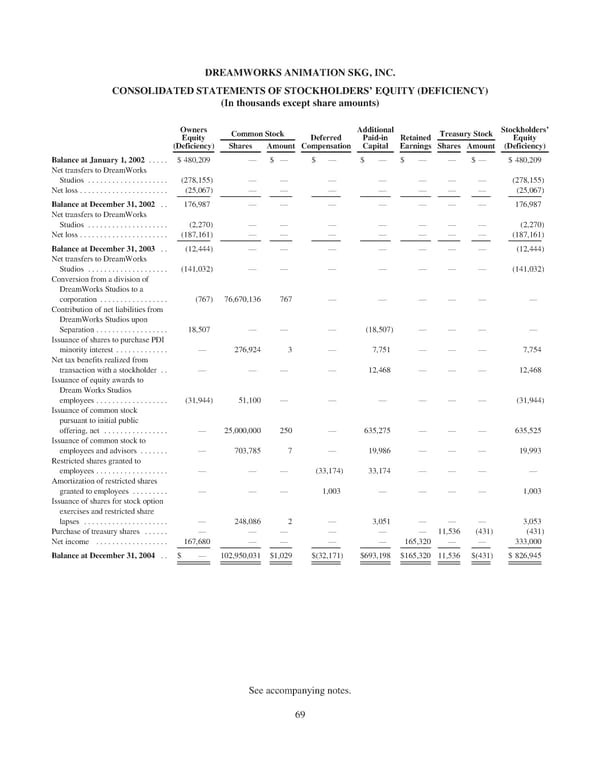

DREAMWORKSANIMATIONSKG,INC. CONSOLIDATEDSTATEMENTSOFSTOCKHOLDERS’EQUITY(DEFICIENCY) (In thousands except share amounts) Owners CommonStock Additional Treasury Stock Stockholders’ Equity Deferred Paid-in Retained Equity (Deficiency) Shares Amount Compensation Capital Earnings Shares Amount (Deficiency) Balance at January 1, 2002 ..... $480,209 — $ — $ — $ — $ — — $— $ 480,209 Net transfers to DreamWorks Studios .................... (278,155) — — — — — — — (278,155) Net loss ...................... (25,067) — — — — — — — (25,067) Balance at December 31, 2002 . . 176,987 — — — — — — — 176,987 Net transfers to DreamWorks Studios .................... (2,270) — — — — — — — (2,270) Net loss ...................... (187,161) — — — — — — — (187,161) Balance at December 31, 2003 . . (12,444) — — — — — — — (12,444) Net transfers to DreamWorks Studios .................... (141,032) — — — — — — — (141,032) Conversion from a division of DreamWorksStudiostoa corporation ................. (767) 76,670,136 767 — — — — — — Contribution of net liabilities from DreamWorksStudiosupon Separation .................. 18,507 — — — (18,507) — — — — Issuance of shares to purchase PDI minority interest ............. — 276,924 3 — 7,751 — — — 7,754 Net tax benefits realized from transaction with a stockholder . . — — — — 12,468 — — — 12,468 Issuance of equity awards to DreamWorksStudios employees .................. (31,944) 51,100 — — — — — — (31,944) Issuance of common stock pursuant to initial public offering, net ................ — 25,000,000 250 — 635,275 — — — 635,525 Issuance of common stock to employees and advisors ....... — 703,785 7 — 19,986 — — — 19,993 Restricted shares granted to employees .................. — — — (33,174) 33,174 — — — — Amortization of restricted shares granted to employees ......... — — — 1,003 — — — — 1,003 Issuance of shares for stock option exercises and restricted share lapses ..................... — 248,086 2 — 3,051 — — — 3,053 Purchase of treasury shares ...... — — — — — — 11,536 (431) (431) Net income .................. 167,680 — — — — 165,320 — — 333,000 Balance at December 31, 2004 . . $ — 102,950,031 $1,029 $(32,171) $693,198 $165,320 11,536 $(431) $ 826,945 See accompanying notes. 69

DreamWorks Annual Report Page 74 Page 76

DreamWorks Annual Report Page 74 Page 76