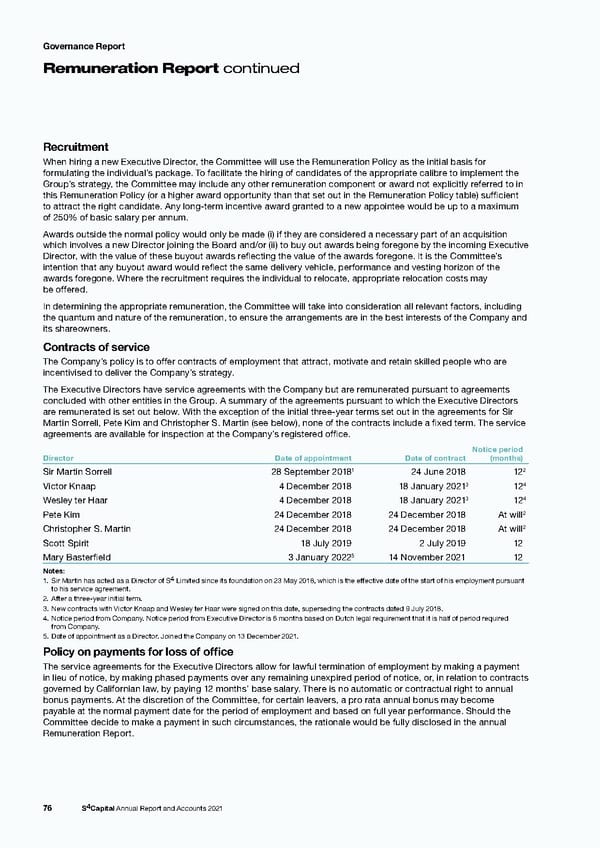

Governance Report Remuneration Report continued Recruitment When hiring a new Executive Director, the Committee will use the Remuneration Policy as the initial basis for formulating the individual’s package. To facilitate the hiring of candidates of the appropriate calibre to implement the Group’s strategy, the Committee may include any other remuneration component or award not explicitly referred to in this Remuneration Policy (or a higher award opportunity than that set out in the Remuneration Policy table) sufficient to attract the right candidate. Any long-term incentive award granted to a new appointee would be up to a maximum of 250% of basic salary per annum. Awards outside the normal policy would only be made (i) if they are considered a necessary part of an acquisition which involves a new Director joining the Board and/or (ii) to buy out awards being foregone by the incoming Executive Director, with the value of these buyout awards reflecting the value of the awards foregone. It is the Committee’s intention that any buyout award would reflect the same delivery vehicle, performance and vesting horizon of the awards foregone. Where the recruitment requires the individual to relocate, appropriate relocation costs may be offered. In determining the appropriate remuneration, the Committee will take into consideration all relevant factors, including the quantum and nature of the remuneration, to ensure the arrangements are in the best interests of the Company and its shareowners. Contracts of service The Company’s policy is to offer contracts of employment that attract, motivate and retain skilled people who are incentivised to deliver the Company’s strategy. The Executive Directors have service agreements with the Company but are remunerated pursuant to agreements concluded with other entities in the Group. A summary of the agreements pursuant to which the Executive Directors are remunerated is set out below. With the exception of the initial three-year terms set out in the agreements for Sir Martin Sorrell, Pete Kim and Christopher S. Martin (see below), none of the contracts include a fixed term. The service agreements are available for inspection at the Company’s registered office. Notice period Director Date of appointment Date of contract (months) 1 2 Sir Martin Sorrell 28 September 2018 24 June 2018 12 3 4 Victor Knaap 4 December 2018 18 January 2021 12 3 4 Wesley ter Haar 4 December 2018 18 January 2021 12 Pete Kim 24 December 2018 24 December 2018 At will2 Christopher S. Martin 24 December 2018 24 December 2018 At will2 Scott Spirit 18 July 2019 2 July 2019 12 5 Mary Basterfield 3 January 2022 14 November 2021 12 Notes: 4 1. Sir Martin has acted as a Director of S Limited since its foundation on 23 May 2018, which is the effective date of the start of his employment pursuant to his service agreement. 2. After a three-year initial term. 3. New contracts with Victor Knaap and Wesley ter Haar were signed on this date, superseding the contracts dated 9 July 2018. 4. Notice period from Company. Notice period from Executive Director is 6 months based on Dutch legal requirement that it is half of period required from Company. 5. Date of appointment as a Director. Joined the Company on 13 December 2021. Policy on payments for loss of office The service agreements for the Executive Directors allow for lawful termination of employment by making a payment in lieu of notice, by making phased payments over any remaining unexpired period of notice, or, in relation to contracts governed by Californian law, by paying 12 months’ base salary. There is no automatic or contractual right to annual bonus payments. At the discretion of the Committee, for certain leavers, a pro rata annual bonus may become payable at the normal payment date for the period of employment and based on full year performance. Should the Committee decide to make a payment in such circumstances, the rationale would be fully disclosed in the annual Remuneration Report. 76 S4Capital Annual Report and Accounts 2021

s4 capital annual report and accounts 2021 Page 77 Page 79

s4 capital annual report and accounts 2021 Page 77 Page 79