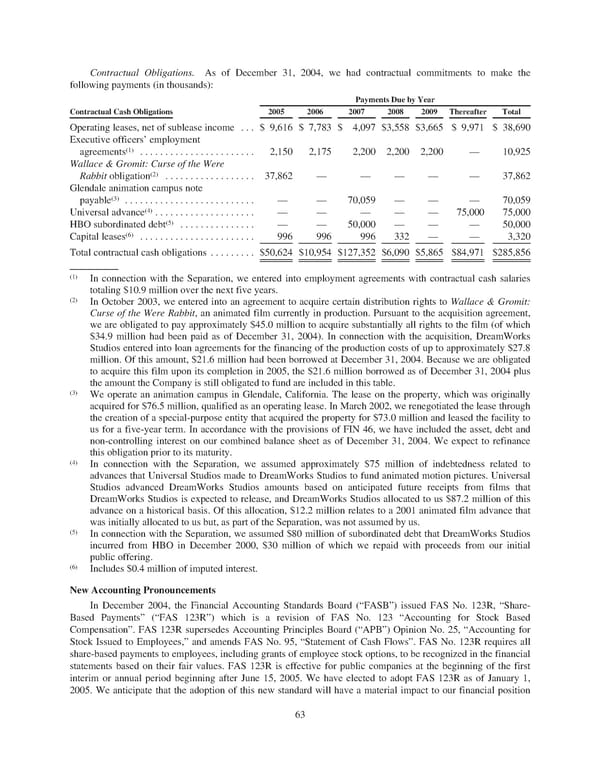

Contractual Obligations. As of December 31, 2004, we had contractual commitments to make the following payments (in thousands): PaymentsDuebyYear Contractual Cash Obligations 2005 2006 2007 2008 2009 Thereafter Total Operating leases, net of sublease income . . . $ 9,616 $ 7,783 $ 4,097 $3,558 $3,665 $ 9,971 $ 38,690 Executive officers’ employment agreements(1) ....................... 2,150 2,175 2,200 2,200 2,200 — 10,925 Wallace & Gromit: Curse of the Were Rabbit obligation(2) .................. 37,862 — — — — — 37,862 Glendale animation campus note payable(3) .......................... — — 70,059 — — — 70,059 Universal advance(4) .................... — — — — — 75,000 75,000 HBOsubordinated debt(5) ............... — — 50,000 — — — 50,000 Capital leases(6) ....................... 996 996 996 332 — — 3,320 Total contractual cash obligations ......... $50,624 $10,954 $127,352 $6,090 $5,865 $84,971 $285,856 (1) In connection with the Separation, we entered into employment agreements with contractual cash salaries totaling $10.9 million over the next five years. (2) In October 2003, we entered into an agreement to acquire certain distribution rights to Wallace & Gromit: Curse of the Were Rabbit, an animated film currently in production. Pursuant to the acquisition agreement, weare obligated to pay approximately $45.0 million to acquire substantially all rights to the film (of which $34.9 million had been paid as of December 31, 2004). In connection with the acquisition, DreamWorks Studios entered into loan agreements for the financing of the production costs of up to approximately $27.8 million. Of this amount, $21.6 million had been borrowed at December 31, 2004. Because we are obligated to acquire this film upon its completion in 2005, the $21.6 million borrowed as of December 31, 2004 plus the amount the Company is still obligated to fund are included in this table. (3) Weoperate an animation campus in Glendale, California. The lease on the property, which was originally acquired for $76.5 million, qualified as an operating lease. In March 2002, we renegotiated the lease through the creation of a special-purpose entity that acquired the property for $73.0 million and leased the facility to us for a five-year term. In accordance with the provisions of FIN 46, we have included the asset, debt and non-controlling interest on our combined balance sheet as of December 31, 2004. We expect to refinance this obligation prior to its maturity. (4) In connection with the Separation, we assumed approximately $75 million of indebtedness related to advances that Universal Studios made to DreamWorks Studios to fund animated motion pictures. Universal Studios advanced DreamWorks Studios amounts based on anticipated future receipts from films that DreamWorks Studios is expected to release, and DreamWorks Studios allocated to us $87.2 million of this advance on a historical basis. Of this allocation, $12.2 million relates to a 2001 animated film advance that wasinitially allocated to us but, as part of the Separation, was not assumed by us. (5) In connection with the Separation, we assumed $80 million of subordinated debt that DreamWorks Studios incurred from HBO in December 2000, $30 million of which we repaid with proceeds from our initial public offering. (6) Includes $0.4 million of imputed interest. NewAccountingPronouncements In December 2004, the Financial Accounting Standards Board (“FASB”) issued FAS No. 123R, “Share- Based Payments” (“FAS 123R”) which is a revision of FAS No. 123 “Accounting for Stock Based Compensation”. FAS 123R supersedes Accounting Principles Board (“APB”) Opinion No. 25, “Accounting for Stock Issued to Employees,” and amends FAS No. 95, “Statement of Cash Flows”. FAS No. 123R requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values. FAS 123R is effective for public companies at the beginning of the first interim or annual period beginning after June 15, 2005. We have elected to adopt FAS 123R as of January 1, 2005. We anticipate that the adoption of this new standard will have a material impact to our financial position 63

DreamWorks Annual Report Page 68 Page 70

DreamWorks Annual Report Page 68 Page 70