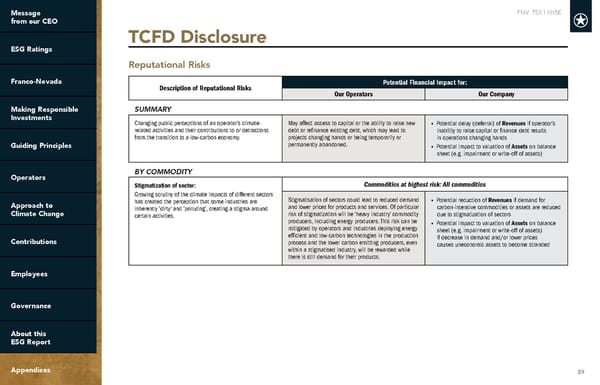

FNV: TSX | NYSE 89 TCFD Disclosure Reputational Risks Description of Reputational Risks Potential Financial Impact for: Our Operators Our Company SUMMARY Changing public perceptions of an operator’s climate- related activities and their contributions to or detractions from the transition to a low-carbon economy. May affect access to capital or the ability to raise new debt or refinance existing debt, which may lead to projects changing hands or being temporarily or permanently abandoned. • Potential delay (deferral) of Revenues if operator’s inability to raise capital or finance debt results in operations changing hands • Potential impact to valuation of Assets on balance sheet (e.g. impairment or write-off of assets) BY COMMODITY Stigmatization of sector: Growing scrutiny of the climate impacts of different sectors has created the perception that some industries are inherently ‘dirty’ and ‘polluting’, creating a stigma around certain activities. Commodities at highest risk: All commodities Stigmatisation of sectors could lead to reduced demand and lower prices for products and services. Of particular risk of stigmatization will be ‘heavy industry’ commodity producers, including energy producers. This risk can be mitigated by operators and industries deploying energy efficient and low-carbon technologies in the production process and the lower carbon emitting producers, even within a stigmatised industry, will be rewarded while there is still demand for their products. • Potential reduction of Revenues if demand for carbon-intensive commodities or assets are reduced due to stigmatization of sectors • Potential impact to valuation of Assets on balance sheet (e.g. impairment or write-off of assets) if decrease in demand and/or lower prices causes uneconomic assets to become stranded

2022 ESG Report | Franco-Nevada Page 88 Page 90

2022 ESG Report | Franco-Nevada Page 88 Page 90