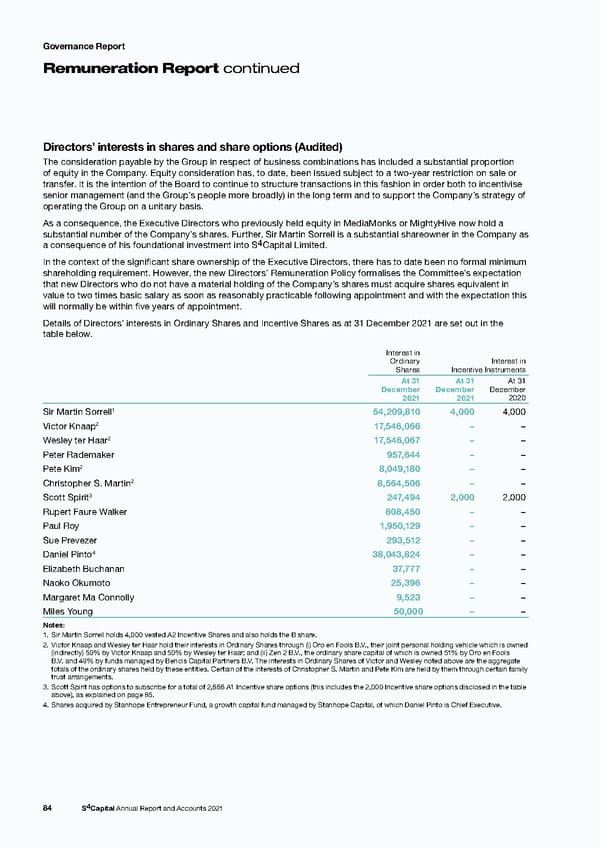

Governance Report Remuneration Report continued Directors’ interests in shares and share options (Audited) The consideration payable by the Group in respect of business combinations has included a substantial proportion of equity in the Company. Equity consideration has, to date, been issued subject to a two-year restriction on sale or transfer. It is the intention of the Board to continue to structure transactions in this fashion in order both to incentivise senior management (and the Group’s people more broadly) in the long term and to support the Company’s strategy of operating the Group on a unitary basis. As a consequence, the Executive Directors who previously held equity in MediaMonks or MightyHive now hold a substantial number of the Company’s shares. Further, Sir Martin Sorrell is a substantial shareowner in the Company as a consequence of his foundational investment into S4Capital Limited. In the context of the significant share ownership of the Executive Directors, there has to date been no formal minimum shareholding requirement. However, the new Directors’ Remuneration Policy formalises the Committee’s expectation that new Directors who do not have a material holding of the Company’s shares must acquire shares equivalent in value to two times basic salary as soon as reasonably practicable following appointment and with the expectation this will normally be within five years of appointment. Details of Directors’ interests in Ordinary Shares and Incentive Shares as at 31 December 2021 are set out in the table below. Interest in Ordinary Interest in Shares Incentive Instruments At 31 At 31 At 31 December December December 2021 2021 2020 1 Sir Martin Sorrell 54,209,810 4,000 4,000 2 Victor Knaap 17,546,066 – – Wesley ter Haar2 17,546,067 – – Peter Rademaker 957,644 – – Pete Kim2 8,049,180 – – 2 8,564,506 – – Christopher S. Martin 3 Scott Spirit 247,494 2,000 2,000 Rupert Faure Walker 808,450 – – Paul Roy 1,950,129 – – Sue Prevezer 293,512 – – Daniel Pinto4 38,043,824 – – Elizabeth Buchanan 37,777 – – Naoko Okumoto 25,396 – – Margaret Ma Connolly 9,523 – – Miles Young 50,000 – – Notes: 1. Sir Martin Sorrell holds 4,000 vested A2 Incentive Shares and also holds the B share. 2. Victor Knaap and Wesley ter Haar hold their interests in Ordinary Shares through (i) Oro en Fools B.V., their joint personal holding vehicle which is owned (indirectly) 50% by Victor Knaap and 50% by Wesley ter Haar; and (ii) Zen 2 B.V., the ordinary share capital of which is owned 51% by Oro en Fools B.V. and 49% by funds managed by Bencis Capital Partners B.V. The interests in Ordinary Shares of Victor and Wesley noted above are the aggregate totals of the ordinary shares held by these entities. Certain of the interests of Christopher S. Martin and Pete Kim are held by them through certain family trust arrangements. 3. Scott Spirit has options to subscribe for a total of 2,666 A1 Incentive share options (this includes the 2,000 Incentive share options disclosed in the table above), as explained on page 85. 4. Shares acquired by Stanhope Entrepreneur Fund, a growth capital fund managed by Stanhope Capital, of which Daniel Pinto is Chief Executive. 84 S4Capital Annual Report and Accounts 2021

s4 capital annual report and accounts 2021 Page 85 Page 87

s4 capital annual report and accounts 2021 Page 85 Page 87