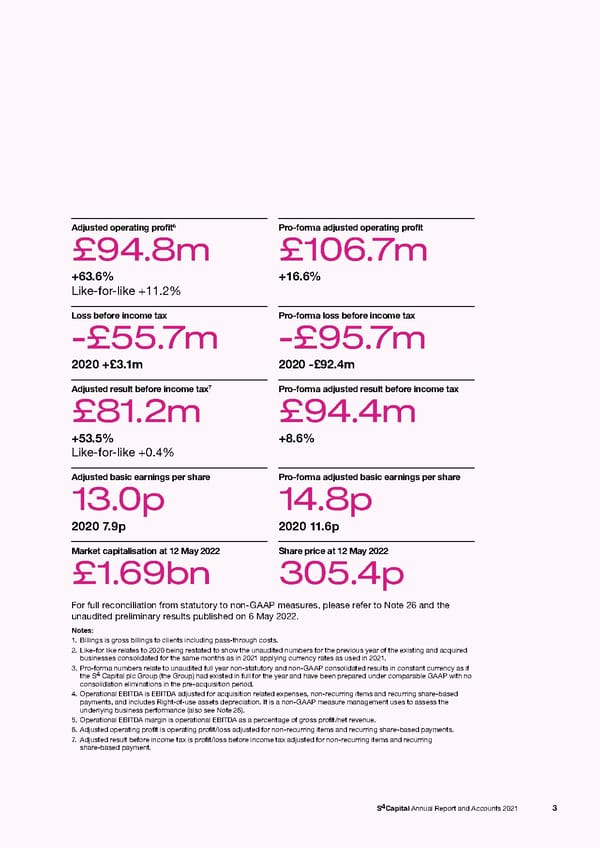

Adjusted operating profit6 Pro-forma adjusted operating profit £94.8m £106.7m +63.6% +16.6% Like-for-like +11.2% Loss before income tax Pro-forma loss before income tax -£55.7m -£95.7m 2020 +£3.1m 2020 -£92.4m 7 Adjusted result before income tax Pro-forma adjusted result before income tax £81.2m £94.4m +53.5% +8.6% Like-for-like +0.4% Adjusted basic earnings per share Pro-forma adjusted basic earnings per share 13.0p 14.8p 2020 7.9p 2020 11.6p Market capitalisation at 12 May 2022 Share price at 12 May 2022 £1.69bn 305.4p For full reconciliation from statutory to non-GAAP measures, please refer to Note 26 and the unaudited preliminary results published on 6 May 2022. Notes: 1. Billings is gross billings to clients including pass-through costs. 2. Like-for like relates to 2020 being restated to show the unaudited numbers for the previous year of the existing and acquired businesses consolidated for the same months as in 2021 applying currency rates as used in 2021. 3. Pro-forma numbers relate to unaudited full year non-statutory and non-GAAP consolidated results in constant currency as if 4 the S Capital plc Group (the Group) had existed in full for the year and have been prepared under comparable GAAP with no consolidation eliminations in the pre-acquisition period. 4. Operational EBITDA is EBITDA adjusted for acquisition related expenses, non-recurring items and recurring share-based payments, and includes Right-of-use assets depreciation. It is a non-GAAP measure management uses to assess the underlying business performance (also see Note 26). 5. Operational EBITDA margin is operational EBITDA as a percentage of gross profit/net revenue. 6. Adjusted operating profit is operating profit/loss adjusted for non-recurring items and recurring share-based payments. 7. Adjusted result before income tax is profit/loss before income tax adjusted for non-recurring items and recurring share-based payment. S4Capital Annual Report and Accounts 2021 3

s4 capital annual report and accounts 2021 Page 4 Page 6

s4 capital annual report and accounts 2021 Page 4 Page 6