The Intelligent Treasury | EuroFinance | The Economist Group

EuroFinance’s 23rd annual conference on Strategic International Treasury

EuroFinance’s 23rd annual conferenceon Strategic InternationalTreasury The IntelligentTreasury Official sponsors Technology sponsor www.eurofinance.com/miami

The most senior-level The IntelligentTreasury Programhighlights international treasury Using digitalisation and data to finally release the strategic value of Technological advancements –casestudiesonimplementation, treasury, the intelligent treasurywillnot onlyboostrevenuesbutalso including Artificial Intelligence, Big Data, TMS upgrades and eventintheAmericas savecompaniesmillions inprocess,compliance andregulatory costs. cloudsolutions Data has not only become the lifeblood of the company but also its Theintelligenttreasury –wheretreasuryandthebusiness biggest challenge,anddigital transformation isaleapallbusinesses intersect –key partners in transformation need to make to maintain excellence in treasury. The pace of Bestpractice treasury – whatconcrete,measureable stepscan technological change demands your role to be constantly evolving treasury take to ensure bestpractices? and pushing the boundaries to both unlock opportunities and drive business growth. Howtofutureproofyourbusinesswithastrategiclongterm Bringing together treasury leads and their finance colleagues, the 3 treasuryplan “It is an opportunity to discover what’s dayconference focussesonvitaltreasuryupdatesplus strategiesfor NEW: The Complex Countries Series – interactive workshops new in treasury, best practices and maintaining best practiceglobally. tounderstandthechallengesandsolutionsfacedinchallenging latest innovations and market trends.” Join us in Miami in May forthe mostsenior-levelinternational markets treasury event in theAmericas. NEW:FinTechcompaniesrevealed–meettheinnovators —Yosymar Vasquez, turning treasury on itshead HeadofTreasuryLatinAmerica,AkzoNobel Approved for up to 15.1 CTPrecertification credits by the Association for FinancialProfessionals. 40+ 350+ 70+ 20+ SESSIONS DELEGATES SPEAKERS EXHIBITORS Approvedfor upto10.3FP&Arecertificationcredits by the Association for FinancialProfessionals. 2

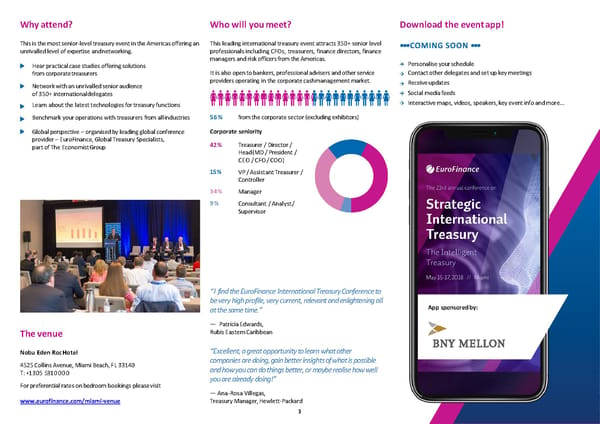

Whyattend? Whowillyoumeet? Download the eventapp! This is the mostsenior-leveltreasuryeventinthe Americasofferingan This leading international treasury event attracts 350+ senior level ••• COMING SOON••• unrivalled level of expertise andnetworking. professionals including CFOs, treasurers, finance directors, finance managersandriskofficersfromtheAmericas. Personalise yourschedule Hearpracticalcasestudiesofferingsolutions from corporatetreasurers It is also open to bankers,professionaladvisersandotherservice Contactotherdelegatesandsetupkeymeetings Networkwithanunrivalledsenioraudience providers operating in the corporate cashmanagement market. Receiveupdates of 350+ internationaldelegates Social mediafeeds Learn about the latest technologies for treasury functions Interactivemaps,videos, speakers,keyeventinfoandmore... Benchmark your operations with treasurers from allindustries 56% from the corporate sector (excludingexhibitors) Globalperspective – organisedby leadingglobal conference Corporate seniority provider – EuroFinance, Global Treasury Specialists, 42% Treasurer / Director / part of The EconomistGroup Head(MD / President / CEO / CFO/ COO) 15% VP / AssistantTreasurer / Controller 34% Manager 9% Consultant / Analyst/ Supervisor “I find the EuroFinance International Treasury Conference to be very high profile, very current, relevant and enlightening all App sponsoredby: at the same time.” — Patricia Edwards, Thevenue Rubis EasternCaribbean Nobu Eden RocHotel “Excellent, a great opportunity to learn what other 4525CollinsAvenue,MiamiBeach,FL33140 companies are doing, gain better insights of what is possible T: +1 305 5310000 and how you can do things better, or maybe realise how well For preferential rates on bedroom bookings pleasevisit you are already doing!” —Ana-Rosa Villegas, www.eurofinance.com/miami-venue Treasury Manager,Hewlett-Packard 3

AGENDA // AT A GLANCE PRE- DAY 1 // TUESDAY MAY15 CONFERENCE 9:00 Chairs’ introduction STREAM1 STREAM2 STREAM3 STREAM4 TRAINING 9:15 Selecting thesignificant DIGITALTREASURY: END-TO-END RISKOVERSIGHT: HOW TREASURY CAN LATINAMERICA // MONDAY MAY 14 from thenoise STRATEGICEDGE AROLEFORTHEINTELLIGENT SUPPORT ANDPROMOTE FOCUS 10:00 Makingsenseofachangingworld 11:40 Creating a digital TREASURY? BUSINESSGROWTH 11:40 Brazil CASH FLOW 11:00 Refreshmentbreak roadmap: reaching 11:40 The endlesscyber 11:40 Centralize and 12:20 Argentina FORECASTING 11:40 Conference breaks intostreams tomorrow’streasury problem centralize andcentralize 1:00 Lunch SEE PAGE5 today 12.20 Treasury’stwo-way again Mexico 12:20 SSCthenextgeneration: street: what are you 12:20 Gettingthebestfrom 2:20 3:40 Refreshment break how to make itso worth to your banks? your banks, keeping 3:00 Peru 4:00 Banking oninnovation: 1:00 Lunch Andwhatdoyougetin your optionsopen thefightforfinancialservices 2:20 C2Bconnectivity: return? 1:00 Lunch (on the exhibitionfloor) a difficultdance 1:00 Lunch 2:20 Isyourtreasuryfitfor 5:00 Networkingreception 3:00 The journeyto 2:20 Managing risingrates, change? automation and rising investment 3:00 FX riskmanagement risks 3:00 Refinance or wait? How toplaythetippingpoint DAY 2 // WEDNESDAY MAY16 9:00 Chairs’ introduction STREAM1 STREAM2 STREAM3 STREAM4 9:10 Howdigitalhumansarechangingthefinancialfuture DIGITALTREASURY: END-TO-END RISKOVERSIGHT: HOW TREASURY CAN BEST PRACTICETREASURY 10:00 Navigating taxandotherreforms: STRATEGICEDGE AROLEFORTHEINTELLIGENT SUPPORT ANDPROMOTE 11:20 Best treasuryin Latin areyoumakingtherightchoices? 11:20 Automating KYC:a TREASURY? BUSINESSGROWTH America 10:40 Refreshmentbreak problemshared? 11:20 Centralizing currency –the 11.20 Making M&A makesense 12.00 Best attreasury 11:20 Conference breaks intostreams 12:00 Theoldonesarethebest last great treasury –a role for treasury? transformation ones: solving treasury problem? 12:00 Changingtheratio:howto 12:40 Lunch problems I 12:40 Lunch get more science and less 2:00 Bestatremovingthepain 12:40 Lunch 2:00 Planfortheworst,hopefor art inforecasting from globalcash DAY 3 // THU MAY 17* 2:00 Treasury takes back thebest 12:40 Lunch 2.40 Best maximizingliquidity control? Solvingpayments 3:20 Refreshmentbreak 2:00 Working capital while minimizing cross- issues II 4:00 Changingthefaceofglobal management: how canyou currencyexposure *On the exhibition floor 2:40 Swift GPIversus Ripple cash management, dobetter? 3:20 Refreshmentbreak 9:00 Chairs’ introduction versus Chain: Solving virtually 2:40 Building bridgesfrom 4.00 Bestatsupplychain 9:10 Makingthemostofbanking4.0 payments issuesIII 5:20 Adjourn to day3 business totreasury finance 10:00 Forgettheblockchain, thinkditributed applications 3:20 Refreshmentbreak 3:20 Refreshmentbreak 4.40 Best atworking capital 10:40 Refreshmentbreak 4:00 Choosingtherightsupply 4.00 New technologyworkshop management 11:20 FinTechunravelled: forgetthe theoretical, focus onthe chain solution 5:20 Adjourn to day3 5:20 Adjourn to day3 practical 5:20 Adjourn to day3 12:20 Lunch 4

PRE- CASH FLOWFORECASTING CONFERENCE Overview Agenda TRAINING This course will not only set the context for and 8:30 REGISTRATION ANDREFRESHMENTS 3:15 REFRESHMENTBREAK // MONDAY highlight the importance of cash flow forecasting in 9:00 INTRODUCTIONS,EXPECTATIONS 3:30 BESTCASHFORECASTINGPRACTICES today’scomplexbusiness environment, butwill also ANDADMINISTRATION MAY14 illustrate how to optimize forecasting processes in • Tips andtricks order to deliver value for yourcompany. 9:30 TODAY’S TREASURYLANDSCAPE • Processattributes • Treasurer’s accountability incontext 4:00 ENHANCING CORPORATEVALUE Who shouldattend? • Risk management –effective mitigation WITH CASHFORECASTS • Liquidity –cashanddebt • Marketrisk • Relationships –internal and external • Liquidity and creditrisk Thiscourse is designed for treasury, finance and banking • Capabilities –to deliver excellence • Operationalrisk professionals and leaders who are seeking to identify • Major disruptors –regulations, cyber, FinTechs • Working capitalmanagement proven ways to enhance the effectiveness of forecast • Know your corporatecontext processes and methodologies used to deliver value 10:15 THEIMPORTANCEOFCASHFORECASTS 5:00 WRAP-UP ANDPRESENTATION across anenterprise. OFCERTIFICATES • Axioms of cashforecasts 5:30 END OFCOURSE • Changingpriorities Learningobjectives • Objectives andusesofcashforecasts • Impacts of limited/noforecasting 10:45 REFRESHMENTBREAK Today’s treasury landscape 11:00 THEBASICSOFCASHFORECASTING Importance of cashforecasts Constructing an effective forecast • Net income vs cashflow model, tools andprocesses • Daily cashposition • Elements and typesof forecasts Technology as anenabler • Methods: direct andindirect Best cash forecastingpractices • Keyroleofvarianceanalysis • Enrichmentoptions Enhancing shareholdervalue overtime via cashforecasts 12:00 FORECASTINGMODELS,TOOLS ANDPROCESSES Tutor • Liquidity managementprocess • Forecastmodels • Datacollection Robert J. Novaria • Analytics EuroFinance Tutor &Partner • Evaluatingresults Treasury Alliance Group,US • Metrics andreports 1:00 LUNCH 2:00 TECHNOLOGYASANENABLER • Methodology andstrategy Collect7 CPEcredits– inaccordance with • Challenges the standards of the National Registry of • Options CPE Sponsors. Credits have been granted 2:45 CASHFORECASTINGQUESTIONNAIRE based on a 50-minute hour. National ANDFEEDBACK RegistryofCPESponsorsIDNo.105441 5

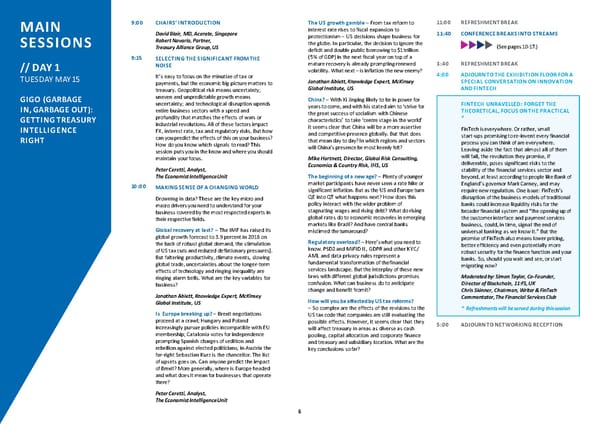

9:00 CHAIRS’INTRODUCTION The US growth gamble – From tax reform to 11:00 REFRESHMENTBREAK MAIN David Blair, MD, Acarate, Singapore interest rate rises to fiscal expansion to 11:40 CONFERENCEBREAKSINTOSTREAMS Robert Novaria,Partner, protectionism – US decisions shape business for SESSIONS Treasury Alliance Group,US the globe. In particular, the decision to ignore the (See pages10-17.) deficit and double public borrowing to $1 trillion 9:15 SELECTINGTHESIGNIFICANTFROMTHE (5% of GDP) in the next fiscal year on top of a // DAY 1 NOISE mature recovery is already prompting renewed 3:40 REFRESHMENTBREAK volatility. Whatnext–isinflation thenewenemy? 4:00 ADJOURNTOTHEEXHIBITIONFLOORFORA TUESDAY MAY15 It’s easy to focus on the minutiae of tax or Jonathan Ablett, Knowledge Expert, McKinsey SPECIAL CONVERSATION ON INNOVATION payments, but the economic big picture matters to Global Institute, US ANDFINTECH treasury. Geopolitical risk means uncertainty; GIGO (GARBAGE uneven and unpredictable growth means China? – With Xi Jinping likely to be in power for IN,GARBAGE OUT): uncertainty; and technological disruption upends yearstocome,andwithhisstatedaimto‘strivefor FINTECH UNRAVELLED: FORGET THE entire business sectors with a speed and the great success of socialism with Chinese THEORETICAL,FOCUSONTHEPRACTICAL GETTINGTREASURY profundity that matches the effects of wars or characteristics’ to take ‘centre stage in the world’ * INTELLIGENCE industrial revolutions. All of these factors impact it seems clear that China will be a more assertive FinTech iseverywhere. Or rather, small FX, interest rate, tax and regulatory risks. But how and competitive presence globally. But that does start-ups promisingtore-inventeveryfinancial RIGHT canyoupredicttheeffectsofthisonyourbusiness? that meandaytoday?Inwhichregionsandsectors processyoucanthinkofareeverywhere. How do you know which signals to read? This will China’s presencebemostkeenlyfelt? Leaving aside the fact that almost all of them session putsyou intheknowandwhereyoushould will fail, the revolution they promise, if maintain yourfocus. Mike Hartnett, Director, Global Risk Consulting, deliverable, poses significant risks to the Peter Ceretti,Analyst, Economics&CountryRisk,IHS,US stability of the financial services sector and The Economist IntelligenceUnit The beginning of a new age? – Plenty of younger beyond, atleast accordingtopeople likeBank of 10:00 MAKINGSENSEOFACHANGINGWORLD market participants have never seen a rate hike or England’s governor Mark Carney, and may significant inflation. But astheUSandEuropeturn require new regulation. One issue: FinTech’s Drowning in data? These are the key micro and QE into QT what happens next? How does this disruption of the business models of traditional macro drivers you need to understand for your policy interact with the wider problem of banks could increase liquidity risks for the business coveredbythemostrespectedexperts in stagnating wages and rising debt? What do rising broaderfinancial systemand“theopeningupof their respectivefields. global rates do to economic recoveries in emerging the customer interface and payment services markets like Brazil? And have central banks business, could, in time, signal the end of Global recovery at last? – The IMF has raised its mistimed theturnaround? universal banking as we know it.” But the global growth forecast to 3.9 percent in 2018 on Regulatoryoverload?–Here’swhatyouneedto promise of FinTech also means lower pricing, the back of robust global demand, the stimulation know. PSD2 and MiFID II, GDPR and other KYC/ better efficiency and even potentially more of UStaxcutsandreduceddeflationary pressures]. AML and data privacy rules represent a robustsecurity for thefinancefunction andyour But faltering productivity, climate events, slowing fundamental transformation of thefinancial banks. So, should you wait and see, or start global trade, uncertainties about the longer-term services landscape. Buttheinterplay of these new migrating now? effects of technology and ringing inequality are laws with different global jurisdictions promises Moderated by: Simon Taylor, Co-Founder, ringing alarm bells. What are the key variables for confusion. What can business do to anticipate Director of Blockchain, 11:FS,UK business? change and benefit fromit? Chris Skinner, Chairman, Writer &FinTech Jonathan Ablett, Knowledge Expert, McKinsey HowwillyoubeaffectedbyUStaxreforms? Commentator, The Financial ServicesClub Global Institute, US – So complex are the effects of the revisions to the * Refreshments will be served during thissession Is Europe breaking up? – Brexit negotiations UStaxcodethatcompaniesarestillevaluating the proceed at a crawl; Hungary and Poland possible effects. However, it seems clear that they 5:00 ADJOURNTONETWORKINGRECEPTION increasingly pursue policies incompatible with EU will affect treasury in areas as diverse as cash membership; Catalonia votes for independence pooling, capital allocation and corporate finance prompting Spanish charges of sedition and andtreasury andsubsidiary location. Whatarethe rebellion against elected politicians; in Austria the key conclusions sofar? far-right Sebastian Kurz is the chancellor. The list of upsets goes on. Can anyone predict the impact of Brexit? More generally, where is Europe headed andwhatdoesitmeanforbusinesses thatoperate there? Peter Ceretti,Analyst, The Economist IntelligenceUnit 6

SESIONES 9:00 INTRODUCCIONDELPRESIDENTEDELA ¿Europa se estádesmembrando? ¿Sobrecarga regulatoria? – Esto es lo que CONFERENCIA –Las negociaciones en torno al Brexit avanzan a necesita saber. PSD2 y MiFID II, GDPR y otras PLENARIAS David Blair, MD, Acarate, Singapore paso de tortuga; Hungría y Polonia implementan normas de identificación del cliente y contra el Robert Novaria,Partner, cada vez más políticas incompatibles con la lavadodedinerocomoKYCyAMLmáslasnormas Treasury Alliance Group,US pertenencia a la Unión Europea; Cataluña vota la de privacidad de datos representan una // DÍA1 independencia y España acusa de sedición y transformación fundamental del entorno de los 9:15 SEPARANDOLAPAJADELTRIGO rebelión apolíticos electos; en Austria es canciller servicios financieros. Al mismo tiempo, la MARTES 15MAYO Sebastian Kurz, perteneciente a la extrema interrelación entre esta nueva normativa y las Es fácil centrarse en minucias impositivas o en los derecha.Lalista decomplicaciones continúa. diferentes jurisdicciones internacionales promete pagos, pero seguir el panorama económico general ¿Alguien puede prever los efectos delBrexit? En confusión. ¿Qué pueden hacer las empresas para es importante para la tesorería. El riesgo términos más generales, ¿hacia dónde se dirige preverelcambioybeneficiarsedeél? geopolítico implica incertidumbre, el crecimiento Europa y qué implica para las empresas que ¿Cómo se verá afectado por las reformas desparejo e impredecible conlleva incertidumbre y operanallí? tributarias de los Estados Unidos? – Tan las disrupciones tecnológicas modifican Peter Ceretti,Analyst, complejos son los efectos de las revisiones del drásticamente sectores de negocios enteros con The Economist IntelligenceUnit código tributario de EE. UU. que las empresas unavelocidadyunaprofundidad queseasemejana todavía están evaluando los posibles efectos. Sin los efectos de las guerras o las revoluciones LaapuestadecrecimientodeEE.UU embargo, parece claro que afectarán a la tesorería industriales. Todos estos factores afectan el –Desde la reforma fiscal a los aumentos de las en áreas tan diversas como el pooling de efectivo, mercado de divisas, las tasas de interés, los tasas de interés, la expansión fiscal y el la asignación decapitalylasfinanzas corporativas impuestos y los riesgos regulatorios. Pero ¿cómo proteccionismo, las decisiones de EE. UU. y la tesorería y la ubicación subsidiaria. ¿Cuáles predecir los efectos de estos fenómenos en su impactan a los negocios en todo el mundo. En sonlasconclusiones clavehastaahora? negocio? ¿Cómo saber qué señalesinterpretar? particular, la decisión de ignorar el déficit y doblar Estasesion leinforma enquémantenerelfoco. el monto de la deuda pública a $ 1 trillón (5% del 11:00 RECESOPARAELREFRIGERIO Peter Ceretti,Analyst, PIB) en el próximo año fiscal además de una 11:40 LACONFERENCIASEDIVIDEENSECCIONES The Economist IntelligenceUnit recuperación madura ya está provocando una 10:00 renovada volatilidad. ¿Qué esperar a futuro? ¿Esla ENTENDERUNMUNDOCAMBIANTE inflación el nuevoenemigo? ¿Se siente inundado de datos? Estos son los Jonathan Ablett, Knowledge Expert, McKinsey 3:40 RECESOPARAELREFRIGERIO indicadores micro y macroeconómicos claveque Global Institute, US 4:00 DIRIJASEALASALADEEXHIBICIONPARA tiene que entender para que su negocio esté ¿China ? – con Xi Jinping probablemente en el PARTICIPAR DE UNA CONVERSACION cubierto, presentados por los especialistas más poder durante los próximos años, y su objetivo ESPECIALSOBREINNOVACIONYFINTECH. reconocidos de sus respectivasáreas. declarado de “luchar por el gran éxito del LASESIONSERASOLAMENTEENINGLES. ¿Recuperación mundialfinalmente? socialismo con características chinas” para tomar 5.00 COCKTAIL DENETWORKING –ElFMIelevósuprevisióndecrecimientomundial el “centro de la escena en el mundo”, parece claro al 3,9porcientoen2018graciasalarobustezdela que China será una presencia más fuerte y demanda mundial, la estimulación de los recortes competitivaanivelmundial.Pero¿quésignifica eso tributarios en los Estados Unidos y la reducción de en el día a día? ¿En qué regiones y sectores se las presiones deflacionarias. Pero las oscilaciones sentirá más profundamente lapresencia de China? en la productividad, los eventos climáticos, la Mike Hartnett, Director, Global Risk Consulting, desaceleración del comercio mundial, la Economics&CountryRisk,IHS,US incertidumbre en torno a los efectos de la tecnología en el largo plazo y la resonante ¿El comienzo de una nueva era? – Muchos desigualdad encienden señales de alarma. ¿Cuáles participantes delmercadomásjóvenesnuncahan sonlasvariables claveparalosnegocios? visto un aumento de tasas o una inflación Jonathan Ablett, Knowledge Expert, McKinsey significativa. Pero ¿qué sucederáamedidaqueEE. Global Institute, US UU. y Europa pasan de la flexibilización cuantitativa al ajuste cuantitativo? ¿Cómo interactúa esta política conelproblema mayordel estancamiento de los salarios y el aumento de la deuda? ¿Qué efecto tiene el aumento en las tasas mundiales en la recuperación económica de los mercados emergentes como Brasil? ¿Los bancos centrales van a destiempo con el cambio de rumbo? 7

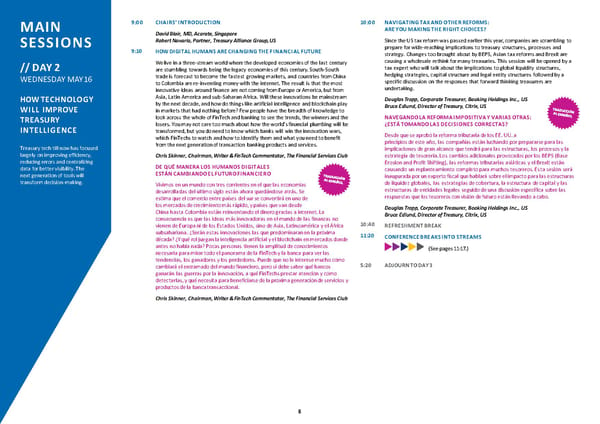

9:00 CHAIRS’INTRODUCTION 10:00 NAVIGATINGTAXANDOTHERREFORMS: MAIN David Blair, MD, Acarate,Singapore AREYOUMAKINGTHERIGHTCHOICES? SESSIONS Robert Novaria, Partner, Treasury Alliance Group,US SincetheUStaxreformwaspassedearlierthisyear,companiesarescrambling to 9:10 HOWDIGITALHUMANSARECHANGINGTHEFINANCIALFUTURE prepare for wide-reaching implications to treasury structures, processes and strategy. Changes too brought about by BEPS, Asian tax reforms and Brexit are We live in a three-stream world where the developed economies of the last century causing a wholesale rethink for many treasuries. This session will be opened by a // DAY 2 are stumbling towards being the legacy economies of this century. South-South tax expert who will talk about the implications to global liquidity structures, WEDNESDAY MAY16 trade is forecast to become the fastest growing markets, and countries from China hedging strategies, capital structure and legal entity structures followed by a to Colombia are re-inventing money with the internet. The result is that the most specific discussion on the responses that forward thinking treasurers are innovative ideas around finance are not coming from Europe or America, but from undertaking. HOWTECHNOLOGY Asia, Latin America and sub-Saharan Africa. Will these innovations be mainstream Douglas Tropp, Corporate Treasurer, Booking Holdings Inc., US WILL IMPROVE bythenextdecade,andhowdothingslikeartificial intelligence andblockchain play Bruce Edlund, Director of Treasury, Citrix,US in markets that had nothing before? Few people have the breadth of knowledge to TREASURY look across the whole of FinTech and banking to see the trends, the winners and the NAVEGANDOLAREFORMAIMPOSITIVAYVARIASOTRAS: INTELLIGENCE losers. You may not care too much about how the world’s financial plumbing will be ¿ESTÁTOMANDOLASDECISIONESCORRECTAS? transformed, but you do need to know which banks will win the innovation wars, DesdequeseaprobólareformatributariadelosEE.UU.a which FinTechs to watch and how to identify them and what you need to benefit principios de este año, las compañías están luchando por prepararse para las Treasurytechtillnowhasfocused fromthenextgenerationoftransaction bankingproductsandservices. implicaciones de gran alcance que tendrá para las estructuras, los procesos y la largely on improving efficiency, Chris Skinner, Chairman, Writer &FinTech Commentator, The Financial Services Club estrategia de tesorería. Los cambios adicionales provocados por los BEPS (Base reducing errors and centralizing DE QUÉ MANERA LOS HUMANOS DIGITALES Erosion and Profit Shifting), las reformas tributarias asiáticas y el Brexit están data for better visibility.The ESTÁNCAMBIANDOELFUTUROFINANCIERO causando un replanteamiento completo para muchos tesoreros. Esta sesión será next generation of toolswill inauguradaporunexpertofiscal quehablará sobreelimpactoparalasestructuras transformdecision-making. Vivimos en un mundo con tres corrientes en el que las economías de liquidez globales, las estrategias de cobertura, la estructura de capital y las desarrolladas del último siglo están ahora quedándose atrás. Se estructuras de entidades legales seguido de una discusión específica sobre las estima queelcomercioentrepaíses delsurseconvertirá enunode respuestasquelostesorerosconvisióndefuturoestánllevandoacabo. los mercadosdecrecimientomásrápido,ypaíses quevandesde Douglas Tropp, Corporate Treasurer, Booking Holdings Inc., US China hasta Colombia están reinventando el dinero gracias a internet. La Bruce Edlund, Director of Treasury, Citrix,US consecuencia es que las ideas más innovadoras en el mundo de las finanzas no 10:40 vienen de Europa ni de los Estados Unidos, sino de Asia, Latinoamérica y el África REFRESHMENTBREAK subsahariana. ¿Serán estas innovaciones las que predominaran en la próxima 11:20 CONFERENCEBREAKSINTOSTREAMS década?¿Yquéroljueganlainteligencia artificial yelblockchain enmercadosdonde antes no había nada? Pocas personas tienen la amplitud de conocimientos (See pages11-17.) necesaria para mirar todo el panorama de la FinTech y la banca para ver las tendencias, los ganadores y los perdedores. Puede que no le interese mucho cómo 5:20 ADJOURNTODAY3 cambiará el entramado del mundo financiero, pero sí debe saber qué bancos ganarán las guerras por la innovación, a qué FinTechs prestar atención y cómo detectarlas,yquénecesita parabeneficiarsedelapróxima generacióndeservicios y productos de la bancatransaccional. Chris Skinner, Chairman, Writer &FinTech Commentator, The Financial Services Club 8

MAIN 9:00 CHAIRS’INTRODUCTION 11:20 BANKINGONINNOVATION:THEFIGHTFORFINANCIALSERVICES David Blair, MD, Acarate,Singapore Digital transformation means different things to different banks. In Hong Kong it SESSIONS Robert Novaria, Partner, Treasury Alliance Group,US mayberollingoutcontactlesstothousands ofsmallmerchants;intheUKitmaybe 9:10 MAKINGTHEMOSTOFBANKING4.0 newmortgageplatforms;inEuropeitmaybeautomatingtradefinance.There’sthe voice revolution,mobile, 3Dholographic data display for trading rooms,Cloud, How much do FinTechs actually threaten the current banking and payments status AI-based advisory services and bots, distributed ledger – the list goes on. So what // DAY 3 quo? Isn’t Big Tech – cloud computing, customer-facing artificial intelligence and dothekeybanksbelievearethemostsignificant trendsfortheirbusinesses? Which THURSDAY MAY17 “big data” customeranalyticsdelivered byAmazon andGoogle–abiggerissue than of thesetrendsdotheybelievewill impacttheirdelivery ofproductsandservices to FinTech?Willthedisintermediationseeninconsumerfinancial services extendinthe corporatesthemost?Andhowdotheythinkcustomersshouldprepareforchanges same way to the corporate world? The battle for the key roles in the provision of inthewaysthatbankswilloperate?Inthispanel,theheadsofdigitalchangeatkey INTELLIGENT financial services is on, but how can treasurers ensure they benefit? Few people global financial institutions sharetheirinsights. TREASURY: have the breadth of knowledge to look across the whole of FinTech and banking to Moderated by: Simon Taylor, Co-Founder, Director of Blockchain, 11:FS, UK see the trends, the winners and the losers. You may not care too much about how Juan Jiménez, Head of Global Corporate Banking Innovation, Santander,Spain EMBRACING the world’s financial plumbing will be transformed, but you do need to know which THEFUTURE banks will win the innovation wars, which FinTechs to watch and how to identify 12:20 CONFERENCECLOSES–PLEASEJOINUS them and what you need to benefit from the next generation of transaction banking FORLUNCH products andservices. 10:00 BLOCKCHAIN:WHAT’SGOINGONBENEATHTHEHEADLINESANDHYPE Blockchain is at once the most over and under hyped technology in history. It has been positioned as being as world changing as the internet, but is also seen as the home of fraud and financial crime. Neither of these statements is fully true, or fully false. The family of technologies we call “blockchain” are moving into production in 2018, with major enterprises now taking the space seriously and software tools maturing.Sotherealquestionis,howdowezoomin,howdoweunderstandwhat’s signalandwhat’snoiseandwhatifanything shouldwedoaboutit? Simon Taylor, Co-Founder, Director of Blockchain, 11:FS,UK 10:40 REFRESHMENTBREAK “Eurofinance Miami was a great forum. I see a different approach from the traditional forms in as much as EFC is forward looking, what’s going on in the market, what are the new technologies. The panel approach is much more conducive to sharing best practices and engaging the audience. The level of participants are in the executive suite which I found to be very engaging. Great conference.” —FionaDeroo,BankofAmericaMerrillLynch 9

STREAM1 Chaired by: David Blair, MD, Acarate,Singapore 2:20 C2BCONNECTIVITY:ADIFFICULTDANCE 11:40 CREATINGADIGITALROADMAP:REACHINGTOMORROW’STREASURY Simplifying corporate-to-bank connectivity has long been a two-way headache. TODAY Corporates struggle with multiple standards, bank-specific practices and // DAY 1 Digital transformation is not an end in itself. Each treasury should define, in detail, jurisdictions; banks struggle with the often unique demands of particular corporate its own objectives and the problems it needs to solve. Only then can it begin to ERP and TMS implementations and the demands of their treasurers. SWIFT is part TUESDAY MAY15 identify andevaluate thetechnologies that maybeappropriate.Isvisibility thecore of the answer.Butsoisadditional technology.Sophisticated solutions areavailable issue? Is that opacity the result of tangled legacy systems or a centralization to handle complex protocol management, mapping, translation, report generation programme so successful that treasury is drowning in data? The solutions in each and automation needs. These are starting to incorporate sophisticated DIGITALTREASURY: case are digital but different. More generally, has treasury done the core work on cybersecurity and data security protection. But to achieve the levels of simplicity, STRATEGICEDGE process simplification, the implementation of industry standards and interface reliability and ease of switching treasurers would like, corporates, ERP and TMS building? If not, then advanced automation technologies and AI analytics are providers, banks and other technology partners have to co-ordinate in a complex probably a waste of time and money. This treasury took a deep-dive on all its danceinwhichplug-and-playisstilladistantdream.Withsomanypotentialpoints Harnessing the power of systems and processes as the prelude to a treasury-wide digital transformation of failure, and the costs of implementation still high, what are the key lessons that digital transformation is programme. In this session the treasurer explains what the process revealed, the have been learnt? What are the sensible compromises treasurers should make? And solutions they chose andwhy. at what point is it worth making which levels of investment? In this debate, easier said thandone.Sois panellists fromall thekeypartners sharetheirinsights. it better to get the basics Heather Kissinger, Treasury Operations – Cash Management, Katrina Baptista-Capelo, Assistant Group Treasurer, Metalor,US sorted out rather than go Anadarko Petroleum Corporation, US straight for the newest Luis Eduardo Díaz Loera, Treasury and Financing Manager, Grupo Kuo, Mexico 3:00 THEJOURNEYTOAUTOMATION techniques and Tom Durkin, MD, Digital Channels, Bank of America Merrill Lynch,US Changing regulation and compliance alongside improvements in the financial sector technologies? 12:20 SSCTHENEXTGENERATION: have increased the importance of the treasury function and its impact on business HOWTOMAKEITSO and operating divisions within a company. Royston Da Costa of the Ferguson Group Companies looking at setting up an SSC, and those concerned with protecting will takeyou throughtheirjourney ofautomationandfuture proofing ofthe existing investments in them, need new technology to justify these structures. Treasury function. This session will look at improving banking relationships, Outsourcing as a short-term cost fix is not enough. Using advanced analytics to workflows,visibility and collaboration. How can companies challenge theirbanking derive value from the cross-functional data embedded in operational processes and third party vendors to innovate. The session will touch om key initiatives such offers onepossible approach.Theroboticprocessautomationof processesthat can as cybercrime, GDPR and other regulatory issues common to many companies and be broken down into repeatable tasks and learned by a software robot is another. howtreasury hasaroletoplay. But does the use of these technologies in SSCs make them more efficient, or does it Royston Da Costa, Assistant Group Treasurer, Ferguson Group Services,UK just provide a model for re-onshoring processes outsourced for labour cost reasons 3:40 REFRESHMENTBREAK in the first place? How do treasurers harness the power of these technologies in offshore SSCs when this kind of digital transformation is proving extremely difficult 4:00 ADJOURNTOTHEEXHIBITIONFLOORFORASPECIALCONVERSATIONON in the core treasury operations? A year is a long time in technology and many SSCs INNOVATION ANDFINTECH weresetupyearsago.Cantheybecost-effectively upgradedatall? (See page6.) Catherine Stone, Assistant Treasurer, Cabot Corporation,US 1:00 LUNCH “The event was really awesome! From beginning to end you had my entire attention.” —Gustavo Alejandro Morales Gonzalez, CBC–CompañiadeJarabesyBebidasGaseosasLaMariposaS.A. 10

STREAM1 Chaired by: David Blair, MD, Acarate,Singapore 2:40 SOLVINGPAYMENTSISSUESIII 11:20 AUTOMATINGKYC:APROBLEMSHARED? Cross-border payments have long been the bane of treasury: too slow, too Satisfying customers and regulators is banks’ problem du jour. Their initial response expensive and too opaque. Nimble FinTech service layers get all the hype, but the // DAY 2 to KYC/AML regulations was to beef up back offices to trawl through transaction key competition is about incumbency and the fundamentals of correspondent and client records. This approach is unsustainable: it is expensive, time consuming banking. Blockchain is the much-hyped potential solution but the key question for WEDNESDAY MAY16 and error-prone. And it stifles growth. Client onboarding, client lifecycle global financial infrastructure is whether distributed applications and permissioned, management and transaction compliance need technology solutions. Banks that distributed ledgers are fundamentally suitable for particular transaction types and are able to ease the client experience and satisfy the regulators most cost- flows. Whichattributes aretheydesignedtomaximiseandwhichdotheynothandle DIGITALTREASURY: effectivelywill winmarketshareaswellasimprovetheiroperational efficiency.This well? How do they actually work and does that mechanism provide the security and STRATEGICEDGE panel will look at how digitization and automation can speed up Customer Due scalabilty required? The most famous distributed applications and their associated Diligence and provide a consistent, repeatable, provable and auditable system of cryptoassets now use more electricity than small countries - so can they even risk based controls. What technologies and platforms offer thebestsolutions?What operateatallashigh-volumeglobal infrastructure? Harnessing the power of aboutKYCandtheblockchain? Howcantreasurershelptheirbankpartners inwhat 3:20 REFRESHMENTBREAK digital transformation is is a problem theybothshare? 4:00 CHOOSINGTHERIGHTSUPPLYCHAINSOLUTION easier said thandone.Sois 12:00 THEOLDONESARETHEBESTONES:SOLVINGTREASURYPROBLEMSI Technology is transforming supply chain finance. It has expanded SCF availability it better to get the basics Itistemptingtofocusonnoveltyandinnovation askeytreasury challenges, butask outside the initial few global trade finance banks; it makes the onboarding process sorted out rather than go treasurers and they list the same problems with which they have struggled for practical for both sides; and, most importantly, it has made it easier for nonbank, straight for the newest years: how long a payment takes for the beneficiary to be paid; the predictability of third-party investors (asset managers, private equity, hedge funds) to contribute techniques and that time; impossibility of tracking payment status; inconsistency of data their capital and risk appetites to the business, which is essential to finance technologies? requirements by different banks; poor quality of remittance data sent with programsastheygrowinsizeandcomplexity.However,technologycreatesitsown payments; costs and predictability of costs of making a payment; the time and issues, one of which is choice: there is a now a wide range of SCF, credit evaluation, difficulty of dealing with rejections, stopping payments and performing payment e-Procurement, e-Invoicing and other trade-finance related vendors all offering the repairs. So what are the existing payment providers doing to solve these long- ideal combination of easy onboarding, access to credit and flexible terms. There are standing issues? What about the banks, whose inconsistent practices compound also new platforms that enable corporates to help with the credit evaluation and the inefficiencies in the various systems? And do the new tech providers really insurance theymayneedtosetupSCFprogrammesfortheirownsuppliers.Sohow address any of the fundamentalissues? do treasurers evaluate these new products? What questions should they ask the 12:40 LUNCH sellers of Cloud and blockchain solutions?Andwhich banks aremakingthebestuse of these third-party technologyproviders? 2:00 TREASURYTAKESBACKCONTROL?SOLVINGPAYMENTSISSUESII Prabhakar Vaidyanathan, Advisor, Cierus,US Theevolutionofthepaymentsecosystem hasbecomesorapidthatfewoutsidethe VictorPausin, Director, Finance& Strategy– Treasury, race itself can fully understand it. And focusing on the innovations in B2C user The Goodyear Tire & Rubber Company,US experiences can mask the far more profound changes in the underlying plumbing of 5:20 ADJOURN TO DAY3 the payments system. PSD2, other regulatory changes, real time payments and SWIFT’s GPII are all part of a tipping point in the development of global payment infrastructure. But where does treasury fit in? The end-user payment experience is determined by third-parties, not the corporate producer of the product or service. So what role should treasury play in the new digital channels? Should in-house banks takecontrolof commercialflowsanddigitaldevelopment? Orwillcompanies outsource more and more of their interaction with customers, leaving treasury to just plug intothird-party apps? Ifso,whataretherisks? JavierOrejas, HeadofBanking,EMEA&Americas,IATA,Spain “The moderators at EuroFinance are WAY ABOVE average! They kept audience and speakers highly engaged, and effectively progressed the discussions forward, taking creative tangents along the way!” —TimHusnik,Medtronic 11

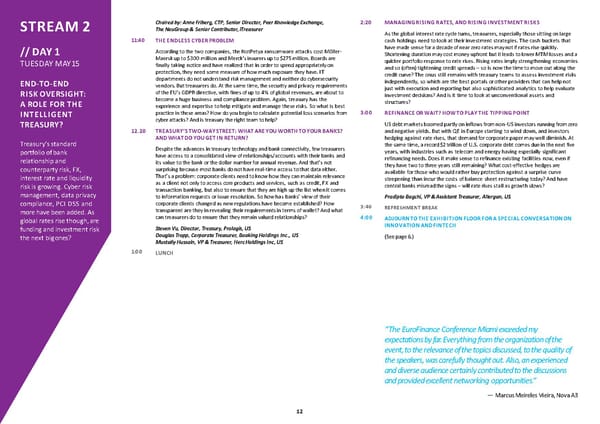

Chaired by: Anne Friberg, CTP, Senior Director, Peer Knowledge Exchange, 2:20 MANAGINGRISINGRATES,ANDRISINGINVESTMENTRISKS STREAM2 The NeuGroup & Senior Contributor,iTreasurer Astheglobal interestratecycleturns,treasurers,especially thosesittingonlarge 11:40 THEENDLESSCYBERPROBLEM cash holdings need to look at their investment strategies. The cash buckets that // DAY 1 According to the two companies, the NotPetya ransomware attacks cost Möller- havemadesenseforadecadeofnearzeroratesmaynotifratesrisequickly. Maersk up to $300 million and Merck’s insurers up to $275 million. Boards are Shortening durationmaycostmoneyupfrontbutitleads tolowerMTMlossesanda TUESDAY MAY15 finally taking notice and have realized that in order to spend appropriately on quicker portfolio response to rate rises. Rising rates imply strengthening economies protection, they need some measure of how much exposure they have. IT and so (often) tightening credit spreads – so is now the time to move out along the departments do not understand risk management and neither do cybersecurity credit curve? The onus still remains with treasury teams to assess investment risks END-TO-END vendors.Buttreasurersdo.Atthesametime,thesecurity andprivacy requirements independently, so which are the best portals or other providers that can help not RISKOVERSIGHT: of the EU’s GDPR directive, with fines of up to 4% of global revenues, are about to just with execution and reporting but also sophisticated analytics to help evaluate become a huge business and compliance problem. Again, treasury has the investment decisions? And is it time to look at unconventional assets and A ROLE FOR THE experience and expertise to help mitigate and manage these risks. So what is best structures? INTELLIGENT practice in these areas? How doyou begin tocalculate potential lossscenarios from 3:00 REFINANCEORWAIT?HOWTOPLAYTHETIPPINGPOINT TREASURY? cyberattacks? Andistreasury therightteamtohelp? USdebtmarketsboomedpartlyoninflowsfromnon-USinvestors runningfromzero 12.20 TREASURY’STWO-WAYSTREET:WHATAREYOUWORTHTOYOURBANKS? and negative yields. But with QE in Europe starting to wind down, and investors Treasury’s standard ANDWHATDOYOUGETINRETURN? hedging against rate rises, that demand for corporate paper may well diminish. At Despitetheadvances intreasury technologyandbankconnectivity, few treasurers the same time, a record $2 trillion of U.S. corporate debt comes due in the next five portfolio of bank have access to a consolidated view of relationships/accounts with their banks and years, with industries such as telecom and energy having especially significant relationship and its value to the bank or the dollar number for annual revenue. And that’s not refinancing needs. Does it make sense to refinance existing facilities now, even if counterparty risk, FX, surprising becausemostbanks donothavereal-timeaccesstothatdataeither. they have two to three years still remaining? What cost-effective hedges are interest rate and liquidity That’saproblem:corporateclients needtoknowhowtheycanmaintain relevance available for those who would rather buy protection against a surprise curve as a client not only to access core products and services, such as credit, FX and steepening than incur the costs of balance sheet restructuring today? And have risk is growing. Cyber risk transaction banking, butalso toensure that theyarehigh upthelistwhenitcomes central banks misreadthesigns–will raterises stallasgrowthslows? management, data privacy to information requests or issue resolution. So how has banks’ view of their Pradipto Bagchi, VP &Assistant Treasurer, Allergan, US compliance, PCI DSS and corporate clients changed as new regulations have become established? How 3:40 REFRESHMENTBREAK more have been added. As transparent are they in revealing their requirements in terms of wallet? And what globalratesrisethough,are cantreasurersdotoensurethattheyremainvaluedrelationships? 4:00 ADJOURNTOTHEEXHIBITIONFLOORFORASPECIALCONVERSATIONON funding and investment risk Steven Vu, Director, Treasury, Prologis, US INNOVATION ANDFINTECH the next bigones? Douglas Tropp, Corporate Treasurer, Booking Holdings Inc., US (See page6.) Mustally Hussain, VP&Treasurer, HercHoldings Inc,US 1:00 LUNCH “The EuroFinance Conference Miami exceeded my expectations by far. Everything from the organization of the event, to the relevance of the topics discussed, to the quality of the speakers, was carefully thought out. Also, an experienced and diverse audience certainly contributed to the discussions and provided excellent networking opportunities.” —MarcusMeirelesVieira,NovaA3 12

STREAM2 Chairedby: DanielL.Blumen,CTP,Partner,Treasury Alliance Group LLC, US 4:00 CHANGINGTHEFACEOFGLOBALCASHMANAGEMENT,VIRTUALLY 11:20 CENTRALIZINGCURRENCY–THELASTGREATTREASURYPROBLEM? Proponents of virtual account management (VAM) claim that it fundamentally Even among the world’s very largest companies, tracking FX risk positions on a changes global cashmanagement.Theysaythatbyrationalizing accountstructures // DAY 2 global basis is a challenge. Firms often run a combination of regional FX programs and enabling corporate customers to conduct transactional operations against side-by-side, forgoing accurate results or theother benefits of a centralized program virtual account enables entirely new operating and service model for global cash WEDNESDAY MAY16 such as identifying and achieving internal natural hedges. Running FX risk like this and liquidity management. Banks benefit from a system that improves profitability also increases transaction costs and can complicate regulatory reporting and and creates new business opportunities in transaction banking. Corporates gain the accounting. And decentralized operations of any kind are harder to automate and list of advantagesall treasurers will have seen.Butisittoogoodtobetrue? END-TO-END harder to incorporate into modern, high-tech treasuries. It is still common to find CertainlyVAMisnotaone-size-fits-allplug-n-playsolution. Just asothersolutions RISKOVERSIGHT: scattered FX risk management tools not even directly connected to ERPs. Even that have made similar promises, such as notional pooling and ZBA, there are companies on the road to centralization may use multiple automated platforms and jurisdictions it doesn’t work. And there are still plenty of tax, KYC and data privacy A ROLE FOR THE operate multiple operations centers executing FX. So what are the possible issuesthatneedtobesolvedbothatthebanksandatanylargeMNChopingtouse INTELLIGENT solutions? The largest companies can set up dedicated central currency risk this model globally. Hear from companies operating VAM in Europe, the US and managemententities,butwhatabouttherest?Thebottomlineisthattreasury has Asia.Thisiswhatthey’velearnt. TREASURY? to understand FX exposures and therefore the business implications of currency Debbie Riezenman, Senior Manager, Treasury Services, KLXInc., US movements on an enterprise-wide basis. So what are the latest tools and Edwin Veenman, Treasurer EMEA &NA, Yanfeng Global Interior Systems, Germany Treasury’s standard techniques to help themdo that? 5:20 ADJOURN TO DAY3 portfolio of bank Fraser Woodford, SVP, Treasurer, Discovery,US relationship and 12:40 LUNCH counterparty risk, FX, 2:00 PLANFORTHEWORST,HOPEFORTHEBEST interest rate and liquidity risk is growing. Cyber risk When there are too many Black Swans to ignore, but too few to make a trend, management, data privacy modelling a series of possible outcomes and looking at contingency planning is a compliance, PCI DSS and critical part of the risk management process. In this double session, our panelists will lead an interactive discussion around key treasury scenario planning issues, more have been added. As possible areas of discussion will include Brexit and what that might mean for globalratesrisethough,are liquidity structures and supply chain to US tax reform and how that will impact funding and investment risk accounts, liquidity, cross-border trade and so on. The session will look at the next bigones? investment and geopolitical risk as well as regulatory risk like new EU directives which impact US businesses. What are MNCs planning for in terms of risk and opportunity?Inthis highly interactive session, companies will talkabout global risk worriesandhowtheyaredrivingbusiness decisions. Mustally Hussain, VP&Treasurer,HercHoldings Inc. 3:20 REFRESHMENTBREAK “The sessions were informative and thought provoking for individuals in strategic treasury roles. Quality speakers and content.” —ElizabethSuter,ThermoFisherScientific 13

STREAM3 Chaired by: Robert Novaria, Partner, Treasury Alliance Group,US 2:20 ISYOURTREASURYFITFORCHANGE? 11:40 CENTRALIZEANDCENTRALIZEANDCENTRALIZEAGAIN Centralfinancefunctions havenottraditionally been notedfor theirflexibility and So you think you’ve centralized? So your TMS has been implemented for 100% of agility. Itis truethat as corporatetreasuries have been slimmeddown, the // DAY 1 the business? All instances of TMSs and ERPs, if different, can seamlessly exchange tight-knit teams that result have become inherently more nimble and potentially all the data you need? And your proprietary solutions – including Excel – can able to respond more quickly to changing circumstances. In smaller, high-growth TUESDAY MAY15 integrate too? In fact, treasury centralization is an ongoing project that is never companies, this treasury flexibility and agility is critical: growth is change, and finished. Old problems are solved, but new ones emerge – from new businesses, growth today involves the rapid integration of new geographies and technologies. acquisitions, technology. The key is to identify where decentralized processes are But in larger firms, even if teams are small and open to change, treasury, ERP and HOW TREASURY constraining the business and to deal with the most significant pain points quickly. MISsystemsareoftennot.Sohowcancompanieskeeptheflexibility inforecasting, CAN SUPPORT AND Whichstructures arebecomingoutdatedandneedtobereplaced? Whichprocesses planning, fundingandriskmanagementtheydevelop whentheyaresmall?Dosmall can benefit from proven technological innovation? And are you sure you’ve teams really create agility or are they just overworked and unable to change? And PROMOTEBUSINESS addressed the fundamentalissues? howcanagilitybebuiltuponlegacy technologyframeworksandprocesses? GROWTH Noel Marsden, VP &Corporate Treasurer, Brightstar Corporation, US Jeffrey Williams, Senior Director, Treasury Operations, American Tower,US 12:20 GETTINGTHEBESTFROMYOURBANKS,KEEPINGYOUROPTIONSOPEN 3:00 FX RISKMANAGEMENT Akey treasury objective is In ten years, we’re told, we will all be buying micro-services from a teeming The foundations of any risk management process are first, an understanding of the the creation of a scalable ecosystem of FinTechs. The whole concept of a bank will have changed. But until exposures the company faces; second, the consequent a board-sanctioned risk treasury organization to then treasurers need a strategy for bank relationships and the purchase of core management policy; and third buy-in from business units that they either pay for support rapid growth in banking services. How this works depends on how developed the treasury is. In a risk mitigation or own any risk that they don’t want to pay for. In practice, those the underlying business. fast-growing firm with a handful of banks, there is an opportunity to build an foundationsarenotstraightforward tobuild.Andtheyarecomplicatedtodaybythe optimum structure from scratch, incorporating best-of-breed technologies, bank rapidly changing nature of FX market liquidity provision, risk management Technology is important, agnostic platforms and solutions such as virtual account management to drive technology and the possibilities for outsourcing. So what are the critical points but so are thebasics. simplicity, efficiency and visibility. Larger firms, with the tangled complexity that treasurers must get right in setting up and maintaining a scalable FX risk process? results fromlongerevolution,first need toaudittheircurrent arrangements,identify What is must-have and what is just nice-to-have? And how is technology changing unnecessary complexity and remove it. All companies still need to ensure they have the internal corporate FX process, the FX market and the interplay between the sufficient strong relationships to guarantee access to core services. Wise ones will two? keep abreast of new providers. Rationalize or expand? Old banks or new providers? Charlie Herche, Director, Treasury Capital Markets, Expedia,US It’s more complicated thanthat. John Zavaglia, Senior Director, Treasury Capital Markets, Expedia,US 1:00 LUNCH 3:40 REFRESHMENTBREAK 4:00 ADJOURNTOTHEEXHIBITIONFLOORFORASPECIALCONVERSATIONON INNOVATION ANDFINTECH (See page6.) “Great event, which provides perfect exchange possibilities based on the appropriate size.” —Christopher Schöffel, Boehringer Ingelheim 14

STREAM3 Chaired by: Robert Novaria, Partner, Treasury Alliance Group,US 2:00 WORKINGCAPITALMANAGEMENT:HOWCANYOUDOBETTER? 11.20 MAKINGM&AMAKESENSE–AROLEFORTREASURY? AccordingtoPwC“networkingcapitaldays(NWCD)arehitting theirhighest (worst) Depending on which statistics you choose, more than half of all M&A deals destroy level in the last five years.” Companies face global pressure on capital employed; // DAY 2 shareholder value and another third make no difference at all. Whatever the exact many have significantly increased debt levels and debt to cash ratios but not truth, it is acknowledged that deals oftenfail throughalackof upfront analysisand delivered commensurate returns; and many in the US have increasing amounts of WEDNESDAY MAY16 post-deal lack of discipline in execution. While it is unrealistic to see treasury as a cash tied up in working capital. The key working capital management response has strategicdriver of M&A,isthereanexpandedrolefortreasury inhelpingcompanies been to increase DPOs using new and not-so-new SCF solutions, as well as simply avoid disasters on the one hand, and helping with post-deal delivery? Can treasury not paying on time, but this single variable approach is not sustainable. At many HOW TREASURY identify overvaluation or fraud in advance? Can it apply innovative techniques to firms, particularly outside the very largest, the working capital solutions lie in CAN SUPPORT AND reverse engineerthevalue ofsynergies –wouldtheacquirepaytoaccessthe receivables, inventory, procurement and better tax management. So what are the services of the acquirer in the absence of a deal? And how can treasury not simply continued issues with accounts receivable and are there new solutions? How can PROMOTEBUSINESS enumeratewhatmustbedoneafterthedealissigned,butinfluencewhatactuallyis treasury and procurement work together across their shared portfolios and in terms GROWTH done? of better inventory management? And are the larger issues of ROCE and debt storing upworkingcapitalproblemsforthefuture? 12:00 CHANGINGTHERATIO:HOWTOGETMORESCIENCEANDLESSARTIN BrianSullivan,SVP&Treasurer, Veolia NorthAmerica,US Akey treasury objective is FORECASTING the creation of a scalable People whose day jobs involve arguing with suppliers in Indonesia or understanding 2:40 BUILDINGBRIDGESFROMBUSINESSTOTREASURY treasury organization to Generation Z’s buying habits have little time to focus on cashflow statements – and How much time does treasury spend delivering business insights? About 25% of the support rapid growth in they’re not paid to do so either. Analysts are often stumped by the seemingly low time, according to one recent study. Is that good enough? It depends on whether the underlying business. forecastability of businesses once they start to dig down. So how to bridge the gap? treasurers truly believe in the idea of treasury as a strategic consultant to the One first step is to accept and define the boundaries of forecast accuracy and to business ornot.Centralfinancefunctions toooftenoperateascorporatepolicemen, Technology is important, omit data with no proven value in previous forecasts. A second is to investigate delivering bad news, cost cuts and redundancy programs from on high. The best but so are thebasics. correlations outside the normal MIS data. A third is to focus on probabilistic ranges, ones put staff into the businesses where they operate alongside business unit as much risk management does, rather than point forecasting which is all too management with a shared mission to drive profitability and expansion. Some are commonstill. Atthatstage,automationisanoption.Inaworldoflowpredictability, even incentivised on the bottom line of the business unit. In this way, treasury can data analytics, particularly enhanced by machine learning, is likely to perform at deliver solutions with obvious business benefits, and because they are embedded in least as well (and much faster) than human forecasters, especially when identifying the business and are seen as integral to it, if tough calls have to be made, they are new external correlations. So how can treasurers make practical use of some of the morereadilyaccepted.Thistreasury hastrulydelivered value tothebusiness. new thinking in the forecasting of complex systems? How can business manage the Ronald Villanueva, Deputy Treasurer for Americas, Royal Dutch Shell,US forecasting function? And can better forecasts be used to steer businesses towards morestablestatesandavoidreal-worldproblems? 3:20 REFRESHMENTBREAK VincentDelort,GlobalTreasury Risk&Reporting Manager, JTI, Switzerland 4.00 NEW TECHNOLOGYWORKSHOP 12:40 LUNCH The treasury technology ecosystem offers a bewildering array of potential solutions, across a large number of process areas and delivered on a variety of platforms and cost bases. From ERP and TMS, to payments, SCF and trade finance, cash management and liquidity management, and even automated regulatory and compliancesolutions. Thereareestablished players andinnovative start-ups,many of whom will likely disappear. So who to choose? Where should new technology be adopted and where is it better to wait? One way to identify the solutions that meet your needs is to see how your peers have made these choices and to look at how those choices turned out. So in this session, a series of companies will explain how and why they chose new software in core treasury functionalities. How did the processworkandwhathavebeentheresults? 5:20 ADJOURN TO DAY3 “Excellent conference to come up to speed on what’s happening in the treasury space.” —Vikram Dhiman, ICD Group Holdings Ltd 15

STREAM4 // DAY 1 TUESDAY MAY15 // DAY 1 TUESDAY MAY15 LATINAMERICA FOCUS NEW! COMPLEX COUNTRIESSERIES Chaired by: Patrick Peters-Buhler, MD, Treasuryinthe.World, US Many countries present unique challenges for corporate treasury, whether from volatile macroeconomic and geo- political constraints or because of shifting regulatory 11:40 BRAZIL 12:20 ARGENTINA landscapes, underdeveloped banking infrastructure, exchange controls, and liquidity and FX constraints to name a few. How cancompaniesnavigatetheseenvironments, mitigatetherisks and the impacts to the bottom line as well as to identify opportunities? Join these small, interactive workshops with market briefings from the Economist Intelligence Unit and Gustavo Gontijo, Treasurer, Ford South America, Joe Andris, Treasurer/Finance Manager, practical insights from corporate treasurers and banks active Ford Motor Company,Brazil Caterpillar Inc.,US in these markets. There may be no outright solution to all the Prabhakar Vaidyanathan, Advisor, Cierus, US problems these markets pose, but this series will help you to benchmark your operations and question our panellists on 1:00 LUNCH howtodomoreeffectivebusiness. NUEVASERIE:PAÍSESCOMPLEJOS Muchospaíses presentandesafíossingulares parala 2:20 MEXICO 3:00 PERU tesorería corporativa, ya sea debido a volatilidad macroeconómica y restriccionesgeopolíticas o debido al cambio de los entornos regulatorios, infraestructura bancaria subdesarrollada, controles cambiarios y limitaciones de liquidez y al cambio de Alicia Núñez De la Huerta, Corporate Treasurer, divisas,pornombrarsoloalgunos. ¿Dequé Grupo Aeromexico,Mexico modo las empresas pueden navegar estos entornos, mitigar los riesgos ylos efectossobre los resultados finales, así como detectar oportunidades? Únase a estos pequeños talleres 3:40 REFRESHMENTBREAK interactivos enlosquesepresentaráninformesdemercadode 4:00 ADJOURNTOTHEEXHIBITIONFLOORFORA The Economist Intelligence Unit y conocimientos prácticos de SPECIAL CONVERSATION ON INNOVATION tesoreroscorporativos ybancosactivosenestospaíses.Puede ANDFINTECH que no haya una solución directa a todos los problemas que plantean estos mercados, pero esta serie lo ayudará a (See page6.) comparar sus operaciones y cuestionar a nuestros panelistas sobrecómohacernegociosdemaneramásefectiva. 16

11:20 BESTTREASURYINLATINAMERICA 2.40 BESTMAXIMIZINGLIQUIDITYWHILEMINIMIZING STREAM4 Latin America faces an all-too familiar mix of growth, crisis, scandal and upcoming CROSS-CURRENCYEXPOSURE elections. Itslargesteconomy,Brazil,istheregioninmicrocosm.Fortreasurers,the A holistic approach that encompasses cash management, loan portfolio // DAY 2 volatility in underlying businesses, funding costs and currencies makes cash king management and the supply chain is critical to improving FX risk management. and risk management critical. So how are firms keeping DSOs under control? Is it Traditional hedging with forwards is as efficient as the cash and rate forecasts on WEDNESDAY MAY16 time to review hedge policies? In tough times what is the best trade-off between which it is based. And those cash positions themselves can be radically improved handing local operation more responsibility for liquidity management, hedging and before theneed hedging.Companies first need toimprovetheirliquidity structures, cashcollection local responsibilities, and thecentralization requiredtomaintain the review their multi-currency portfolios of financings and intercompany loans and BESTPRACTICE visibility that is critical to maintaining stability? How can treasury respond to an remove redundancies. This company embarked on a root-and-branch re- TREASURY economy with reduced bank lending and general liquidity challenges? Hear from organization of its cash management and financing structures and in the process companies that in partnership with core bank partners, have managed to combine dramatically reduced its need for FX hedges while improving the efficiency of those the best practice of a modern, sophisticated international treasury with the that remained. In this series of practicalities of managing treasury inLatinAmerica. Daniel Herrera, Manager of Financial Strategy & Trading, Belcorp, Peru presentations best Benjamin Tejadio, Treasury LATAM Banking Lead, General Electric, Mexico Christian Toyama, Corporate Treasurer, Belcorp,Peru practice companiesreveal Marc Dubois, Treasury Operations Manager, Hasbro Inc.,US 3:20 REFRESHMENTBREAK how they have responded Joao Cabral, Regional Treasury Director, Interpublic Group, US Santiago Thompson, Managing Director, BBVA,US 4.00 BESTATSUPPLYCHAINFINANCE to the challenges and 12.00 BESTATTREASURYTRANSFORMATION To implement a best practice SCF programme, companies need to understand the opportunities of new different solution types, the web and other platforms, the new FinTech solutions treasury technology to ‘Transformation’ may be an overused word, but the innovations coming from Big andthelatestbankprogrammes.Theyneedtounderstandtheirownsuppliersand improve efficiency and Data,AIandadvancedanalytics,mobile,Cloud andautomation,ontopofthemore their needs, the needs of their banks in terms of onboarding and the needs of the increase their strategic prosaic improvements in payments infrastructure and bank connectivity, do various different suppliers of capital and insurance to this market. Most of all they represent the drivers of a treasury revolution. Only a treasury able to support need to be able to map their own operations and objectives onto this complex value to thebusiness. businesses themselves adopting new digital strategies will be fit for purpose. So ecosystem of suppliers, to understand the specific costs and benefits that an SCF what does a transformed treasury look like? How can treasurers translate programme will generate for them. This company realised that a successful SCF consultant-speak into a series of achievable, cost-effective objectives? This implementation would significantly enhance their working capital and opted to for treasurer explains what they mean by transformation and what they have found is an integrated package that included automation of invoices and payment, invoice possible. They reveal how the department made the business case for change at a discount management, procurement and supplier-initiated early payment. In this time when budgets are tight and how the resulting investments in key systems, presentation theyexplainthechoicestheymade. along with strategic reviews of its in-house and SSC structures, really have made a significant difference. 4.40 BESTATWORKINGCAPITALMANAGEMENT 12:40 LUNCH How can companies shorten entire whole cash conversion cycle to generate 2:00 BESTATREMOVINGTHEPAINFROMGLOBALCASH maximum liquidity without harming t business efficiency and supplier and customer relations? The answer is total treasury optimization: the payment cycle must be Global cash visibility is still one of treasurers’ key concerns. For multinational extendedwithoutdamaging supplychains;thereceivables cyclemustbeshortened; companieswithcomplexbusiness structures andmanyhundredsofbankaccounts, inventory levels must fall and innovative inventory financing options explored; beingconfidentthat cashandliquidity reportsareaccurateiscritical, butachieving receivables financing programmes from whole-book securitization to simple that goal has proved problematic. However, without visibility, treasurers cannot receivables purchase facilities must be evaluated. And that is in addition to all the adequately control and mobilise group cash, create usable forecasts, manage FX standard treasury optimizations around banking, cash management and the use of risk or maximize returns from excess cash. Treasury technology has long been in-house banks, POBO/ROBOstructures andsharedservicecenters. heralded as the answer to these problems, but the costs and complexity of 5:20 ADJOURN TO DAY3 implementationhavebeensignificant barriers,especially formid-sized firms. Smaller firms struggle with spreadsheets and downloads from different single bank portals to manually build up a picture of the company’s cash; larger firms wrestle with legacy systems and multiple TMS and ERP implementations. But there are solutions. In this case study, learn how this treasurer has used new treasury technologytodelivermeasurableoperational improvements.Andseehowtreasury technology can help treasury teams move from an operational role to a strategic role within theirorganization. Dayna Padgett, Treasury Manager, JDA Software Group, Inc., US Warren Davey, EVP, GTreasury,US 17

11:20 LAMEJORTESORERÍAENLATINOAMÉRICA 2.40 LAMEJORMAXIMIZACIÓNDELIQUIDEZALTIEMPOQUESEMINIMIZALA SECCIÓN4 Latinoamérica enfrentaelyaconocidopanorama formadoporunamezcla decrecimiento, EXPOSICIÓNATIPOSDECAMBIO crisis, escándalo y las próximas elecciones. Su mayor economía, Brasil, representa la Para mejorar la gestión del riesgo de moneda extranjera, es fundamental tener un región en un microcosmos. Para los tesoreros, la volatilidad en los negocios subyacentes, enfoqueholístico queabarquela gestión deefectivo,lagestión decartera depréstamos y // DÍA2 los costos de financiación y las divisas hacen que reine el efectivo y que sea esencial la la cadena de suministro. La cobertura tradicional con futuros es tan eficiente como las MIÉRCOLES 16MAY0 gestión de riesgos. Entonces, ¿cómo hacen las empresas para mantener las fechas de previsiones de efectivo y de tasas en que se basa, y esas posiciones de efectivo en sí cobro bajo control? ¿Es momento de revisar las políticas de cobertura? En épocas pueden mejorarse sustancialmente antes de necesitar cobertura. Antes que nada, las complicadas, ¿cuál es el equilibrio ideal entre darle más responsabilidad a las empresas necesitan mejorar sus estructuras de liquidez, revisar sus carteras de operacioneslocalessobrelagestión deliquidez, elhedgingyla captación deefectivo,yla financiamiento en múltiples divisas y préstamos inter compañía y eliminar las MEJORESPRÁCTICAS centralización necesaria para mantener la visibilidad que es fundamental para asegurar redundancias. Esta empresa se embarcó en una reorganización de raíz de sus estructuras EN LA GESTIÓN la estabilidad? ¿De qué manera la tesorería puede responder ante una economía con de gestión de efectivo y de financiamiento y en el proceso redujo sustancialmente su reducción de préstamos bancarios y problemas de liquidez general? Esta empresa, en necesidad de coberturas de cambio de divisa al tiempo que mejoró la eficiencia de las TESORERÍA asociación con sus principales bancos, ha logrado combinar las mejores prácticas de una estructuras que no semodificaron. tesorería internacional moderna y sofisticada con las realidades de la gestión de la 3:20 RECESOPARAELREFRIGERIO tesorería enLatinoamérica. En esta serie de Benjamin Tejadio, Treasury LATAM Banking Lead, General Electric, Mexico 4.00 LOMEJORENFINANCIAMIENTOAPROVEEDORES presentaciones, las Marc Dubois, Treasury Operations Manager, Hasbro Inc.,US Para implementar un programa de financiación a la cadena de suministros conforme a empresas que siguen las Santiago Thompson, Managing Director, BBVA,US las mejoresprácticas,lasempresastienenqueentender los diferentestiposde mejores prácticas revelan 12.00 LOMEJORENLATRANSFORMACIÓNDELATESORERÍA soluciones,la web y otras plataformas, las nuevas soluciones de FinTech y los cómo respondieron a los programas bancarios más recientes. Tienen que entender a sus propios proveedores y problemas y las Es posible que la palabra “transformación” se haya utilizado demasiado, pero las sus necesidades, las necesidades de sus bancos para la incorporación de los innovaciones provenientes de Big Data, la inteligencia artificial y las analíticas proveedores y las necesidades de los varios proveedores de capital y seguros para este oportunidades queplantea avanzadas, la telefonía móvil, la nube y la automatización, además de las mejoras más mercado. Más que nada, necesitan poder hacer un mapa de sus propias operaciones y la nueva tecnología de la prosaicas en la infraestructura de pagos y la conectividad bancaria, sí representan lo objetivos en este complejo ecosistema para comprender los costos y beneficios tesorería para mejorar la que impulsa la revolución de la tesorería. Solo la tesorería que pueda apoyar a que las específicos que les generará un programa de financiamiento a la cadena de proveedores. empresasmismasadoptennuevasestrategiasdigitalesseráadecuadas para elfin. Esta empresa se dio cuenta de que implementar un programa de financiación a la eficiencia y aumentar su ¿Cómo se ve una tesorería transformada? ¿De qué manera los tesoreros pueden traducir cadena de suministro exitoso mejoraría significativamente su capital de trabajo y optó valor estratégico para el la jerga de la consultoría en una serie de objetivos alcanzables y asequibles? Este por un paquete integrado que incluía automatización de facturas y pagos, gestión de negocio. tesorero explica qué entiende por transformación y qué ha descubierto que es posible. descuento de facturas, compras y pago temprano generado por el proveedor. En su Revela dequémaneraeldepartamentodefendió elcambioconargumentoscomerciales presentación, explican las elecciones que hicieron. en tiempos de presupuestos ajustados y cómo las inversiones resultantes en sistemas 4.40 LOMEJORENGESTIÓNDECAPITALDETRABAJO claves, juntoconrevisionesestratégicasdesusestructurasinternas ydecentrosde servicios compartidos,realmentehanmarcadounadiferencia importante. ¿De qué manera pueden las empresas acortar todo el ciclo de conversión de efectivo para 12:40 ALMUERZO generar la máxima liquidez sin dañar la eficiencia comercial y las relaciones con clientes y proveedores? La respuesta es la optimización total de la tesorería: el ciclo de pagos 2:00 L0MEJORENELIMINACIÓNDELASCOMPLICACIONESDELEFECTIVOANIVEL debe extenderse sin dañar a las cadenas de suministro; se debe acortar el ciclo de MUNDIAL cuentas por cobrar; los niveles de inventario deben caer y se deben explorar opciones de financiamiento de inventario innovadoras; deben evaluarse programas de financiamiento La visibilidad del efectivo a nivel global es aún una de las principales preocupaciones de de cuentas por cobrar, desde securitización integral hasta simples facilidades de los tesoreros. Para las multinacionales con estructuras de negocios complejas y muchos compras de cuentas por cobrar. Y esto es además de todas las optimizaciones de cientos de cuentas bancarias, es fundamental tener la confianza de que los reportes de tesorería estándares en torno a la banca, la gestión de efectivo y el uso de bancos liquidez y de efectivo sean precisos, pero lograr ese objetivo ha resultado ser internos, estructurasPOBO/ROBOycentrosdeservicios compartidos. problemático. Sin embargo, sin visibilidad, los tesoreros no pueden controlar 5:20 RECESOHASTAELDÍA3 apropiadamente y movilizar efectivo del grupo, crear previsiones utilizables, gestionar el riesgo de cambio de divisas, ni maximizar los rendimientos del exceso de efectivo. Hace tiempo que se pregona que la tecnología de tesorería es la respuesta a estos problemas, perolos costos yla complejidaddela implementación hansidobarreras importantes, en especial para las empresas medianas. Las empresas más pequeñas luchan con planillas de cálculo y descargas de diferentes portales bancarios para crear manualmente una imagen del efectivo de la empresa; las empresas más grandes luchan con sistemas heredados y múltiples implementaciones de sistemas de tesorería y de gestión empresarial. Pero hay soluciones. En este caso de estudio, entérese de cómo el tesorero usó la nueva tecnología de tesorería para ofrecer mejoras operativas mesurables. Y vea de qué manera la tecnología puede ayudar a los equipos de tesorería a apartarse de un papeloperativohaciaunpapelestratégico dentro dela organización. 18

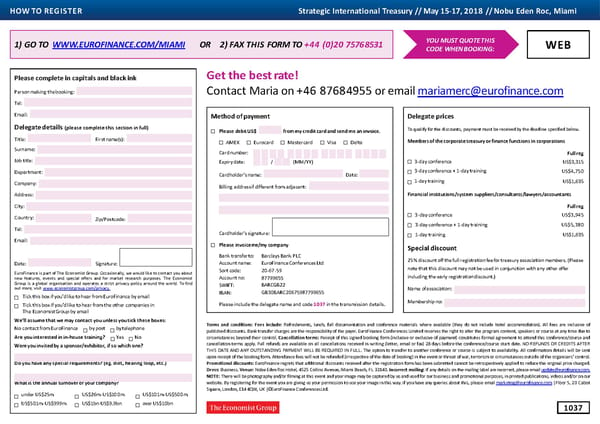

Official sponsors Technologysponsor BBVA is a customer-centric Banco Santander is a BNP Paribas is a leading Global TransactionBanking Deutsche AssetManagement BankofAmericaMerrillLynch GTreasuryisthegloballeaderin global financial services group leading retail andcommercial global financial services Deutsche Bank’s Global With $840 billion of assets isone of the world’s largest cash and liquiditymanagement, founded in 1857. TheGroup has bank, founded in 1857and provider. Present in more Transaction Banking (GTB) under management, Deutsche financial institutions, providinga helping corporate treasurers a strong leadershipposition headquartered in Spain. It has than70countrieswithmore division is a leading provider Asset Management is one of full range of banking, investing, become strategic business in the Spanish market,is the a meaningful market share in than 190,000employees, of products and services for the world’s leadinginvestment asset management and other partners since inception in largest financial institution 10corecountriesinEuropeand BNP Paribas is capable of corporations and financial management organizations. financial products and services. 1986. GTreasury has a range of in Mexico, it has leading theAmericas, andisamongthe accompanying its clients in their institutions. Businesses Deutsche Asset Management It is a leading global bank and solutions that will automate all franchises in SouthAmerica world’s top banks by market international development with include Trade Finance,Cash offers individuals and wealth management franchise your cash activities including and the Sunbelt Region of the capitalization. At theend of more than 1,700 dedicated Management, Trust and Agency institutions traditional and and a premier corporate and cash visibility, forecasting, United States; and it is also the June 2017, Banco Santanderhad relationship managerswho have Services and SecuritiesServices. alternative investmentsacross investment banking and capital concentration, reconciliation leading shareholder in Garanti, EUR 1.65 trillion in managed a firm understanding of local GTB offers integrated solutions all major assetclasses. market business, providing and payments to increase Turkey’s biggest bank for market funds, 131 million customers, specificities via an unrivalled covering domestic and cross- innovative services in M&A, automation, reduce operational capitalization. Its diversified 13,800 branches and 200,000 network of over 220 business border payments, riskmitigation Compellingproducts, equity and debtcapital risk, and driveproductivity. business is focused on high- employees. Banco Santander centers around theworld. for international trade,and smartersolutions raising, lending, trading, GTreasury will illuminate your growth markets and it relies on made attributable profitof EUR As one of the primary cash the provision of trust, agency, risk management,research, liquidity and give you the tools technology as a key sustainable 3.6billion in the first half of 2017, management playersglobally, depositary andcustodyservices. Our products and solutions and liquidity and payments to make quicker, moreconfident competitive advantage.Corporate an increase of 24% compared to and as the European leader, Our customers are supported provide flexible access to a management. Clientsand decisions that optimize your responsibility is at the core of its thesameperiodlastyear. BNP Paribas provides clients in their domestic, regionaland wide range of investment customerscanexpectaccessto treasury operations and drive business model. BBVA fosters Santander Global Corporate with sophisticated solutions globaltradefinanceandcash opportunities acrossall asset a comprehensive suite of world corporatevalue. financial education and inclusion, Banking (SGCB) is the global to help them operatemore management programs through classes. Productsrange class products, services, and For more information pleasecontact and supports scientific research business division focused efficiently. BNP Paribas is rolling our network of offices situated in from pooled funds to highly expertise from an organization marketing@gtreasury.com orvisit: and culture. Itoperates with primarily on corporate clients out its integrated retail banking all major and secondary financial customized portfolios for a that serves clients through the highest integrity, a long- andinstitutions that, duetotheir model across countries in the markets, including hubs in wide range of investors. They operations in more than 40 www.gtreasury.com term vision and applies thebest size or sophistication, require Mediterranean basin, in Turkey, Frankfurt, London, NewYorkand include active and passive countries and has treasury practices. custom services or value-added in Eastern Europe and a large funds, institutional mandates, relationships with 95 percent Warren Davey Singapore. and alternativeproducts. of the U.S. Fortune1,000 Executive VicePresident www.bbva.com wholesale products. network in the western part of SethBrener Our advisers and investment companiesand79percentofthe wdavey@gtreasury.com LauraFranco Yago Espinosa de los Monteros the United States. The breadth Head of Cash Management specialists are dedicated to Fortune Global500. TerryBeadle Head of GlobalSales Global Head Cash Management and depth of the BNP Paribas Corporates Americas, Deutsche creating asset management Global Head ofCorporate –Global TransactionServices yaespinosa@gruposantander.com network, innovative technology, Bank, Global TransactionBanking solutions for every clientneed For additional information Development laura.franco@bbva.com client proximity, and regulatory seth.brener@db.com and every risk, return and regarding Bank of AmericaMerrill tbeadle@gtreasury.com Luis PastorInnerarity and cultural expertise enable T: +1 (212) 2501898 liquidity preference. Lynch, please see: AnnetteVivoni Global Head Cash the bank to design, deliver and www.baml.com Global SalesAmerica ManagementSales support cohesive solutions Jonathan Richman –Global TransactionServices lupastor@gruposantander.com worldwide. These capabilities Head of Trade Finance and annette.vivoni@bbva.com uniquely position BNPParibas to Financial Supply Chain Americas, meet its clients’ local, regional Deutsche Bank, GlobalTransaction and global cash management Banking objectives both today and in the jonathan.richman@db.com future. T: +1 (212) 2509600 cashmanagement. bnpparibas.com 19