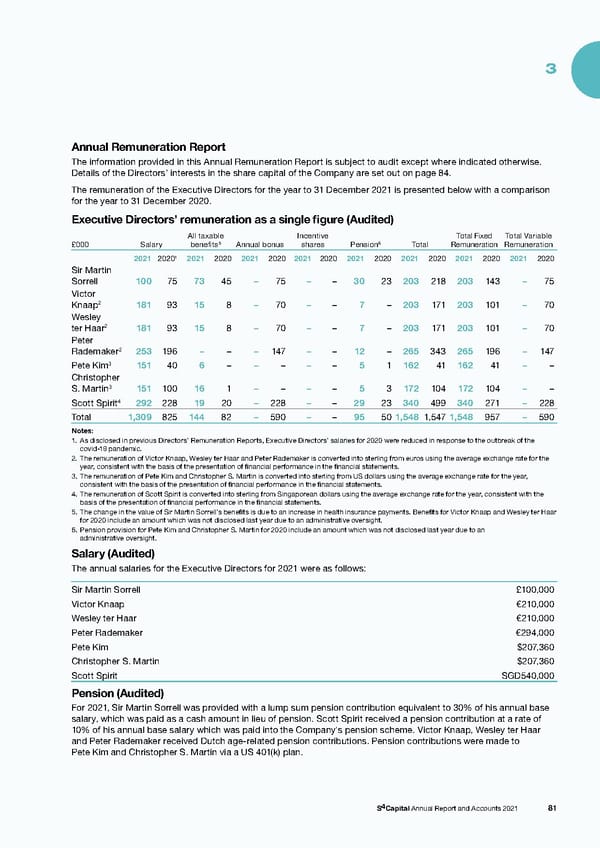

3 Annual Remuneration Report The information provided in this Annual Remuneration Report is subject to audit except where indicated otherwise. Details of the Directors’ interests in the share capital of the Company are set out on page 84. The remuneration of the Executive Directors for the year to 31 December 2021 is presented below with a comparison for the year to 31 December 2020. Executive Directors’ remuneration as a single figure (Audited) All taxable Incentive Total Fixed Total Variable £000 Salary benefits5 Annual bonus shares Pension6 Total Remuneration Remuneration 1 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 Sir Martin Sorrell 100 75 73 45 – 75 – – 30 23 203 218 203 143 – 75 Victor 2 Knaap 181 93 15 8 – 70 – – 7 – 203 171 203 101 – 70 Wesley ter Haar2 181 93 15 8 – 70 – – 7 – 203 171 203 101 – 70 Peter Rademaker2 253 196 – – – 147 – – 12 – 265 343 265 196 – 147 Pete Kim3 151 40 6 – – – – – 5 1 162 41 162 41 – – Christopher S. Martin3 151 100 16 1 – – – – 5 3 172 104 172 104 – – 4 Scott Spirit 292 228 19 20 – 228 – – 29 23 340 499 340 271 – 228 Total 1,309 825 144 82 – 590 – – 95 50 1,548 1,547 1,548 957 – 590 Notes: 1. As disclosed in previous Directors’ Remuneration Reports, Executive Directors’ salaries for 2020 were reduced in response to the outbreak of the covid-19 pandemic. 2. The remuneration of Victor Knaap, Wesley ter Haar and Peter Rademaker is converted into sterling from euros using the average exchange rate for the year, consistent with the basis of the presentation of financial performance in the financial statements. 3. The remuneration of Pete Kim and Christopher S. Martin is converted into sterling from US dollars using the average exchange rate for the year, consistent with the basis of the presentation of financial performance in the financial statements. 4. The remuneration of Scott Spirit is converted into sterling from Singaporean dollars using the average exchange rate for the year, consistent with the basis of the presentation of financial performance in the financial statements. 5. The change in the value of Sir Martin Sorrell’s benefits is due to an increase in health insurance payments. Benefits for Victor Knaap and Wesley ter Haar for 2020 include an amount which was not disclosed last year due to an administrative oversight. 6. Pension provision for Pete Kim and Christopher S. Martin for 2020 include an amount which was not disclosed last year due to an administrative oversight. Salary (Audited) The annual salaries for the Executive Directors for 2021 were as follows: Sir Martin Sorrell £100,000 Victor Knaap €210,000 Wesley ter Haar €210,000 Peter Rademaker €294,000 Pete Kim $207,360 Christopher S. Martin $207,360 Scott Spirit SGD540,000 Pension (Audited) For 2021, Sir Martin Sorrell was provided with a lump sum pension contribution equivalent to 30% of his annual base salary, which was paid as a cash amount in lieu of pension. Scott Spirit received a pension contribution at a rate of 10% of his annual base salary which was paid into the Company's pension scheme. Victor Knaap, Wesley ter Haar and Peter Rademaker received Dutch age-related pension contributions. Pension contributions were made to Pete Kim and Christopher S. Martin via a US 401(k) plan. S4Capital Annual Report and Accounts 2021 81

s4 capital annual report and accounts 2021 Page 82 Page 84

s4 capital annual report and accounts 2021 Page 82 Page 84