operations by 2 industries and across ecosystems of suppliers, partners, and 50% (without offsetting) since 2019 and are targeting 90% customers. in 2030. We reduced our energy consumption by 9% since fiscal 2021, meanwhile 96% of our locations have imple- An excellent example of the power of ecosystems is how mented a water strategy. software can track and manage carbon footprints throughout lifecycles and along supply chains. SiGREEN, an emissions- Applying our own technologies in our own operations is key tracking tool on our Siemens Xcelerator platform, enables to achieving these ambitions. In Nanjing, China, for example, companies to connect to all their suppliers, enabling data- we consolidated three production sites into one lean and driven decisions to reduce product carbon footprints and green digital native factory, which was first built as a digital decarbonize at scale. twin. This led to annual savings of 5,000,000 kWh of energy, 3,300 metric tons of CO , and 6,000 m3 of water. At the Our DEGREE sustainability framework 2 same time, productivity went up by 20%. For Siemens, And we do not stop at the sustainability impact of our port- rethinking scalable products and services for a sustainable folio. We define our environmental, social, and governance world should go hand in hand with savings, efficiency gains, (ESG) ambitions within our DEGREE sustainability framework – and customer value. a 360-degree approach reflecting our core sustainability values. We look at sustainability from every angle with clear ambitions in six fields of action – Decarbonization, Ethics, Governance, Resource efficiency, Equity, and Employability. SIEMENS SUSTAINABILITY REPORT 2023 5

Foreword Our sustainability ambitions are supported by 320,000 colleagues who bring our purpose to life every day – in an increasingly inclusive environment in 190 countries around the world. Within Siemens AG, women now hold 31% of top management roles, having achieved our 2025 ambition for 30% two years ahead of time. Our people are at the heart of this company. In fiscal 2023 we invested €416 million in our active learning culture, ensuring sustainable employability in rapidly changing markets. We have also made progress in the number of hours our people spent learning across the three strategic focus areas of digitalization, sustainability, and leadership: On average, our people have accrued 23 digital learning hours per person per year. And they are on track to increase that to our ambition of 25 digital learning hours by 2025. Easier, faster, and at scale We create technology to transform the everyday, for everyone. By combining the real and digital worlds we can accelerate digital and sustainability transformations easier, faster, and at scale. Together, by scaling across ecosystems, we will continue to leverage the power of the digital world to have a positive sustainability impact in our precious real world. At Siemens, what’s good for business and good for the planet and society go hand in hand. Dr. Roland Busch Judith Wiese SIEMENS SUSTAINABILITY REPORT 2023 6

Pages 7 – 19 Siemens at a glance SIEMENS SUSTAINABILITY REPORT 2023 7

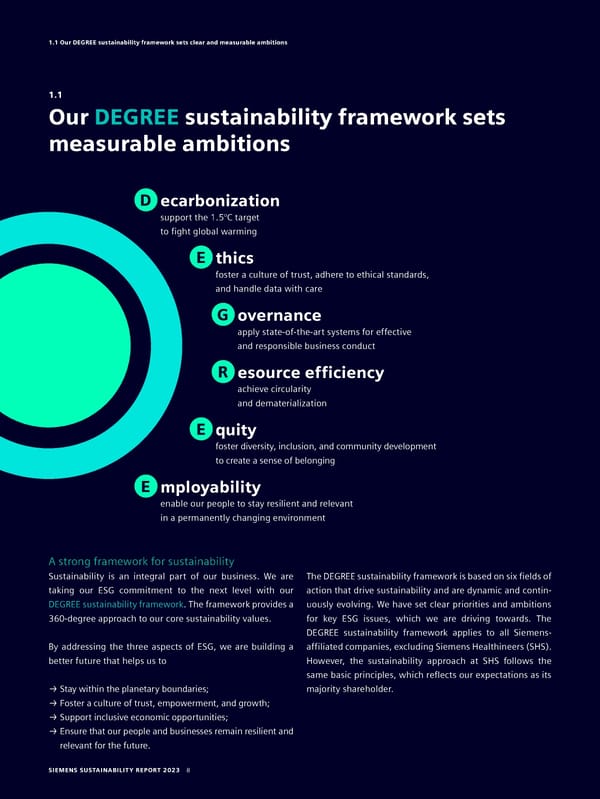

1.1 Our DEGREE sustainability framework sets clear and measurable ambitions 1.1 Our DEGREE sustainability framework sets measurable ambitions D ecarbonization support the 1.5°C target to fight global warming E thics foster a culture of trust, adhere to ethical standards, and handle data with care G overnance apply state-of-the-art systems for effective and responsible business conduct R esource efficiency achieve circularity and dematerialization E quity foster diversity, inclusion, and community development to create a sense of belonging E mployability enable our people to stay resilient and relevant in a permanently changing environment A strong framework for sustainability Sustainability is an integral part of our business. We are The DEGREE sustainability framework is based on six fields of taking our ESG commitment to the next level with our action that drive sustainability and are dynamic and contin- DEGREE sustainability framework. The framework provides a uously evolving. We have set clear priorities and ambitions 360-degree approach to our core sustainability values. for key ESG issues, which we are driving towards. The DEGREE sustainability framework applies to all Siemens- By addressing the three aspects of ESG, we are building a affiliated companies, excluding Siemens Healthineers (SHS). better future that helps us to However, the sustainability approach at SHS follows the same basic principles, which reflects our expectations as its →Stay within the planetary boundaries; majority shareholder. →Foster a culture of trust, empowerment, and growth; →Support inclusive economic opportunities; →Ensure that our people and businesses remain resilient and relevant for the future. SIEMENS SUSTAINABILITY REPORT 2023 8

1.1 Our DEGREE sustainability framework sets clear and measurable ambitions What are our ESG ambitions and priorities, and what progress did we make by end of fiscal 2023? Progress Baseline at the end of FY 23 Ambitions 1. Net Zero operations by 2030, with 55% FY 19: 737 kt CO e – 50% – 55% by 2025 Decarboni 2 zation emissions reduction by 2025 and 90% by 2030 – 90% by 2030 2. Net Zero supply chain by 2050, 20% emissions FY 20: 8,098 kt CO e – 1% – 20% by 2030 2 reduction by 2030 – 100% by 2050 Ethics 3. Striving to train 100% of our people on Siemens’ From FY 23 69% 100% by 2025 Business Conduct Guidelines every three years Governance 4. ESG-secured supply chain based on supplier − − Suppliers committed − − commitment to the Supplier Code of Conduct 5. Long-term incentives based on ESG criteria 1 − − ESG criteria anchored − − Resource 6. Next-level Robust Eco Design for 100% of FY 21: 26% 51% 100% by 2030 efficiency relevant Siemens product families by 2030 7. Natural resource decoupling through increased − − Metals 35% − − purchase of secondary materials for metals and − − Resins

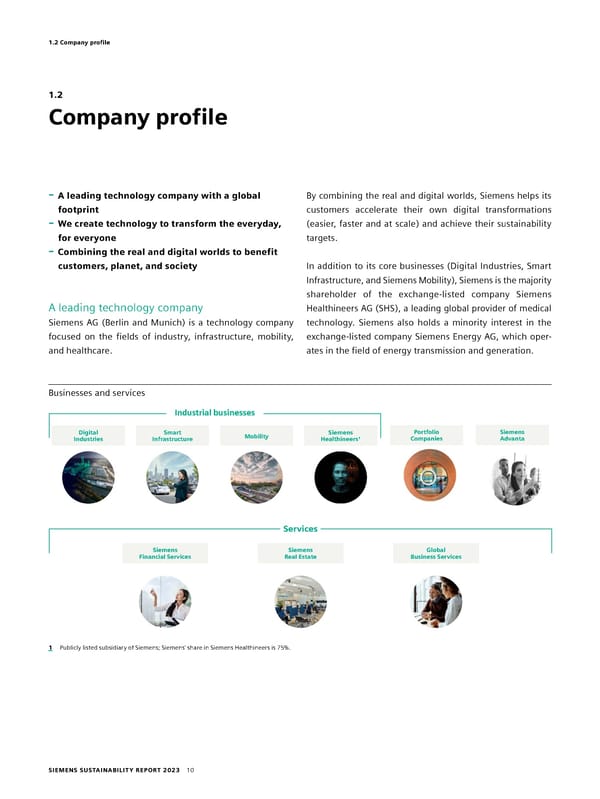

1.2 Company profile 1.2 Company profile – A leading technology company with a global By combining the real and digital worlds, Siemens helps its footprint customers accelerate their own digital transformations – We create technology to transform the everyday, (easier, faster and at scale) and achieve their sustainability for everyone targets. – Combining the real and digital worlds to benefit customers, planet, and society In addition to its core businesses (Digital Industries, Smart Infrastructure, and Siemens Mobility), Siemens is the majority shareholder of the exchange-listed company Siemens A leading technology company Healthineers AG (SHS), a leading global provider of medical Siemens AG (Berlin and Munich) is a technology company technology. Siemens also holds a minority interest in the focused on the fields of industry, infrastructure, mobility, exchange-listed company Siemens Energy AG, which oper- and healthcare. ates in the field of energy transmission and generation. Businesses and services Industrial businesses Digital Smart Mobility Siemens Portfolio Siemens Industries Infrastructure Healthineers1 Companies Advanta Services Siemens Siemens Global Financial Services Real Estate Business Services 1 Publicly listed subsidiary of Siemens; Siemens’ share in Siemens Healthineers is 75%. SIEMENS SUSTAINABILITY REPORT 2023 10

1.2 Company profile As a minority interest, Siemens Energy AG is not included in Siemens Healthineers this Sustainability Report. Siemens is a technology company Based on its foundation in in vitro diagnostics, image-guided that operates in nearly all countries of the world. Ever since therapy, in vivo diagnostics, and cancer care, Siemens it was founded in 1847, Siemens has provided solutions to Healthineers aims to fight the most dangerous non-commu- global challenges and stands for innovation, quality, and nicable diseases such as cancer, stroke, and coronary heart reliability. We are focused on leveraging the digital and sus- disease worldwide, enable efficient workflows in hospitals, tainability transformation to drive sustainable growth. and improve access to modern medical care. Today, more than three billion people around the world still lack access to Industrial businesses adequate medical care. Depending on where you live, this Digital Industries lack of access is even true in developed countries. It is the The industrial world faces tremendous challenges. As our privilege of Siemens Healthineers to provide innovative planet‘s resources are finite, we must decarbonize and do healthcare solutions and services which make healthcare more with less. Digital Industries’ offerings enable customers affordable and accessible for underserved communities to optimize entire value chains from product design and everywhere. development through production and post-sale services. With its advanced software solutions in particular, Digital Key figures Industries supports customers in their evolution towards the In fiscal 2023, which ended on September 30, 2023, Siemens “Digital Enterprise,” resulting in increased flexibility and generated revenues of €78 billion and profits after tax of efficiency of production processes and reduced time to €8.5 billion. As of September 30, 2023, the company had market for new products. approximately 320,000 employees worldwide. SIEMENS FINANCIAL REPORT FISCAL 2023, COMBINED MANAGEMENT Smart Infrastructure REPORT, CHAPTER 7, OVERALL ASSESSMENT OF THE ECONOMIC POSITION Siemens Smart Infrastructure drives the decarbonization, resource-efficiency, and people-centricity of energy systems, Customers buildings, and industries by connecting the real and digital Putting customers first is a longstanding tradition at 1 worlds. This helps to improve the way people live and work Siemens. When it comes to technology, sustainability, and by paving the way for the sustainability transition to an innovation, our customers are always at the heart of what all-electric world with decarbonized power supply and effi- we think and do: everything begins with them. That is why cient energy use. we have made “customer impact” a strategic priority. We listen to understand our customers’ needs as early as possible, and Siemens Mobility ideally, before our customers even become aware of them. Siemens Mobility drives the decarbonization and resource- efficiency of transportation by connecting the real and digital To meet our customers’ needs and the constantly changing worlds. Leveraging digital technologies enables lifecycle demands of the markets, Siemens draws on a global sales cost-optimized rail infrastructure and rolling stock, 100% force that takes its guidance from our regional companies. system availability, maximized network capacity, and opti- Key success factors include a strong customer focus, digital mized customer experience and processes to support a transformation, efficient processes, and collaboration with mobility shift in our society. external partners. 1 We call any current or potential purchaser of Siemens products or services, no matter what the sales channel, a “customer.” Some customers who are especially significant for Siemens are called “Key Customers”. SIEMENS SUSTAINABILITY REPORT 2023 11

1.2 Company profile Sustainable growth through digital Customer Impact transformation At Siemens we rely on a mature Key Account Management The COVID-19 pandemic has rapidly accelerated digitalization. approach to systematically structure and drive our Key Cus- New business models are emerging, and the importance of tomer relationships company-wide. While all our customers collaborative partnerships within ecosystems is increasing, are served by the general Sales organization, Key Customers especially in the context of sustainability challenges that are also managed through our Key Account Management cannot be solved unilaterally. We need to achieve more, and approach. we need to do it sustainably while consuming fewer resources. We can do this by increasing our efficiency with Over and above our basic sales approach, Siemens’ primary the help of new technologies and by working in ecosystems principles for successful Key Account Management are a with new business models to keep resources in circulation. special understanding of our customers’ technology and vertical markets along with the collaboration among all Combining the real and digital worlds represents a major customer-facing parties – across functional, organizational, leap forward for Siemens and our customers as well as for and regional boundaries (“go-to-market” approach). industries, planet, and society. This will help shape a world where intelligent manufacturing, smart energy systems, Our harmonized Key Account Management process enables smart buildings, and connected mobility can make our infra- us to act as one company and serve our customers in a structure more sustainable and our lives easier. global, sustainably coordinated approach. Technology is driving sustainability, and the digital transfor- mation is also essential to accelerating sustainability. To speed up our customers’ digital transformation and increase their value added, we have created Siemens Xcelerator, an open digital business platform. It is intended to accelerate Key Account Management – A holistic digital transformation (easier, faster, and at scale). It com- approach to meeting customer needs prises three fundamental elements: 1. A curated modular portfolio of IoT-enabled hardware, Systematically measuring and improving software, and digital services from Siemens and certified customer satisfaction partners based on standard application programming We use the Net Promoter Score (NPS) every year to measure interfaces (APIs) customer satisfaction, and by extension, the quality of our 2. An ever-growing open ecosystem of partners partnerships. Management compensation at Siemens also 3. An evolving marketplace that enables customers, partners, includes a component that is based on customer satisfaction. and developers to explore, teach, and exchange digital This component incorporates long-term performance incen- solutions. tives using ESG criteria and is defined under Governance in our DEGREE sustainability framework. The assessment is The platform is constantly growing and provides many market- based on the internal ESG/Sustainability index, which 2 3 tested solutions that enable customers to easily begin their includes the Net Promoter Score , among others. sustainability projects. These projects can include managing SUSTAINABILITY GOVERNANCE AND ORGANIZATION energy efficiency, integrating renewable energies, and saving resources. Siemens Xcelerator provides cybersecurity standards at every level to reduce risks for customers. 2 Assessment based on the Siemens internal ESG/sustainability index, which is based on customer satisfaction (Net Promoter Score), CO reduction, and digital learning hours. 2 3 Siemens without SHS. SIEMENS SUSTAINABILITY REPORT 2023 12

1.2 Company profile Siemens’ systematic evaluation draws from customer satisfac- Innovation strengthens Siemens and its tion surveys conducted annually worldwide. The score itself customers is based on a single question: “How likely is it that you would Our Research and Development (R&D) activities are geared recommend Siemens to a colleague or business partner?” towards developing innovative and sustainable solutions for Siemens’ customers and businesses, while simultaneously The survey pursues a holistic approach to customer relations strengthening our competitive positioning. This is also how because it follows up by implementing processes and systems we contribute to society. 4 designed to help foster long-term customer loyalty. We focus on core technologies and innovation fields – Regardless of the score, we initiate a follow-up process after Siemens Company Core Technologies – that play an essential the survey, both internally and externally. When a score is role in the success of Siemens and its customers. The imple- low and considered critical, we take immediate action to mentation of our core technologies by our operating identify key issues and determine what measures are needed businesses and Technology – our central R&D department – to improve the relationship. ensures that research activities and business strategies are closely aligned, and that all businesses can profit equally and quickly from technological developments. For example: Our customers’ satisfaction → Data Analytics & AI: Industrial facilities and infrastruc- is our top priority tures are generating ever-growing amounts of data. Using methods of machine-based data analysis and artificial Despite the tense global situation (for example, with supply intelligence (AI), we help operators increase availability, bottlenecks for materials and goods), our customers have improve operational quality, and reduce the stress on recognized us for our customer support, reliable products, humans and the environment. At the same time, our and a wide range of offerings. By consistently addressing quality statement on industrial-grade AI expresses its their concerns, we have achieved a higher Net Promoter trustworthiness, reliability, and robustness according to Score than the previous year. the requirements suggested for the European Union’s upcoming AI Act. We are focusing on areas where we can make a difference. → Connectivity & Edge: The Industrial Internet of Things This means creating sustainable, long-term value for our (IIoT) is the result of the increasing networking of field customers, for the environment, for society, and for the devices. The IIoT enables field devices to be equipped people who work for Siemens. with additional software-based functions during ongoing operations and makes it possible for the data generated Research and Development by these devices to be evaluated in the field or in the At Siemens our purpose is to provide innovations that cloud. improve the quality of life and create added value for people → Simulation & Digital Twin: Digital twins are the result all over the world. of modeling and simulating systems and processes, including the development and manufacturing of products. Digital twins make it easier to accelerate the commissioning of manufacturing plants, speed up time-to-market, and improve the operation of infrastructures throughout their lifecycles. 4 In most cases, the survey questions are focused on the business unit level. However, the overall score can be aggregated up to the business level and to the level of the entire company. SIEMENS SUSTAINABILITY REPORT 2023 13

1.2 Company profile → Software Systems & Processes: Complex, distributed Siemens Healthineers’ focus also lies on other research prior- industrial software systems that integrate software from ities with the goal of shaping the healthcare of the future. different providers can only be developed using new These include medical technology, sensor systems, and methods and processes in software system development. robotics and any of the increasingly complex applications → Power Electronics: Power electronics for inverters have that can be automated. By using digitalization and AI respon- always played a major role in industry. As the amount of sibly, Siemens Healthineers is increasing the quality, efficiency, electricity generated by renewable energy sources grows, and effectiveness of care at all levels of the healthcare the stable operation of power grids will also depend on delivery system. advances in power electronics. → Additive Manufacturing & Materials (from fiscal 2024 Siemens supports research, founders, and students to help on: Advanced Manufacturing & Circularity): Because of drive the development of innovative solutions. We work the increasing importance of circularity for our customers closely with scientists at more than 500 leading universities and society, we will sharpen our focus on elements like and research institutions, not just through bilateral research recycling. Additive manufacturing technologies continue cooperation agreements but also in publicly funded collec- to play an essential role by facilitating flexible production: tive research projects. With the Siemens Research and Inno- for instance, component designs with optimized material vation Ecosystem program (RIE), we want to address today’s utilization and an optimized performance-weight ratio. challenges with technologies of the future in a collaborative → Future of Automation: We are shaping automation approach. In fiscal 2023 we collaborated in 16 local Siemens 3 technologies with the goal of cutting engineering Research and Innovation Ecosystems around the globe . expenses, increasing flexibility – by integrating autonomous manufacturing machines, for example – and improving Siemens’ global venture unit, Next47, provides capital to our customers’ productivity while also reducing energy help enterprise-focused start-ups expand and scale. It nurtures consumption. next-generation business for Siemens by partnering with → Cybersecurity & Trust: Industrial cybersecurity is a key global start-ups at the early and expansion stages of their technology for digitalization. The security of industrial development. Next47 seeks to anticipate the impact that facilities and the protection of data and intellectual prop- new technologies will have on our markets. This knowledge erty are important requirements for customers as well as enables Siemens and its customers to grow and thrive in the governments and societies. age of digitalization. → Sustainable Energy & Infrastructure: Energy generation is moving away from the paradigm of large, centralized Continued high investment in R&D power plants towards a network of smaller independent In fiscal 2023, we reported research and development generators. Sustainable infrastructure and energy sources expenses of €6.2 billion, compared with €5.6 billion in fiscal are essential to this transformation. 2022. The resulting R&D intensity, defined as the ratio of → Integrated Circuits & Electronics: Integrated Circuits & R&D expenses to revenue, was rated at 8.0%. Additions to Electronics bundles R&D activities in areas like optimized capitalized development expenses amounted to €0.3 billion. circuit design and resource-efficient manufacturing, the As of September 30, 2023, Siemens held approximately testing and operation of industrial electronics, and recy- 45,000 granted patents worldwide in its continuing opera- cling electronics-based products. tions. COMBINED MANAGEMENT REPORT → User Experience: Users expect intuitive operation in all our products. The purpose of the User Experience core technology is to find out how customers use Siemens products, what functions they need, what they expect, and what is unnecessary. 3 Siemens without SHS. SIEMENS SUSTAINABILITY REPORT 2023 14

1.2 Company profile Our Siemens Company Core Technologies drive technology development to master key sustainability challenges Data Analytics & Connectivity & Simulation & Software AI Edge Digital Twin Systems & Trustworthy AI in Robust IoT wireless Data-based digital Processes critical IT/OT infrastructures connections and edge building twin and knowledge Siemens Water Apps (SIWA) to safeguard sustainability, solutions for efficient manage- graphs to optimize building for greater efficiency and transparency, safety, security, ment of energy consumption operation over the lifecycle security of the water supply and privacy in buildings and grids (e.g., Siemens headquarters) Future of Cybersecurity & Sustainable Advanced Automation Trust Energy & Manufacturing & Automation hard- SiGREEN for a trust- Infrastructure Circularity ware based on Supervisory worthy exchange of product Lifecycle Assessment and opti- Tools and procedures for design- Control and Data Acquisition carbon footprints in the value mization of production, supply ing products that optimize re- enables the reuse of waste- chain, with verifiable creden- chain, logistics, and trans- source use, including AM designs water in agriculture tials for transparency and portation for Environmental and strategies for 4R (reuse, control Product Declaration remanufacture, repair, recycle) Power User Integrated Electronics Experience Circuits & Tools for optimizing Serious gaming to Electronics energy efficiency, advanced increase awareness Reduce-reuse-recycle lifecycle services, and circular of the product carbon approaches through life- economy designs for power footprint cycle management for electronic systems electronics-based products Patent portfolio reflects sustainable innovation Siemens’ sustainable innovation is reflected in the compa- ny’s patent portfolio. Using the LexisNexis® PatentSight® patent information platform, we evaluate our sustainable innovations against the United Nations’ 17 defined Sustain- able Development Goals (SDGs) and the corresponding 169 targets. 46.8% of the active patent families in Siemens’ patent portfolio relate to at least one SDG, mainly in the categories of Good Health and Well-Being (SDG 3), Industry, Innovation, and Infrastructure (SDG 9), Affordable and Clean Energy (SDG 7), and Climate Action (SDG 13). SIEMENS SUSTAINABILITY REPORT 2023 15

1.2 Company profile SDG-related Siemens IP portfolio by SDG category Absolute figures represent patent families. Multiple assignments of patents possible. n S o D G e f i L 0 1 : : 5 1 N o G D P S o d v n e a rt L y w S o D l G e b 0 e H 2 f i u : L r Z n : e g e 4 t e r 1 a r o w G D S S D a G e t n 0 a d 3 : m W i G l n e o C l o o l : i - d 3 t B 1 c e H A i e G n a D 6,276 g l S 188 th 1,434 3027 288 C G D S y o n Portfolio lit Pr s 12 956 Size 323 a n o u : u io d m 10 t u p Re Q a c t s 57 : c t i p 794 4 u i o o 0 d o n n G E n a s D n i S d b l e 1,588 C S r i D e t G i d e n s 1 e 1 a : G n 5,207 y d S : t u 5 i l C s 0 a o t u m a G q i m n D E a S u b l n e i t i e s S r D e t G a W I 0 n 9 n n : a n o I e n l o I v d C i n a u t t s : a f i t 6 t r o ry 0 i a n , n s G D a t a S S r n u d c e d t S l n D b u G a a d r 0 o 7 ff : r A e a y n g d r e C n l E e a n SIEMENS SUSTAINABILITY REPORT 2023 16

1.3 Strategy 1.3 Strategy – We combine the real and the digital worlds to scale Global megatrends sustainability impact Complexity in the industrial world has never been greater – Siemens’ business is focused on enabling customers than today. Several megatrends are driving us to rethink to achieve positive sustainability impact along established ways of doing things: three customer value propositions: decarbonization & energy efficiency, resource efficiency & circularity, → Environmental change and the associated climate change, people centricity & societal impact along with extreme weather conditions like increasing – The DEGREE sustainability framework defines clear flooding and drought, pose critical challenges. Current fields of action for our sustainability ambition legislation alone is insufficient to effectively combat environmental change. We are also facing challenges related to resource efficiency and material extraction, Siemens is a leading technology company with a portfolio water scarcity, and biodiversity loss. designed to drive the digital and sustainable transformation → In times of crisis, glocalization can create a greater balance of industry, infrastructure, mobility, and healthcare. We between the global and the local in our economy. For firmly believe that technology is the answer to creating a instance, by ensuring production of our products and sustainable future. As key pillars of our strategy, digitaliza- solutions near our customers, we can strengthen our tion and sustainability help future-proof our business and resilience to shocks while also reducing the environmental that of our customers. impact of our products. → Increasing urbanization, especially in less-developed Siemens offers technologies and solutions to advance regions, is a significant megatrend. In this context, the growth as societies transition toward a more sustainable demand for more sustainable and efficient products, future. We enable our customers to accelerate the energy technologies, and solutions – including passenger trans- transition, create more resource-efficient factories, smarter portation and access to renewable energy – continues to buildings, and cleaner transportation, and advance health- grow as more and more people move to cities. care. By combining the real and the digital worlds, we → As global population growth progresses at a slower pace, empower our customers to be more competitive and more our societies are aging, and an increasing number of resilient while simultaneously reducing their environmental people need medical care. This demographic change is impact. Managing data across complex value chains has also contributing to a shortage of workers across industries. become an important prerequisite for accelerating this → Lastly, digitalization continues to accelerate advancements transformation. Siemens’ industrial metaverse and digital in connectivity, the Internet of Things (IoT), automation, twin technologies integrate data from physical factories and and AI technologies. Digitalization is being rapidly products across entire lifecycles to optimize production adopted by multiple industries in the public and private design, increase production efficiency, and reduce CO2e sectors. By optimizing processes, it can play a decisive role emissions and the consumption of energy, water, and raw in reducing environmental impacts. materials. Our products, services, and solutions demonstrate how technology advances sustainability and is helping shape the world we want to live in. SIEMENS SUSTAINABILITY REPORT 2023 17

1.3 Strategy Scaling sustainability impact Supporting our customers in their sustainability These megatrends and their impacts are reshaping the needs transformation of our customers and markets. To create a holistic picture of Siemens’ business is focused on enabling customers to potential futures, we execute sustainability scenario analyses achieve a positive sustainability impact along the following that enable us to map impacts and risks, identify opportunities, value propositions: and find new ways to create value through pathways by 2030 and 2040. Strategic insights are derived from scientific Decarbonization & energy efficiency frameworks like the Intergovernmental Panel on Climate We support our customers with their efforts to decarbonize Change’s (IPCC) Representative Concentration Pathways their infrastructure and operations, drive energy-efficiency, (RCPs) and Shared Socioeconomic Pathways (SSPs) as well as and future-proof entire industries. We do this by offering market trends and expert knowledge. The sustainability products, systems, solutions, and services that are based on scenarios illustrate different possible development pathways our strategic focus on digitalization, electrification, and for the global economy and Siemens’ operating environment automation. For example, our energy-efficient products and across the focus topics climate, circularity, biodiversity, and solutions support the transition from fossil fuels to renew- society that take into account both an organized 1.5°C and a able energy sources, and our electrification solutions enable disorganized 3°C pathway. These scenarios guide the devel- renewable grid integration and the electrification of heat opment of our sustainability strategy. and hydrogen. Across industries, we offer energy optimiza- tion and carbon footprint management throughout our To further increase our positive impact, we believe that products’ lifecycles and supply chains. In buildings, we offer working in ecosystems is the best way to jointly create seam- energy efficiency and decarbonization solutions, such as less solutions for our customers and their specific challenges. smart buildings and smart energy management for a reduced This approach increases our own sustainable offerings and carbon footprint. Our rail systems offer low-carbon mobility solutions and facilitates our customers’ sustainability trans- and increased energy efficiency. formation. Our commitment to sustainability covers the entire value chain. Based on our strategic priority to produce Resource efficiency & circularity purpose-driven technology, we strive to create a positive Through their use of our digital technology, our customers long-term impact for our customers with our products across can achieve resource efficiency and profitability. For our operations and through connected ecosystems. instance, we harness digitalization to reduce the require- ments of physical assets and resources. We combine the real and the digital worlds with our digital twin technology, a virtual representation of a physical product or process that is used to simulate, predict, and optimize its physical counter- part. Digital twins enable users to do more with fewer resources and make current and future environmental foot- prints transparent. Our building solutions also contribute to optimized space utilization and ultimately increase resource efficiency. Our mobility solutions focus on enhanced network capacity and extended lifecycles. SIEMENS SUSTAINABILITY REPORT 2023 18

1.3 Strategy People centricity & societal impact Social: Equity, Employability We enable our partners and customers to improve people’s Equal treatment and respect are the core of our corporate lives today and transform the backbone of societies for a values. Our goal is to position Siemens as the inclusive better tomorrow. For instance, our technologies support the employer of choice in all our relevant talent markets. We well-being, productivity, safety, and security of building foster diversity, equity, inclusion, and community develop- tenants and operators. Similarly, in the field of mobility, ment in order to create a sense of belonging and a healthy passengers and operators benefit from greater safety and and safe environment where all our people can give their convenience thanks to our technologies. They also promote best. At Siemens, we invest in the education, development, the socioeconomic development of communities by enabling and individual growth of our people. We maintain a strong access to basic goods, resilient electric power, affordable real focus on digital learning, employee assistance programs, estate, food and water, healthcare, education, and public and occupational health and safety. transportation. Governance: Ethics, Governance DEGREE: High ambitions for sustainability At Siemens, we believe that the way we do business is as Sustainability is integral to our business and influences important as our business success. Our values and ethical everything we do. The DEGREE sustainability framework principles are embedded in our Business Conduct Guidelines, defines our comprehensive approach to sustainability. Across which are mandatory throughout the company. In addition six fields of action, the framework defines clear priorities for to embedding these principles in our own management us in key sustainability areas that we drive in our own oper- systems, we extend them to our suppliers who are required ations and in collaboration with our partners, suppliers, and to follow a comprehensive Code of Conduct. Beyond that, customers. We continuously develop these priorities and we have made sustainability criteria an integral part of our 1 ambitions while fully integrating the expectations of all our long-term variable compensation programs for both the 2 stakeholders. The fields of action are defined along the Managing Board and our senior management. dimensions of Environment, Social, and Governance: The DEGREE sustainability framework applies to Siemens AG Environment: Decarbonization, Resource efficiency apart from Siemens Healthineers (SHS), which is an indepen- As part of DEGREE, we have set high ambitions to signifi- dent stock-listed company. In its sustainability concept, SHS cantly reduce CO e emissions in Siemens’ operations and pursues the same values as Siemens AG, because they repre- 2 upstream supply chain. Our approach to resource efficiency sent our expectations as the majority shareholder. SHS’s own accelerates recycling and promotes a more circular business. sustainability approach is described in a dedicated report. Our software and simulations reduce the use of substances OUR DEGREE SUSTAINABILITY FRAMEWORK of concern and other resource usage and introduce recycled materials as early as the design and simulation phases of our products, factories, and solutions. In addition, we promote the decoupling of natural resource consumption from eco- nomic growth by increasing the amount of secondary materials that we purchase. 1 Assessment based on the Siemens internal ESG/sustainability index, which is based on customer satisfaction (Net Promoter Score), CO reduction, and digital learning hours. 2 2 Siemens without SHS. SIEMENS SUSTAINABILITY REPORT 2023 19

Pages 20 – 30 Our sustainability management SIEMENS SUSTAINABILITY REPORT 2023 20

2.1 Materiality assessment 2.1 Materiality assessment – Materiality assessment based on GRI 2021 Identifying and prioritizing the topics – 15 material sustainability topics of the greatest In 2023, Siemens conducted internal workshops to help relevance to Siemens identify our material topics by assessing their impacts, risks, – Material impacts, risks, and opportunities as part and opportunities from two different perspectives: of our strategic considerations → Insideout perspective: Siemens took a closer look at its positive and negative Key topics as guiding principles impacts on the environment and society (inside-out) caused Our materiality assessment is based on external frameworks by the company’s business activities. like the UN Global Compact and the Standards of the Global Reporting Initiative (GRI 2021), which are the foundation for During the inside-out assessment, we identified actual and our reporting. The key topics covered in this report are struc- potential positive and negative impacts for 17 sustainability tured based on ESG. topics and evaluated them according to their likelihood and their severity. Based on evaluations of the individual impacts, Materiality assessment our material topics were derived. These topics are the foun- We updated our materiality assessment with an emphasis dation for determining the content of the GRI report. Including on our industrial businesses Digital Industries, Smart Infra- the outside-in perspective (see below) does not alter the structure, and Mobility in fiscal 2023 based on the GRI 2021 results. standards. Our aim was to identify our company’s key eco- nomic, ecological, and social impacts on the environment The material topics where Siemens can exert the greatest and society in accordance with the updated GRI Standards. influence on society and the environment are climate action, The resulting topics also align with Siemens Healthineers’ social and ecological standards in the supply chain, and (SHS) material topics, which were determined in an indepen- sustainable product design and lifecycle management. These dent materiality assessment. topics received the highest scores in this year’s analysis. The material topics form the framework for implementing → Outsidein perspective: sustainability in the company – at the central corporate The outside-in perspective refers to sustainability topics that level, in our business units, and in the countries. Siemens can be associated with opportunities and risks for the strives to continuously improve sustainability management company’s business activities or financial situation. This and understands the materiality assessment to be a prereq- - perspective was taken into account in the inside-out per uisite for identifying and managing potential opportunities spective in order to introduce the double materiality principle and risks. The Siemens business units derive their key action of future regulation. areas from the requirements and basic conditions of their local markets. The material sustainability topics with the highest degree of influence on our business activities and the generation of lasting value are climate protection and sustainable product design and lifecycle management. SIEMENS SUSTAINABILITY REPORT 2023 21

2.1 Materiality assessment Result of the materiality assessment and “Innovation and business model” were merged into one We identified 15 material sustainability topics of the greatest combined topic, “Innovation and business model.” relevance to Siemens from both perspectives. “Waste and hazardous substance management” and “Employee develop- The alignment of our material sustainability topics with the ment” were determined in fiscal 2023 to be two additional GRI framework and the SDGs can be found here: material topics. The two topics “Responsible governance” ANNEX GRI INDEX, ANNEX SUSTAINABLE DEVELOPMENT GOALS Siemens’ material sustainability topics are clearly linked to the United Nations’ Sustainability Development Goals (SDGs). They also serve as the basis for our considerations related to the DEGREE sustainability framework as well as our overall portfolio strategy and customer considerations. STRATEGY Sustainability topics SDGs DEGREE Climate action1 D ECARBONIZATION Innovation and business model D ECARBONIZATION R ESOURCE EFFICIENCY G OVERNANCE Cybersecurity and data management E THICS Social and ecological standards in the supply chain G OVERNANCE Corporate governance and sustainability leadership G OVERNANCE Partner management and collaboration G OVERNANCE D ECARBONIZATION ESG risk management G OVERNANCE E THICS Compliance management G OVERNANCE E THICS 1 Sustainable product design and lifecycle management R ESOURCE EFFICIENCY Waste and hazardous substance management R ESOURCE EFFICIENCY Sustainable handling of natural resources and R ESOURCE EFFICIENCY material efficiency Diversity, equity, and inclusion E QUITY Future of work E QUITY E MPLOYABILITY Employee development E QUITY E MPLOYABILITY Employee health and safety E MPLOYABILITY 1 Top 2 material sustainability topics. SIEMENS SUSTAINABILITY REPORT 2023 22

2.2 Sustainability governance and organization 2.2 Sustainability governance and organization – Responsibility for sustainability at Siemens lies Supervisory Board meets regularly to discuss business devel- with the Managing Board and Chief Sustainability opment, planning, strategy, and the implementation of that Officer, supported by the Siemens Sustainability strategy. Board – The Sustainability Executive Committee is our More detailed information on the structure and responsibilities guidance body for Siemens’ sustainability business of the Managing Board and Supervisory Board can be found with a focus on portfolios, market segments, and in the SIEMENS FINANCIAL REPORT FOR FISCAL 2023, COMBINED gotomarket topics MANAGEMENT REPORT, CORPORATE GOVERNANCE STATEMENT – ESG criteria are included in the compensation system for members of the Managing Board and Clear organizational structure and senior managers responsibilities In 2023, we significantly strengthened our sustainability organization throughout the company by introducing the At Siemens, sustainability is rooted in all that we do, includ- Sustainability Executive Committee (EC SUS) and Heads of ing our business purpose and strategy, corporate culture, Sustainability in key businesses and business units, and we processes, and guidelines. The management of sustainability increased the responsibility of the Global Head of Sustain- matters is embedded across our Siemens businesses, Service ability (Global Head of SUS) and the Siemens Sustainability and Governance units, and countries. Sustainability has also department. been an integral component of management compensation since fiscal 2020. Put simply, we strive to make sustainability The Managing Board addresses sustainability-related risks everyone’s responsibility at Siemens. - and opportunities of strategic and company-wide impor tance and adopts appropriate measures. The Managing Foundation: Corporate governance Board also approves any changes to the DEGREE sustainability We believe that compliance with recognized principles of framework. corporate governance is the cornerstone of sustainability- based corporate management. Siemens AG is governed by The Siemens Sustainability Board (SSB) monitors and German corporate law, under which it has a two-tier board resolves Siemens’ sustainability topics, including tracking structure consisting of a Managing Board and a Supervisory the progress of our DEGREE ambition, providing input and Board. guidance on sustainability reporting, and acting as a catalyst for regional sustainability initiatives with the potential to As the top management body, the Managing Board is scale across Siemens. The SSB is composed of representa- responsible for serving the company’s best interests and for tives from Siemens’ businesses, countries, and Service and achieving sustainable growth in company value. The Managing Governance units. The SSB meets four times per year or Board members are responsible for the entire management more frequently as needed. The SSB provides updates and of the company and decide on key issues of business policy recommendations to the Managing Board. and corporate strategy. The Sustainability Executive Committee (EC SUS) acts as The Supervisory Board oversees and advises the Managing guidance body for Siemens sustainability business – the Board in its management of the company’s business. The Siemens portfolio that enables positive sustainability impact SIEMENS SUSTAINABILITY REPORT 2023 23

2.2 Sustainability governance and organization by addressing and financing (i) decarbonization and energy ations for the Siemens sustainability business in alignment efficiency, (ii) resource efficiency and circularity as well as with the Managing Board, EC SUS, and the CEOs. (iii) people centricity and social impact – with a focus on portfolio market segments and go-to-market topics, and it CEOs are ultimately responsible for all sustainability topics in meets on an ad hoc basis to discuss relevant subjects. their area of responsibility. This includes responsibility for Chaired by Siemens’ CEO, the EC SUS includes Siemens’ Chief the sustainability business, implementation of DEGREE, Sustainability Officer, the CEOs of key businesses, Chief sustainability reporting, the Sustainability Risk Due Diligence Strategy Officer, General Counsel, and Global Head of SUS. Process, and other related responsibilities. The Chief Sustainability Officer (CSO) oversees Siemens’ The CEOs of Digital Industries, Smart Infrastructure, Siemens sustainability topics. The CSO is a member of the Siemens Mobility, and Siemens Financial Services (SFS) are supported Managing Board, chairs the Siemens Sustainability Board by their respective Heads of SUS to achieve their sustainability (SSB), and is a member of the Sustainability Executive Com- mandates. The Heads of SUS also assist the Global Head of mittee (EC SUS). The CSO is also responsible for the Siemens SUS with their responsibilities in the Sustainability depart- Sustainability department. ment, as they pertain to their businesses. Heads of SUS have a governance reporting line to the Global Head of SUS in The Global Head of Sustainability (Global Head of SUS) leads addition to their reporting line to their respective CEOs. The the Siemens Sustainability department. In this capacity, the Heads of SUS are appointed by the respective CEOs, in align- Global Head of SUS reports to the CSO on all Siemens sus- ment with the Global Head of SUS. tainability topics excluding sustainability business and related strategy topics. For the latter topics, the Global Head In addition, the CEOs of the business units in Digital Indus- of SUS reports to Siemens’ CEO. The Global Head of SUS is a tries, Smart Infrastructure, Siemens Mobility, and SFS each regular member of the SSB. The Global Head of SUS regularly appoint Sustainability Managers who have a governance informs the Supervisory Board on sustainability matters. reporting line to the Heads of SUS and to their reporting line to their respective CEOs. The Siemens Sustainability department is responsible for developing our DEGREE sustainability framework in coordi- Lead Country SUS Managers support their respective Lead nation with the SSB, businesses, Service and Governance Country CEOs and their assigned countries. They also lead units, and countries and controlling the DEGREE target Siemens’ sustainability topics within the scope of responsi- achievements. Responsibility for sustainability reporting and bility of the Lead Country management. 1 the Net Zero Operations Program also lies with the Sustain- ability department. It also governs the purchase of carbon Our Service and Governance units are responsible for the offsets and the Sustainability Risk Due Diligence Process2. ongoing development of sustainability-related topics within The Sustainability department also supports sustainability their own mandate in line with the DEGREE sustainability initiatives with scalability across Siemens. This includes framework and regulatory and organizational requirements. developing the processes, training, and tools needed to address overarching sustainability topics for our countries, Lastly, Sustainability Risk Due Diligence Subject Matter businesses, and Service and Governance units in collaboration Experts are appointed by and support Digital Industries, with other Siemens organizations. Finally, the Sustainability Smart Infrastructure, Siemens Mobility, and SFS to responsibly department is responsible for developing strategic consider- conduct the Sustainability Risk Due Diligence Process. 1 Siemens has established the Net Zero Operations Program, which is comprised of a series of greenhouse gas (GHG) emission reduction initiatives targeting real estate, production, our vehicle fleet, and related topics to address our commitment to GHG reduction under the DEGREE ambition “Net Zero Operations by 2030.” For more details, see chapter 4.1 Climate action. 2 Siemens has established the Sustainability Risk Due Diligence Process to ensure that environmental, social, and associated human rights and reputational risks (Sustainability Risks) are appropriately assessed and mitigated. The Sustainability department, as the governance owner, has established minimum company-wide standards for the Sustainability Risk Due Diligence Process in our customer-related business that are applicable to the businesses and SFS. SIEMENS SUSTAINABILITY REPORT 2023 24

2.2 Sustainability governance and organization CEOs in businesses and lead countries are responsible for anchoring sustainability in their organizations Overview of roles and responsibilities Supervisory Board Managing Board incl. Chief Sustainability Officer Sustainability Executive Committee Siemens Sustainability Board Sustainability Organization incl. Global Head of Sustainability Business and SFS Service & Governance units Countries Sustainability reflected in management G overnance compensation The current compensation system for the members of the Progress on DEGREE ambition #5: Managing Board of Siemens AG has been in place since fiscal Long-term incentives based on ESG criteria 2020. It incorporates long-term performance incentives based on ESG criteria and is defined under the field of action Siemens grants long-term variable compensation in the Governance in our DEGREE sustainability framework. We form of Stock Awards. Long-term variable compensation assess the Managing Board’s performance against Siemens’ represents at least 30% and at most 42% of total target internal ESG/Sustainability index. Targets include CO2e compensation. Since fiscal 2020, allocated Stock Awards emissions, digital learning hours, and the Net Promoter depend on a comparison of total shareholder return Score (NPS) for measuring customer satisfaction. Additional (TSR) with an international sector index (the MSCI World sustainability matters are also defined as individual targets Industrials Index) and on an internal ESG/Sustainability for short-term variable compensation (bonuses). index, weighted at 20%, with three equally weighted SIEMENS FINANCIAL REPORT FOR FISCAL 2023, COMBINED MANAGEMENT indicators. The ESG indicators reflect relevant strategic REPORT, COMPENSATION REPORT 2023 and socio-political topics. For the Stock Awards Tranche 2023, which was awarded in November 2022, these indicators include CO e emissions, digital learning 2 hours, and the Net Promoter Score (NPS) for measuring customer satisfaction. These criteria are applicable to Managing Board members of Siemens AG and all senior managers globally who are eligible for Stock Awards. Progress ESG criteria anchored Siemens without SHS SIEMENS SUSTAINABILITY REPORT 2023 25

2.3 Partnerships and collaborations for sustainability 2.3 Partnerships and collaborations for sustainability – Close collaborations with our stakeholders non-financial reporting legislation, trade policy, and con- – Partnerships are key to longterm sustainable nected and automated mobility for rail and road. business success – Siemens is an active member of numerous business Our political involvement is guided by strong principles: associations and organizations → We are politically neutral and take a zero-tolerance approach to corruption, violations of fair competition Siemens operates in nearly every country in the world. We principles, and other breaches of applicable law and work with our customers to find innovative solutions to internal regulations. some of the world’s most pressing issues. We believe that → Siemens does not make political donations or contributions close collaboration with our stakeholders enables us to make to politicians, political parties, or political organizations. serious progress on complex sustainability challenges. We → Any contributions that support purely political purposes maintain a consistent dialog with all our stakeholders, or the representation of political interests – for example, including customers, investors, suppliers, our people, election events for political campaigns – are prohibited by communities, policymakers, media, non-governmental our internal guidelines. organizations, business organizations, and academia. In addition, our DEGREE sustainability framework is also based Engagement in associations and organizations on a 360-degree stakeholder approach. Siemens is a member of numerous business associations and other organizations, some of which advocate for their mem- In dialog with politics and society bers’ interests in the political arena. Selected examples of Our Managing Board, CEOs, and governance departments in the most important memberships are: our business units oversee stakeholder engagement. The overall responsibility for Siemens’ dialog with policymakers → The International Chamber of Commerce (ICC) lies with our Managing Board, which has given the Govern- → The German Mechanical Engineering Industry Association ment Affairs department a mandate for company-wide (VDMA) coordination tasks and the corresponding governance → The German Electrical and Electronic Manufacturers’ responsibilities. Within the business units, the unit’s CEO is Association (ZVEI) responsible for a coordinated dialog with the policymakers. → The European Round Table for Industry (ERT) → The U.S. Chamber of Commerce The way that regulations and legislation are shaped has in → The European Chamber of Commerce in China (EUCCC) many cases impacted Siemens and our products and solu- tions. Therefore, we believe that maintaining an ongoing More information on political activities at Siemens can be dialog with political decision-makers is crucial for our found on our GOVERNMENT AFFAIRS website. company’s success and for our commitment to sustainability. We have joined forces with leading companies from around We prioritize our activities based on our business strategies the world to establish the Charter of Trust, which aims to and innovation fields. As a result, our advocacy activities make the digital world safer and more secure. focus on but are not limited to the following topics: cyber- WWW.CHARTEROFTRUST.COM security, digitalization, climate protection, energy, R&D, SIEMENS SUSTAINABILITY REPORT 2023 26

2.3 Partnerships and collaborations for sustainability We also support the goal of achieving a carbon-neutral have also joined the World Bank’s Carbon Pricing Leadership Europe by 2050, which was announced as part of the Euro- Coalition (CPLC), and we advocate for the global introduction pean Green Deal. We will achieve this through a variety of of carbon pricing. We are likewise committed to the UNGC commitments, including our active memberships in the Women’s Empowerment Principles and have signed the EUROPEAN ALLIANCE TO SAVE ENERGY and the EUROPEAN GREEN Diversity Charter, an initiative by the German government. DIGITAL COALITION. For over ten years we have supported One Young World We work closely with the Organization for Economic Cooper- (OYW), a non-profit organization that supports young busi- ation and Development (OECD), the United Nations (UN), ness leaders around the globe to build a better world with the European Union, and the World Economic Forum (WEF). more responsible, more effective leadership. At the 2023 Siemens participates in a number of WEF initiatives, including OYW Summit in Belfast, we championed this event by send- the WEF CEO Climate Leaders Coalition. We also cooperate ing more than 45 of our Siemens colleagues to participate. with the United Nations, for instance, as part of our commit- ment to the Ten Principles of the United Nations Global Siemens collaborates with numerous partners globally Compact (UNGC). On several environmental issues, we support across the topics of decarbonization and energy efficiency, the United Nations Framework Convention on Climate resource efficiency and circularity, and people-centricity and Change (UNFCCC) and the UN Climate Change Conferences, societal impact. Our selected strategic sustainability partner- and we are actively involved in the CEO Water Mandate. We ships are listed below. Partnership organization Description Decarbonization and energy efficiency The Climate Group The EV100 initiative expedites the shift to electric vehicles (EVs). Siemens intends for EVs to account for → EV100 100% of its fleet by 2030. We are also investing in the establishment of charging infrastructure in the → EP100 same timeframe. → RE100 EP100 brings together over 125 ambitious businesses committed to improving energy efficiency. Siemens is committed to owning only assets that are Net Zero carbon in operation and occupying only assets that are Net Zero carbon in operation by 2030. RE100 unites hundreds of ambitious companies committed to 100% renewable electricity. Siemens is committed to reaching this target by 2030. United Nations The United Nations Conference of Parties (COP) is the world’s highest decision-making body on climate → Conference of the Parties (COP) issues. COP connects stakeholders from politics, society, and business for discussions about the global path → Global Compact (UNGC) Working to Net Zero. COP provides a unique opportunity to showcase Siemens as a multiplier of change that Group on Climate empowers customers and societies to drive their sustainability transformation. The 28th session of the COP was held in Dubai, UAE in 2023. The United Nations Global Compact (UNGC) is the world’s largest corporate sustainability initiative. It calls for companies to align their strategies and operations with universal principles on human rights, labor, environment, and anti-corruption. Siemens is active in the UNGC’s Working Group on Climate. U.S. Department of Energy (DOE) Better Buildings is an Initiative of the U.S. Department of Energy (DOE) that is designed to improve the Better Buildings initiative lives of the American people by driving leadership in energy innovation. Siemens is an active participant in the initiative’s Better Climate Challenge. The World Bank Carbon Pricing The Carbon Pricing Leadership Coalition (CPLC) brings together leaders from government, the private Leadership Coalition (CPLC) sector, academia, and civil society to expand the use of carbon pricing policies. Siemens is a member of the coalition and actively advocates for the global introduction of carbon pricing. The World Economic Forum (WEF) The World Economic Forum (WEF) is the international organization for public-private cooperation. Siemens → Alliance for Clean Air is a founding member of the WEF Alliance for Clean Air, which brings together business leaders to measure → Alliance of CEO Climate Leaders and reduce value chain air pollutant emissions, invest in innovation, and work with policymak ers and → ESG Practitioners peers to champion the social, economic, and climate benefits of tackling air pollution. The WEF Alliance of CEO Climate Leaders is a CEO-led community committed to defining bold climate goals and accelerating the Net Zero transition by setting science-based targets, disclosing emissions, and catalyzing decarbonization and partnerships across global value chains. The WEF ESG Practitioners help implement the recommendations from the WEF Stakeholder Capitalism Metrics in reports. SIEMENS SUSTAINABILITY REPORT 2023 27

2.3 Partnerships and collaborations for sustainability Partnership organization Description Resource efficiency and circularity The European Union (EU) Business The EU Business and Biodiversity Platform provides a unique forum for dialog and a policy interface for and Biodiversity Platform discussing the links between business and biodiversity at the EU level. Siemens is an active member of the Platform. The European Union (EU) Circular The EU Circular Plastics Alliance aims to boost the EU market for recycled plastics. The Alliance covers the Plastics Alliance Declaration full plastics value chain and includes over 330 organizations representing industry, academia, and public authorities. Siemens is an active member of the Alliance. The Federation of German Industries The BDI Circular Economy Initiative is a network of about 60 organizations across the entire industrial (BDI) Circular Economy Initiative spectrum. Siemens is a founding member of the Circular Economy Initiative. Responsible Minerals Initiative The Responsible Minerals Initiative (RMI) is one of the most utilized and respected resources used by (RMI) companies in a variety of industries for addressing responsible minerals sourcing issues in their supply chains. Siemens is an active member of RMI and is involved in advancing the topic of responsible minerals sourcing at Siemens. Peoplecentricity and societal impact The European Union (EU) Agency for EU-OSHA is the EU’s information agency overseeing occupational safety and health at work. Siemens is a Safety and Health at Work (OSHA) partner of the EU-OSHA Healthy Workplaces Campaign and is committed to championing safe and healthy work in the digital age. Global Business Initiative (GBI) on The Global Business Initiative (GBI) works to shape practices, inspire commitment, and build the capability Human Rights for implementing respect for human rights, in line with the UN Guiding Principles on Business and Human Rights. Siemens is an active member of the Initiative. The International Organisation of The IOE GOSH is a network of more than 150 member organizations focused on improving occupational Employers (IOE) Global Occupational health and safety, providing forums to identify and, discuss emerging trends and international best practices. and Health Network (GOSH) Siemens is an active member of the Network. One Young World (OYW) One Young World (OYW) is a non-profit organization that empowers and develops young leaders to build a fair, sustainable future for all. Siemens has been an active partner of OYW for over a decade, with over 500 Siemens delegates having participated the annual OYW Summits since they began. United Nations Global Compact The United Nations Global Compact (UNGC) is the world’s largest corporate sustainability initiative. It calls (UNGC) European Working Group on for companies to align their strategies and operations with universal principles on human rights, labor, Business and Human Rights environment, and anti-corruption. Siemens is a member of the European Working Group on Business and Human Rights. G7 and the International Labour The Vision Zero Fund is an initiative of the G7 countries aimed at preventing work-related deaths, injuries, Organization (ILO) Vision Zero Fund and disease in sectors operating in or aspiring to join global supply chains. The ILO administers and imple- ments the fund’s projects. Siemens was the first private sector donor to join the fund. The World Economic Forum (WEF) The World Economic Forum (WEF) is the international organization for public-private cooperation. Siemens Chief Health Officer Group is an active member of the WEF Chief Health Officer Group, which works to advance the overall well-being of the workforce. Support for nonprofit organizations So far we have allocated about US$120 million to 85 projects in more than 50 countries across all funding that promote business integrity rounds. Information is available on the INTEGRITY INITIATIVE WEBSITE and the SIEMENS INTEGRITY and the fight against corruption INITIATIVE REPORT 2022. worldwide Crosstopic partnerships The Conference Board (TCB) The Conference Board (TCB) is a non-profit corporate membership and research organization that organizes conferences and peer learning groups, conducts economic and business research, and publishes economic indicators. Siemens is active in multiple TCB Councils on topics like corporate sustainability, the environment, and well-being. econsense Econsense is a German economic sustainability network whose members’ objective is to actively shape the transition to a more sustainable economy. Siemens is a founding member of econsense, member of the Board of Trustees and the Executive Board, and an active participant in working groups on Environment, Climate, Disclosure and Reporting, Business and Human Rights, and Human Rights in the Supply Chain. The World Business Council for The World Business Council for Sustainable Development (WBCSD) is a community of over 200 leading Sustainable Development (WBCSD) organizations that are working together to take action to limit the climate crisis, restore nature, and tackle inequality. Siemens has actively participated in a number of workstreams, including those focused on carbon accounting and reduction and the sustainable built environment. SIEMENS SUSTAINABILITY REPORT 2023 28

2.4 Sustainability ratings reflect our performance 2.4 Sustainability ratings reflect our performance – Our engagement is recognized in a number of ratings status and a B rating, the best rating in our industry (Industrial – These ratings help us continuously improve our Conglomerates). Prime status recognizes companies for sustainability performance being one of the leaders in their respective industry. – They also strengthen the comparability and trans parency of our sustainability performance for our Sustainalytics customers and investors Sustainalytics’ ESG Risk Ratings measure a company’s expo- sure to industry-specific material ESG risks and how well a company is managing those risks. In 2023, we were once Our approach to ESG ratings again rated as one of the leading companies in our industry We are proud that our commitment to sustainability and our (Industrial Conglomerates) with a risk rating of 28.4 points efforts are reflected in our public assessments and ratings. (Medium Risk). Siemens actively participates in several sustainability ratings to provide our capital markets and our customers with robust S&P Global Corporate Sustainability Assessment (CSA)/ information and support the comparability and transparency Dow Jones Sustainability Index (DJSI) of our sustainability performance. Ratings also give us The S&P Global CSA is an annual evaluation of companies’ important insights that assist in our continuous improvement. sustainability practices. The CSA focuses on sustainability We focus primarily on the six ratings summarized below. criteria that are both industry-specific and financially material. In fiscal 2023, Siemens again ranks second among our Siemens continues to achieve strong results in external industry peers (Industrial Conglomerates) with a score of sustainability ratings in fiscal 2023, confirming our leading 81/100. Siemens has been listed in the Dow Jones Sustain- position in the industry. ability World Index (DJSI World) for over 20 years. ESG ratings in fiscal 2023 EcoVadis MSCI EcoVadis provides supplier sustainability ratings for global The MSCI ESG Rating scores global companies on a scale of supply chains. Siemens received 77 points on its scorecard in AAA (leader) to CCC (laggard) based on exposure to industry- 2023, placing it among the top 1% of all companies assessed specific ESG risks and the ability to manage those risks rela- by EcoVadis in our industry. Thanks to this rating, Siemens is tive to peers. In fiscal 2023, Siemens was given an overall being awarded the EcoVadis Gold medal. MSCI ESG rating score of AA. In addition, Siemens is a member of the MSCI World ESG Index. CDP CDP is a not-for-profit charity that runs a global disclosure ISS ESG system that helps investors, companies, cities, states, and The ISS ESG Corporate Rating evaluates companies’ ESG- regions manage their environmental impacts. In the most related risks, opportunities, and impacts along the corporate recent CDP Climate Change Rating, Siemens’ climate efforts value chain. Companies are rated from D- to A+ on their continue to be recognized with the rating score A-, which sustainability performance based on an absolute best-in- maintains its position at the Leadership Level of the CDP class standard. For ISS ESG, Siemens again received prime rating. SIEMENS SUSTAINABILITY REPORT 2023 29

2.4 Sustainability ratings reflect our performance Siemens’ sustainability performance has received high recognition in external ratings External sustainability ratings Latest Siemens AA B- 28.4 81/100 77 A- score Siemens Top in industry st industry rank Leader 1 in our industry Top 15% Top 1% Top 1% (industry average C-) Progress from Improvement previous Unchanged Unchanged of 1.7 points Unchanged +7 points Unchanged assessment Strong “Carbon – Over 10 years Highlights Leader (AAA/AA) Prime status Products and Over 20 years in Gold medal at leadership for 7 years Services” risk the World Index level (A/A-) for management Climate Change Siemens has also satisfied the requirements to be included in several additional ESG stock market indices Additional Included in the Included in the ESG indices FTSE4Good Index Series Euronext Vigeo Euro 120 Index SIEMENS SUSTAINABILITY REPORT 2023 30

Pages 31 – 53 Governance Responsible Business Practices Ethics Governance Foster a culture of trust, adhere to ethical standards, Apply state-of-the-art systems for effective and and handle data with care responsible business conduct 1 1 Our key ambitions Our key ambitions → Striving to train 100% of our people on Siemens’ → ESG-secured supply chain based on supplier Business Conduct Guidelines every three years commitment to the Supplier Code of Conduct → Long-term incentives based on ESG criteria2 Additional highlights: → Zero-tolerance approach to breaches of applicable Additional highlights laws and our own internal guidelines → Focus on human rights within supply chain: climate → A global, risk-based compliance system protection, occupational safety, and responsible → Aiming for a leading role in cybersecurity sourcing of minerals → Comprehensive environmental and social due diligence in customer business (ESG Radar) 1 Siemens without SHS. 2 Assessment based on the Siemens internal ESG/sustainability index, which is based on customer satisfaction (Net Promoter Score), CO reduction, and digital learning hours. 2 SIEMENS SUSTAINABILITY REPORT 2023 31