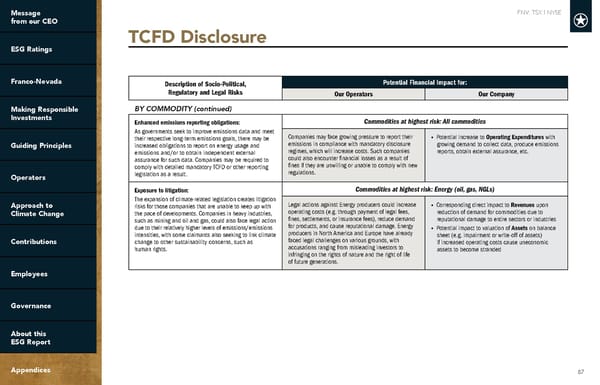

FNV: TSX | NYSE 87 TCFD Disclosure Description of Socio-Political, Regulatory and Legal Risks Potential Financial Impact for: Our Operators Our Company BY COMMODITY (continued) Enhanced emissions reporting obligations: As governments seek to improve emissions data and meet their respective long-term emissions goals, there may be increased obligations to report on energy usage and emissions and/or to obtain independent external assurance for such data. Companies may be required to comply with detailed mandatory TCFD or other reporting legislation as a result. Commodities at highest risk: All commodities Companies may face growing pressure to report their emissions in compliance with mandatory disclosure regimes, which will increase costs. Such companies could also encounter financial losses as a result of fines if they are unwilling or unable to comply with new regulations. • Potential increase to Operating Expenditures with growing demand to collect data, produce emissions reports, obtain external assurance, etc. Exposure to litigation: The expansion of climate-related legislation creates litigation risks for those companies that are unable to keep up with the pace of developments. Companies in heavy industries, such as mining and oil and gas, could also face legal action due to their relatively higher levels of emissions/emissions intensities, with some claimants also seeking to link climate change to other sustainability concerns, such as human rights. Commodities at highest risk: Energy (oil, gas, NGLs) Legal actions against Energy producers could increase operating costs (e.g. through payment of legal fees, fines, settlements, or insurance fees), reduce demand for products, and cause reputational damage. Energy producers in North America and Europe have already faced legal challenges on various grounds, with accusations ranging from misleading investors to infringing on the rights of nature and the right of life of future generations. • Corresponding direct impact to Revenues upon reduction of demand for commodities due to reputational damage to entire sectors or industries • Potential impact to valuation of Assets on balance sheet (e.g. impairment or write-off of assets) if increased operating costs cause uneconomic assets to become stranded

2022 ESG Report | Franco-Nevada Page 86 Page 88

2022 ESG Report | Franco-Nevada Page 86 Page 88