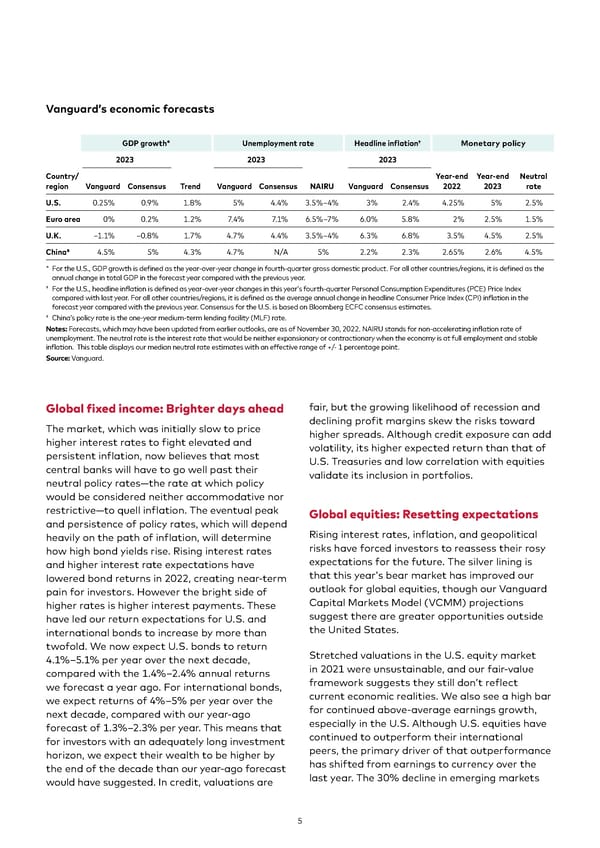

Vanguard’s economic forecasts GDP growth* Unemployment rate Headline inflation† Monetary policy 2023 2023 2023 Country/ Year-end Year-end Neutral region Vanguard Consensus Trend Vanguard Consensus NAIRU Vanguard Consensus 2022 2023 rate U.S. 0.25% 0.9% 1.8% 5% 4.4% 3.5%–4% 3% 2.4% 4.25% 5% 2.5% Euro area 0% 0.2% 1.2% 7.4% 7.1% 6.5%–7% 6.0% 5.8% 2% 2.5% 1.5% U.K. –1.1% –0.8% 1.7% 4.7% 4.4% 3.5%–4% 6.3% 6.8% 3.5% 4.5% 2.5% China‡ 4.5% 5% 4.3% 4.7% N/A 5% 2.2% 2.3% 2.65% 2.6% 4.5% * For the U.S., GDP growth is defined as the year-over-year change in fourth-quarter gross domestic product. For all other countries/regions, it is defined as the annual change in total GDP in the forecast year compared with the previous year. † For the U.S., headline inflation is defined as year-over-year changes in this year’s fourth-quarter Personal Consumption Expenditures (PCE) Price Index compared with last year. For all other countries/regions, it is defined as the average annual change in headline Consumer Price Index (CPI) inflation in the forecast year compared with the previous year. Consensus for the U.S. is based on Bloomberg ECFC consensus estimates. ‡ China’s policy rate is the one-year medium-term lending facility (MLF) rate. Notes: Forecasts, which may have been updated from earlier outlooks, are as of November 30, 2022. NAIRU stands for non-accelerating inflation rate of unemployment. The neutral rate is the interest rate that would be neither expansionary or contractionary when the economy is at full employment and stable inflation. This table displays our median neutral rate estimates with an effective range of +/- 1 percentage point. Source: Vanguard. Global fixed income: Brighter days ahead fair, but the growing likelihood of recession and The market, which was initially slow to price declining profit margins skew the risks toward higher interest rates to fight elevated and higher spreads. Although credit exposure can add persistent inflation, now believes that most volatility, its higher expected return than that of central banks will have to go well past their U.S. Treasuries and low correlation with equities neutral policy rates—the rate at which policy validate its inclusion in portfolios. would be considered neither accommodative nor restrictive—to quell inflation. The eventual peak Global equities: Resetting expectations and persistence of policy rates, which will depend heavily on the path of inflation, will determine Rising interest rates, inflation, and geopolitical how high bond yields rise. Rising interest rates risks have forced investors to reassess their rosy and higher interest rate expectations have expectations for the future. The silver lining is lowered bond returns in 2022, creating near-term that this year’s bear market has improved our pain for investors. However the bright side of outlook for global equities, though our Vanguard higher rates is higher interest payments. These Capital Markets Model (VCMM) projections have led our return expectations for U.S. and suggest there are greater opportunities outside international bonds to increase by more than the United States. twofold. We now expect U.S. bonds to return Stretched valuations in the U.S. equity market 4.1%–5.1% per year over the next decade, in 2021 were unsustainable, and our fair-value compared with the 1.4%–2.4% annual returns framework suggests they still don’t reflect we forecast a year ago. For international bonds, current economic realities. We also see a high bar we expect returns of 4%–5% per year over the for continued above-average earnings growth, next decade, compared with our year-ago especially in the U.S. Although U.S. equities have forecast of 1.3%–2.3% per year. This means that continued to outperform their international for investors with an adequately long investment peers, the primary driver of that outperformance horizon, we expect their wealth to be higher by has shifted from earnings to currency over the the end of the decade than our year-ago forecast last year. The 30% decline in emerging markets would have suggested. In credit, valuations are 5

Vanguard economic and market outlook for 2023 Page 4 Page 6

Vanguard economic and market outlook for 2023 Page 4 Page 6