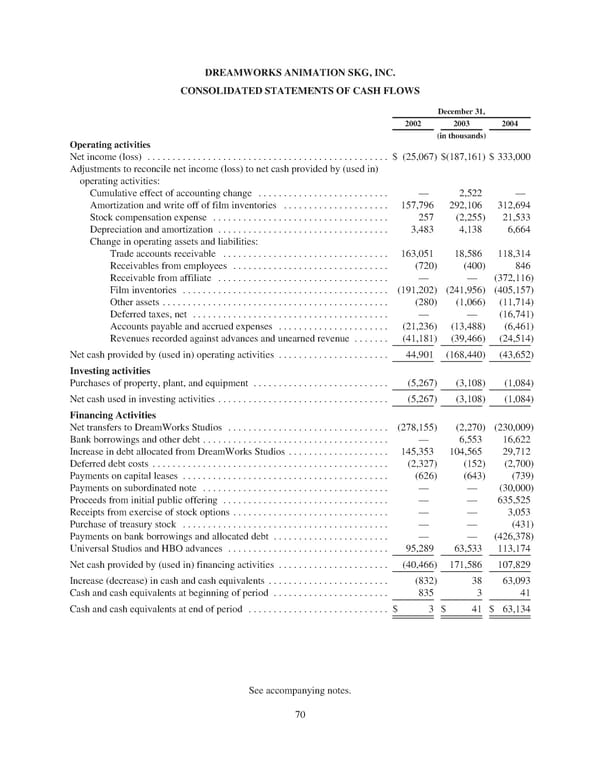

DREAMWORKSANIMATIONSKG,INC. CONSOLIDATEDSTATEMENTSOFCASHFLOWS December31, 2002 2003 2004 (in thousands) Operating activities Net income (loss) ................................................ $ (25,067) $(187,161) $ 333,000 Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: Cumulative effect of accounting change .......................... — 2,522 — Amortization and write off of film inventories ..................... 157,796 292,106 312,694 Stock compensation expense ................................... 257 (2,255) 21,533 Depreciation and amortization .................................. 3,483 4,138 6,664 Changeinoperating assets and liabilities: Trade accounts receivable ................................. 163,051 18,586 118,314 Receivables from employees ............................... (720) (400) 846 Receivable from affiliate .................................. — — (372,116) Film inventories ......................................... (191,202) (241,956) (405,157) Other assets ............................................. (280) (1,066) (11,714) Deferred taxes, net ....................................... — — (16,741) Accounts payable and accrued expenses ...................... (21,236) (13,488) (6,461) Revenues recorded against advances and unearned revenue ....... (41,181) (39,466) (24,514) Net cash provided by (used in) operating activities ...................... 44,901 (168,440) (43,652) Investing activities Purchases of property, plant, and equipment ........................... (5,267) (3,108) (1,084) Net cash used in investing activities .................................. (5,267) (3,108) (1,084) Financing Activities Net transfers to DreamWorks Studios ................................ (278,155) (2,270) (230,009) Bankborrowings and other debt ..................................... — 6,553 16,622 Increase in debt allocated from DreamWorks Studios .................... 145,353 104,565 29,712 Deferred debt costs ............................................... (2,327) (152) (2,700) Payments on capital leases ......................................... (626) (643) (739) Payments on subordinated note ..................................... — — (30,000) Proceeds from initial public offering ................................. — — 635,525 Receipts from exercise of stock options ............................... — — 3,053 Purchase of treasury stock ......................................... — — (431) Payments on bank borrowings and allocated debt ....................... — — (426,378) Universal Studios and HBO advances ................................ 95,289 63,533 113,174 Net cash provided by (used in) financing activities ...................... (40,466) 171,586 107,829 Increase (decrease) in cash and cash equivalents ........................ (832) 38 63,093 Cash and cash equivalents at beginning of period ....................... 835 3 41 Cash and cash equivalents at end of period ............................ $ 3 $ 41 $ 63,134 See accompanying notes. 70

DreamWorks Annual Report Page 75 Page 77

DreamWorks Annual Report Page 75 Page 77