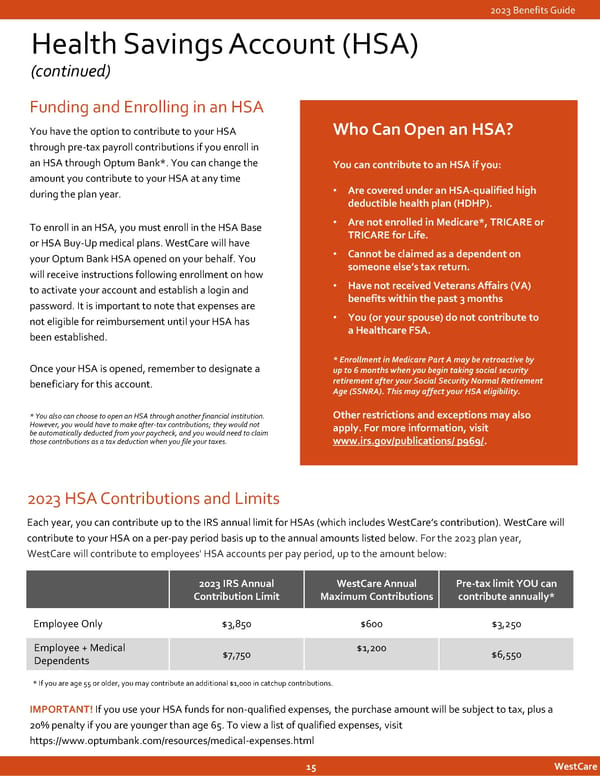

2023 Benefits Guide Health Savings Account (HSA) (continued) Funding and Enrolling in an HSA You have the option to contribute to your HSA Who Can Open an HSA? through pre-tax payroll contributions if you enroll in an HSA through Optum Bank*. You can change the You can contribute to an HSA if you: amount you contribute to your HSA at any time during the plan year. • Are covered under an HSA-qualified high deductible health plan (HDHP). To enroll in an HSA, you must enroll in the HSA Base • Are not enrolled in Medicare*, TRICARE or or HSA Buy-Up medical plans. WestCarewill have TRICARE for Life. your Optum Bank HSA opened on your behalf. You • Cannot be claimed as a dependent on will receive instructions following enrollment on how someone else’s tax return. to activate your account and establish a login and • Have not received Veterans Affairs (VA) password. It is important to note that expenses are benefits within the past 3 months not eligible for reimbursement until your HSA has • You (or your spouse) do not contribute to been established. a Healthcare FSA. Once your HSA is opened, remember to designate a * Enrollment in Medicare Part A may be retroactive by up to 6 months when you begin taking social security beneficiary for this account. retirement after your Social Security Normal Retirement Age (SSNRA). This may affect your HSA eligibility. * You also can choose to open an HSA through another financial institution. Other restrictions and exceptions may also However, you would have to make after-tax contributions; they would not apply. For more information, visit be automatically deducted from your paycheck, and you would need to claim those contributions as a tax deduction when you file your taxes. www.irs.gov/publications/ p969/. 2023 HSA Contributions and Limits Each year, you can contribute up to the IRS annual limit for HSAs (which includes WestCare’s contribution). WestCare will contribute to your HSA on a per-pay period basis up to the annual amounts listed below. For the 2023 plan year, WestCarewill contribute to employees' HSA accounts per pay period, up to the amount below: 2023 IRS Annual WestCare Annual Pre-tax limit YOU can Contribution Limit Maximum Contributions contribute annually* Employee Only $3,850 $600 $3,250 Employee + Medical $7,750 $1,200 $6,550 Dependents * If you are age 55 or older, you may contribute an additional $1,000 in catchup contributions. IMPORTANT!If you use your HSA funds for non-qualified expenses, the purchase amount will be subject to tax, plus a 20% penalty if you are younger than age 65. To view a list of qualified expenses, visit https://www.optumbank.com/resources/medical-expenses.html 15 WestCare

2023 | Employee Benefits Guide Page 14 Page 16

2023 | Employee Benefits Guide Page 14 Page 16