ACME Benefits Guide

Plan Year 2024 - Employee Benefits

Employee Benefits Plan Year 2024

Our Benefits With an employee-centric, future-focused culture, our company strives to continually improve the overall experience and wellbeing of our employees so they can thrive at both work and home. We actively engage with our employees to hear what is meaningful for them and incorporate changes into our plan to meet those needs. Thank you for your input; your feedback has directly impacted our benefit offerings this year and we look forward to sharing these exciting updates with you! John Doe FVP, CHIEF PEOPLE OFFICER [email protected]

Eligibility Employees Spouse & Legal Dependents Qualifying Events All full-time employees working at least 30 hours per Legally married spouses and children up to the age of 26 You may make a change to your benefits if you have a week are eligible to participate in benefit enrollment. are eligible dependents under our benefit plan. qualified status change such as: marriage, You may cover yourself and eligible family members Your children of any age are also eligible if you support divorce, birth/adoption, death, changes in spouse’s under our benefit plan. them, and they are incapable of self-support due to benefits, and more. If your dependent becomes disability and you are their support system. As required by ineligible for coverage during the year, you must our insurance contracts, you may be required to provide contact your plan administrator within 30 days. proof of eligibility for your dependents.

They are your benefits, you deserve to imagine more. At ACME we believe in the power of personal connections. And personal connections are built on trust and understanding. That means we take pride in knowing our employees and their needs. Beyond our amazing culture and casual work environment, we offer attractive benefits that promote work/life balance, wellness and personal and professional growth.

Employee Cost Coverage through UMR and Surest Bi-Weekly Premiums Base Coverage through Davis Network Coverage through Delta Dental Buy-Up Coverage through VSP Network Bi-Weekly Premiums MEDICAL Bi-Weekly Premiums DENTAL VISION Base Buy-Up Surest Base Buy-Up Employee Only $0.00 $0.00 $0.00 Base Buy-Up Employee Only $0.00 $0.00 Employee + Employee Only $0.00 $0.00 Spouse $0.00 $0.00 $0.00 Employee + Spouse $0.00 $0.00 Employee + Spouse $0.00 $0.00 Employee + Employee + Child(ren) $0.00 $0.00 Child(ren) $0.00 $0.00 $0.00 Employee + Child(ren) $0.00 $0.00 Family $0.00 $0.00 Family $0.00 $0.00 $0.00 Family $0.00 $0.00 SEE THIS PLAN SEE THIS PLAN SEE THIS PLAN

Medical BENEFITS Your 2024 medical benefits include two High Deductible Health Plans offered by UMR, and a new PPO plan offered by Surest. The Base & Buy-Up High Deductible Health Surest is a new kind of health plan offered Plans will remain with UMR for 2024 and through UnitedHealthcare. Shop for care on will continue to work in the same way with their website or app with no deductibles and a Health Savings Account. Once you have no copays with lower out-of-pocket costs. completed enrollment with UMR, click the Once you have completed enrollment with link below to login or register. Surest, register at the link below. UMR Portal Surest Portal

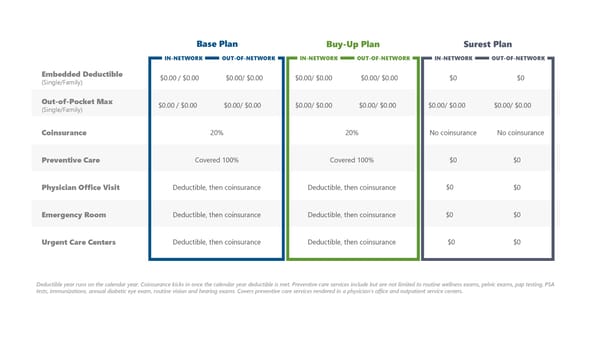

Base Plan Buy-Up Plan Surest Plan IN-NETWORK OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK Embedded Deductible $0.00 / $0.00 $0.00/ $0.00 $0.00/ $0.00 $0.00/ $0.00 $0 $0 (Single/Family) Out-of-Pocket Max $0.00 / $0.00 $0.00/ $0.00 $0.00/ $0.00 $0.00/ $0.00 $0.00/ $0.00 $0.00/ $0.00 (Single/Family) Coinsurance 20% 20% No coinsurance No coinsurance Preventive Care Covered 100% Covered 100% $0 $0 Physician Office Visit Deductible, then coinsurance Deductible, then coinsurance $0 $0 Emergency Room Deductible, then coinsurance Deductible, then coinsurance $0 $0 Urgent Care Centers Deductible, then coinsurance Deductible, then coinsurance $0 $0 Deductible year runs on the calendar year. Coinsurance kicks in once the calendar year deductible is met. Preventive care services include but are not limited to routine wellness exams, pelvic exams, pap testing, PSA tests, immunizations, annual diabetic eye exam, routine vision and hearing exams. Covers preventive care services rendered in a physician's office and outpatient service centers.

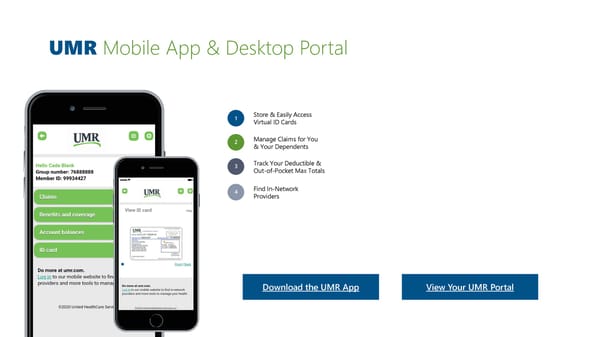

UMR Mobile App & Desktop Portal 1 Store & Easily Access Virtual ID Cards 2 Manage Claims for You & Your Dependents 3 Track Your Deductible & Out-of-Pocket Max Totals 4 Find In-Network Providers Download the UMR App View Your UMR Portal

24/7 Virtual Doctor Visits 24/7 access to U.S. Doctors can diagnose, Quality care from licensed doctors by treat, & prescribe wherever you are phone or video medication Download the App Register or Schedule Online

ACME: Behavioral Health Virtual Counseling from Psychologists and Therapists Choose a therapist, psychologist or psychiatrist who fits your needs and schedule visits 7 days a week from wherever you're most comfortable. Our online therapists help with: Anxiety, stress, feeling overwhelmed Negative thought patterns Depression Not feeling like yourself Not wanting to get out of bed Relationship conflicts Marriage and relationship issues Trauma and PTSD Mood swings Medication management (Psychiatry only) Register & Schedule Online

What is WellBridge? High-quality, low-cost care for surgical needs, right here in Indianapolis. Check out pricing and a full market price comparison. TRANSPARENT, UP-FRONT PRICING WellBridge tells you up front what your procedure will cost. Total. There are no hidden costs. No surprise charges. QUALITY SURGICAL SERVICES From our accomplished, prominent surgeons to our staff dedicated to providing the best possible patient care, you can expect an experience second to none. AFFORDABILITY The most recent study by Rand Corp revealed Indiana to be the fourth highest surgical facility costs in the country. That is precisely why we started WellBridge Surgical. To give you a fairly priced alternative to the “way it’s always been done”.

Please note when going through the demo this is how the app will function, but some of the price UnitedHealthcare’s Try the Surest Demo Surest Health Plan points will be different for your specific plan. Access Code: ACMEdemo Upfront Pricing No deductibles. No coinsurance. Copay-only plan with lower out-of-pocket costs. Find Care Quickly Find the care you need on the Surest app or website. Compare & Save Check costs and compare options before you make an appointment.

How does Surest Work?

Prescription DRUGS EpiphanyRx is the pharmacy manager for Navitus is the pharmacy manager for Surest UMR HDHP participants. Costco mail-order participants. Kroger mail-order services are services are available for UMR members. available for Surest members.

Base Plan Buy-Up Plan Surest Plan Retail Pharmacy: You pay $0 You pay $0 N/A Preventive Retail Pharmacy Tier One: Deductible, then $0 copay Deductible, then $0 copay $0 copay (30-day supply) Generic Retail Pharmacy Tier Two: Deductible, then $0 copay Deductible, then $0 copay $0 copay (30-day supply) Brand Name Formulary Retail Pharmacy Tier Three: Deductible, then $0 copay Deductible, then $0 copay $0 copay (30-day supply) Brand Name Non-Formulary Retail Pharmacy Tier Four: Deductible, then 15% max $0 Deductible, then 25% max $200 N/A Specialty Medication Mail Order Tier One: Deductible, then $0 copay Deductible, then $0 copay $25 copay (90-day supply) Generic Mail Order Tier Two: Deductible, then $5 copay Deductible, then $0 copay $0 copay (90-day supply) Brand Name Formulary Mail Order Tier Three: Deductible, then $0 copay Deductible, then $0 copay $0 copay (90-day supply) Brand Name Non-Formulary Mail Order Tier Four: Deductible, then 15% max $0 Deductible, then 25% max $0 $0 - $0 copay Specialty Medication Retail pharmacy is a 30-day supply, mail-order is a 90-day supply. Specialty medications are limited to a 30-day supply, regardless of whether they are retail or mail order. The Preventive Drug Plan is an in-network benefit that covers preventive drugs at 100% for the base and buy-up HDHP plans. For UMR HDHP plan members, any preventive drug purchased, which is not on the UMR Preventive Drug List, will have the deductible and coinsurance applied. Please refer to the Preventive Drug List for a complete listing of drugs covered under this benefit.

Health Savings ACCOUNT A Health Savings Account (HSA) is available to those enrolled Annual ACME Contribution Up To in a High Deductible Health Plan. HSA funds can be used for a wide variety of qualified medical expenses all tax-free. Any unused earnings rollover from year-to-year. ACME will $4,500 contribute $500 to your HSA, match up to $200 more, and offers a $400 wellness incentive.

Example Employee First IB First IB Completed Annual Total in Contribution Match Contribution Wellness Incentive Employee HSA $0 + $0 + $0 + $0 = $0 $0 + $0 + $0 + $0 = $0 $0 + $0 + $0 + $0 = $0 View Qualified Expenses The 2024 IRS contribution maximum is $4,150 for individuals and $8,300 for families.

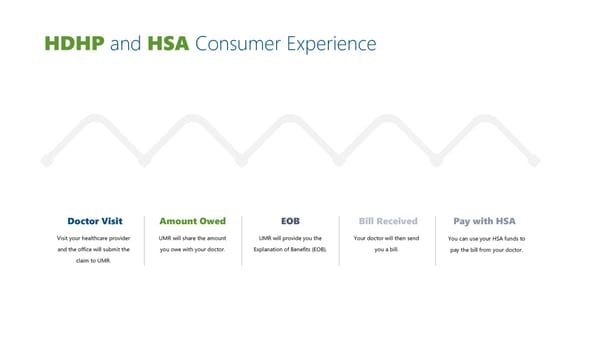

HDHP and HSA Consumer Experience Doctor Visit Amount Owed EOB Bill Received Pay with HSA Visit your healthcare provider UMR will share the amount UMR will provide you the Your doctor will then send You can use your HSA funds to and the office will submit the you owe with your doctor. Explanation of Benefits (EOB). you a bill. pay the bill from your doctor. claim to UMR.

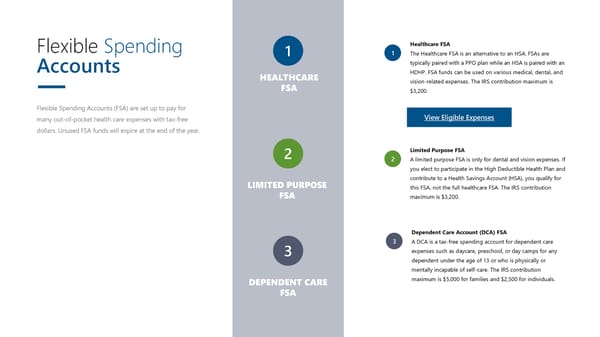

Flexible Spending Healthcare FSA 1 1 The Healthcare FSA is an alternative to an HSA. FSAs are Accounts typically paired with a PPO plan while an HSA is paired with an HEALTHCARE HDHP. FSA funds can be used on various medical, dental, and FSA vision-related expenses. The IRS contribution maximum is $3,200. Flexible Spending Accounts (FSA) are set up to pay for many out-of-pocket health care expenses with tax-free View Eligible Expenses dollars. Unused FSA funds will expire at the end of the year. 2 Limited Purpose FSA 2 A limited purpose FSA is only for dental and vision expenses. If you elect to participate in the High Deductible Health Plan and LIMITED PURPOSE contribute to a Health Savings Account (HSA), you qualify for FSA this FSA, not the full healthcare FSA. The IRS contribution maximum is $3,200. Dependent Care Account (DCA) FSA 3 A DCA is a tax-free spending account for dependent care 3 expenses such as daycare, preschool, or day camps for any dependent under the age of 13 or who is physically or mentally incapable of self-care. The IRS contribution DEPENDENT CARE maximum is $5,000 for families and $2,500 for individuals. FSA

DENTAL DELTA DENTAL OF INDIANA 225 S East St Indianapolis, IN 46202 317-842-4022 Dental Coverage with Delta Dental KRISTEN JONES Group Delta Dental PPO There are two plan options: Base and Buy-Up. The primary difference in benefits between the Base Plan and Buy-Up Plan is the annual maximum available under the plan and orthodontic services (only available under the Buy-Up planFind providers, view your ID card, and more online or using the mobile app. Online Portal Download the App

Base Plan Buy-Up Plan Deductible $0 / $0 $0/$0 (Single/Family) Annual Maximum $0 (Per Person) $0 $0 Dental Maximum Rollover $0 Preventive Services Covered 100%, no deductible Covered 100%, no deductible Exams, Cleanings, Fluoride, X-Rays Basic Dental Services 60% after deductible is satisfied 70% after deductible is satisfied Fillings, Extractions, Endodontics, Crown Repairs Major Dental Services 20% after deductible is satisfied 30% after deductible is satisfied Crowns, Dentures, In/Outlays, Periodontics Covered 40% with lifetime max of $0 Orthodontia Services Not covered per person; this service is not subject to the deductible Rollover provisions apply. Please see your certificate of coverage.

VISION Coverage through Guardian Your vision coverage is offered through Guardian with your choice of two different networks. The Base Plan utilizes the Davis Vision Network while the Buy-Up plan is through the VSP Network. The primary difference between the Base Plan and Buy-Up Plan are the providers in each network. The Base Plan is geared towards big box retailers, while the Buy-Up plan covers more independent practices. To view networks and providers, visit the links below. Guardian Portal

Base Plan (Davis) Buy-Up Plan (VSP) Exam $0 copay $0 copay Glasses Lenses $0 copay $0 copay (Single / Bifocal/ Trifocal / Lenticular) Glasses Frames $0 retail frame allowance $0 retail frame allowance +10% off remaining balance +10% off remaining balance Contact Lenses $0 copay / $0 copay / (Medically Necessary / Elective) $0 copay with $0 retail allowance $0 retail allowance Each material benefit is paid out once per calendar year.

Additional BENEFITS ACME provides full-time employees several employer- paid options, and a few additional voluntary insurance options, through Symetra and Guardian. Visit them online using the links below. Symetra Portal Guardian Portal

Employer-Paid Benefits Group Life and AD&D Paid Parental Leave The group life and AD&D and dismember policy is available First IB offers paid parental leave to employees for the to all full-time employees. In the event of death, loss of (or purpose of bonding with or caring for a newborn child, loss of use of) a body part or function, speech, eyesight, or newly-adopted child, or newly-placed foster child. Paid hearing, your beneficiaries will receive 1x your annual salary, parental leave pays for up to 2 weeks of leave at 100% minimum of $50K and maximum of $150K. Coverage of the employee’s regular base pay. decrease by 35% at age 65, by 60% at age 70, by 75% at age 75, and by 85% at age 80. Short-Term Disability Long-Term Disability Short-term disability protects a portion of your income Long-term disability protects a portion of your income for during a short period of time if you are unable to work due an extended period of time if you are unable to work due to an illness or an accident not related to your job. Benefits to an illness or an accident not related to your job . th st begin on the 8 day after an illness or the 1 day after an st accident. The policy will pay a tiered percentage of your Benefits begin on the 91 day after the date of the incident weekly salary for 13 weeks at 100% / 85% / 75%. and will cover 60% of your earnings (up to $6,000/month).

Voluntary Benefits Employees have the option to purchase additional life, accident, and critical illness insurance. Coverage is only available to the spouse and dependent child(ren) if the employee elects coverage. Accident Voluntary Life & AD&D Employee Benefit: Up to $00,000 depending Employee Benefit: Increments of $00,000 up to $00,000. severity of accident. Guarantee issue of $00,000. Spouse & Child(ren) Benefit: Up to $5,000 Spouse Benefit: Increments of $0,000 up to $0,000. depending severity of accident. (Cannot exceed 50% of employee amount) Guarantee issue of $0,000. Child(ren) Benefit: Up to $0,000, guarantee issue is face-value. Critical Illness (Children age 14 days to 23 years, 26 if full-time student) Employee Benefit: $0,000 or $0,000 Spouse Benefit: 20% of employee benefit. Child(ren) Benefit: 15% of employee benefit.

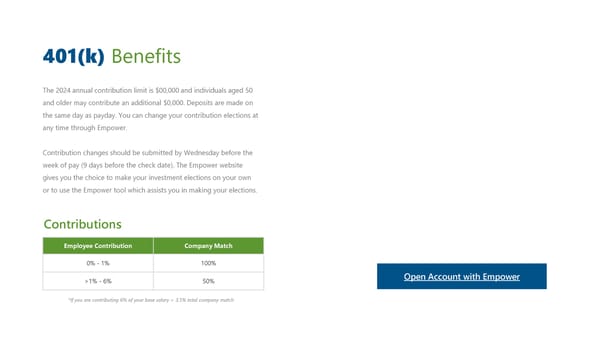

401(k) Benefits The 2024 annual contribution limit is $00,000 and individuals aged 50 and older may contribute an additional $0,000. Deposits are made on the same day as payday. You can change your contribution elections at any time through Empower. Contribution changes should be submitted by Wednesday before the week of pay (9 days before the check date). The Empower website gives you the choice to make your investment elections on your own or to use the Empower tool which assists you in making your elections. Contributions Employee Contribution Company Match 0% - 1% 100% >1% - 6% 50% Open Account with Empower *If you are contributing 6% of your base salary = 3.5% total company match

Employee Clinical Assistance Confidential assistance for a range of concerns including addictions, depression, anxiety, stress, PROGRAM relationships, and parenting. All full-time employees and their families are automatically Wellness (even if you are not enrolled in medical benefits) provided Wellness resources for weight-loss management, access to New Avenue’s EAP. The EAP is a confidential resource fitness and exercise, stress management, parenting, available 24/7/365 to help you deal with a variety of life stages and relationship support. and concerns. The program includes up to 5 in-person, face- to-face confidential consultations per family member per year. Call (800) 731-6501 or visit the website below to register. Work-Life Password: First IB Assistance for daily challenges at home and work including financial, legal, child/elder care, and Get Help identity theft.

Paycom Enroll Today! Log in to the Paycom app or on your desktop to begin enrollment. From the Notification Center or from the Benefits section, click the current year’s Benefits Enrollment. Review instructions and click Start Enrollment. Enroll Online