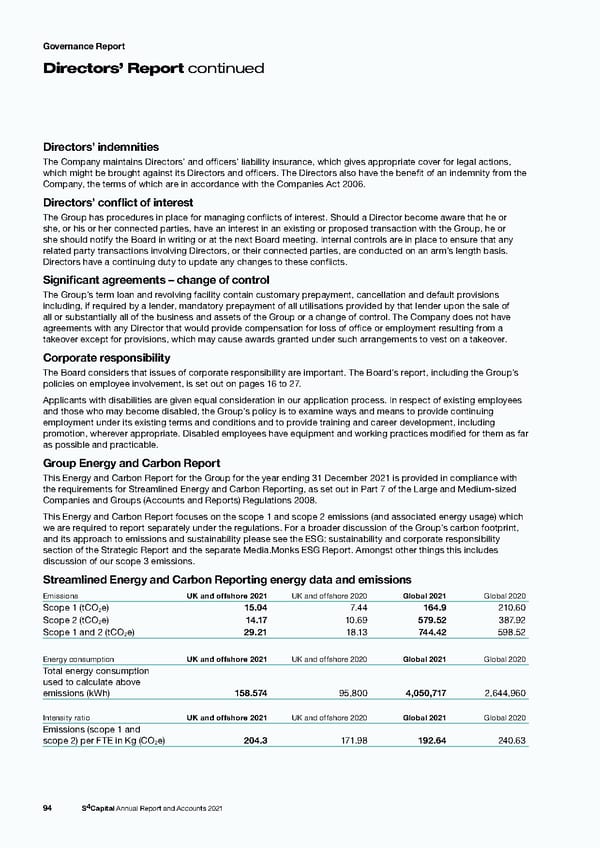

Governance Report Directors’ Report continued Directors’ indemnities The Company maintains Directors’ and officers’ liability insurance, which gives appropriate cover for legal actions, which might be brought against its Directors and officers. The Directors also have the benefit of an indemnity from the Company, the terms of which are in accordance with the Companies Act 2006. Directors’ conflict of interest The Group has procedures in place for managing conflicts of interest. Should a Director become aware that he or she, or his or her connected parties, have an interest in an existing or proposed transaction with the Group, he or she should notify the Board in writing or at the next Board meeting. Internal controls are in place to ensure that any related party transactions involving Directors, or their connected parties, are conducted on an arm’s length basis. Directors have a continuing duty to update any changes to these conflicts. Significant agreements – change of control The Group’s term loan and revolving facility contain customary prepayment, cancellation and default provisions including, if required by a lender, mandatory prepayment of all utilisations provided by that lender upon the sale of all or substantially all of the business and assets of the Group or a change of control. The Company does not have agreements with any Director that would provide compensation for loss of office or employment resulting from a takeover except for provisions, which may cause awards granted under such arrangements to vest on a takeover. Corporate responsibility The Board considers that issues of corporate responsibility are important. The Board’s report, including the Group’s policies on employee involvement, is set out on pages 16 to 27. Applicants with disabilities are given equal consideration in our application process. In respect of existing employees and those who may become disabled, the Group’s policy is to examine ways and means to provide continuing employment under its existing terms and conditions and to provide training and career development, including promotion, wherever appropriate. Disabled employees have equipment and working practices modified for them as far as possible and practicable. Group Energy and Carbon Report This Energy and Carbon Report for the Group for the year ending 31 December 2021 is provided in compliance with the requirements for Streamlined Energy and Carbon Reporting, as set out in Part 7 of the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008. This Energy and Carbon Report focuses on the scope 1 and scope 2 emissions (and associated energy usage) which we are required to report separately under the regulations. For a broader discussion of the Group’s carbon footprint, and its approach to emissions and sustainability please see the ESG: sustainability and corporate responsibility section of the Strategic Report and the separate Media.Monks ESG Report. Amongst other things this includes discussion of our scope 3 emissions. Streamlined Energy and Carbon Reporting energy data and emissions Emissions UK and offshore 2021 UK and offshore 2020 Global 2021 Global 2020 Scope 1 (tCO2e) 15.04 7.44 164.9 210.60 Scope 2 (tCO2e) 14.17 10.69 579.52 387.92 Scope 1 and 2 (tCO2e) 29.21 18.13 744.42 598.52 Energy consumption UK and offshore 2021 UK and offshore 2020 Global 2021 Global 2020 Total energy consumption used to calculate above emissions (kWh) 158.574 95,800 4,050,717 2,644,960 Intensity ratio UK and offshore 2021 UK and offshore 2020 Global 2021 Global 2020 Emissions (scope 1 and scope 2) per FTE in Kg (CO2e) 204.3 171.98 192.64 240.63 94 S4Capital Annual Report and Accounts 2021

s4 capital annual report and accounts 2021 Page 95 Page 97

s4 capital annual report and accounts 2021 Page 95 Page 97