2024 Compliance Guide

The Employee Retirement Income Security Act (ERISA), Department of Labor (DOL), Department of Health and Human Services (HHS) and Internal Revenue Service require plan administrators to provide certain information related to their health and welfare benefits plan to plan participants in writing.

2024 Compliance Guide Contact Name Marcia Maria Contact Title Human Resources Business Partner Email marcia@ACME.com Phone 000-000-0000 All Regulatory Compliance Notices are available online at Paycom.com You may request paper copies of all notices, free of charge, upon request to the plan administrator. IMPORTANT NOTE: Presented by: If you (and/or your dependents) have Medicare or will become eligible for Medicare in the next 12 months, a Federal law gives you more choices about your prescription drug coverage. Please see page 3 for more details.

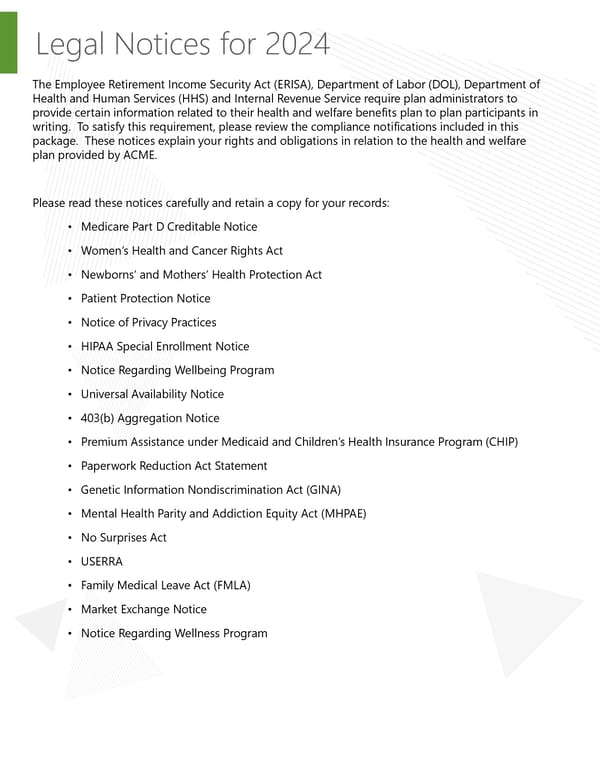

Legal Notices for 2024 The Employee Retirement Income Security Act (ERISA), Department of Labor (DOL), Department of Health and Human Services (HHS) and Internal Revenue Service require plan administrators to provide certain information related to their health and welfare benefits plan to plan participants in writing. To satisfy this requirement, please review the compliance notifications included in this package. These notices explain your rights and obligations in relation to the health and welfare plan provided by ACME. Please read these notices carefully and retain a copy for your records: • Medicare Part D Creditable Notice • Women’s Health and Cancer Rights Act • Newborns’ and Mothers’ Health Protection Act • Patient Protection Notice • Notice of Privacy Practices • HIPAA Special Enrollment Notice • Notice Regarding Wellbeing Program • Universal Availability Notice • 403(b) Aggregation Notice • Premium Assistance under Medicaid and Children’s Health Insurance Program (CHIP) • Paperwork Reduction Act Statement • Genetic Information Nondiscrimination Act (GINA) • Mental Health Parity and Addiction Equity Act (MHPAE) • No Surprises Act • USERRA • Family Medical Leave Act (FMLA) • Market Exchange Notice • Notice Regarding Wellness Program

Medicare Part D Creditable IMPORTANT NOTICE FROM ACME ABOUT YOUR PRESCRIPTION DRUG COVERAGE AND MEDICARE Please read this notice carefully and keep it where you can find it. This notice has information about your current prescription drug coverage with ACME and about your options under Medicare’s prescription drug coverage. This information can help you decide whether or not you want to join a Medicare drug plan. If you are considering joining, you should compare your current coverage, including which drugs are covered at what cost, with the coverage and costs of the plans offering Medicare prescription drug coverage in your area. Information about where you can get help to make decisions about your prescription drug coverage is at the end of this notice. There are two important things you need to know about your current coverage and Medicare’s prescription drug coverage: There are two important things you need to know about your current coverage and Medicare’s prescription drug coverage: 1. Medicare prescription drug coverage became available in 2006 to everyone with Medicare. You can get this coverage if you join a Medicare Prescription Drug Plan or join a Medicare Advantage Plan (like an HMO or PPO) that offers prescription drug coverage. All Medicare drug plans provide at least a standard level of coverage set by Medicare. Some plans may also offer more coverage for a higher monthly premium. 2. ACME has determined that the prescription drug coverage offered by the Anthem is, on average for all plan participants, expected to pay out as much as standard Medicare prescription drug coverage pays and is therefore considered Creditable Coverage. Because your existing coverage is Creditable Coverage, you can keep this coverage and not pay a higher premium (a penalty) if you later decide to join a Medicare drug plan. When Can You Join A Medicare Drug Plan? You can join a Medicare drug plan when you first become eligible for Medicare and each year from October 15th to December 7th. However, if you lose your current creditable prescription drug coverage, through no fault of your own, you will also be eligible for a two (2) month Special Enrollment Period (SEP) to join a Medicare drug plan. What Happens To Your Current Coverage If You Decide to Join A Medicare Drug Plan? If you decide to join a Medicare drug plan, your current coverage will not be affected. See pages 7- 9 of the CMS Disclosure of Creditable Coverage To Medicare Part D Eligible Individuals Guidance (available at http://www.cms.hhs.gov/CreditableCoverage), which outlines the prescription drug plan provisions/options that Medicare eligible individuals may have available to them when they become eligible for Medicare Part D.] If you do decide to join a Medicare drug plan and drop your current coverage, be aware that you and your dependents will be able to get this coverage back. Page 3 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Medicare Part D Creditable When Will You Pay A Higher Premium (Penalty) To Join A Medicare Drug Plan? You should also know that if you drop or lose your current coverage with ACME and don’t join a Medicare drug plan within 63 continuous days after your current coverage ends, you may pay a higher premium (a penalty) to join a Medicare drug plan later. If you go 63 continuous days or longer without creditable prescription drug coverage, your monthly premium may go up by at least 1% of the Medicare base beneficiary premium per month for every month that you did not have that coverage. For example, if you go nineteen months without creditable coverage, your premium may consistently be at least 19% higher than the Medicare base beneficiary premium. You may have to pay this higher premium (a penalty) as long as you have Medicare prescription drug coverage. In addition, you may have to wait until the following October to join. For More Information About This Notice Or Your Current Prescription Drug Coverage… Contact your Human Recourses Representative, listed below. NOTE: You’ll get this notice each year. the next period you can join a Medicare drug plan, and if this coverage You will also get it before changes. You also may request a copy of this notice at any time. For More Information About Your Options Under Medicare Prescription Drug Coverage… More detailed information about Medicare plans that offer prescription drug coverage is in the “Medicare & You” handbook. You’ll get a copy of the handbook in the mail every year from Medicare. You may also be contacted directly by Medicare drug plans. For more information about Medicare prescription drug coverage: • Visit www.medicare.gov • Call your State Health Insurance Assistance Program (see the inside back cover of your copy of the “Medicare & You” handbook for their telephone number) for personalized help • Call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048. If you have limited income and resources, extra help paying for Medicare prescription drug coverage is available. For information about this extra help, visit Social Security on the web at www.socialsecurity.gov, or call them at 1-800-772-1213 (TTY 1-800-325-0778). Remember: Keep this Creditable Coverage notice. If you decide to join one of the Medicare drug plans, you may be required to provide a copy of this notice when you join to show whether you have maintained creditable coverage and, therefore, whether you are required to pay a higher premium (a penalty). Date: January 1, 2024 Name of Entity/Sender: ACME Contact Position/Office: Marcia Maria, HR Business Partner Address: Phone Number: 000-000-0000 Page 4 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA) The Health Insurance Portability and Accountability Act of 1996 (HIPAA) is a federal law that addresses the privacy and security of certain individually identifiable health information, called protected health information (or PHI). You have certain rights with respect to your PHI, including a right to see or get a copy of your health and claims records and other health information maintained by a health plan or carrier. For a copy of the Notice of Privacy Practices, describing how your PHI may be used and disclosed and how you get access to the information, contact Human Resources. WOMEN’S HEALTH AND CANCER RIGHTS ACT ENROLLMENT NOTICE If you have had or are going to have a mastectomy, you may be entitled to certain benefits under the Woman’s Health and Cancer Rights Act of 1998 (WHCRA). For individuals receiving mastectomy-related benefits, coverage will be provided in a manner determined in consultation with the attending physician and the patient, for: 1. All stages of reconstruction of the breast on which mastectomy was performed. 2. Surgery and reconstruction of the other breast to produce a symmetrical appearance; prostheses. 3. Treatment of physical complications of the mastectomy, including lymphedema. hese will be provided subject to the same deductibles and coinsurance applicable to other medical and surgical benefits T provided under this benefits plan. NEWBORNS’ AND MOTHERS’ HEALTH PROTECTION ACT DISCLOSURE Group health plans and health insurance issuers generally may not, under Federal law, restrict benefits for any hospital length of stay in connection with childbirth for the mother or newborn child to less than 48 hours following a vaginal delivery, or less than 96 hours following a cesarean section. However, Federal law generally does not prohibit the mother’s or newborn’s attending provider, after consulting with the mother, from discharging the mother or her newborn earlier than 48 hours (or 96 hours as applicable). In any case, plans and issuers may not, under Federal law, require that a provider obtain authorization from the plan or the insurance issuer for prescribing a length of stay not in excess of 48 hours (or 96 hours). Please refer to your plan document for more information about childbirth coverage. PATIENT PROTECTION NOTICE Your carrier generally may require the designation of a primary care provider. You have the right to designate any primary care provider who participates in your network and who is available to accept you or your family members. Until you make this designation, your carrier may designate one for you. For children, you may designate a pediatrician as the primary care provider. You do not need prior authorization from your carrier or from any other person (including a primary care provider) in order to obtain access to obstetrical or gynecological care from a health care professional in your network who specializes in obstetrics or gynecology. The health care professional, however, may be required to comply with certain procedures, including obtaining prior authorization for certain services, following a pre-approved treatment plan, or procedures for making referrals. For information on how to select a primary care provider, a list of the participating primary care providers, or a list of participating health care professionals who specialize in obstetrics or gynecology, contact your plan administrator using the number on the back of your ID card. Page 5 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 NOTICE OF PRIVACY PRACTICES: This notice described how medical information about you may be used and disclosed and how you can get access to this information. Please review it carefully. Certain employer-sponsored health plans are required by the privacy regulations issued under the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) to maintain the privacy of your health information that the plan creates, requests, or is created on the Plan’s behalf, called Protected Health Information (“PHI”) and to provide you, as the participant, covered dependent, or qualified beneficiary, with notice of the plan’s legal duties and privacy practices concerning Protected Health Information. The terms of this Notice of Privacy Practices (“Notice”) apply to the following plans (collective and individually referenced in this Notice as the “Plan”): Group Medical and Prescription Drug Plans, Voluntary Dental Plans, and Voluntary Vision Plan This Notice describes how the Plan may use and disclose your PHI to carry-out payment and health care operations, and for other purposes that are permitted or required by law. The Plan is required to abide by the terms of this Notice so long as the Plan remains in effect. The Plan Reserves the right to change the terms of this Notice as necessary and to make the new Notice effective for all PHI maintained by the Plan. Copies of revised Notices in which there has been a material change will be mailed to all participants then covered by the Plan. Copies of our current Notices may be obtained by calling the plan administrator. DEFINITIONS Plan Sponsor means Employer Entity defined on page one and any other employer that maintains the Plan for the benefit of its associates. Protected health Information (“PHI”) means individually identifiable health information, which is defined under the law as information that is a subset of health information, including demographic information, that is created or received by the Plan and that relates to your past, present or future physical mental health or condition; the health care services you receive, or the past, present, or future payment for health care services you receive; and that identifies you, or which there is a reasonable basis to believe the information can be used to identify you. USES AND DISCLOSURES OF YOUR PROTECTED HEALTH INFORMATION The following categories describe different ways that the Plan may use and disclose your PHI. For each category of uses and disclosures we will explain what we mean and, when appropriate, provide examples for illustrative purposes. Not every use or disclosure in a category will be listed. However, all the ways we are permitted or required to use and disclose PHI will fall within one of the categories. Your Authorization – Except as outlined below or otherwise permitted by law, the Plan will not use or disclose your PHI unless you have signed a form authorizing the Plan to use or disclose specific PHI for an explicit purpose to a specific person or group of persons. Uses and disclosures of your PHI for marketing purposes and/or for the sale of your PHI require your authorization. You have the right to revoke any authorization in writing except to the extent that the Plan has taken action in reliance upon the authorizations. Uses and Disclosures for Payment – The Plan may use and disclose your PHI as necessary for benefit payment purposes without obtaining an authorization from you. The persons to whom the Plan may disclose your PHI for payment purposes include your health care providers that are billing for or requesting a prior authorization for their services and treatments of you, other health plans providing benefits to you, and your approved family member or guardian responsible for amounts, such as deductibles and co-insurance, not covered by the Plan. For example, the Plan may use or disclose your PHI, including information about any medical procedures and treatments you have received, are receiving, or will receive, to your doctor, your spouse’s doctor or other health plan under which you are covered, and your spouse or other family members, unless you object, in order to process your benefits under the Plan. Examples of other payment activities include determinations of your eligibility or coverage under the Plan, annual premium calculations based on health status and demographic characteristics of persons covered under the Plan, billing, claims management, reinsurance claim, and review of health care services with respect to medical necessity, utilization review activities, and disclosures to consumer reporting agencies. Page 6 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 Uses and Disclosures for Health Care Operations – The Plan may use and disclose your PHI as necessary for health care operations without obtaining an authorization from you. Health care operations are those functions of the Plan it needs to operate on a day-to-day basis and those activities that help it to evaluate its performance. Examples of health care operations include underwriting, premium rating or other activities relating to the creation, amendment or termination of the Plan, and obtaining reinsurance coverage. Other functions considered to be health care operations include business planning and development; conducting or arranging for quality assessment and improvement activities, medical review, and legal services and auditing functions; and performing business management and general administrative duties of the Plan, including the provision of customer services to you and your covered dependents. Use or Disclosure of Genetic Information Prohibited – the Genetic Information Nondiscrimination Act of 2009 (GINA), and regulations promulgated thereunder, specific prohibit the use, disclosure or request of PHI that is genetic information for underwriting purposes. Genetic information is defined as (1) your genetic tests; (2) genetic tests of your family member; (3) family medical history, or (4) any request of or receipt by you or your family members’ genetic services. This means that your genetic information cannot be used for enrollment, continued eligibility, computation of premiums, or other activities related to underwriting, even if those activities are for purposes of health care operations or being performed pursuant to your written authorization. Family and Friends Involved in Your Care – If you are available and do not object, the Plan may disclose your PHI to your family, friends, and others who are involved in your care or payment of a claim. If you are unavailable or incapacitated and the Plan determines that a limited disclosure is in your best interest, the Plan, may share limited PHI with such individuals. For example, the Plan may use its professional judgment to disclose PHI to your spouse concerning the processing of a claim. If you do not wish us to share PHI with your spouse or others, you may exercise your right to request a restriction on your disclosure of your PHI (see below), including having correspondence the Plan sends to you mailed to an alternative address. The Plan is also required to abide by certain state laws that are more stringent than the HIPAA Privacy Standards, for example, some states give a minor child the right to consent to his or her own treatment and, under HIPAA, to direct who may know about the care he or she receives. There may be an instance when your minor child would request for you not to be informed of his or her treatment and the Plan would be required to honor that request. Business Associates – Certain aspects and components of the Plan’s services are performed through contracts with outside persons or organizations. Examples of these outside persons and organizations include our third-party administrator, reinsurance carrier, agents, attorney, accountants, banks and consultants. At times it may be necessary for use to provide certain of your PHI to one or more of these outside persons or organizations. However, if the Plan does provide your PHI to any or all of these outside persons or organizations, they will be required, though contract or by law, to follow the same policies and procedures with your PHI as detailed in this Notice. Plan Sponsor – The Plan may disclose a subset of your PHI, called summary health information, to Plan Sponsor in certain situations. Summary health information summarizes claims history, claim expenses, and types of claims experience by individuals under the Plan, but all information that could effectively identify whose claims history has been summarized has been removed. Summary health information may be given to the Plan Sponsor when requested for the purpose of obtain premium bids, for providing coverage under the Plan, or for modifying, amending or terminating the Plan. The Plan may also disclose to the Plan Sponsor whether you are enrolled in or have disenrolled from the Plan. Other Products and Services – The Plan may contact you to provide information about other health-related products and services that may be of interest to you without obtaining your authorizations. For example, the Plan may use and disclose your PHI for the purpose of communicating to you about the health benefit products or services that could enhance or substitute for existing coverage under the Plan, such as long-term health benefits for flexible spending accounts. The Plan may also contact you about health-related products and services, like disease management programs that may add value to you, as a covered person under the Plan. However, the Plan must obtain your authorization before the Plan sends you information regarding non-health related products or services, such as information concerning movie passes, life insurance products, or other discounts or services offered to the general public at large. Other Uses and Disclosures – Unless otherwise prohibited by the law, the Plan may make certain other uses and disclosures of your PHI without your authorization, including the following: The Plan may use or disclose your PHI to the extent that the use or disclosure is required by law. The Plan may disclose your PHI to the proper authorities if the Plan suspects child abuse or neglect; the Plan may also disclose your PHI if we believe you to be a victim of abuse, neglect, or domestic violence. The Plan may disclose your PHI if authorized by law to a government oversight agency (e.g., a state insurance department) conducting audits, investigations, or a civil or criminal proceeding. The Plan may disclose your PHI in response to a court order specifically authorizing the disclosure, or in the course of a judicial or administrative proceeding (e.g. to response to a subpoena or discovery request), provided written and documented efforts by the requesting party have been made to (1) notify you of the disclosure and the purpose of the litigation, or (2) obtain a qualified protective order prohibiting the use or disclosure of your PHI for any other purpose than the litigation or proceeding for which it was requested. Page 7 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 The Plan may disclose your PHI to the proper authorities for law enforcement purposes, including the disclosure of certain identifying information requested by police officers for the purpose of identifying or locating a suspect, fugitive, material witness or missing person; the disclosure of your PHI if you are suspected to be a victim of a crime and you are incapacitated; or if you are suspected of committing a crime on the Plan (e.g., fraud). The Plan may use or disclose PHI to avert a serious threat to health or safety. The Plan may use or disclose your PHI if you are a member of the military, as required by armed forces services, and the Plan may also disclose your PHI for other specialized government functions such as national security or intelligence activities. The Plan may disclose your PHI to state or federal workers’ compensation agencies for your workers’ compensation benefit determination. The Plan may, as required by law, release your PHI to the Secretary of Department Health and Human Services for enforcement of HIPAA Privacy Rules. Verification Requirement – Before the Plan discloses your PHI to anyone requesting it, the Plan is required to verify the identity of the requester’s authority to access your PHI. The Plan may rely on reasonable evidence of authority such as a badge, official credentials, written statements on appropriate government letterhead, written or oral statements of legal authority, warrants, subpoenas, or court orders. RIGHTS THAT YOU HAVE To request to inspect, copy, amend or get accounting of PHI pertaining to your PHI in the Plan, you may contact the plan administrator. Right to Inspect and Copy your PHI – You have the right to request a copy of and/or to inspect your PHI that the Plan maintains, unless the PHI was compiled in reasonable anticipation of litigation or contains psychotherapy notes. In certain limited circumstances, the Plan may deny your request to copy and/or inspect your PHI. In most of those limited circumstances, a licensed health care provider must determine that the release of the PHI to you or a person authorized by you, as your “personal representative,” may cause you or someone else identified in the PHI harm. If your request is denied, you may have the right to have the denial reviewed by a designated licensed health care professional that did not participate in the original decision. Request for access to your PHI must be in writing and signed by you or your personal representative. You must ask for a Participant PHI Inspection Form from the Plan through the plan administrator. If you request that the Plan copy or mail your PHI to you, the Plan may charge you a fee for the cost of copying your PHI and the postage for mailing your PHI to you. If you as the Plan to prepare a summary of PHI, and the Plan agrees to provide that explanation, the Plan may also charge you for the cost associated with the preparation of the summary. Right to Request Amendments to Your PHI – You have the right to request that PHI the Plan maintains about you be amended or corrected. The Plan is not obligated to make requested amendments to PHI that is not created by the Plan, not maintained by the Plan, not available for inspection, or that is accurate and complete. The Plan will give each request careful consideration. To be considered, your amendment request must be in writing, must be signed by you or your personal representative, must state the reasons for the amendment request, and must be sent to the Privacy Office at the address below. If the Plan denies your amendment request, the Plan will provide you with its basis for the denial, advise you of your right to prepare a statement of disagreement which it will place with your PHI, and describe how you may file a complaint with the Plan or the Secretary of the US Department of Health and Human Services. The Plan may limit the length of your statement of disagreement and submit its own rebuttal to accompany your statement of disagreement. If the Plan accepts your amendment request, it must make a reasonable effort to provide the amendment to persons you identify as needing the amendment or persons it believes would rely on your unamended PHI to your detriment. Right to Request an Accounting for Disclosures of Your PHI – You have the right to request an accounting of disclosures of your PHI that the Plan makes. Your request for an accounting of disclosures must state a time period that may not be longer than six years and may not include dates before April 14, 2004. Not all disclosures of your PHI must be included in the accounting of the disclosures. Examples of disclosures that the Plan is required to account for include those pursuant to valid legal process, or for law enforcement purposes. Examples of disclosures that are not subject to an accounting include those made to carry out the Plan’s payment or health care operations, or those made with your authorization. To be considered, your accounting requests must be in writing and signed by you or your personal representative, and sent to the Privacy Office at the address below. The first accounting in any 12-month period is free; however, the Plan may charge you a fee for each subsequent accounting you request within the same 12-month period. Right to Place Restrictions on the Use and Disclosure of Your PHI – You have the right to request restrictions on certain of the Plan’s uses and disclosures of your PHI for payment or health care operations, disclosures made to persons involved in your care, and disclosures for disaster relief purposes. For example, you may request that the Plan not disclose your PHI to your spouse. Your request must describe in detail the restriction you are requesting. The Plan is not required to agree to your request, but will attempt to accommodate reasonable requests when appropriate. The Plan retains the right to terminate an agreed-to restriction if it believes such termination is appropriate. In the event of a termination by the Plan, it will notify you of the termination. You also have the right to terminate, in writing or orally, any agreed-to restriction. Requests for a restriction (or termination of an existing restriction) may be made by contacting the Plan through the Privacy Office at the telephone number or address below. Page 8 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 Request for Confidential Communications – You have the right to request that communications regarding your PHI be made by alternative means or at alternative locations. For example, you may request that messages not be left on voice mail or sent to a particular address. The Plan is required to accommodate reasonable requests if you inform the Plan that disclosure of all or part of your information could place you in danger. The Plan may grant other requests for confidential communications in its sole discretion. Requests for confidential communications must be in writing, signed by you or your personal representative, and sent to the Privacy Office at the address below. Right to a Copy of the Notice – You have the right to a paper copy of this Notice upon request by contacting the Privacy Office at the telephone number or address below. Right to Notice of Breach - You have the right to receive notice if your PHI is improperly used or disclosed as a result of a breach of unsecured PHI. Complaints – If you believe your privacy rights have been violated, you can file a complaint with the Plan through the plan administrator in writing at the address below. You may also file a complaint in writing with the Secretary of the U.S. Department of Health and Human Services in Washington, D.C., within 180 days of a violation of your rights. There will be no retaliation for filing a complaint. FOR FURTHER INFORMATION If you have questions or need further assistance regarding this Notice, you may contact our plan administrator. Page 9 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 HIPAA SPECIAL ENROLLMENT NOTICE If you are declining enrollment for yourself or your dependents (including your spouse) because of other health insurance or group health plan coverage, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the employer stops contributing toward your or your dependents’ other coverage). However, you must request enrollment within 30 days after your or your dependents’ other coverage ends (or after the employer stops contributing toward the other coverage). In addition, if you have a new dependent as a result of marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your dependents. However, you must request enrollment within 30 days after the marriage, birth, adoption, or placement for adoption. If you or your dependents lose eligibility for coverage under Medicaid or the Children’s Health Insurance Program (CHIP) or become eligible for a premium assistance subsidy under Medicaid or CHIP, you may be able to enroll yourself and your dependents. You must request enrollment within 60 days of the loss of Medicaid or CHIP coverage or the determination of eligibility for a premium assistance subsidy. To request special enrollment or to obtain more information about the plan's special enrollment provisions, contact your plan administrator. Page 10 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP) If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit www.healthcare.gov. If you or your dependents are already enrolled in Medicaid or CHIP and you live in a State listed below, contact your State Medicaid or CHIP office to find out if premium assistance is available. If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, contact your State Medicaid or CHIP office or dial 1-877-KIDS NOW or www.insurekidsnow.gov to find out how to apply. If you qualify, ask your state if it has a program that might help you pay the premiums for an employer-sponsored plan. If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of Labor at www.askebsa.dol.gov or call 1-866-444-EBSA (3272). ALABAMA – Medicaid ALASKA – Medicaid Website: http://myalhipp.com/ The AK Health Insurance Premium Payment Program Phone: 1-855-692-5447 Website: http://myakhipp.com/ Phone: 1-866-251-4861 CustomerService@MyAKHIPP.com Email: Medicaid Eligibility: https://health.alaska.gov/dpa/Pages/default.aspx ARKANSAS – Medicaid Website: CALIFORNIA – Medicaid Website: http://myarhipp.com/ Phone: 1-855-MyARHIPP (855-692-7447) Health Insurance Premium Payment (HIPP) Program http://dhcs.ca.gov/hipp Phone: 916-445-8322 Fax: 916-440-5676 Email: hipp@dhcs.ca.gov COLORADO – Health First Colorado FLORIDA – Medicaid (Colorado’s Medicaid Program) & Child Health Plan Plus (CHP+) Health First Colorado Website: Website: https://www.healthfirstcolorado.com/ https://www.flmedicaidtplrecovery.com/flmedicaidt Health First Colorado Member Contact Center: plrecovery.com/hipp/index.html 1-800-221-3943/ State Relay 711 Phone: 1-877-357-3268 https://hcpf.colorado.gov/child-health-plan- CHP+: plus CHP+ Customer Service: 1-800-359-1991/ State Relay 711 Health Insurance Buy-In Program https://www.mycohibi.com/ (HIBI): HIBICustomer Service: 1-855-692-6442 Page 11 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

GEORGIA – Medicaid INDIANA – Medicaid GA HIPP Website: Healthy Indiana Plan for low-income adults 19-64 https://medicaid.georgia.gov/health-insurance- http://www.in.gov/fssa/hip/ Website: premium-payment-program-hipp Phone: 1-877-438-4479 Phone: 678-564-1162, Press 1 All other Medicaid GA CHIPRA Website: https://www.in.gov/medicaid/ Website: https://medicaid.georgia.gov/programs/third-party- Phone 1-800-457-4584 liability/childrens-health-insurance-program- reauthorization-act-2009-chipra Phone: (678) 564-1162, Press 2 IOWA – Medicaid and CHIP (Hawki) KANSAS – Medicaid Medicaid Website: Website: https://www.kancare.ks.gov/ https://dhs.iowa.gov/ime/members Phone: 1-800-792-4884 Medicaid Phone: 1-800-338-8366 HIPP Phone: 1-800-766-9012 Hawki Website: http://dhs.iowa.gov/Hawki Hawki Phone: 1-800-257-8563 HIPP Website: https://dhs.iowa.gov/ime/members/medicaid-a-to- z/hipp HIPP Phone: 1-888-346-9562 KENTUCKY – Medicaid LOUISIANA – Medicaid Kentucky Integrated Health Insurance Premium Website: www.medicaid.la.gov or Payment Program (KI-HIPP) Website: www.ldh.la.gov/lahipp https://chfs.ky.gov/agencies/dms/member/Pages/kih Phone: 1-888-342-6207 (Medicaid hotline) or ipp.aspx 1-855-618-5488 (LaHIPP) Phone: 1-855-459-6328 Email: KIHIPP.PROGRAM@ky.gov KCHIP Website: https://kidshealth.ky.gov/Pages/index.aspx Phone: 1-877-524-4718 https://chfs.ky.gov Kentucky Medicaid Website: MAINE – Medicaid MASSACHUSETTS – Medicaid and CHIP https://www.mass.gov/masshealth/pa Enrollment Website: Website: https://www.mymaineconnection.gov/benefits/s/?lan Phone: 1-800-862-4840 guage=en_US TTY: (617) 886-8102 Phone: 1-800-442-6003 TTY: Maine relay 711 Private Health Insurance Premium Webpage: https://www.maine.gov/dhhs/ofi/applications-forms Phone: 1-800-977-6740 TTY: Maine relay 711 MINNESOTA – Medicaid MISSOURI – Medicaid Website: Website: https://mn.gov/dhs/people-we-serve/children-and- http://www.dss.mo.gov/mhd/participants/pages/hipp families/health-care/health-care- .htm programs/programs-and-services/other-insurance.jsp Phone: 573-751-2005 Phone: 1-800-657-3739 MONTANA – Medicaid NEBRASKA – Medicaid Website: Website: http://www.ACCESSNebraska.ne.gov http://dphhs.mt.gov/MontanaHealthcarePrograms/H Phone: 1-855-632-7633 IPP Lincoln: 402-473-7000 Phone: 1-800-694-3084 Omaha: 402-595-1178 Email: HHSHIPPProgram@mt.gov Page 12 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

NEVADA – Medicaid Website: NEW HAMPSHIRE – Medicaid Medicaid Website: http://dhcfp.nv.gov https://www.dhhs.nh.gov/programs- Medicaid Phone: 1-800-992-0900 services/medicaid/health-insurance-premium-program Phone: 603-271-5218 Toll free number for the HIPP program: 1-800-852- 3345, ext. 5218 NEW JERSEY – Medicaid and CHIP Website: NEW YORK – Medicaid Medicaid Website: http://www.state.nj.us/humanservices/ https://www.health.ny.gov/health_care/medicaid/ dmahs/clients/medicaid/ Phone: 1-800-541-2831 Medicaid Phone: 609-631-2392 CHIP Website: http://www.njfamilycare.org/index.html CHIP Phone: 1-800-701-0710 NORTH CAROLINA – Medicaid Website: NORTH DAKOTA – Medicaid Website: https://medicaid.ncdhhs.gov/ Phone: 919-855-4100 http://www.nd.gov/dhs/services/medicalserv/medicaid/ Phone: 1-844-854-4825 OKLAHOMA – Medicaid and CHIP Website: OREGON – Medicaid http://www.insureoklahoma.org Website: Phone: 1-888-365-3742 http://healthcare.oregon.gov/Pages/index.aspx http://www.oregonhealthcare.gov/index-es.html Phone: 1-800-699-9075 PENNSYLVANIA – Medicaid and CHIP Website: RHODE ISLAND – Medicaid and CHIP Website: http://www.eohhs.ri.gov/ https://www.dhs.pa.gov/Services/Assistance/Pages/HIP Phone: 1-855-697-4347, or P-Program.aspx 401-462-0311 (Direct RIte Share Line) Phone: 1-800-692-7462 CHIP Website: Children's Health Insurance Program (CHIP) (pa.gov) CHIP Phone: 1-800-986-KIDS (5437) SOUTH CAROLINA – Medicaid Website: SOUTH DAKOTA - Medicaid https://www.scdhhs.gov http://dss.sd.gov Website: Phone: 1-888-549-0820 Phone: 1-888-828-0059 TEXAS – Medicaid UTAH – Medicaid and CHIP Medicaid Website: http://gethipptexas.com/ https://medicaid.utah.gov/ Website: Phone: 1-800-440-0493 CHIP Website: http://health.utah.gov/chip Phone: 1-877-543-7669 VERMONT– Medicaid VIRGINIA – Medicaid and CHIP Health Insurance Premium Payment (HIPP) https://www.coverva.org/en/famis-select Website: Website: Program | Department of Vermont Health Access https://www.coverva.org/en/hipp Phone: 1-800-250-8427 Medicaid/CHIP Phone: 1-800-432-5924 WASHINGTON – Medicaid WEST VIRGINIA – Medicaid and CHIP https://www.hca.wa.gov/ Website: https://dhhr.wv.gov/bms/ Website: Phone: 1-800-562-3022 http://mywvhipp.com/ Medicaid Phone: 304-558-1700 CHIP Toll-free phone: 1-855-MyWVHIPP (1-855-699- WISCONSIN – Medicaid and CHIP 8447) WYOMING – Medicaid Website: Website: https://www.dhs.wisconsin.gov/badgercareplus/p- https://health.wyo.gov/healthcarefin/medicaid/progra 10095.htm ms-and-eligibility/ Phone: 1-800-362-3002 Phone: 1-800-251-1269 Page 13 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

To see if any other states have added a premium assistance program since January 31, 2024, or for more information on special enrollment rights, contact either: U.S. Department of Labor U.S. Department of Health and Human Services Employee Benefits Security Administration Centers for Medicare & Medicaid Services www.dol.gov/agencies/ebsa www.cms.hhs.gov 1-866-444-EBSA (3272) 1-877-267-2323, Menu Option 4, Ext. 61565 Paperwork Reduction Act Statement According to the Paperwork Reduction Act of 1995 (Pub. L. 104-13) (PRA), no persons are required to respond to a collection of information unless such collection displays a valid Office of Management and Budget (OMB) control number. The Department notes that a Federal agency cannot conduct or sponsor a collection of information unless it is approved by OMB under the PRA, and displays a currently valid OMB control number, and the public is not required to respond to a collection of information unless it displays a currently valid OMB control number. See 44 U.S.C. 3507. Also, notwithstanding any other provisions of law, no person shall be subject to penalty for failing to comply with a collection of information if the collection of information does not display a currently valid OMB control number. See 44 U.S.C. 3512. The public reporting burden for this collection of information is estimated to average approximately seven minutes per respondent. Interested parties are encouraged to send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the U.S. Department of Labor, Employee Benefits Security Administration, Office of Policy and Research, Attention: PRA Clearance Officer, 200 Constitution Avenue, N.W., Room N-5718, Washington, DC 20210 or email ebsa.opr@dol.gov and reference the OMB Control Number 1210- 0137. OMB Control Number 1210-0137 (expires 1/31/2026) Page 14 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 GENETIC INFORMATION NONDISCRIMINATION ACT (GINA) DISCLOSURES Genetic Information Nondiscrimination Act of 2008 The Genetic Information Nondiscrimination Act of 2008 (“GINA”) protects employees against discrimination based on their genetic information. Unless otherwise permitted, your Employer may not request or require any genetic information from you or your family members. The Genetic Information Nondiscrimination Act of 2008 (GINA) prohibits employers and other entities covered by GINA Title II from requesting or requiring genetic information of an individual or family member of the individual, except as specifically allowed by this law. To comply with this law, we are asking that you not provide any genetic information when responding to this request for medical information. “Genetic information,” as defined by GINA, includes an individual’s family medical history, the results of an individual’s or family member’s genetic tests, the fact that an individual or an individual’s family member sought or received genetic services, and genetic information of a fetus carried by an individual or an individual’s family member or an embryo lawfully held by an individual or family member receiving assistive reproductive services. Page 15 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 GRANDFATHERED PLAN NOTICE Your employer has determined that this is a “grandfathered health plan” under the Patient Protection and Affordable Care Act (the Affordable Care Act). As permitted by the Affordable Care Act, a grandfathered health plan can preserve certain basic health coverage that was already in effect when that law was enacted. Being a grandfathered health plan means that your plan may not include certain consumer protections of the Affordable Care Act that apply to other plans, for example, the requirement for the provision of preventive health services without any cost sharing. However, grandfathered health plans must comply with certain other consumer protections in the Affordable Care Act, for example, the elimination of lifetime limits on benefits. Questions regarding which protections apply and which protections do not apply to a grandfathered health plan and what might cause a plan to change from grandfathered health plan status can be directed to the plan administrator. Page 16 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 YOUR RIGHTS AND PROTECTIONS AGAINST SURPRISE MEDICAL BILLS Pursuant to the No Surprises Act, group health plans and health insurance issuers offering group or individual health insurance coverage must make publicly available, post on a public website of the plan or issuer, and include on each Explanation of Benefits, information in plain language on the restrictions on balance billing in certain circumstances, any applicable state law protections against balance billing, the requirements of the Act, and information on contacting appropriate state and federal agencies to report suspected violations of these balance billing restrictions. Plans and issuers may use this model notice to meet the disclosure requirements. For more information and further instructions, see https://www.cms.gov/httpswwwcmsgovregulations-and-guidancelegislationpaperworkreductionactof1995pra- listing/cms-10780. When you get emergency care or get treated by an out-of-network provider at an in-network hospital or ambulatory surgery center, you are protected from surprise billing or balance billing. What is “balance billing” (sometimes called “surprise billing”)? When you see a doctor or other health care provider, you may owe certain out-of-pocket costs, such as a copayment, coinsurance, and/or a deductible. You may have other costs or have to pay the entire bill if you see a provider or visit a health care facility that isn’t in your health plan’s network. “Out-of-network” describes providers and facilities that haven’t signed a contract with your health plan. Out-of-network providers may be permitted to bill you for the difference between what your plan agreed to pay and the full amount charged for a service. This is called “balance billing.” This amount is likely more than in-network costs for the same service and might not count toward your annual out-of-pocket limit. “Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-of-network provider. You are protected from balance billing for: • Emergency Services: If you have an emergency medical condition and get emergency services from an out-of- network provider or facility, the most the provider or facility may bill you is your plan’s in-network cost-sharing amount (such as copayments and coinsurance). You can’t be balance billed for these emergency services. This includes services you may get after you’re in stable condition, unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services. Certain services at an in-network hospital or ambulatory surgical center: When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out-of-network. In these cases, the most those providers may bill you is your plan’s in- network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist services. These providers cannot balance bill you and may not ask you to give up your protections not to be balance billed. Page 17 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 EMPLOYEE RETIREMENT INCOME SECURITY ACT (ERISA) General Requirements ERISA applies to employee welfare benefit plans, including group health plans, unless specifically exempted. Church and government plans are not subject to ERISA. ERISA imposes a variety of compliance obligations on the sponsors and administrators of group health plans. For example, ERISA establishes strict fiduciary duty standards for individuals who operate and manage employee benefit plans and requires that plans create and follow claims and appeals procedures. ERISA requires plan administrators to provide the following notices/disclosures: • Summary Plan Description (SPD) — Plan administrator must automatically provide an SPD to participants within 90 days of becoming covered by the plan. An updated SPD must be provided at least every five years if changes have been made to the information contained in the SPD. Otherwise, an updated SPD must be provided at least every 10 years. • Summary of Material Modifications (SMM) — Plan administrator must provide an SMM automatically to participants within 210 days after the end of the plan year in which the change was adopted. If benefits or services are materially reduced, participants generally must be provided with the SMM within 60 days from adoption. Also, plan administrators and issuers must provide 60 days’ advance notice of any material modification to plan terms or coverage that takes effect mid-plan year and affects the content of the SBC. The 60-day notice can be provided to participants through an updated SBC or by issuing an SMM. Plan administrator must provide copies of plan documents no later than 30 days after a written • Plan Documents — request. • Summary Annual Report (SAR)—Plan administrators of ERISA plans are subject to the SAR requirement, unless an exception applies. The SAR is a narrative summary of the Form 5500 and includes a statement of the right to receive a copy of the plan's annual report. The SAR must generally be provided within nine months after the end of the plan year. If the deadline for filing the Form 5500 was extended, the SAR must be provided within two months after the end of the extension period. Plans that are exempt from the annual Form 5500 filing requirement are not required to provide the SAR. Large, completely unfunded health plans are also exempt from the SAR requirement. However, large insured health plans must provide the SAR. Form 5500 Requirements The Form 5500 requirement applies to plan administrators of ERISA plans, unless an exception applies. Small health plans (fewer than 100 participants) that are fully insured, unfunded or a combination of fully insured and unfunded, are exempt from the Form 5500 filing requirement. The Form 5500 is used to ensure that employee benefit plans are operated and managed according to ERISA’s requirements. The filing requirements vary according to the type of ERISA plan. Unless an extension applies, the Form 5500 must be filed by the last day of the seventh month following the end of the plan year (that is, July 31 of the following year for calendar year plans). Page 18 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 MENTAL HEALTH PARITY AND ADDICTION EQUITY ACT (MHPAEA) The MHPAEA imposes parity requirements on group health plans that provide benefits for mental health or substance use disorders. For example, plans must offer the same access to care and patient costs for mental health and substance use disorder benefits as those that apply to general medical or surgical benefits. The MHPAEA applies to group health plans offering mental health and substance use disorder benefits. There is an exception for health plans that can demonstrate a certain cost increase and an exception for small health plans with fewer than two participants who are current employees (for example, retiree health plans). There is also an exception for employers with 50 or fewer employees during the preceding calendar year. However, in order to satisfy the essential health benefits requirement, mental health and substance use disorder benefits must be provided in a manner that complies with the MHPAEA. Thus, through this ACA mandate, small employers with insured plans are also subject to the mental health parity requirements. Under the MHPAEA, the plan administrator or the health insurance issuer must disclose the criteria for medical necessity determinations with respect to mental health or substance use disorder benefits to any current or potential participant, beneficiary or contracting provider upon request and the reason for any denial of reimbursement or payment for services with respect to mental health or substance use disorder benefits to the participant or beneficiary. Page 19 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Legal Notices for 2024 USERRA NOTICE Your Rights Under USERRA A. The Uniformed Services Employment and Reemployment Rights Act USERRA protects the job rights of individuals who voluntarily or involuntarily leave employment positions to undertake military service or certain types of service in the National Disaster Medical System. USERRA also prohibits employers from discriminating against past and present members of the uniformed services, and applicants to the uniformed services. B. Reemployment Rights You have the right to be reemployed in your civilian job if you leave that job to perform service in the uniformed service and: • You ensure that your employer receives advance written or verbal notice of your service; • You have five years or less of cumulative service in the uniformed services while with that particular mployer; e • You return to work or apply for reemployment in a timely manner after conclusion of service; and e • You have not been separated from service with a disqualifying discharge or under other than honorabl conditions. If you are eligible to be reemployed, you must be restored to the job and benefits you would have attained if you had not been absent due to military service or, in some cases, a comparable job. C. Right to Be Free from Discrimination and Retaliation If you: • Are a past or present member of the uniformed service; • Have applied for membership in the uniformed service; or • Are obligated to serve in the uniformed service; then an employer may not deny you o Initial employment; o Reemployment; o Retention in employment; o Promotion; or o Any benefit of employment because of this status. n addition, an employer may not retaliate against anyone assisting in the enforcement of USERRA rights, including I testifying or making a statement in connection with a proceeding under USERRA, even if that person has no service connection. D. Health Insurance Protection • If you leave your job to perform military service, you have the right to elect to continue your existing mployer-based health plan coverage for you and your dependents for up to 24 months while in the e military. • Even if you do not elect to continue coverage during your military service, you have the right to be reinstated in your employer's health plan when you are reemployed, generally without any waiting periods or exclusions (e.g., pre-existing condition exclusions) except for service-connected illnesses or injuries. E. Enforcement • The U.S. Department of Labor, Veterans' Employment and Training Service (VETS) is authorized to investigate and resolve complaints of USERRA violations. For assistance in filing a complaint, or for any other information on USERRA, contact VETS at 1-866-4-USA-DOL or visit its Web site at http://www.dol.gov/vets. An interactive online USERRA Advisor can be viewed at http://www.dol.gov/elaws/userra.htm. • If you file a complaint with VETS and VETS is unable to resolve it, you may request that your case be referred to the Department of Justice or the Office of Special Counsel, as applicable, for representation. • You may also bypass the VETS process and bring a civil action against an employer for violations of USERRA. The rights listed here may vary depending on the circumstances. The text of this notice was prepared by VETS, and may be viewed on the Internet at this address: http://www.dol.gov/vets/programs/userra/poster.htm. Federal law requires employers to notify employees of their rights under USERRA, and employers may meet this requirement by displaying the text of this notice where they customarily place notices for employees. U.S. Department of Labor, Veterans' Employment and Training Service, 1-866-487-2365. Page 20 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

COBRA MODEL GENERAL NOTICE OF COBRA CONTINUATION COVERAGE RIGHTS Introduction You’re getting this notice because you recently gained coverage under a group health plan (the Plan). This notice has important information about your right to COBRA continuation coverage, which is a temporary extension of coverage under the Plan. This notice explains COBRA continuation coverage, when it may become available to you and your family, and what you need to do to protect your right to get it. When you become eligible for COBRA, you may also become eligible for other coverage options that may cost less than COBRA continuation coverage. The right to COBRA continuation coverage was created by a federal law, the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA). COBRA continuation coverage can become available to you and other members of your family when group health coverage would otherwise end. For more information about your rights and obligations under the Plan and under federal law, you should review the Plan’s Summary Plan Description or contact the plan administrator. You may have other options available to you when you lose group health coverage. For example, you may be eligible to buy an individual plan through the Health Insurance Marketplace. By enrolling in coverage through the Marketplace, you may qualify for lower costs on your monthly premiums and lower out-of-pocket costs. Additionally, you may qualify for a 30-day special enrollment period for another group health plan for which you are eligible (such as a spouse’s plan), even if that plan generally doesn’t accept late enrollees. What is COBRA continuation coverage? COBRA continuation coverage is a continuation of Plan coverage when it would otherwise end because of a life event. This is also called a “qualifying event.” Specific qualifying events are listed later in this notice. After a qualifying event, COBRA continuation coverage must be offered to each person who is a “qualified beneficiary.” You, your spouse, and your dependent children could become qualified beneficiaries if coverage under the Plan is lost because of the qualifying event. Under the Plan, qualified beneficiaries who elect COBRA continuation coverage must pay for COBRA continuation coverage. If you’re an employee, you’ll become a qualified beneficiary if you lose your coverage under the Plan because of the following qualifying events: • Your hours of employment are reduced, or • Your employment ends for any reason other than your gross misconduct. If you’re the spouse of an employee, you’ll become a qualified beneficiary if you lose your coverage under the Plan because of the following qualifying events: • Your spouse dies; • Your spouse’s hours of employment are reduced; • Your spouse’s employment ends for any reason other than his or her gross misconduct; • Your spouse becomes entitled to Medicare benefits (under Part A, Part B, or both); or • You become divorced or legally separated from your spouse. Your dependent children will become qualified beneficiaries if they lose coverage under the Plan because of the following qualifying events: • The parent-employee dies; • The parent-employee’s hours of employment are reduced; mployee’s employment ends for any reason other than his or her gross misconduct; • The parent-e ployee becomes entitled to Medicare benefits (Part A, Part B, or both); • The parent-em • The parents become divorced or legally separated; or • The child stops being eligible for coverage under the Plan as a “dependent child.” Page 21 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

COBRA When is COBRA continuation coverage available? The Plan will offer COBRA continuation coverage to qualified beneficiaries only after the plan administrator has been notified that a qualifying event has occurred. The employer must notify the plan administrator of the following qualifying events: • The end of employment or reduction of hours of employment; • Death of the employee; • or • The employee’s becoming entitled to Medicare benefits (under Part A, Part B, or both). For all other qualifying events (divorce or legal separation of the employee and spouse or a dependent child’s losing eligibility for coverage as a dependent child), you must notify the plan administrator within 60 days after the qualifying event occurs. How is COBRA continuation coverage provided? Once the plan administrator receives notice that a qualifying event has occurred, COBRA continuation coverage will be offered to each of the qualified beneficiaries. Each qualified beneficiary will have an independent right to elect COBRA continuation coverage. Covered employees may elect COBRA continuation coverage on behalf of their spouses, and parents may elect COBRA continuation coverage on behalf of their children. COBRA continuation coverage is a temporary continuation of coverage that generally lasts for 18 months due to employment termination or reduction of hours of work. Certain qualifying events, or a second qualifying event during the initial period of coverage, may permit a beneficiary to receive a maximum of 36 months of coverage. There are also ways in which this 18-month period of COBRA continuation coverage can be extended: Disability extension of 18-month period of COBRA continuation coverage If you or anyone in your family covered under the Plan is determined by Social Security to be disabled and you notify the plan administrator in a timely fashion, you and your entire family may be entitled to get up to an additional 11 months of COBRA continuation coverage, for a maximum of 29 months. The disability would have to have started at some time before the 60th day of COBRA continuation coverage and must last at least until the end of the 18-month period of COBRA continuation coverage. Second qualifying event extension of 18-month period of continuation coverage If your family experiences another qualifying event during the 18 months of COBRA continuation coverage, the spouse and dependent children in your family can get up to 18 additional months of COBRA continuation coverage, for a maximum of 36 months, if the Plan is properly notified about the second qualifying event. This extension may be available to the spouse and any dependent children getting COBRA continuation coverage if the employee or former employee dies; becomes entitled to Medicare benefits (under Part A, Part B, or both); gets divorced or legally separated; or if the dependent child stops being eligible under the Plan as a dependent child. This extension is only available if the second qualifying event would have caused the spouse or dependent child to lose coverage under the Plan had the first qualifying event not occurred. Are there other coverage options besides COBRA Continuation Coverage? Yes. Instead of enrolling in COBRA continuation coverage, there may be other coverage options for you and your family through the Health Insurance Marketplace, Medicare, Medicaid, Children’s Health Insurance Program (CHIP), or other group health plan coverage options (such as a spouse’s plan) through what is called a “special enrollment period.” Some of these options may cost less than COBRA continuation coverage. You can learn more about many of these options at www.healthcare.gov. Page 22 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

COBRA Can I enroll in Medicare instead of COBRA continuation coverage after my group health plan coverage ends? In general, if you don’t enroll in Medicare Part A or B when you are first eligible because you are still employed, after the Medicare initial enrollment period, you have an 8-month special enrollment period1 to sign up for Medicare Part A or B, beginning on the earlier of • The month after your employment ends; or • The month after group health plan coverage based on current employment ends. f you don’t enroll in Medicare and elect COBRA continuation coverage instead, you may have to pay a Part B late I enrollment penalty and you may have a gap in coverage if you decide you want Part B later. If you elect COBRA continuation coverage and later enroll in Medicare Part A or B before the COBRA continuation coverage ends, the Plan may terminate your continuation coverage. However, if Medicare Part A or B is effective on or before the date of the COBRA election, COBRA coverage may not be discontinued on account of Medicare entitlement, even if you enroll in the other part of Medicare after the date of the election of COBRA coverage. If you are enrolled in both COBRA continuation coverage and Medicare, Medicare will generally pay first (primary payer) and COBRA continuation coverage will pay second. Certain plans may pay as if secondary to Medicare, even if you are not enrolled in Medicare. For more information visit https://www.medicare.gov/medicare-and-you. If you have questions Questions concerning your Plan or your COBRA continuation coverage rights should be addressed to the contact or contacts identified below. For more information about your rights under the Employee Retirement Income Security Act (ERISA), including COBRA, the Patient Protection and Affordable Care Act, and other laws affecting group health plans, contact the nearest Regional or District Office of the U.S. Department of Labor’s Employee Benefits Security Administration www.dol.gov/agencies/ebsa. (Addresses and phone numbers of Regional and District EBSA (EBSA) in your area or visit www.healthcare.gov. Offices are available through EBSA’s website.) For more information about the Marketplace, visit Keep your Plan informed of address changes To protect your family’s rights, let the plan administrator know about any changes in the addresses of family members. You should also keep a copy, for your records, of any notices you send to the plan administrator. Page 23 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Family Medical Leave Act (FMLA) Eligible employees who work for a covered employer can take up to 12 weeks of unpaid, job-protected leave in a 12- month period for the following reasons: • The birth of a child or placement of a child for adoption or foster care; • To bond with a child (leave must be taken within one year of the child’s birth or placement); • To care for the employee’s spouse, child, or parent who has a qualifying serious health condition; m • For the employee’s own qualifying serious health condition that makes the employee unable to perfor the employee’s job; • For qualifying exigencies related to the foreign deployment of a military member who is the employee’s spouse, child, or parent. An eligible employee who is a covered servicemember’s spouse, child, parent, or next of kin may also take up to 26 weeks of FMLA leave in a single 12-month period to care for the servicemember with a serious injury or illness. Benefits & Protections An employee does not need to use leave in one block. When it is medically necessary or otherwise permitted, employees may take leave intermittently or on a reduced schedule. Employees may choose, or an employer may require, use of accrued paid leave while taking FMLA leave. If an employee substitutes accrued paid leave for FMLA leave, the employee must comply with the employer’s normal paid leave policies. While employees are on FMLA leave, employers must continue health insurance coverage as if the employees were not on leave. Upon return from FMLA leave, most employees must be restored to the same job or one nearly identical to it with equivalent pay, benefits, and other employment terms and conditions. An employer may not interfere with an individual’s FMLA rights or retaliate against someone for using or trying to use FMLA leave, opposing any practice made unlawful by the FMLA, or being involved in any proceeding under or related to the FMLA. Eligibility Requirements An employee who works for a covered employer must meet three criteria in order to be eligible for FMLA leave. The employee must: • Have worked for the employer for at least 12 months; • Have at least 1,250 hours of service in the 12 months before taking leave;* and s • Work at a location where the employer has at least 50 employees within 75 miles of the employee’ worksite. *Special “hours of service” requirements apply to airline flight crew employees. Page 24 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Family Medical Leave Act (FMLA) Generally, employees must give 30-days’ advance notice of the need for FMLA leave. If it is not possible to give 30- days’ notice, an employee must notify the employer as soon as possible and, generally, follow the employer’s usual procedures. Employees do not have to share a medical diagnosis but must provide enough information to the employer so it can determine if the leave qualifies for FMLA protection. Sufficient information could include informing an employer that the employee is or will be unable to perform his or her job functions, that a family member cannot perform daily activities, or that hospitalization or continuing medical treatment is necessary. Employees must inform the employer if the need for leave is for a reason for which FMLA leave was previously taken or certified. Employers can require a certification or periodic recertification supporting the need for leave. If the employer determines that the certification is incomplete, it must provide a written notice indicating what additional information is required. Employer Responsibilities Once an employer becomes aware that an employee’s need for leave is for a reason that may qualify under the FMLA, the employer must notify the employee if he or she is eligible for FMLA leave and, if eligible, must also provide a notice of rights and responsibilities under the FMLA. If the employee is not eligible, the employer must provide a reason for ineligibility. Employers must notify its employees if leave will be designated as FMLA leave, and if so, how much leave will be designated as FMLA leave. Enforcement Employees may file a complaint with the U.S. Department of Labor, Wage and Hour Division, or may bring a private lawsuit against an employer. The FMLA does not affect any federal or state law prohibiting discrimination or supersede any state or local law or collective bargaining agreement that provides greater family or medical leave rights. Page 25 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Market Exchange NEW HEALTH INSURANCE MARKETPLACE COVERAGE Form Approved OMB No. 1210-0149 OPTIONS AND YOUR HEALTH COVERAGE (expires 9-30-2023) PART A: General Information When key parts of the healthcare law take effect in 2014, there will be a new way to buy health insurance: the Health Insurance Marketplace. To assist you as you evaluate options for you and your family, this notice provides some basic information about the new Marketplace and employment–based health coverage offered by your employer. What is the Health Insurance Marketplace? The Marketplace is designed to help you find health insurance that meets your needs and fits your budget. The Marketplace offers "one–stop shopping" to find and compare private health insurance options. You may also be eligible for a new kind of tax credit that lowers your monthly premium right away. Open enrollment for health insurance coverage through the Marketplace begins in October 2013 for coverage starting as early as January 1, 2014 in your area. Can I Save Money on my Health Insurance Premiums in the Marketplace? You may qualify to save money and lower your monthly premium, but only if your employer does not offer coverage, or offers coverage that doesn't meet certain standards. The savings on your premium that you're eligible for depends on your household income.. Does Employer Health Coverage Affect Eligibility for Premium Savings through the Marketplace? Yes. If you have an offer of health coverage from your employer that meets certain standards, you will not be eligible for a tax credit through the Marketplace and may wish to enroll in your employer's health plan. However, you may be eligible for a tax credit that lowers your monthly premium, or a reduction in certain cost–sharing if your employer does not offer coverage to you at all or does not offer coverage that meets certain standards. If the cost of a plan from your employer that would cover you (and not any other members of your family) is more than 9.5% of your household income for the year, or if the coverage your employer provides does not meet the "minimum value" standard set by the Affordable Care Act, you may be eligible for a tax credit. Note: If you purchase a health plan through the Marketplace instead of accepting health coverage offered by your employer, then you may lose the employer contribution (if any) to the employer–offered coverage. Also, this employer contribution, as well as your employee contribution to employer–offered coverage, is often excluded from income for Federal and State income tax purposes. Your payments for coverage through the Marketplace are made on an after–tax basis. How Can I Get More Information? For more information about your coverage offered by your employer, please check your summary plan description or contact Stephanie Cernero, HR Business Partner, scernero@firstIB.com The Marketplace can help you evaluate your coverage options, including your eligibility for coverage through the Marketplace and its cost. Please visit HealthCare.gov for more information, including an online application for health insurance coverage and contact information for a Health Insurance Marketplace in your area. Page 26 | ACME| Plan Year 2024 Open Enrollment This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.