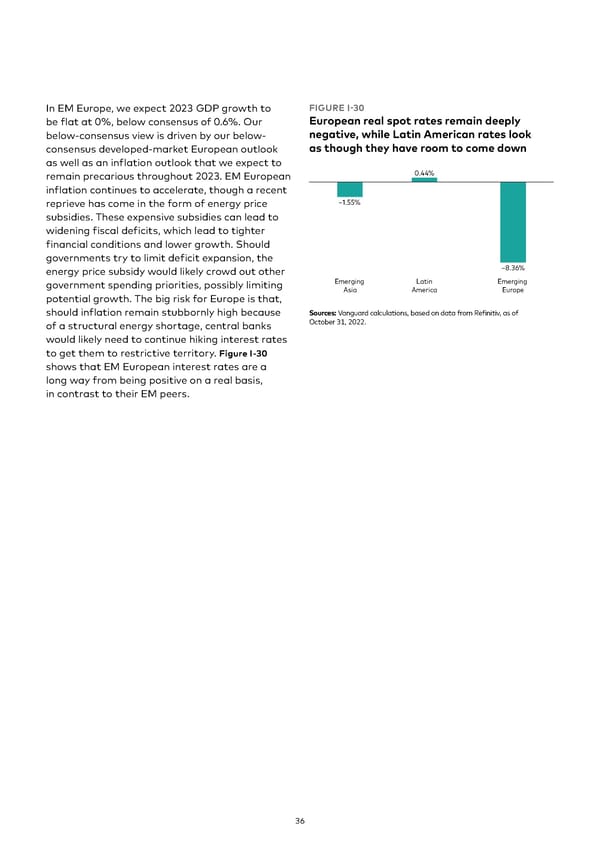

In EM Europe, we expect 2023 GDP growth to FIGURE I-30 be flat at 0%, below consensus of 0.6%. Our European real spot rates remain deeply below-consensus view is driven by our below- negative, while Latin American rates look consensus developed-market European outlook as though they have room to come down as well as an inflation outlook that we expect to remain precarious throughout 2023. EM European 0.44% inflation continues to accelerate, though a recent reprieve has come in the form of energy price –1.55% subsidies. These expensive subsidies can lead to widening fiscal deficits, which lead to tighter financial conditions and lower growth. Should governments try to limit deficit expansion, the energy price subsidy would likely crowd out other –8.36% government spending priorities, possibly limiting Emerging Latin Emerging potential growth. The big risk for Europe is that, Asia America Europe should inflation remain stubbornly high because Sources: Vanguard calculations, based on data from Refinitiv, as of of a structural energy shortage, central banks October 31, 2022. would likely need to continue hiking interest rates to get them to restrictive territory. Figure I-30 shows that EM European interest rates are a long way from being positive on a real basis, in contrast to their EM peers. 36

Vanguard economic and market outlook for 2023 Page 35 Page 37

Vanguard economic and market outlook for 2023 Page 35 Page 37