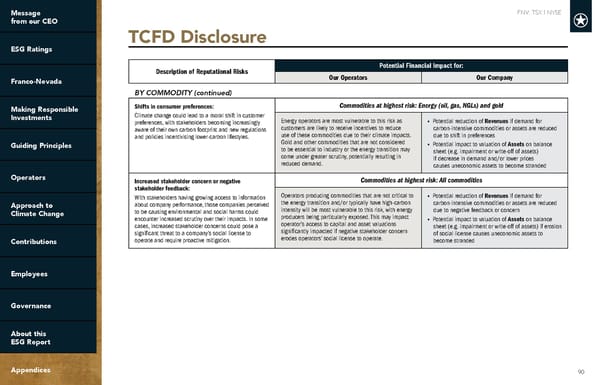

FNV: TSX | NYSE 90 TCFD Disclosure Description of Reputational Risks Potential Financial Impact for: Our Operators Our Company BY COMMODITY (continued) Shifts in consumer preferences: Climate change could lead to a moral shift in customer preferences, with stakeholders becoming increasingly aware of their own carbon footprint and new regulations and policies incentivising lower-carbon lifestyles. Commodities at highest risk: Energy (oil, gas, NGLs) and gold Energy operators are most vulnerable to this risk as customers are likely to receive incentives to reduce use of these commodities due to their climate impacts. Gold and other commodities that are not considered to be essential to industry or the energy transition may come under greater scrutiny, potentially resulting in reduced demand. • Potential reduction of Revenues if demand for carbon-intensive commodities or assets are reduced due to shift in preferences • Potential impact to valuation of Assets on balance sheet (e.g. impairment or write-off of assets) if decrease in demand and/or lower prices causes uneconomic assets to become stranded Increased stakeholder concern or negative stakeholder feedback: With stakeholders having growing access to information about company performance, those companies perceived to be causing environmental and social harms could encounter increased scrutiny over their impacts. In some cases, increased stakeholder concerns could pose a significant threat to a company’s social license to operate and require proactive mitigation. Commodities at highest risk: All commodities Operators producing commodities that are not critical to the energy transition and/or typically have high-carbon intensity will be most vulnerable to this risk, with energy producers being particularly exposed. This may impact operator’s access to capital and asset valuations significantly impacted if negative stakeholder concern erodes operators’ social license to operate. • Potential reduction of Revenues if demand for carbon-intensive commodities or assets are reduced due to negative feedback or concern • Potential impact to valuation of Assets on balance sheet (e.g. impairment or write-off of assets) if erosion of social license causes uneconomic assets to become stranded

2022 ESG Report | Franco-Nevada Page 89 Page 91

2022 ESG Report | Franco-Nevada Page 89 Page 91