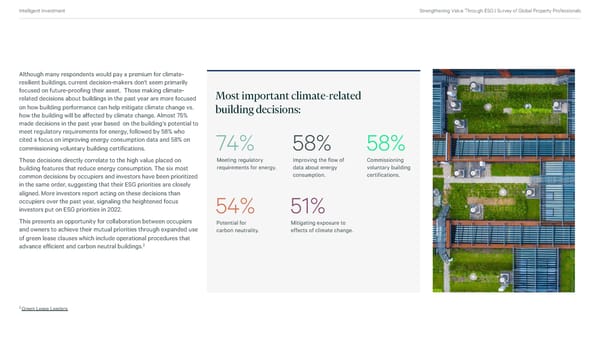

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Although many respondents would pay a premium for climate- resilient buildings, current decision-makers don't seem primarily focused on future-proofing their asset. Those making climate- Most important climate-related related decisions about buildings in the past year are more focused on how building performance can help mitigate climate change vs. building decisions: how the building will be affected by climate change. Almost 75% made decisions in the past year based on the building’s potential to meet regulatory requirements for energy, followed by 58% who cited a focus on improving energy consumption data and 58% on commissioning voluntary building certifications. 74% 58% 58% These decisions directly correlate to the high value placed on Meeting regulatory Improving the flow of Commissioning building features that reduce energy consumption. The six most requirements for energy. data about energy voluntary building common decisions by occupiers and investors have been prioritized consumption. certifications. in the same order, suggesting that their ESG priorities are closely aligned. More investors report acting on these decisions than occupiers over the past year, signaling the heightened focus investors put on ESG priorities in 2022. 54% 51% This presents an opportunity for collaboration between occupiers Potential for Mitigating exposure to and owners to achieve their mutual priorities through expanded use carbon neutrality. effects of climate change. of green lease clauses which include operational procedures that 2 advance efficient and carbon neutral buildings. 2 Green Lease Leaders

2022 Global ESG Survey Page 27 Page 29

2022 Global ESG Survey Page 27 Page 29