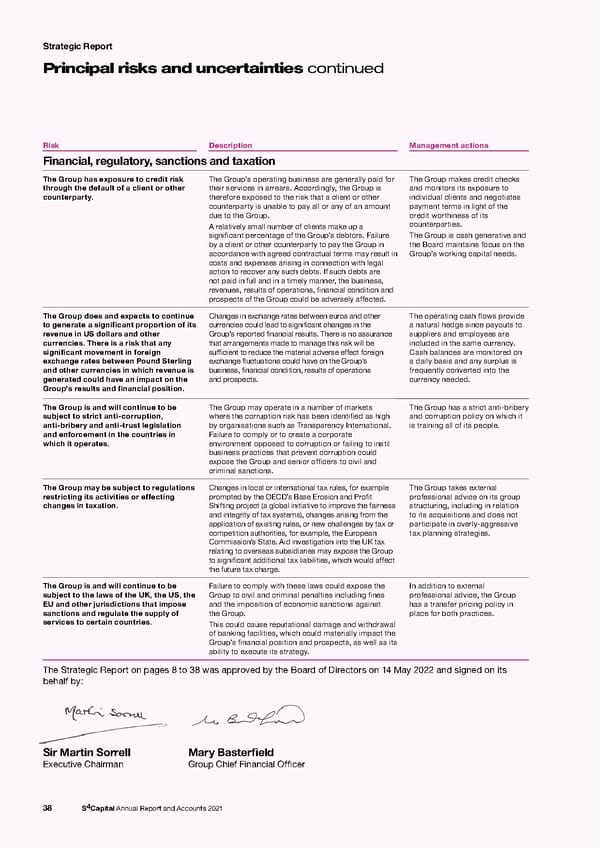

Strategic Report Principal risks and uncertainties continued Risk Description Management actions Financial, regulatory, sanctions and taxation The Group has exposure to credit risk The Group’s operating business are generally paid for The Group makes credit checks through the default of a client or other their services in arrears. Accordingly, the Group is and monitors its exposure to counterparty. therefore exposed to the risk that a client or other individual clients and negotiates counterparty is unable to pay all or any of an amount payment terms in light of the due to the Group. credit worthiness of its A relatively small number of clients make up a counterparties. significant percentage of the Group’s debtors. Failure The Group is cash generative and by a client or other counterparty to pay the Group in the Board maintains focus on the accordance with agreed contractual terms may result in Group’s working capital needs. costs and expenses arising in connection with legal action to recover any such debts. If such debts are not paid in full and in a timely manner, the business, revenues, results of operations, financial condition and prospects of the Group could be adversely affected. The Group does and expects to continue Changes in exchange rates between euros and other The operating cash flows provide to generate a significant proportion of its currencies could lead to significant changes in the a natural hedge since payouts to revenue in US dollars and other Group’s reported financial results. There is no assurance suppliers and employees are currencies. There is a risk that any that arrangements made to manage this risk will be included in the same currency. significant movement in foreign sufficient to reduce the material adverse effect foreign Cash balances are monitored on exchange rates between Pound Sterling exchange fluctuations could have on the Group's a daily basis and any surplus is and other currencies in which revenue is business, financial condition, results of operations frequently converted into the generated could have an impact on the and prospects. currency needed. Group's results and financial position. The Group is and will continue to be The Group may operate in a number of markets The Group has a strict anti-bribery subject to strict anti-corruption, where the corruption risk has been identified as high and corruption policy on which it anti-bribery and anti-trust legislation by organisations such as Transparency International. is training all of its people. and enforcement in the countries in Failure to comply or to create a corporate which it operates. environment opposed to corruption or failing to instil business practices that prevent corruption could expose the Group and senior officers to civil and criminal sanctions. The Group may be subject to regulations Changes in local or international tax rules, for example The Group takes external restricting its activities or effecting prompted by the OECD’s Base Erosion and Profit professional advice on its group changes in taxation. Shifting project (a global initiative to improve the fairness structuring, including in relation and integrity of tax systems), changes arising from the to its acquisitions and does not application of existing rules, or new challenges by tax or participate in overly-aggressive competition authorities, for example, the European tax planning strategies. Commission’s State. Aid investigation into the UK tax relating to overseas subsidiaries may expose the Group to significant additional tax liabilities, which would affect the future tax charge. The Group is and will continue to be Failure to comply with these laws could expose the In addition to external subject to the laws of the UK, the US, the Group to civil and criminal penalties including fines professional advice, the Group EU and other jurisdictions that impose and the imposition of economic sanctions against has a transfer pricing policy in sanctions and regulate the supply of the Group. place for both practices. services to certain countries. This could cause reputational damage and withdrawal of banking facilities, which could materially impact the Group’s financial position and prospects, as well as its ability to execute its strategy. The Strategic Report on pages 8 to 38 was approved by the Board of Directors on 14 May 2022 and signed on its behalf by: Sir Martin Sorrell Mary Basterfield Executive Chairman Group Chief Financial Officer 38 S4Capital Annual Report and Accounts 2021

s4 capital annual report and accounts 2021 Page 39 Page 41

s4 capital annual report and accounts 2021 Page 39 Page 41