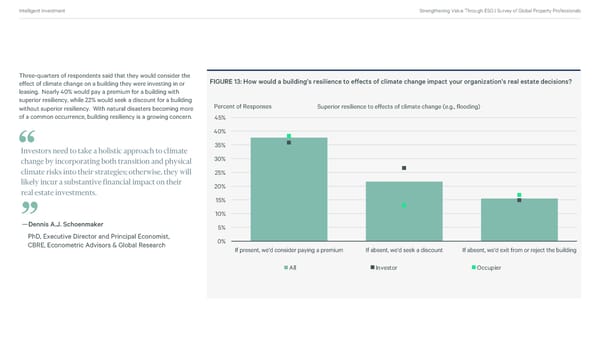

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Three-quarters of respondents said that they would consider the FIGURE 13: How would a building’s resilience to effects of climate change impact your organization’s real estate decisions? effect of climate change on a building they were investing in or leasing. Nearly 40% would pay a premium for a building with superior resiliency, while 22% would seek a discount for a building without superior resiliency. With natural disasters becoming more Percent of Responses Superior resilience to effects of climate change (e.g., flooding) of a common occurrence, building resiliency is a growing concern. 45% 40% Investors need to take a holistic approach to climate 35% change by incorporating both transition and physical 30% “ climate risks into their strategies; otherwise, they will 25% likely incur a substantive financial impact on their 20% real estate investments. 15% 10% —Dennis A.J. Schoenmaker 5% PhD, Executive Director and Principal Economist, ” 0% CBRE, Econometric Advisors & Global Research If present, we’d consider paying a premium If absent, we’d seek a discount If absent, we’d exit from or reject the building All Investor Occupier

2022 Global ESG Survey Page 26 Page 28

2022 Global ESG Survey Page 26 Page 28