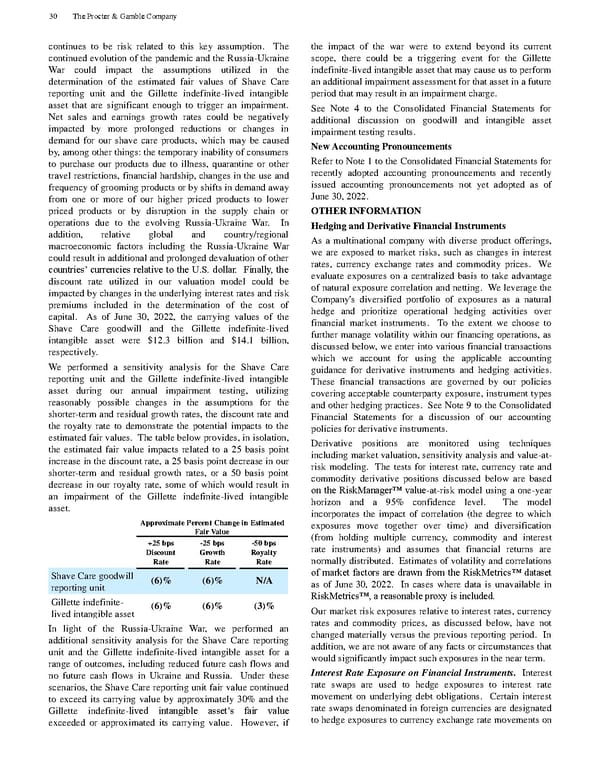

continues to be risk related to this key assumption. The continued evolution of the pandemic and the Russia - Ukraine War could impact the assumptions utilized in the determination of the estimated fair values of S have Care reporting unit and the Gillette indefinite - lived intangible asset that are significant enough to trigger an impairment. Net sales and earnings growth rates could be negatively impacted by more prolonged reductions or changes in demand for our sh ave care products, which may be caused by, among other things: the temporary inability of consumers to purchase our products due to illness, quarantine or other travel restrictions, financial hardship, changes in the use and frequency of grooming products or by shifts in demand away from one or more of our higher priced products to lower priced products or by disruption in the supply chain or operations due to the evolving Russia - Ukraine War. In addition, relative global and country/regional macroeconomic factors including the Russia - Ukraine War could result in additional and prolonged devaluation of other countries’ currencies relative to the U.S. dollar. Finally, the discount rate utilized in our valuation model could be impacted by changes in the underl ying interest rates and risk premiums included in the determination of the cost of capital. As of June 30, 2022, the carrying values of the Shave Care goodwill and the Gillette indefinite - lived intangible asset were $12.3 billion and $14.1 billion, respec tively. We performed a sensitivity analysis for the Shave Care reporting unit and the Gillette indefinite - lived intangible asset during our annual impairment testing, utilizing reasonably possible changes in the assumptions for the shorter - term and resid ual growth rates, the discount rate and the royalty rate to demonstrate the potential impacts to the estimated fair values. The table below provides, in isolation, the estimated fair value impacts related to a 25 basis point increase in the discount rate, a 25 basis point decrease in our shorter - term and residual growth rates, or a 50 basis point decrease in our royalty rate, some of which would result in an impairment of the Gillette indefinite - lived intangible asset. Approximate Percent Change in Estim ated Fair Value +25 bps Discount Rate - 25 bps Growth Rate - 50 bps Royalty Rate Shave Care goodwill reporting unit (6)% (6)% N/A Gillette indefinite - lived intangible asset (6)% (6)% (3)% In light of the Russia - Ukraine War, we performed an additional sensitivity analysis for the Shave Care reporting unit and the Gillette indefinite - lived intangible asset for a range of outcomes, including reduced future cash flows and no future cash flows i n Ukraine and Russia. Under these scenarios, the Shave Care reporting unit fair value continued to exceed its carrying value by approximately 30% and the Gillette indefinite - lived intangible asset’s fair value exceeded or approximated its carrying value. However, if the impact of the war were to extend beyond its current scope, there could be a triggering event for the Gillette indefinite - lived intangible asset that may cause us to perform an additional impairment assessment for that asset in a future per iod that may result in an impairment charge. See Note 4 to the Consolidated Financial Statements for additional discussion on goodwill and intangible asset impairment testing results. New Accounting Pronouncements Refer to Note 1 to the Consolidated Financ ial Statements for recently adopted accounting pronouncements and recently issued accounting pronouncements not yet adopted as of June 30, 2022. OTHER INFORMATION Hedging and Derivative Financial Instruments As a multinational company with diverse product offerings, we are exposed to market risks, such as changes in interest rates, currency exchange rates and commodity prices. We evaluate exposures on a centralized basis to take advantage of natural exposure correlation and netting. We leverage th e Company's diversified portfolio of exposures as a natural hedge and prioritize operational hedging activities over financial market instruments. To the extent we choose to further manage volatility within our financing operations, as discussed below, we enter into various financial transactions which we account for using the applicable accounting guidance for derivative instruments and hedging activities. These financial transactions are governed by our policies covering acceptable counterparty exposure , instrument types and other hedging practices. See Note 9 to the Consolidated Financial Statements for a discussion of our accounting policies for derivative instruments. Derivative positions are monitored using techniques including market valuation, sen sitivity analysis and value - at - risk modeling. The tests for interest rate, currency rate and commodity derivative positions discussed below are based on the RiskManager™ value - at - risk model using a one - year horizon and a 95% confidence level. The model i ncorporates the impact of correlation (the degree to which exposures move together over time) and diversification (from holding multiple currency, commodity and interest rate instruments) and assumes that financial returns are normally distributed. Estima tes of volatility and correlations of market factors are drawn from the RiskMetrics™ dataset as of June 30, 2022. In cases where data is unavailable in RiskMetrics™, a reasonable proxy is included. Our market risk exposures relative to interest rates, cur rency rates and commodity prices, as discussed below, have not changed materially versus the previous reporting period. In addition, we are not aware of any facts or circumstances that would significantly impact such exposures in the near term. Interest R ate Exposure on Financial Instruments. Interest rate swaps are used to hedge exposures to interest rate movement on underlying debt obligations. Certain interest rate swaps denominated in foreign currencies are designated to hedge exposures to currency e xchange rate movements on 30 The Procter & Gamble Company

The Procter & Gamble Annual Report Page 41 Page 43

The Procter & Gamble Annual Report Page 41 Page 43