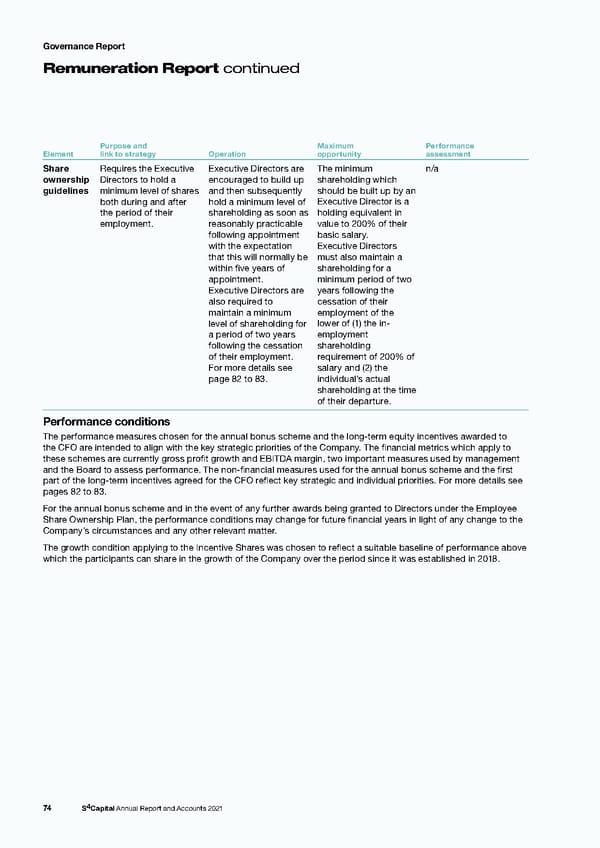

Governance Report Remuneration Report continued Purpose and Maximum Performance Element link to strategy Operation opportunity assessment Share Requires the Executive Executive Directors are The minimum n/a ownership Directors to hold a encouraged to build up shareholding which guidelines minimum level of shares and then subsequently should be built up by an both during and after hold a minimum level of Executive Director is a the period of their shareholding as soon as holding equivalent in employment. reasonably practicable value to 200% of their following appointment basic salary. with the expectation Executive Directors that this will normally be must also maintain a within five years of shareholding for a appointment. minimum period of two Executive Directors are years following the also required to cessation of their maintain a minimum employment of the level of shareholding for lower of (1) the in- a period of two years employment following the cessation shareholding of their employment. requirement of 200% of For more details see salary and (2) the page 82 to 83. individual’s actual shareholding at the time of their departure. Performance conditions The performance measures chosen for the annual bonus scheme and the long-term equity incentives awarded to the CFO are intended to align with the key strategic priorities of the Company. The financial metrics which apply to these schemes are currently gross profit growth and EBITDA margin, two important measures used by management and the Board to assess performance. The non-financial measures used for the annual bonus scheme and the first part of the long-term incentives agreed for the CFO reflect key strategic and individual priorities. For more details see pages 82 to 83. For the annual bonus scheme and in the event of any further awards being granted to Directors under the Employee Share Ownership Plan, the performance conditions may change for future financial years in light of any change to the Company’s circumstances and any other relevant matter. The growth condition applying to the Incentive Shares was chosen to reflect a suitable baseline of performance above which the participants can share in the growth of the Company over the period since it was established in 2018. 74 S4Capital Annual Report and Accounts 2021

s4 capital annual report and accounts 2021 Page 75 Page 77

s4 capital annual report and accounts 2021 Page 75 Page 77