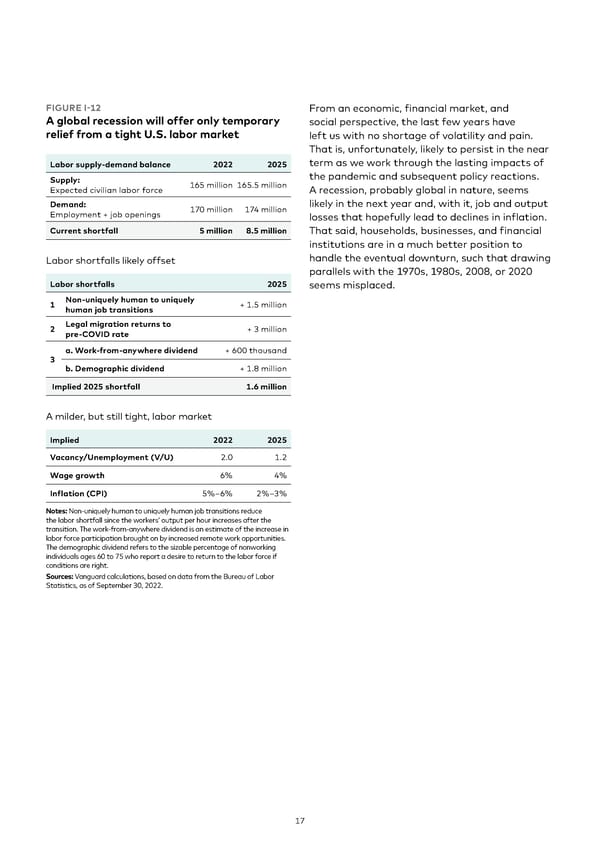

FIGURE I-12 From an economic, financial market, and A global recession will offer only temporary social perspective, the last few years have relief from a tight U.S. labor market left us with no shortage of volatility and pain. That is, unfortunately, likely to persist in the near Labor supply-demand balance 2022 2025 term as we work through the lasting impacts of Supply: the pandemic and subsequent policy reactions. Expected civilian labor force 165 million 165.5 million A recession, probably global in nature, seems Demand: 170 million 174 million likely in the next year and, with it, job and output Employment + job openings losses that hopefully lead to declines in inflation. Current shortfall 5 million 8.5 million That said, households, businesses, and financial institutions are in a much better position to Labor shortfalls likely offset handle the eventual downturn, such that drawing parallels with the 1970s, 1980s, 2008, or 2020 Labor shortfalls 2025 seems misplaced. 1 Non-uniquely human to uniquely + 1.5 million human job transitions 2 Legal migration returns to + 3 million pre-COVID rate a. Work-from-anywhere dividend + 600 thousand 3 b. Demographic dividend + 1.8 million Implied 2025 shortfall 1.6 million A milder, but still tight, labor market Implied 2022 2025 Vacancy/Unemployment (V/U) 2.0 1.2 Wage growth 6% 4% Inflation (CPI) 5%–6% 2%–3% Notes: Non-uniquely human to uniquely human job transitions reduce the labor shortfall since the workers’ output per hour increases after the transition. The work-from-anywhere dividend is an estimate of the increase in labor force participation brought on by increased remote work opportunities. The demographic dividend refers to the sizable percentage of nonworking individuals ages 60 to 75 who report a desire to return to the labor force if conditions are right. Sources: Vanguard calculations, based on data from the Bureau of Labor Statistics, as of September 30, 2022. 17

Vanguard economic and market outlook for 2023 Page 16 Page 18

Vanguard economic and market outlook for 2023 Page 16 Page 18