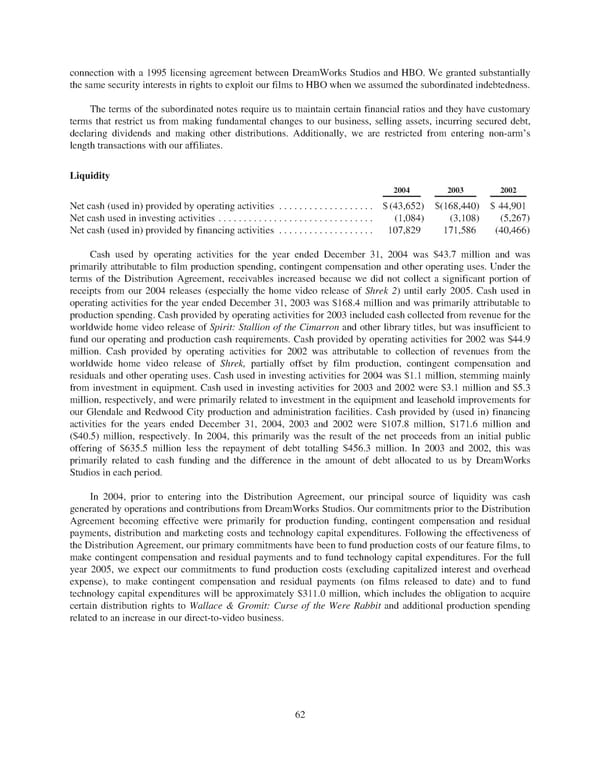

connection with a 1995 licensing agreement between DreamWorks Studios and HBO. We granted substantially the same security interests in rights to exploit our films to HBO when we assumed the subordinated indebtedness. The terms of the subordinated notes require us to maintain certain financial ratios and they have customary terms that restrict us from making fundamental changes to our business, selling assets, incurring secured debt, declaring dividends and making other distributions. Additionally, we are restricted from entering non-arm’s length transactions with our affiliates. Liquidity 2004 2003 2002 Net cash (used in) provided by operating activities ................... $(43,652) $(168,440) $ 44,901 Net cash used in investing activities ............................... (1,084) (3,108) (5,267) Net cash (used in) provided by financing activities ................... 107,829 171,586 (40,466) Cash used by operating activities for the year ended December 31, 2004 was $43.7 million and was primarily attributable to film production spending, contingent compensation and other operating uses. Under the terms of the Distribution Agreement, receivables increased because we did not collect a significant portion of receipts from our 2004 releases (especially the home video release of Shrek 2) until early 2005. Cash used in operating activities for the year ended December 31, 2003 was $168.4 million and was primarily attributable to production spending. Cash provided by operating activities for 2003 included cash collected from revenue for the worldwide home video release of Spirit: Stallion of the Cimarron and other library titles, but was insufficient to fund our operating and production cash requirements. Cash provided by operating activities for 2002 was $44.9 million. Cash provided by operating activities for 2002 was attributable to collection of revenues from the worldwide home video release of Shrek, partially offset by film production, contingent compensation and residuals and other operating uses. Cash used in investing activities for 2004 was $1.1 million, stemming mainly from investment in equipment. Cash used in investing activities for 2003 and 2002 were $3.1 million and $5.3 million, respectively, and were primarily related to investment in the equipment and leasehold improvements for our Glendale and Redwood City production and administration facilities. Cash provided by (used in) financing activities for the years ended December 31, 2004, 2003 and 2002 were $107.8 million, $171.6 million and ($40.5) million, respectively. In 2004, this primarily was the result of the net proceeds from an initial public offering of $635.5 million less the repayment of debt totalling $456.3 million. In 2003 and 2002, this was primarily related to cash funding and the difference in the amount of debt allocated to us by DreamWorks Studios in each period. In 2004, prior to entering into the Distribution Agreement, our principal source of liquidity was cash generated by operations and contributions from DreamWorks Studios. Our commitments prior to the Distribution Agreement becoming effective were primarily for production funding, contingent compensation and residual payments, distribution and marketing costs and technology capital expenditures. Following the effectiveness of the Distribution Agreement, our primary commitments have been to fund production costs of our feature films, to make contingent compensation and residual payments and to fund technology capital expenditures. For the full year 2005, we expect our commitments to fund production costs (excluding capitalized interest and overhead expense), to make contingent compensation and residual payments (on films released to date) and to fund technology capital expenditures will be approximately $311.0 million, which includes the obligation to acquire certain distribution rights to Wallace & Gromit: Curse of the Were Rabbit and additional production spending related to an increase in our direct-to-video business. 62

DreamWorks Annual Report Page 67 Page 69

DreamWorks Annual Report Page 67 Page 69