2023 | Annual Report

Annual Report for the period starting 1 July 2022 and ending 30 June 2023 MLC Super Fund Preparation date Issued by the Trustee ABN 80 008 515 633 For MLC Super Fund 18 December 2023 NULIS Nominees (Australia) AFSL 236465 (The Fund) Limited ABN 70 732 426 024

This Annual Report is relevant to: MLC MasterKey Super & Pension Fundamentals MLC MasterKey Business Super MLC MasterKey Personal Super MLC MasterKey Term Allocated Pension MLC Capital Guaranteed Personal Super Savings Plan Series 1-2 MLC Super Pension Plan MLC Maturity Growth Superannuation Plan MLC Whole of Life Superannuation MLC Endowment Superannuation Whole of Life Endowment MLC Pure Endowment Superannuation MLC Life Cover Super MLC Insurance (Super) MLC Protectionfirst

Contents A message from the Chair 5 Looking out for your interests 8 Some things you should know 10 How your money is invested 13 Financial Report 17 This document has been prepared on behalf of NULIS Nominees (Australia) Limited, ABN 80 008 515 633, AFSL 236465 (NULIS) as Trustee of MLC Super Fund, ABN 70 732 426 024. NULIS is part of the group of companies comprising Insignia Financial Ltd, ABN 49 100 103 722 and its related bodies corporate (Insignia Financial Group). The information in this document is general in nature and doesn’t take into account your objectives, financial situation or individual needs. Before acting on any of this information you should consider whether it is appropriate for you. You should consider obtaining financial advice before making any decisions based on this information. References to ‘we’, ‘us’ or ‘our’ are references to the Trustee, unless otherwise stated. MLC Limited uses the MLC brand under licence. MLC Limited is part of the Nippon Life Insurance Group and is not a part of the Insignia Financial Group. Subject to super law, the final authority on any issue relating to your account is the Fund's Trust Deed, and the relevant insurance policy, which governs your rights and obligations as a member. Past performance is not a reliable indicator of future performance. Any projection or other forward looking statement ('Projection') in this document is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially. An online copy of this document is available atmlc.com.au/annualreports MLC Super Fund 2023 Annual Report | 3

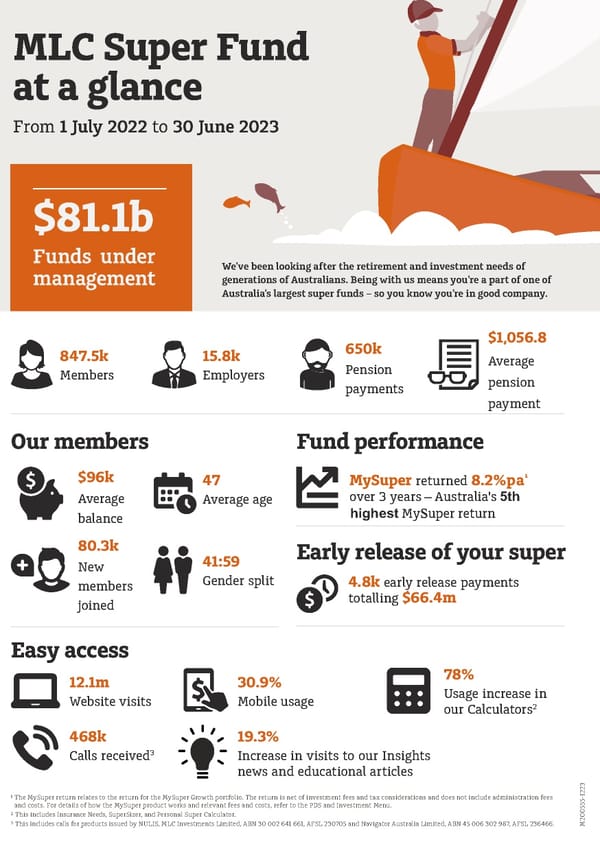

MLC Super Fund at a glance From 1 July 2022 to 30 June 2023 $81.1b Funds under We’ve been looking after the retirement and investment needs of management generations of Australians. Being with us means you’re a part of one of Australia’s largest super funds – so you know you’re in good company. 650k $1,056.8 847.5k 15.8k Average Members Employers Pension payments pension payment Our members Fund performance $96k 47 MySuper returned 8.2%pa¹ Average Average age over 3 years – Australia's 5th balance highest MySuper return 80.3k Early release of your super New 41:59 members Gender split 4.8k early release payments joined totalling $66.4m Easy access 12.1m 30.9% 78% Website visits Mobile usage Usage increase in 2 our Calculators 468k 19.3% Calls received3 Increase in visits to our Insights news and educational articles 3 2 2 1 ¹ The MySuper return relates to the return for the MySuper Growth portfolio. The return is net of investment fees and tax considerations and does not include administration fees - 5 and costs. For details of how the MySuper product works and relevant fees and costs, refer to the PDS and Investment Menu. 5 5 ² This includes Insurance Needs, SuperSizer, and Personal Super Calculator. 0 0 ³ This includes calls for products issued by NULIS, MLC Investments Limited, ABN 30 002 641 661, AFSL 230705 and Navigator Australia Limited, ABN 45 006 302 987, AFSL 236466. M2

A message from the Chair Welcome to the MLC Super Fund2022-23 Annual Report. The 2023 financial year was again marked by global and domestic economic uncertainty. Despite this, I’m pleased to say our dedicated team of experts again achieved solid investment returns for members. I’m also proud that we delivered on our promise to simplify and improve our products, investments, customer service and technology processes. That’s important to us, because we believe driving continual improvement of our products and services and providing consistent performance—in good times and bad—is key Lindsay Smartt to our members’ long-term financial wellbeing. Delivering for our members Over the year, we introduced a simpler, more contemporary investment menu that continues to offer members a diverse investment choice. The new investment menu is part of our ongoing commitment to helping members meet their retirement goals by providing enhanced products—with most members now paying lower investment fees and earning higher net investment returns over time. And I was pleased to see our efforts recognised, with MLC's MySuper product delivering the industry's fifth-highest return over three years in the SuperRatings MySuper survey1. MLC MasterKey Business Super was also awarded Insurance Best Fund 2023 Winner by Chant West, which is given to the product judged to best deliver the right benefits to the people who really need them, for a reasonable price. This follows significant enhancements to our insurance claims experience, with the introduction of online underwriting and tele claims services making our claims process quicker and easier for members. Straddling high inflation and possible recession As always, it’s key to look at the broader economic environment to understand what’s driving investment performance. The 2023 financial year saw inflation, interest rates and the war in Ukraine maintain pressure on consumers, globally. The steep increase of interest rates by central banks showed signs of moderating inflation but also stirred concerns of overstepping the mark, potentially leading to a global recession. And indeed, some economies like Germany and New Zealand did fall into recession due to lower consumer spending resulting from increased interest rates. Encouragingly though, lower oil prices, reduced international shipping costs and the normalisation of global supply chains, have taken some heat out of global inflation pressures. On the domestic front, high electricity, rent, property and food prices look set to continue, maintaining the inflation threat at home. With Australia’s consumer inflation running at 6% in the year to June 2023, the Reserve Bank of Australia (RBA) maintains relatively high interest rates which are needed to reduce it to their 2% to 3% target. It remains to be seen if the RBA’s interest rate increases manage to achieve that target without driving Australia’s economy into recession. Strong markets, despite global challenges Despite economic challenges, global and US share market performance remained strong during the year. 2 The global share market, returned 14.6% for the 2023 financial year, largely stemming from the strength of the US share market. MLC Super Fund 2023 Annual Report | 5

A message from the Chair By contrast, the Chinese share market continued to struggle, with concerns over the government’s handling of its economy and private sector. Australian shares, as measured by the S&P/ASX 300, made a robust 14.4% return for the 2023 financial year, boosted by very strong gains in the Information Technology and Resources sectors. The Consumer Discretionary and Financial sectors also delivered strong gains, despite the challenge of higher inflation and interest rates squeezing consumers. Given the positive and negative developments at play in the current investment environment, it’s important for investors to maintain an appropriately disciplined and diversified portfolio at this challenging time. Your Future, Your Super Turning to regulatory developments, namely the Your Future, Your Super reforms, which aim to make super easier and more effective for members. When first introduced, the Australian Prudential Regulation Authority focused on how the industry’s MySuper products stacked up to the reforms by conducting an annual performance test. In 2023, the test was expanded to include non-MySuper products with diversified investment strategies—of which all ours passed. Likewise, our MySuper product also passed again. Responsible investment Our members are increasingly looking for investments that better align to their preferences regarding social and ethical issues which is why we introduced the MLC Socially Responsible Growth investment option. Importantly, we believe responsible investment can improve investment outcomes for our members, which drives our continued consideration of ESG factors, where possible, in the MLC investment options we offer. If you’d like information about ESG factors and our responsible investing approach, please visit mlc.com.au/responsible-investment-policy 6 | MLC Super Fund 2023 Annual Report

A message from the Chair Thank you On behalf of the Trustee Board, thank you for trusting MLC Super Fund to look after your long-term financial wellbeing. We also look forward to inviting you to the 2023 Annual Members’ Meeting. You’ll receive your invitation to the meeting by this December, which will be held in February 2024. At the meeting, you’ll hear about your fund’s performance, get an outlook of what’s to come, and have the opportunity to ask questions to the people looking after your super, including me. Lindsay Smartt Chair NULIS Nominees (Australia) Limited 1 SuperRatings Fund Crediting Rate Survey, June 2023 2 MSCI AC World Index $A Hedged (Net) This report has been prepared by NULIS Nominees (Australia) Limited, as Trustee of the MLC Super Fund. It contains general information about the MLC Super Fund, including abridged financial statements and changes to the MLC Super Fund during the year. MLC Super Fund 2023 Annual Report | 7

Looking out for your interests The directors of the Trustee Board have a variety of work and life experiences which help them represent and look out for your interests. Made up of non-executive directors, the Trustee Steve Schubert Board is responsible for the management and Bachelor of Science (Applied Mathematics and performance of the Fund. Physics) The Trustee Board has professional indemnity Fellow Institute of Actuaries of Australia insurance. And the Trustee has appointed its related Graduate Australian Institute of Company Directors company, MLC Wealth Limited, ABN 97 071 514 264, (Order of Merit) to carry out the day-to-day functions of the Fund. Meet the Board Trustee director movements Robert Andrew Blooreresigned effective 9 December The directors are: 2022. Lindsay Smartt (Chair) Bachelor of Arts Fellow of the Institute of Actuaries Fellow Australian Institute of Company Directors Karen Gibson Bachelor of Science Graduate Diploma of Teaching Master of Business Administration Associate Diploma of Superannuation Management Graduate Australian Institute of Company Directors Jane Harvey Bachelor of Commerce Master of Business Administration Fellow Institute of Chartered Accountants Australia and New Zealand Fellow Australian Institute of Company Directors Beth McConnell Master of Commercial Laws Bachelor of Commerce Bachelor of Laws (Honours) Diploma of Superannuation Management Graduate Australian Institute of Company Directors 8 | MLC Super Fund 2023 Annual Report

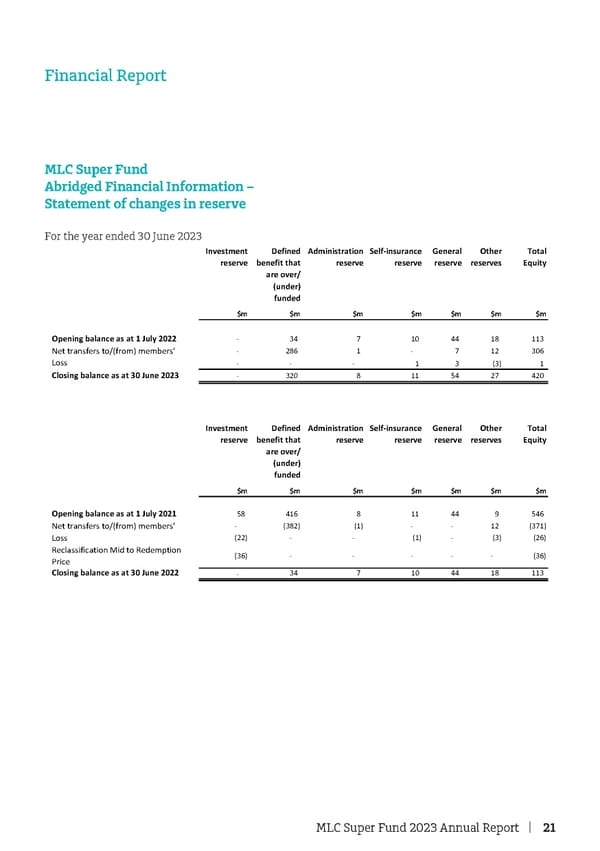

Looking out for your interests Operational Risk Financial Requirement General reserves (Reserve) We have established general reserves to provide The Government requires superannuation fund liquidity to assist in the management of the Fund trustees to hold adequate financial resources for the benefit of members. We manage and replenish (Reserve) to cover any losses that members incur due these reserves in accordance with its applicable to operational errors. The Reserve has been policy, with the guiding principle that the general established in full by corporate capital contributed reserves should be replenished from sources that are by the Trustee and its former ultimate shareholder. not easily allocated back to members, unless If the Reserve falls below our targets, we propose to members have been explicitly advised. fund the shortfall through corporate capital, rather The balance of the General reserve at the end of the than seeking contributions from members. This last 3 financial years is summarised below: means that we don't currently require members to 30 June 2023: $54M contribute to the Reserve, but members will be 30 June 2022: $44M notified if this changes in the future. As the Reserve 30 June 2021: $44M is held by the Trustee, it isn't reported in the financial statements of the Fund. For details of the balances and movement of the The balance of the Reserve at the end of the last 3 General reserve and other reserves, refer to the financial years is summarised below: Abridged financial information – Statement of 30 June 2023: $297M changes in reserves on page 21. 30 June 2022: $286M 30 June 2021: $288M MLC Super Fund 2023 Annual Report | 9

Some things you should know been able to identify or contact the beneficiary of Policy Committees (MLC MasterKey your account. Business Super members only) We're also required to transfer your super balance to If your employer plan had a policy committee during the ATO if your account remains inactive for a period the financial year, you can find details about your of 16 months or more, and the balance is less than plan’s policy committee and members in your Annual $6,000. Your account is considered inactive if you Statement. haven't made any additional contributions or certain We have a set of rules for the appointment and changes to it over that time including: removal of employer and member representatives had contributions or rollovers from other super of the Policy Committee. These rules provide for equal funds paid into your account representation of member and employer changed your investment options or strategy representatives. Member representatives are changed or elected to cancel your insurance cover generally elected by members and are typically (where your insurance is held within your super appointed for a period of three years. Employer account), or representatives are appointed by your employer for made or amended a binding beneficiary a period determined by your employer. nomination. Transfers to the Australian Taxation We may also transfer your account balance to the Office (ATO) in Other Circumstances ATO if: your investment switching activity is deemed to The law and rules defining the transfer of unclaimed be contrary to the interests of other members, or superannuation money to the ATO can be viewed at your account has been closed and you are eligible ato.gov.au for a payment from MLC and we’ve not received any instructions from you. In summary, we’re generally required by law to We’ll advise you in writing at your last known address transfer your account to the ATO if any of the if we intend to transfer your account balance and will following occurs: proceed if you don’t respond with instructions your account balance is less than $6,000 and regarding an alternative super fund. either: – no contributions or rollovers have been made There may be other circumstances in which we need to your account for 12 months, you haven't to transfer your account to the ATO. otherwise contacted the Fund for 12 months and If your account is transferred to the ATO, you can we have no way of contacting you, or contact them on 13 10 20 to claim your benefit. – you’ve been a member of the Fund for more than 2 years, your account was set up through your Special rules for temporary residents employer sponsor, and there have been no contributions or rollovers made to your account If you’re a temporary resident and your visa has for over 5 years, expired and you leave Australia permanently, you you’re over 65, contributions haven't been made may be able to claim the superannuation you hold to your account for over 2 years, you haven’t with us as a Departing Australia Superannuation contacted us for at least 5 years, and we haven't Payment. Withholding taxes may apply to the been able to contact you, lump-sum payment. However, if you don’t make a the ATO informs us that you were a former claim within six months of your visa expiring or your temporary resident and left the country over six departure from Australia (whichever happens last), months ago, or we may be required to transfer your superannuation to the ATO as unclaimed super. In these upon your death, where no contributions have circumstances, relying on relief from ASIC, we're not been made for at least 2 years, and after a required to notify you or give you an exit statement reasonable period of time, we’ve tried but haven't and you'll need to contact the ATO directly to claim 10 | MLC Super Fund 2023 Annual Report

Some things you should know your superannuation. For more information go to Resolving complaints ato.gov.au If you have a complaint, we can usually resolve it Delayed and suspended transactions quickly over the phone on 132 652.If you’d prefer to put your complaint in writing, you can email us at We may delay or suspend transactions, for example [email protected],or send a letter to GPO Box where an investment manager delays or suspends 4341, Melbourne VIC 3001. unit pricing, or when there are adverse market We’ll conduct a review and provide you with a conditions. response in writing. If you’re not satisfied with our We may process withdrawal and switch requests in resolution, or we haven’t responded to you in 45 days, instalments over a period of time and may also you can lodge a complaint with the Australian suspend processing of withdrawal and switch Financial Complaints Authority (AFCA). requests we have received. In certain circumstances AFCA provides an independent financial services we may refuse a request. Where requests are delayed, complaint resolution process that’s free to suspended or being paid in instalments, the unit consumers. You can contact AFCA at any time by prices used for transactions will be those available writing to GPO Box 3, Melbourne VIC 3001, at their on the day the transaction takes effect, rather than website (afca.org.au), by email at [email protected], the day of the request. In the event that the or by phone on 1800 931 678 (free call). investment option becomes suspended (e.g. due to To view our complaints management policy, visit illiquidity), you will be unable to make additional mlc.com.au/complaint contributions, withdrawals or switches into or out of that suspended investment option. As part of the suspension: Any contributions or rollovers that would otherwise be invested in the suspended investment option in accordance with your investment strategy will instead be invested in an alternative option, e.g. MLC Cash, until you provide us with alternative instructions; Any insurance cover you hold may cease if there are insufficient monies in your non-suspended investment options to cover the cost of the insurance; and You may only withdraw your funds in accordance with any withdrawal offer that we make. We are not responsible for losses that delayed or suspended transactions may cause. MLC Super Fund 2023 Annual Report | 11

Some things you should know This section is specific to MLC MasterKey. It is a reminder about how your account operates. Protecting all members Buy-sell spreads and transaction costs We look out for you, so we’ve introduced processes We are responsible for ensuring that the costs of that help protect the interests of all members. buying and selling assets when members transact are shared in an equitable way. This is achieved by Investment switching meeting costs as they arise: for an investment option as a whole by offsetting You can change your investment options any time. them against investment earnings. This is the We do not charge a fee for you to do this. However, approach when there is a single unit price, buy-sell spreads may apply. sometimes called no-spread unit pricing, or due to member transactions by offsetting them Monitoring of frequent switching against the individual member assets. This is the approach when investment options have a buy-sell This product is not appropriate for members who spread in the unit price. wish to switch their investments frequently in the The transaction costs borne by an investment option pursuit of short-term gains. are identical in each approach and, generally, both We monitor all investment options for abnormal methods work well. transaction activity because this sort of activity can For no-spread investment options, we allow for have adverse impacts for other members. expected transaction costs in the valuation of assets To maintain equity, we have the right to deal with to protect members in an investment option that is members who frequently switch by: in decline. delaying, limiting, rejecting or applying special Buy-sell spreads may change daily and in certain conditions to future switch requests circumstances, increase or decrease significantly. permanently cancelling membership The current buy-sell spreads of an investment option rejecting applications to open new accounts in the are available at mlc.com.au/buysellspreads Fund, and/or Note: Buy-sell spreads are managed through our rejecting contributions and rollovers to existing Product Governance Framework. accounts. Prudent management We reserve the right to refuse applications or vary the terms for processing any transaction in certain circumstances, such as when: there are significant falls in investment markets we have difficulty in completing transactions due to low liquidity We also reserve the right to suspend processing of requests for up to five business days at the end of the financial year. Should any of these events occur, we’ll use the unit price on the day we process your request. 12 | MLC Super Fund 2023 Annual Report

How your money is invested Platinum Investment Management Limited In this section we tell you how the Trustee invests your money Schroder Investment Management Australia Limited One of our responsibilities is to make sure your Vanguard Investments Australia Ltd investments are managed according to the We may use the services of Insignia Financial Group investment strategies and objectives established by related companies where it makes good business us. sense to do so and will benefit our customers. We offer many products for you to invest in. Some Amounts paid for these services are always of these will have similar investment objectives and negotiated on an arm's-length basis. strategies. To make this section easier for you to read, we’ve grouped products with common objectives and Asset allocation and large investments strategies together on the following pages. Further information about your actual asset Investment managers allocation can be found atmlc.com.au/ fundprofiletoolor for MLC Capital Guaranteed Investment managers of the investment options products, the actual asset allocation can be found in available on our menu during the year were: your Annual Statement. Altrinsic Global Advisors, LLC As at 30 June 2023, the MLC Super Fund held the Antares Capital Partners Limited1 following assets with a value of greater than 5% of the Fund’s total assets: Ausbil Investment Management Limited 3 WM Pool - Australian Equities No. 2 – 12% BlackRock Investment Management Australia 3 JANA Diversified Australian Share Trust – 10.1% Limited JANA Diversified Global Share Trust – 8.9%3 2 3 Fairview Equity Partners Pty Ltd WM Sector - Diversified Debt (All) Trust – 6.4% Investors Mutual Limited WM Pool - Equities Trust No. 75 – 5.5%3 Macquarie Investment Management Global Limited Many different investment options and products MAPP Pty Limited across the MLC Super Fund invest in these underlying assets. MLC Limited MLC Asset Management Services Limited1 National Australia Bank Limited Perennial Value Management Limited Perpetual Investment Management Limited PIMCO Australia Pty Limited 1 A member of the Insignia Financial Group. 2The Insignia Financial Group of Companies (Insignia Financial Group) is a minority shareholder in this investment manager. 3MLC Investments Limited, a related company, is the responsible entity of these investment options. MLC Super Fund 2023 Annual Report | 13

How your money is invested Derivatives Understanding your investment Derivatives may be used in any of the investment performance options. We offer many products, most of which offer a range Derivatives are contracts that have a value derived of investment options for you to invest in. The from another source such as an asset, market index investment performance of the Fund is determined or interest rate. There are many types of derivatives by reference to the investment performance of each including swaps, options and futures. They are a product and its investment option(s). Investment common tool used to manage risk or improve returns. options can invest in a range of assets, and different Some derivatives allow investment managers to earn types of assets will perform differently in different large returns from small movements in the market conditions. In your product, you may get to underlying asset’s price. However, they can lose large choose the investment options for your super (and, amounts if the price movement in the underlying accordingly, the assets that the Fund is invested in). asset is unfavourable. The investment performance of your investment option(s) is allocated to your account. You should Risks particular to derivatives include the risk that refer to your annual statement for the year ended 30 the value of a derivative may not move in line with June 2023 for details of the investment performance the underlying asset, the risk that counterparties to of your investment option(s). the derivative may not be able to meet payment Alternatively, information on the performance of obligations and the risk that a particular derivative most investment options is available at mlc.com.au/ may be difficult or costly to trade. fundprofiletool. Our Derivatives Policy permits the use of derivatives Some investment options are closed to additional in MLC investment options where consistent with and new investment. If you're invested in a closed an investment option’s objective, risk profile, investment option, it may not be referred to in the disclosure and governing documents, legislative and current Investment Menu or in a current Product regulatory requirements. They may be used for: Disclosure Statement for your product. hedging efficient portfolio management, and investment return generation. Further information on our Derivatives Policy is available at mlc.com.au/derivativesforsuper How the external investment managers invest in derivatives is included in their PDS, available at mlc. com.au/findafund in the 'External funds' tab. 14 | MLC Super Fund 2023 Annual Report

How your money is invested Product name Investment Investment strategy About your account value objective MLC MasterKey MLC MasterKey To provide a The Trustee invests in suitably When money is paid into your account, units are Super & Pension selection of structured portfolios. allocated to your account and when money is paid Fundamentals investment Each investment option available out, units are deducted from your account. MLC MasterKey options so you has an individual investment The value of your account is based on: Business Super can invest objective and strategy. the number of units in your chosen investment according to options, and MLC MasterKey your individual Personal Super needs and the price of those units. MLC MasterKey circumstances. The overall value of your account will change Term Allocated according to the unit price and the number of units Pension you hold. Unit prices are calculated as at the end of each business day and robust unit pricing policies are used to do this. The unit price will reflect the performance of the underlying assets, income earned, fees, expenses and taxes paid and payable. The performance of the underlying assets is influenced by movements in investment markets such as local and overseas share markets, bond and property markets. If you would like to find out more about our unit pricing philosophy, go to mlc.com.au/ unitpricephilosophy NAB Term Deposit (only available to members in MLC MasterKey Super & Pension Fundamentals) A guaranteed interest rate is payable for the term selected. Interest is calculated daily and credited annually on the anniversary of the term, or on maturity. Early withdrawals are only permitted in extreme circumstances and will result in reduced interest. MLC Super Fund 2023 Annual Report | 15

How your money is invested Product name Investment objective Investment strategy About your account value MLC Super Pension Plan MLC Super Pension Plan To provide a fixed The Trustee has purchased an This plan provides a fixed or regular income stream annuity policy with MLC Limited. indexed regular income stream for for a selected period or a selected period. life. MLC Capital Guaranteed products MLC Maturity Growth To balance risk and The Trustee invests in policies A declared rate of interest is Superannuation Plan return considerations issued by MLC Limited who, in allocated to your account after 30 MLC Capital Guaranteed while securing turn, invests in a suitably June each year. Personal Super Savings guarantees to members. structured portfolio of securities. If you make a full withdrawal Plan Series 1-2 Surplus assets, over and above during the year, an interim rate is those required to fund guaranteed calculated and applied to your daily benefits, are generally invested in account balance before your a more diversified portfolio to benefit is paid. increase potential returns. The interim rate is set with the intention to reflect the year to date earnings and, as a result, may differ from the declared rate. MLC Whole of Life Aims to provide a The Trustee invests in policies In most cases, these products earn Superannuation guaranteed benefit issued by MLC Limited who, in bonuses which are allocated MLC Endowment payable on maturity of turn, invests in a suitably annually. Your bonuses, where Superannuation the policy or your death. structured portfolio of securities. applicable, are advised each year Surplus assets, over and above in your Annual Statement. MLC Pure Endowment those required to fund guaranteed Superannuation benefits, are generally invested in Whole of Life a more diversified portfolio to Endowment increase potential returns. MLC Insurance products MLC Life Cover Super Your contributions are These products do not have an MLC Insurance (Super) used to pay the account balance or value. premiums for the MLC Protectionfirst insurance cover selected. 16 | MLC Super Fund 2023 Annual Report

Financial Report The following abridged Fund financial information for the financial year ended 30 June 2023 is for the MLC Super Fund. Please call us if you wish to receive a printed copy of the full audited financial statements and auditor's report. MLC Super Fund 2023 Annual Report | 17

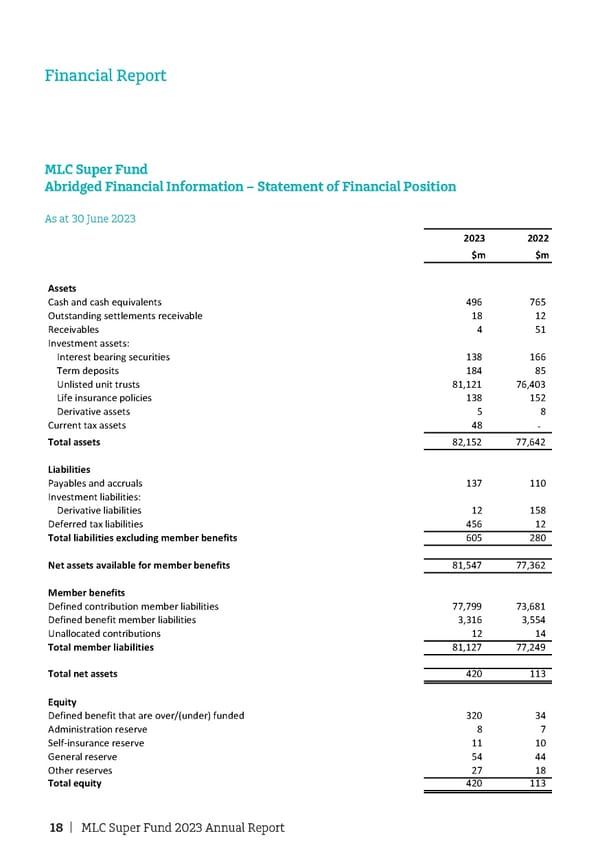

Financial Report MLC Super Fund MLC Super Fund Statement of financial position Abridged Financial Information – Statement of Financial Position As at 30 June 2023 As at 30 June 2023 2023 2022 $m $m Assets Cash and cash equivalents 4 96 7 65 Outstanding settlements receivable 1 8 1 2 Receivables 4 5 1 Investment assets: Interest bearing securities 1 38 1 66 Term deposits 1 84 8 5 Unlisted unit trusts 8 1,121 7 6,403 Life insurance policies 1 38 1 52 Derivative assets 5 8 Current tax assets 4 8 - Total assets 82,152 77,642 Liabilities Payables and accruals 1 37 1 10 Investment liabilities: Derivative liabilities 1 2 1 58 Deferred tax liabilities 4 56 1 2 Total liabilities excluding member benefits 6 05 2 80 Net assets available for member benefits 8 1,547 7 7,362 Member benefits Defined contribution member liabilities 7 7,799 7 3,681 Defined benefit member liabilities 3 ,316 3 ,554 Unallocated contributions 1 2 1 4 Total member liabilities 8 1,127 7 7,249 Total net assets 4 20 1 13 Equity Defined benefit that are over/(under) funded 3 20 3 4 Administration reserve 8 7 Self-insurance reserve 1 1 1 0 General reserve 5 4 4 4 Other reserves 2 7 1 8 Total equity 4 20 1 13 18 | MLC Super Fund 2023 Annual Report The above statement of financial position should be read in conjunction with the accompanying notes to the financial statements. MLC Super Fund 2

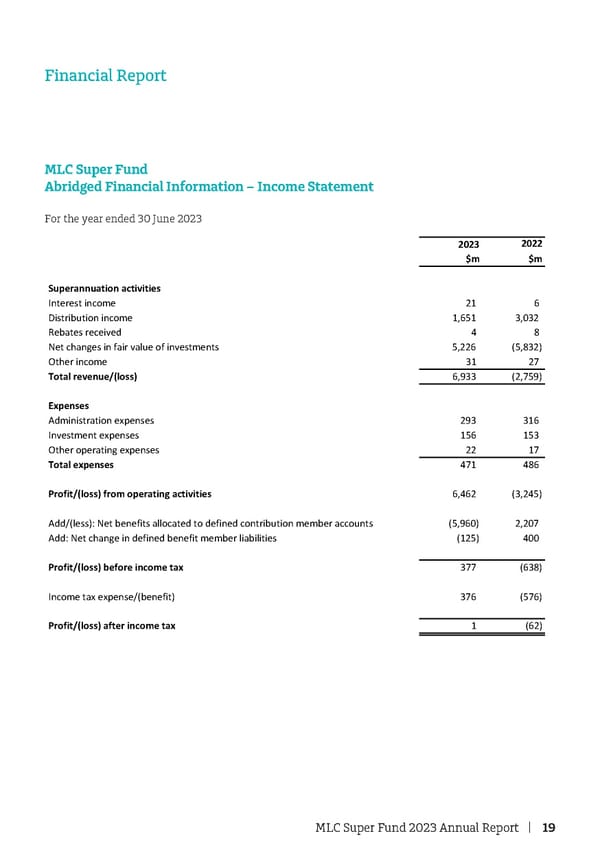

Financial Report MLC Super Fund Abridged Financial Information – Income Statement For the year ended 30 June 2023 2022 2023 $m $m Superannuation activities Interest income 21 6 Distribution income 1,651 3,032 Rebates received 4 8 Net changes in fair value of investments 5,226 (5,832) Other income 31 27 Total revenue/(loss) 6,933 (2,759) Expenses Administration expenses 293 316 Investment expenses 156 153 Other operating expenses 22 17 Total expenses 471 486 Profit/(loss) from operating activities 6,462 (3,245) Add/(less): Net benefits allocated to defined contribution member accounts (5,960) 2,207 Add: Net change in defined benefit member liabilities ( 125) 400 Profit/(loss) before income tax 377 ( 638) Income tax expense/(benefit) 376 (5 76) Profit/(loss) after income tax 1 (62) MLC Super Fund 2023 Annual Report | 19

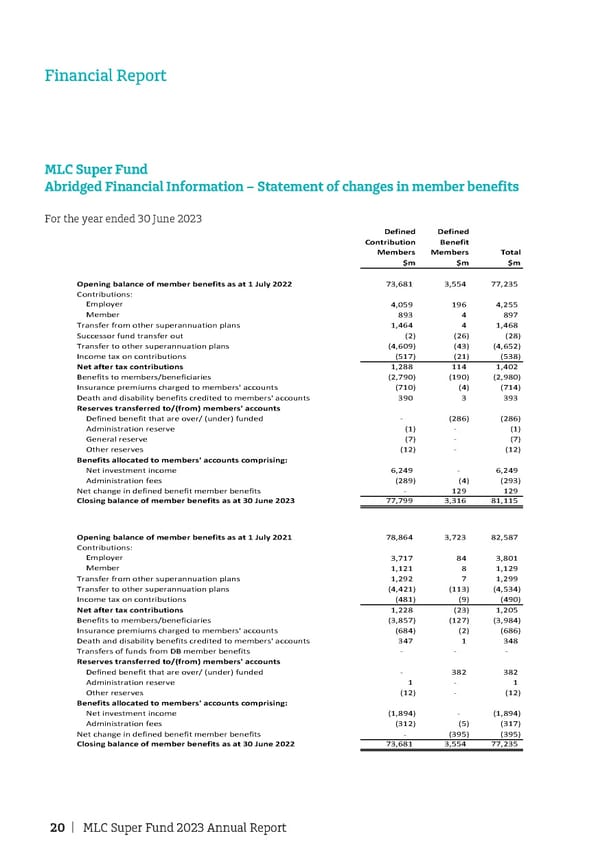

Financial Report MLC Super Fund Abridged Financial Information – Statement of changes in member benefits For the year ended 30 June 2023 Defined Defined Contribution Benefit Members Members Total $m $m $m Opening balance of member benefits as at 1 July 2022 73,681 3,554 77,235 Contributions: Employers 4 ,059 196 4,255 Member 893 4 897 Transfer from other superannuation plans 1 ,464 4 1,468 Successor fund transfer out (2) (26) (28) Transfer to other superannuation plans (4,609) (43) ( 4,652) Income tax on contributions ( 517) (21) (538) Net after tax contributions 1 ,288 114 1,402 Benefits to members/beneficiaries (2,790) (190) ( 2,980) Insurance premiums charged to members' accounts ( 710) ( 4) (714) Death and disability benefits credited to members' accounts 390 3 393 Reserves transferred to/(from) members' accounts Defined benefit that are over/ (under) funded - (286) (286) Administration reserve (1) - ( 1) General reserve (7) - ( 7) Other reserves (12) - (12) Benefits allocated to members' accounts comprising: Net investment income 6 ,249 6,249 - Administration fees ( 289) ( 4) (293) Net change in defined benefit member benefits 129 129 - Closing balance of member benefits as at 30 June 2023 7 7,799 3 ,316 8 1,115 Opening balance of member benefits as at 1 July 2021 78,864 3,723 82,587 Contributions: Employer 3 ,717 8 4 3,801 Member 1 ,121 8 1,129 Transfer from other superannuation plans 1 ,292 7 1,299 Transfer to other superannuation plans (4,421) (113) ( 4,534) Income tax on contributions ( 481) ( 9) (490) Net after tax contributions 1 ,228 (23) 1,205 Benefits to members/beneficiaries (3,857) (127) ( 3,984) Insurance premiums charged to members' accounts ( 684) ( 2) (686) Death and disability benefits credited to members' accounts 347 1 348 Transfers of funds from DB member benefits - - - Reserves transferred to/(from) members' accounts Defined benefit that are over/ (under) funded - 382 382 Administration reserve 1 - 1 Other reserves (12) - (12) Benefits allocated to members' accounts comprising: Net investment income (1,894) ( 1,894) - Administration fees ( 312) ( 5) (317) Net change in defined benefit member benefits (395) (395) - Closing balance of member benefits as at 30 June 2022 73,681 3,554 77,235 20 | MLC Super Fund 2023 Annual Report

Financial Report MLC Super Fund Abridged Financial Information – Statement of changes in reserve For the year ended 30 June 2023 Investment Defined Administration Self-insurance General Other Total reserve benefit that reserve reserve reserve reserves Equity are over/ (under) funded $m $m $m $m $m $m $m 5 - Opening balance as at 1 July 2022 34 7 10 44 18 1 13 - 286 1 - 7 12 3 06 Net transfers to/(from) members' Loss - - - 1 3 (3) 1 Closing balance as at 30 June 2023 320 8 11 54 27 4 20 - Investment Defined Administration Self-insurance General Other Total reserve benefit that reserve reserve reserve reserves Equity are over/ (under) funded $m $m $m $m $m $m $m Opening balance as at 1 July 2021 58 416 8 11 44 9 5 46 - ( 382) (1) - - 12 (371) Net transfers to/(from) members' ( 22) - - (1) - (3) ( 26) Loss Reclassification Mid to Redemption ( 36) - - - - - (3 6) Price Closing balance as at 30 June 2022 34 7 1 0 44 18 1 13 - MLC Super Fund 2023 Annual Report | 21

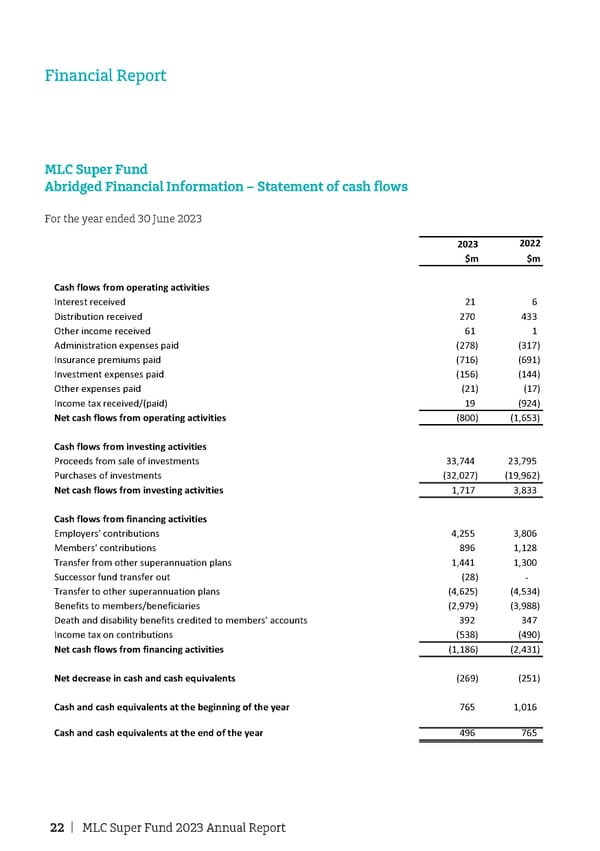

Financial Report MLC Super Fund Abridged Financial Information – Statement of cash flows For the year ended 30 June 2023 2022 2023 $m $m Cash flows from operating activities Interest received 21 6 Distribution received 270 433 Other income received 61 1 Administration expenses paid (2 78) (3 17) Insurance premiums paid ( 716) (6 91) Investment expenses paid ( 156) (1 44) Other expenses paid (21) (17) Income tax received/(paid) 19 (9 24) Net cash flows from operating activities (8 00) (1,653) Cash flows from investing activities Proceeds from sale of investments 33,744 23,795 Purchases of investments (32,027) (19,962) Net cash flows from investing activities 1,717 3,833 Cash flows from financing activities Employers' contributions 4,255 3,806 Members' contributions 896 1,128 Transfer from other superannuation plans 1,441 1,300 Successor fund transfer out (28) - Transfer to other superannuation plans (4,625) (4,534) Benefits to members/beneficiaries (2,979) (3,988) Death and disability benefits credited to members' accounts 392 347 Income tax on contributions ( 538) (4 90) Net cash flows from financing activities (1,186) (2,431) Net decrease in cash and cash equivalents ( 269) (2 51) Cash and cash equivalents at the beginning of the year 765 1,016 Cash and cash equivalents at the end of the year 496 765 22 | MLC Super Fund 2023 Annual Report

This page has been left blank intentionally. MLC Super Fund 2023 Annual Report | 23

For more information call us from anywhere in Australia on 132 652or contact your financial adviser. Postal address PO Box 200 North Sydney NSW 2059 mlc.com.au OBJ53885A-1223