2023 | Employee Benefits Guide

Effective January 1, 2023 — December 31, 2023

2023 Benefits Guide 2023 EMPLOYEE BENEFITS GUIDE EffEffective ective January 1 , 2023 — December 31, 2023 1 WestCare

2023 Benefits Guide Inside This Guide Welcome to your WestCare2023 Benefits! Welcome 2 Benefits Overview 3 It’s time to make your benefit decisions for 2023! Your Eligibility and Enrollment 4 effective date of coverage will be January 1, 2023 or the first of the month following 60 calendar days. Enrolling with the Paycom App 6 Medical Plans 7 Your needs, and those of your family, are unique to you. Medical Plan Options 9 That’s why WestCareprovides a comprehensive and flexible benefits program that you can customize to fit Where to Seek Care 12 your personal situation. Our program offers you and your Health Savings Account (HSA) 14 family important healthcare coverage and financial Flexible Spending Accounts (FSA) 17 security. Open enrollment is your yearly opportunity to Wellness Benefit Program 18 make any benefit changes for you and your family. Enrollment elections will be made online in Paycom. How to Save $$$! 19 Dental 20 Some of the benefits we offer are paid for in full by Vision 21 WestCare.For others,it is a shared contribution between you and the company. Other benefitsare also available to Life Insurance 22 you at reasonable group rates. All rates are in the Disability Insurance 23 benefits section of Paycom. Optional Protection Benefits 24 Your benefits are an important part of your total Additional Benefits 25 compensation at WestCare. Please take the time to 401(k) Retirement Savings Plan 29 review and evaluate all the options available to you and Resources / Contact Information 30 your family. Benefit Definitions 32 This guide is not intended to be a complete description of the insurance coverage offered, nor is it a binding contract. Controlling provisions are provided in each benefit plan policy. Should there be a difference between this guide and the official plan documents, the official plan documents will govern. More information about specific terms and conditions of each plan is included in the Summary Plan Description (SPD) and Summary of Benefits and Coverage (SBC). 2 WestCare

2023 Benefits Guide Benefits Overview • Basic Life/AD&D –New York Life • Life Assistance Program –New York Life • Telemedicine -Telehealth • Medical – BRMS with Anthem Network • Base Plan with HSA • Buy-Up Plan with HSA • PPO Plan ✓Plans include prescription drug coverage • Health Savings Account (HSA) –Optum • Dental–Delta Dental • Vision–Anthem Blue View • Voluntary Life and AD&D – New York Life • Short-Term and Long-Term Disability –New York Life • Flexible Spending Accounts (FSA) –BRMS General Purpose Healthcare FSA (not available for those enrolled in the HSA plans and who open an HSA) • Limited Purpose Healthcare FSA (for those enrolled in the HSA plans • Dependent Care FSA • Group Legal Insurance –MetLife Legal • Optional Protection Benefits (Accident, Hospital Indemnity, Cancer Care and Critical Illness Insurance) – MetLife • Identity Theft Protection –ID Watchdog 3 WestCare

2023 Benefits Guide Eligibility and Enrollment Who is Eligible? When Can You Enroll in Benefits? Youare eligible for WestCare benefits if you are: You can enroll for benefits: • An active, full-time and regular employee of • When you are a new hire. All full-time new hires WestCare have 60 days from their start date to select benefits Your dependents are eligible if they are: for the current plan year. Benefits are effective the first of the month following 60 days from your hire • Your legal spouse or domestic partner date. New employees hired near the end of the year may need to complete two enrollments –one for the • Your and/or your domestic partner’s child(ren)* up to current year’s plans and another for the coming the end of the calendar year they reach age 26 year’s plans. • Your disabled child(ren) up to any age (if disabled • During the annual Open Enrollment period prior to age 19)* • During the plan year, if you experience a Qualifying • Your children* through age 19, or if dependent on Life Event (QLE). Benefit changes due to a QLE you, through age 25, for voluntary products must be made in the benefit section of Paycom. * Includes natural, step, legally adopted/or a child placed for adoption, or a child under your legal guardianship. You may be required to show proof of dependent status, Open Enrollment have these documents handy during open enrollment. Open Enrollment is your once-a-year opportunity to review your benefit About Domestic Partner Coverage plan elections and make adjustments WestCareallows you to enroll your same-sex or that meet the needs of you and your opposite-sex domestic partner and his or her dependents family. for coverage. Under federal law, WestCare’s contribution Changes to medical, HSA, dental , toward the cost of healthcare coverage for your vision, life and any other domestic partner and his or her dependents is considered supplemental benefits made during taxable income to you. Open Enrollment will go into effect Domestic partner premiums will be deducted on a post- January 1,2023. tax basis. You may wish to consult with a tax adviser for Flexible Spending Accounts run on a more information. calendar year. Open Enrollment for these plans is typically held in November with changes effective January 1. 4 WestCare

2023 Benefits Guide Eligibility and Enrollment (continued) How Do I Enroll in Benefits? Making Benefit Changes You must actively enroll in all benefits that require employee During the Plan Year contributions. You will be automatically enrolled in all Company paid benefits. The benefit elections you make during your To enroll (or make changes) to your benefits, you must log initial enrollment period will be in effect through onto Paycom at https://www.paycomonline.net. Select 2023 12/31/2023. Benefits Enrollment under the Benefits section. If you have a QLE, you may make changes to You may want to have your spouse or partner present while certain benefits if you apply for the change and selecting benefits as your benefit choices impact your whole provide supporting documentation to Human family. Resources within 30 days of the event. Proof of life events is subject to approval by WestCare. Changes are effective retroactive to the date of Please Note: the event. Federal regulations require WestCare to obtain the following information during enrollment: Qualifying life events include: • Social Security numbers for your dependents covered by • Your marriage the medical plan • Your divorce or legal separation • Dates of birth and your relationship to your dependents • Birth, adoption or placement for adoption of an eligible child • Death of your spouse, domestic partner or covered child Termination of Coverage • Change in you or your spouse/domestic If you or a covered dependent no longer meet these eligibility partner’s work status that affects benefits requirements or if your employment ceases, your medical, eligibility (for example, starting a new job, leaving a job, changing from part-time to full- dental, vision, and Health Care FSA coverage will end on the last time, starting or returning from an unpaid day of the month in which you become ineligible. leave of absence, etc.) You may be eligible to elect COBRA for yourself and your • Your spouse’s Open Enrollment eligible dependents for medical, dental, and vision coverage. • A change in your child’s eligibility for benefits • Gain or loss of Medicare or Medicaid during Life and AD&D coverage will end on the day you become the year ineligible. Your life coverages are convertible. • Relocation You are responsible for informing Human Resources within 30 days if any of your dependents become ineligible for benefits. Other qualifying events may also apply. Please contact the Benefits Department at [email protected]. 5 WestCare

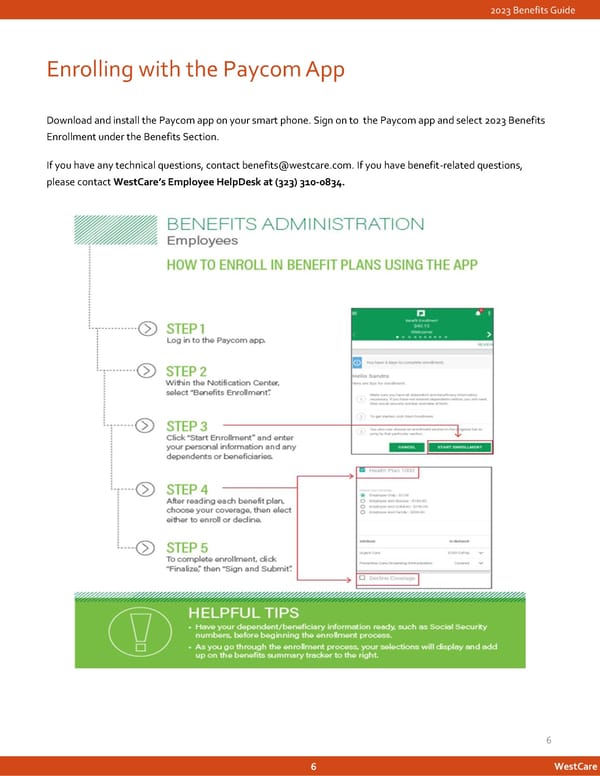

2023 Benefits Guide Enrolling with the Paycom App Download and install the Paycom app on your smart phone. Sign on to the Paycom app and select 2023 Benefits Enrollment under the Benefits Section. If you have any technical questions, contact [email protected]. If you have benefit-related questions, please contact WestCare’sEmployee HelpDeskat (323) 310-0834. 6 6 WestCare

2023 Benefits Guide Medical Plans WestCareoffers 3 medical plans through BRMS/Anthem Network with the following features: • Option to receive care from in-network or out-of-network providers; higher benefits are paid when using in-network Anthem providers. • Preventive care is covered at 100% when using an in- networkprovider. • Includes prescription drug coverage. • Deductibles and out-of-pocket maximums accumulate on a plan year which runs January 1 through December 31. • If you enroll in the Base Plan with HSA or Buy-Up Plan with HSA, you can open and contribute to a Health Savings Account (HSA) to help cover some of your medical plan costs (please see page 14 for more about HSAs). • For a comparison of the plans, please refer to the Medical Plans Comparison Chart. Specific benefit levels and limitations can be found in the plan summaries and Summary of Benefits and Coverage (SBC). Finding In-Network Providers To search for in-network medical providers, log onto anthem.com/ca and log in . If you are a health plan member, select the “Find a Doctor” option in the upper-right corner. If you are not a health plan member, after selecting “Find a Doctor,” select Access to Your Claims “Search as a Guest” and click “Continue.” Information • Chose “Medical” for type of care After you are enrolled in a WestCaremedical plan, log onto www.myhealthbenefits.comand • Select “California” as state, regardless of location register to access self-service tools and resources to help manage your medical • Click on “Medical –Employer Sponsored,” benefits. then “Blue Cross PPO (Prudent Buyer) – Large Group” Narrow your search further by using zip code, provider name, specialty or other available options. 7 WestCare

2023 Benefits Guide Medical Plans (continued) What’s New for 2023 Medical Coverage Progyny –Smarter Fertility Benefits Progyny connects you to leading fertility specialists and allows them to provide the most advanced, effective fertility treatment, the first time – without barriers to treatment –so you can obtain the best chance of achieving a successful pregnancy with the course of treatment that is best for you. Why Progyny? • Comprehensive coverage –bundled fertility treatment coverage for every unique path to parenthood • Personalized guidance –unlimited guidance and support from a dedicated Patient Care Advocate (PCA) • Premier specialists – convenient access to the largest national network of fertility experts and in- demand Reproductive Endocrinologists • Superior outcomes –multiples rate 72% lower and live birth rate 25% higher than national averages To learn more and activate your benefits, call (844) 930-3339. 8 WestCare

2023 Benefits Guide Medical Plan Options WestCareFoundation Base Plan with HSA Buy-Up Plan with HSA Plan Year Company HSA Contribution (Individual / Family) Maximum -EE $600 / EE+1 $1,200 Maximum -EE $600 / EE+1 $1,200 Medical You Pay You Pay In-Network Out-of-Network In-Network Out-of-Network Plan Year Deductible 1 $4,000/$10,000 $10,000/$20,000 $3,000/$6,000 $3,000/$6,000 (Individual / Family) Coinsurance %30 * %50* %20 * %50* Plan Year Out-of-Pocket Max 2 $6,450 / $ 12,900 $12,900 / $ 25,800 $5,000/ $10,000 $10,000/ $20,000 (Individual / Family) Preventive Care Covered in full 50%* Covered in full 50% Primary Care Office Visit 30%* 50%* 20%* 50%* Specialty Care Office Visit 30%* 50%* 20%* 50%* Telemedicine Consultation Covered in full N/A Covered in full N/A (must use Teladoc doctors) Urgent Care Facility 30%* 50%* 20%* 50%* Emergency Room Care 30%* 20%* Inpatient Hospital 30%* 50%* 20%* 50%* Outpatient Surgery 30%* 50%* 20%* 50%* Routine Radiology / Lab 30%* 50%* 20%* 50%* Advanced Radiology 30%* 50%* 20%* 50%* (MRI, MRA, CAT, PET Scan) Prescription You Pay You Pay Retail (up to 30-day supply) $10 / $35 / $60/ 20% with $250 max per Rx $10 / $35 / $60/ 20% with $250 max per Rx Tier 1 / Tier 2 / Tier 3/Tier 4 Home Delivery 2.5 x Retail N/A 2.5 x Retail N/A (up to 90-day supply) Limitations and maximums may apply. Please refertothe plan summaries and Summary of Benefits and Coverage formore information. 1 Each family member must meet the deductible individually until the family deductible is met 2 Plan Year Out-of-Pocket Maximum includes deductibles, Rx copays and coinsurance *After Deductible 9 WestCare

2023 Benefits Guide Medical Plan Options WestCareFoundation PPO Plan Medical You Pay In-Network Out-of-Network Plan Year Deductible 1 $2,000/$4,000 $3,000/$6,000 (Individual / Family) Coinsurance %20 * %50* Plan Year Out-of-Pocket Max 2 $4,000 / $ 8,000 $10,000 / $ 20,000 (Individual / Family) Preventive Care Covered in full 50%* Primary Care Office Visit $30 copay 50%* Specialty Care Office Visit $60 copay 50%* Telemedicine Consultation Covered in full N/A (must use Teladoc doctors) Urgent Care Facility $100 copay 50%* Emergency Room Care 20%* Inpatient Hospital 20%* 50%* Outpatient Surgery 20%* 50%* Routine Radiology / Lab Covered in full 50%* Advanced Radiology 20%* 50%* (MRI, MRA, CAT, PET Scan) Prescription You Pay 3 3 3 Retail (up to 30-day supply) $10 / $35 / $60/ 20% $10 / $35 / $60 / Tier 1 / Tier 2 / Tier 3/Tier 4 with $250 max per Rx 20% with $250 max per Rx Home Delivery 2.5 x Retail N/A (up to 90-day supply) Limitations and maximums may apply. Please refertothe plan summaries and Summary of Benefits and Coverage formore information. 1 Each family member must meet the deductible individually until the family deductible is met 2 Plan Year Out-of-Pocket Maximum includes deductibles, Rx copays and coinsurance 3 Plus in-network difference *After Deductible 10 WestCare

2023 Benefits Guide Medical Plan Options About Your Medical Plan ID Card When you enroll in medical benefits, you will receive an ID card in the mail. You will receive one card for yourself and an additional card for your covered family members. You need to present your ID card every time you receive care –at the doctor’s office, urgent care clinic, lab, hospital, outpatient facility and pharmacy. Below is a sample of the information your ID card may include. 1. Eligibility Information – your name, group number (WestCare’sassigned number with BRMS), your identification number 2. Pharmacy Information –Identifies the pharmacy vendor (Optum Rx), logo and contact information 3. Information for Providers –Claims questions and pre-authorization requests 4. Claims Mailing Address –Mail all claims to this address at the BRMS office 5. Member Support Tools –Phone numbers for customer support, pre-authorization, pharmacy, and more If you need a card call 1844-747-9708 11 11 WestCare

2023 Benefits Guide Where to Seek Care Telehealth WestCarebenefit-eligible employees and their dependents have access to Teladoc visits, at no cost. Teladoc provides 24-7-365 access to board-certified primary care doctors and pediatricians by secure video chat or phone. For an illness or injury that is not an emergency, Teladoc’s Telemedicine program offers a convenient, cost-effective alternative to hospital emergency rooms and urgent care clinics. Teladoc is not intended to replace your relationship with You can register for and access Teladoc services via the your doctor, but rather provides access to healthcare when Teladoc mobile app: Teladoc.com/mobile, at reaching the doctor is difficult or inconvenient. Teladoc.com, or via Facebook at Facebook.com/Teladoc. Teladoc physicians can diagnose, recommend treatment Alternatively, y0u may call Teladoc at 1-800-Teladoc. and write short-term prescriptions for minor, non-life- threatening conditions including, but not limited to: Please note that Teladoc services are currently not • Acne • Insect Bites available to residents of Arkansas. • Allergies • Sinus Infections • Arthritic Pain • Nausea/Stomach Aches • Bronchitis • Pink Eye • Cold/Flu Symptoms • Skin Infections Benefits of Telemedicine Visits • Ear Infections • Sore Throat • Less time away from work • Headaches/Migraines • Upper Respiratory • No travel expenses or time Infections • Less interference with child or elder care responsibilities • No exposure to other potentially contagious patients How to Use Teladoc 1. Download the Teladoc app, go online www.Teladoc.comor call 1-800-Teladoc. 2. Register and complete your account profile, including a brief medical history, for you and your enrolled family members. 3. Video chat or talk with a doctor from home, work or when traveling. 12 WestCare

2023 Benefits Guide Where to Seek Care (continued) Preventive Care The Affordable Care Act requires that health plans cover Go to Urgent Care certain in-network preventive services at no cost to the • Moderate fever member. As such, your medical plan covers preventive services at 100% when performed by an Anthem provider. • Colds, cough or flu Some covered services include: • Bruises and abrasions • Physicalexam • Cuts and minor lacerations • Immunizations based on guidelines for your • Minor burns and skin irritations age • Paptests • Eye, ear, or skin infections • Mammogram, based on guidelines for your • Sprains or strains age • Possible fractures • Colonoscopy, based on guidelines for yourage • Prostate cancer screening, based on • Urinary tract infections guidelines for yourage • Respiratory infections • Tests for cholesterol and bloodpressure When you need help in a hurry, you have choices. Of or course, when it’s a life-threatening problem, you should Go to Emergency Room call 911 or go straight to the nearest hospital emergency room (ER). Emergency Care vs. Urgent Care • Heart attack or stroke • Chest pain or intense pain When you need help in a hurry, you have choices. Of • Shortness of breath course, when it’s a life-threatening problem, you should • Severe abdominal pain call 911 or go straight to the nearest hospital emergency • Head injury or other major trauma room (ER). • Loss of consciousness In the ER, true emergencies are treated first, so unless your • Major burns or severe bleeding life is in danger, you’ll wait – sometimes for hours. The ER • One-sided weakness or numbness is also the most expensive option for care. • Open fractures For non-life-threatening problems, call your doctor, call • Poisoning or suspected overdose Teladoc, or go to an urgent care center. 13 WestCare

2023 Benefits Guide Health Savings Account (HSA) Only available for those enrolled in the HSA Base and HSA Buy-Up medical plan(s) A Health Savings Account (HSA) is a tax-advantaged Advantages of an HSA savings vehicle available to individuals covered by a High Deductible Health Plan (HDHP). Funds in the account are • Balance rolls over each year and accrues used to pay for qualified medical, dental and vision expenses. interest, so you won’t lose your contributions An HSA is a great way to save for the future. You can set • Triple tax savings —you do not pay aside money from each paycheck now and save funds to federal tax* on: cover healthcare expenses that come up later. Plus, your contributions are free from federal income tax, so you’re • Contributions to the account stretching your healthcare dollars while lowering your • Spending on qualified expenses taxable take-home pay amount. WestCarewill also make contributions to your HSA if you • Interest that accrues enroll in the HSA Base or HSA Buy-Up plans. You must • Account is portable, so the funds are yours have active healthcare coverage in one of these plans even if you change medical plans next and an open and valid HSA account with Optum Bank to year or leave WestCarein the future receive WestCarecontributions. This is “free money” for you to use to pay for eligible healthcare expenses. • Use the funds for eligible medical, dental or vision expenses, including coinsurance HSA funds can only be used for yourself, your spouse and costs, prescriptions, glasses, orthodontia your taxable dependents. Expenses for domestic partners and more—now or in the future and/or otherdependents who do not qualify as tax dependents are not reimbursable under the HSA. • Money left in the savings account earns tax-free interest* • Once your account balance reaches $3,850 for self-only or $7,750 for family contributions, you may move any balance above that amount into mutual funds and direct your investment strategy *Tax treatment of HSAs for state tax purposes may vary by state. 14 WestCare

2023 Benefits Guide Health Savings Account (HSA) (continued) Funding and Enrolling in an HSA You have the option to contribute to your HSA Who Can Open an HSA? through pre-tax payroll contributions if you enroll in an HSA through Optum Bank*. You can change the You can contribute to an HSA if you: amount you contribute to your HSA at any time during the plan year. • Are covered under an HSA-qualified high deductible health plan (HDHP). To enroll in an HSA, you must enroll in the HSA Base • Are not enrolled in Medicare*, TRICARE or or HSA Buy-Up medical plans. WestCarewill have TRICARE for Life. your Optum Bank HSA opened on your behalf. You • Cannot be claimed as a dependent on will receive instructions following enrollment on how someone else’s tax return. to activate your account and establish a login and • Have not received Veterans Affairs (VA) password. It is important to note that expenses are benefits within the past 3 months not eligible for reimbursement until your HSA has • You (or your spouse) do not contribute to been established. a Healthcare FSA. Once your HSA is opened, remember to designate a * Enrollment in Medicare Part A may be retroactive by up to 6 months when you begin taking social security beneficiary for this account. retirement after your Social Security Normal Retirement Age (SSNRA). This may affect your HSA eligibility. * You also can choose to open an HSA through another financial institution. Other restrictions and exceptions may also However, you would have to make after-tax contributions; they would not apply. For more information, visit be automatically deducted from your paycheck, and you would need to claim those contributions as a tax deduction when you file your taxes. www.irs.gov/publications/ p969/. 2023 HSA Contributions and Limits Each year, you can contribute up to the IRS annual limit for HSAs (which includes WestCare’s contribution). WestCare will contribute to your HSA on a per-pay period basis up to the annual amounts listed below. For the 2023 plan year, WestCarewill contribute to employees' HSA accounts per pay period, up to the amount below: 2023 IRS Annual WestCare Annual Pre-tax limit YOU can Contribution Limit Maximum Contributions contribute annually* Employee Only $3,850 $600 $3,250 Employee + Medical $7,750 $1,200 $6,550 Dependents * If you are age 55 or older, you may contribute an additional $1,000 in catchup contributions. IMPORTANT!If you use your HSA funds for non-qualified expenses, the purchase amount will be subject to tax, plus a 20% penalty if you are younger than age 65. To view a list of qualified expenses, visit https://www.optumbank.com/resources/medical-expenses.html 15 WestCare

2023 Benefits Guide Health Savings Account (HSA) (continued) How to Stretch your HSA Funds When you experience an accident or illness, you may have more questions than answers. The first question you need to answer is where to go to get medical care. When it comes to telemedicine, a family doctor, urgent care, a walk-in clinic or the emergency room, what you select could make a big difference in tern of cost, convenience and care. So, what’s the best option? Service Provider Types of Services When to Go Cost Who You’ll See? TeleHealth* Diagnostics, Prescriptions, Non-acute symptoms, - Practicing Preventive Care for Cold & managing existing conditions, PCPs, flu, allergies, bronchitis, preventive care. pediatricians, urinary, respiratory, sinus and family and ear infections, rash’s, medicine pink eye, ect ect physicians Walk-In Clinic Diagnostics, Prescriptions, Non acute symptoms of $ Nurse Preventive Care common illnesses or skin Practitioner, conditions, screenings, Physician’s vaccinations Assistant Doctor’s Office Diagnostics, Prescriptions, Non-acute symptoms, $$ Preventive Care, Illness managing existing conditions, MD (General Treatment, Disease preventive care Practitioner) Management Referrals Urgent Care Diagnostics, Prescriptions, Non life-threatening $$$ Nurse Minor Injury Treatment, conditions that need to be Practitioner, Illness Treatment assessed the same day Physician’s Assistant Emergency Room Anything relating to Life threatening, sudden- $$$$ ER MD, triage/diagnosis + onset pain, acute injuries trauma stabilization of a serious or surgeon, critical injury or illness Paramedic *For the 2023 plan year, WestCare has enrolled every benefit eligible employee and their dependents in TelaDoc at no cost to employees. When trying to stretch your HSA dollars, consider the below options when medical care is needed. 16 16 WestCare

2023 Benefits Guide Flexible Spending Account (FSA) Flexible Spending Accounts (FSA) allow you to set money Dependent Care FSA aside for certain eligible expenses and draw from it Available to all benefit eligible employees throughout the year to pay for those expenses. If you are Dependent Care FSAs are used to pay for the costs of currently enrolled in an FSA and want to continue, you dependent care that enable you to work. This care may be must re-enroll each year. The money is set aside pre-tax, for a child under age 13 and for older dependents, reducing your taxable income. Three types of FSAs are including children, spouses and parents who are physically available: or mentally unable to care for themselves and who live • Health Care with you for more than half the year. Eligible expenses • Limited Purpose Health Care–HSA plan participants only include daycare, before-school and after-school care, babysitters and elder daycare. For the 2023 calendar year, • Dependent Care you can deposit up to $2,500 to a Dependent Care FSA Money cannot be transferred between the accounts (i.e., ($5,000 if you are married and filing separately). you cannot use money from your Health Care FSA to pay for How the FSA Works dependent care expenses and vice versa). Health Care FSA As a new hire (and again during Open Enrollment), you select the amount of money you wish to deposit into the Not available to HSA plan participants Health Care (or Limited Purpose Health Care) and/or the This FSA allows you to submit eligible medical, dental and Dependent Care Account for the entire plan year. The vision expenses for reimbursement. You can deposit up to plan year for the FSA benefit is January 1 to December $3,050 to the Health Care FSA for the 2023 calendar year. 31. The total amount is then equally divided by the number of pay periods remaining in that year and that Limited Purpose Health Care FSA amount is deducted from each paycheck. The money is set aside in your FSA account(s). Available to HSA plan participants only The easiest way to use your funds is by using your Flex Using this account in conjunction with the HSA gives you Facts debit card at the point of service. The cardcan be the opportunity to save additional pre-tax money. You can used at any medical or dependent care facility that use the Limited Purpose Health Care FSA for eligible dental accepts MasterCard. You can also use your card at most and vision expenses only. You can contribute up to $3,050 pharmacies. When you use your card, the funds are for the 2023 calendar year in this account. automatically deducted from your account to pay for Health Care FSA Roll Over eligible expenses. Please note that you should retain all your receipts. The IRS requires that we request copies of If you enroll in a Health Care FSA, you have the option to receipts for certain claims. If you are required to send in carry forward up to $610 to the following plan year. These receipts an e-mail or letter will be sent to you the business funds will not count against your future FSA election plan day after you use yourcard. contribution limit. Any unused balances in excess of $610 The FSA plans are administered by BRMS. To register and at the end of 2023 will be forfeited. log into your FSA account(s), go to www.brms.com. 17 WestCare

2023 Benefits Guide Wellness Program Participation in the program is voluntary and includes Our company’s strength and success depends on you, so your health and wellbeing is important to us. The everyday the completion of wellness activities. All aspects of the choices we make can help us live healthier, happier and program are completely confidential and will be more fulfilling lives — both at work and at home. That’s administered by WellRight. why we offer you an opportunity to participate in the WestCareWellness Program. Employees (and their spouses or domestic partners)who complete their challenges as required within a calendar Available to all employees and their spouses or domestic quarter throughout the wellness plan year —January 1 partners, the Wellness Program focuses on health throughDecember 31 —may be eligible to earn and awareness and provides you with tools and resources to receive Wellness Premium Contribution Incentives. learn more about healthy living. Wellness Activities Wellness Incentive Our wellness challenges change every year, to cover a wide Employees and their spouses/domestic partners are each range of Wellness activities. Be sure to log onto the site eligible to earn a wellness premium contribution incentive. below on January 1st to see what WestCare has planned for The incentive is based on participation in the activities, not the new year! on the outcome. Wellness.westcare.com Keep an eye on your WestCareemail for more information from the Human Resources team regarding the upcoming year's participation goals. Rewards for participating in WestCare’s Wellness Program are available to all employees and spouses/domestic partners covered under a WestCaremedical plan. If you think you might be unable to meet a standard for a reward under this wellness program, you might qualify for an opportunity to earn the same reward by different means. Contact the Benefits Department at [email protected], and we will work with you (and, if you wish, with your doctor) to find a wellness program with the same reward that is right for you considering your health status. 18 WestCare

2023 Benefits Guide How To Save $$$! When Using Your Medical and Prescription Plans Telehealth Use In-Network Doctors By using in-network doctors, clinics, hospitals and pharmacies, you pay the lowest cost for care. When you visit out-of-network doctors, our health plan covers less of the cost. Choose the Right Type of Care When you need care, know your options. Urgent care Use Optum Rx centers, Teladoc online doctor visits or a visit to your Through Optum Rx, you will use network pharmacies to doctor’s office can help save time and money. obtain your prescriptions. To locate participating Use freestanding imaging centers for MRIs, CT scans pharmacies near you, visit www.optumrx.com or call (844) and other imaging. 568-2154. You can also save money by using your mail order pharmacy benefit and getting up to a 90-day supply Use Your Preventive Care for less than what you would pay through a retail Benefits pharmacy. And because shipping is free, you’ll also save on gas money! The Affordable Care Act requires that health plans cover certain in-network preventive services at no cost Ask Your Doctor for Generic Drugs to the member. As such, your medical plan covers preventive services at 100% when performed by an The next time you need a prescription, ask your doctor if it Anthem provider. Some covered services include: is appropriate to use a generic drug rather than a brand • Physicalexam name drug. Generic drugs contain the same active • Immunizations based on guidelines for ingredients, are identical in dose, form and administrative yourage method AND are less expensive than their brand name • Paptests counterparts. • Mammogram, based on guidelines for yourage If you must take a brand name drug, ask your doctor for • Colonoscopy, based on guidelines for samples or coupons. Also check the drug manufacturer’s yourage website for available rebates and discounts. • Prostate cancer screening, based on guidelines for yourage • Tests for cholesterol and bloodpressure 19 WestCare

2023 Benefits Guide Dental WestCareoffers two dental plans through Delta Dental. Your choice of dentists can determine the cost savings you receive. In-network providers are paid directly by Delta Dental and agree to accept negotiated fees as “payment in full” for services rendered. When you use out-of-network providers, Delta Dental will apply the applicable percentage of the allowed amount, and you are responsible for paying the balance of the bill. In-network coverage is provided when you use Delta Dental providers. To set up your online account or search for in- network providers, go to www.deltadentalins.com. You may also contact Delta Dental at (800) 521-2651. No ID card will be provided; give the group number and your SSN to your provider when obtaining services. Delta Dental Delta Dental PPO Middle Plan** Delta Dental PPO High Plan** In-Network Out-of-Network In-Network Out-of-Network Calendar Year Maximum * Up to $1,000 per person Up to $1,500 per person (plan pays ) Plan Pays Plan Pays Plan Pays Plan Pays Calendar Year Deductible * $25 Individual / $75 Family $50 Individual / $150 Family (applies to Basic and Major Services) Preventive Services (no deductible) 100% 100% Basic Services (after deductible) 80% 90% Major Services (after deductible) 50% 60% Orthodontia (to age 19) Not Covered 50% Orthodontia Lifetime Maximum N/A $2,000 (per person) * Plan deductibles and maximums accumulate on a calendar year (January 1 –December 31). These amounts reset on January 1 of each year. ** Reimbursement is based on PPO contracted fees for PPO dentists, Delta Dental Premier® contracted fees for Premier dentists and the program allowance for non-Delta Dental dentists. Important Information! Did you start on a dental treatment plan before your PPO coverage kicked in? Generally, multi-stage procedures are only covered under your current plan if treatment began after your plan’s effective date of coverage. You can find this date by logging in to Online Services. 20 WestCare

2023 Benefits Guide Vision Routine eye exams are important for maintaining good vision and can also provide early warning of other health conditions. The Anthem Blue View Vision plan provides coverage for exams, glasses and contact lenses, as shown below. In-network coverage is provided when you use Anthem Blue View Vision providers. To locate a participating network eye care doctor or location, log in at www.anthem.com, or from the home page menu under Care, select Find a Doctor.If you choose to, you may instead receive covered benefits outside of the BlueView Vision network. Just pay in full at the time of service, obtain an itemized receipt, and file a claim for reimbursement up to your maximum out-of-network allowance. You can email claim forms to: [email protected] mail to: Blue View Vision, OON Claims, P.O. Box 8504, Mason, OH 45040-7111. You may choose from many private practice doctors, local optical stores, and national retail stores including LensCrafters®, Target Optical®, and most Pearle Vision® locations. You may also use your in-network benefits to order eyewear online at Glasses.com and ContactsDirect.com. No ID card will be provided; give the group number and your SSN to your provider when obtaining services. Call 866-723-0515 for card requests Anthem Blue View Vision Frequency In-Network Out-of-Network You Pay Plan Allowance / Reimbursement Eye Exam Once every $10 copay Up to $42 calendar year Eyeglass Frames (1 pair) Once every $180 allowance, then 20% of Up to $45 calendar year remaining balance Lenses-instead of contacts Once every $10 copay Up to $40/$60/$80 (Singlevision/lined bifocal/lined trifocal) calendar year ProgressiveLenses(Standard) Once every $55 copay, in addition to other N/A calendar year applicable charges Contacts—insteadofglasses (Elective Once every $180 allowance + 15%/180 Up to $105/$105/$210 conventional/elective disposable/non-elective) calendar year allowance/covered in full Savings on items like additional eyewear after your benefits have been used, non-prescription sunglasses, hearing aids and even LASIK laser vision correction surgery are available through a variety of vendors. Just log in at anthem.com. For list of exclusions and limitations, please refer to the certificate of coverage for this plan. 21 WestCare

2023 Benefits Guide Life Insurance Basic Life/AD&D Having appropriate life insurance coverage is a critical part of planning for your family’s current and future financial needs. Proceeds from life insurance can help with salary replacement, mortgage protection, cost of childcare, debt repayment and children’s education expenses. WestCareprovides Basic Life insurance coverage of $15,000.This coverage includes an Accidental Death and Dismemberment (AD&D) provision that also pays $15,000 in the event of accidental death and certain other conditions. Basic Life and AD&D insurance is administered by New York Life and is paid for by Westcare. You are automatically enrolled in these benefits. (According to federal law, only the first $50,000 of employer-paid life insurance is not taxable. Premium paid by WestCare for coverage levels over $50,000 will be taxable to you and will be included on your year-end W-2 statement.) Voluntary Life Voluntary Life Amounts Available As a new hire, you can purchase Voluntary Life insurance for you, your legal spouse and dependent children Employee Increments of $10,000 to lesser of 5 without providing medical information up to certain times your salary or $500,000 guarantee issue (GI) amounts (see chart). If you leave WestCare, this coverage can be taken with you. Increments of $5,000 to $150,000, not Employee and spouse amounts applied for over the GI as a Spouse to exceed 50% of your coverage. The new hire will require you to provide Evidence of cost of coverage is based on age. Insurability (EOI) for review and approval by New York Life. Unmarried, Increments of $5,000 to $10,000 Dependent Maximum for children under six months Benefit amounts reduce at age 65. Please refer to the Child is $500. benefit summary for details. (to age 26) If you elect not to enroll within 31 days of your date of hire, To enroll in Voluntary Spouse and/or Child Life, you must you will still be able to purchase coverage in the future. be enrolled in Voluntary Employee Life. However, ALL amounts elected will be subject to the EOI *Guarantee issue is the amount of coverage you or your dependents can elect up to without medical questions. Guarantee issue is only available to newly benefit requirements provision. At that time, if your evidence of eligible employees. insurability is not satisfactory to NY Life, you will not have Voluntary Life coverage. Voluntary AD&D Employees can also elect to purchase Employee, Spouse and Dependent Child Voluntary AD&D coverage in increments and maximums equal to the Voluntary Life benefits. Employees pay the full cost of Voluntary Life and Voluntary AD&D insurance on an after-tax basis. 22 WestCare

2023 Benefits Guide Disability Insurance If you were to be out of work due to an injury or illness, could you and your family survive without a paycheck? Disability insurance is essentially “paycheck” insurance, ensuring you will receive a portion of your income if you were out of work due to injury or illness. Short-Term Disability (STD) provides a weekly benefit, while Long-Term Disability (LTD) pays a monthly benefit afterSTD insurance has been exhausted. WestCareoffers STD and LTD insurance that is paid by you. Administered by New York Life, you must indicate your disability plan choices or your decision not to select coverage in Paycom. Short-Term Disability (STD) Insurance Long-Term Disability (LTD) Insurance STD benefits become payable when you are unable to LTD insurance offers a monthly benefit to help replace lost work due to an injury or illness unrelated to work. If you income if you experience a disability lasting longer than 24 months. Proof of disability is required. remain disabled and meet the plan’s disability requirements, you will continue to receive a percentage of your weekly earnings until the benefit duration has Benefit ended. Begins After 90 days of qualified disability STD benefits integrate with state-mandated disability Benefit 60% of basic monthly earnings to plans. Amount $5,000per month Benefit Social Security Normal Retirement Benefit You must be disabled for 7 days for Duration Age (SSNRA) Begins accident, 7 days for sickness LTD claims for newly covered employees will be denied if Benefit 60 % of your weekly salary to $1,000 you received medical treatment, medical advice, care or Amount per week services or took prescribed drugs or medicines in the last 3months prior to the effective date of this coverage and Benefit Up to 13 weeks the disability began in the first 12 months after your Duration effective date of coverage. 23 WestCare

2023 Benefits Guide Optional Protection Benefits WestCareoffers additional voluntary benefit plans through Accident Insurance MetLife. These plans are not medical insurance and do not replace your medical coverage, but rather pay cash directly Accident insurance pays a cash benefit when you or your to you in addition to any benefits you receive from your covered family members suffer injuries sustained in an health plan. accident. Covered injuries include fractures, burns, concussions, tears, lacerations, broken teeth and eye Insurance policies available for purchase (through after-tax injuries. Additional benefits may be paid, including payroll deductions) include Critical Illness, Accident and ambulance, emergency care, testing and therapy. Hospital Indemnity.These benefits may help fill the gap until you meet your medical plan deductible. Please refer to the MetLife benefit plan summaries for details, and please visit Paycom for rates. All MetLife benefit plans are portable, which means you can take these benefits with you if you leave the company. Rates are based on age, tobacco status and policy elected. Critical Illness Insurance This insurance pays a lump-sum cash benefit directly to the insured following the diagnosis of a covered critical illness or event, including (but not limited to) Alzheimer’s disease, invasive cancer, heart attack, kidney failure, stroke and major organ transplants. The plan also provides an annual cash benefit (per calendar Hospital Indemnity Insurance year) for eligible health screenings and prevention measures. Since these screenings are often paid at 100% Hospital Indemnity insurance policy can help by paying under the medical plan, you could walk away with cash in lump-sum benefits to help you manage expenses that your pocket for practicing good preventive care. arise if you or an eligible family member ends up in the hospital. You can use the money however you’d like — Please refer to the MetLife benefit plan summaries for from paying for medical copays and deductibles to details, and please visit Paycom for rates. everyday expenses such as the mortgage, transportation, groceries and utilities. There are no copays, deductibles, coinsurance or network requirements. These benefits aren’t reduced because you receive a payment from any other coverage you have, such as Medical, Accident or Critical Illness Insurance. Please refer to the MetLife benefit plan summaries for details, and please visit Paycom for rates. 24 WestCare

2023 Benefits Guide Additional Benefits MetLife Legal WestCare’shigh-low legal assistance plan, offered through MetLife Legal, enables you to choose the right plan to suit your needs and your budget. For $24 per month for our high plan or $11.80 per month for our low plan, you get legal assistance for some of the most frequently needed personallegalmatters—withno waitingperiods,nodeductiblesandnoclaimforms when usinganetworkattorneyfora coveredmatter. Common legal services include estate documents (wills and Life Assistance Program (LAP) trusts), real estate matters, identity theft defense, traffic offenses, document review, adoptions, name changes and We understand how challenging it can be to balance your debt collection defense. work and personal life, and we are committed to helping For the services included, you pay only your monthly you do just that. premium through post-tax payroll deductions; there are no Offered through Cigna, the Life Assistance Program can copays and no deductibles. provide you and your family and household members with Veterinary Care information and assistance on a wide range of topics and issues including work stress, debt problems, family issues, Save on veterinary care with United Pet Care. One low relationship worries, parenting challenges, anxiety, grief monthly premium of $14.85 or less includes preventive, and much more. accident and sick care. You save 20% -50% off every in- Provided at no cost to you, counselors are available for network veterinary visit. support by phone 24 hours a day, seven days a week at United Pet Care features no claim forms, no deductibles, (800)538-3543. no waiting period, no age exclusions, and no exclusions due To help get you started, the program includes up to three to pre-existing or breed-specific conditions. free in-person counseling sessions for you and your For information or to enroll, visit household members. Behavioral counselors can help www.unitedpetcare.com/westcareor call (949) 916-7374 navigate any additional long-term counseling needs. or (602) 266-5303. Online resources are also available by logging onto Use code WCF at check out www.cignabehavioral.com/cgi. 25 WestCare

2023 Benefits Guide Additional Benefits (continued) Identity Theft Protection thousands of public and private databases searching for new and updated information associated with your Identity theft is when thieves steal your personal information in order to take over or open new accounts, file personal, identifiable and financial information. 1B includes fake tax returns, rent or buy properties or commit other monitoring of an employee’s social security number, crimes in your name. ID Watchdog can help you avoid criminal records, address history, TransUnion credit and identity theft and, in the worst-case scenario, get your life more. ID Watchdog Platinum offers in addition to the core back after a breach of your secure personal information. identity monitoring, identity theft detection and resolution WestCareoffers 2 plan options for purchase. services, ID Watchdog Platinum offers credit monitoring, report and scores for all three credit reporting agencies ID Watchdog 1B is our core identity monitoring, identity (Equifax, Experian, and TransUnion). Access credit reports theft detection and resolution product. 1B monitors and credit scores from all three bureaus from your personal ID Watchdog dashboard. 26 WestCare

2023 Benefits Guide Additional Benefits (continued) Vacation and Time Off Benefits Full-time employees receive pay during observed holidays. If you are going to observe a holiday on All other employees will either receive a day off without another day, you have 30 days to use the time pay, or, if required to work, will receive their customary from when WestCareobserved the holiday. pay. WestCareobserves the following holidays: The time must be approved by your supervisor. You must work your regular • New Year’s Day • Martin Luther King Day scheduled day before and after the holiday. • Memorial Day • Juneteenth • Independence Day • Labor Day • Veteran’s Day • Thanksgiving Day • Day After Thanksgiving • Christmas Day • 2 “Floating Holidays” Accrual Schedule for Floating Holidays Employee as of Dec. 31 2 days following Year Hired Jan 1-June 30 1 day in current year Hired after June 30 0 days "Floating holidays" are only to be scheduled with the approval of your supervisor. Vacation Accruals Full-time employees after 1-year anniversary will accrue paid New hires 0-1 year will begin to accrue paid vacation time vacation time, per pay period and based on their anniversary on the first day of the month after their date of hire. No date in accordance with the schedule to the right. Please note vacation time can be taken until the first of the month that only available vacation time may be taken, and that following six months of employment. earned vacation time accrues to a maximum of 240 hours. 27 WestCare

2023 Benefits Guide Additional Benefits (continued) Holidays Catastrophic Leave Program 1. When a holiday falls on a Saturday, it is usually WestCarecreated a pilot program to provide a bank of observed on the preceding Friday. If a holiday falls on a hours for “catastrophic leave” for full-time employees. The Sunday, it is usually observed on the following Monday. hours available in this bank are for an employee when WestCaremay recognize the holiday on another day or he/she or a member of his/her family experiences a grant individual days depending upon whether catastrophe and the employee has used all of his/her WestCarewill be closing. Holiday observance will be accrued leave. announced in advance. Using the “Catastrophic Leave Request Form,” any 2. To be eligible for holiday pay, you must be regularly WestCareemployee may request hours from the bank with scheduled to work on the day of the holiday and must the following provisions: work your scheduled workdays both immediately preceding and immediately following the holiday, • The “catastrophe” meets program requirements. unless an absence on either day is approved, in • The requesting employee has completed at least 6 advance, by your supervisor. months of employment with WestCare. Sick Leave • All other paid leave accruals have been exhausted. WestCare’spolicy is to provide compensation during times • The requesting employee is not on suspension or an employee must be absent due to illness or injury that is administrative leave at the time of the request. unrelated to employment. This benefit is available to full- time employees and is available for use beginning the first • The requesting employee may receive no more than month after the date of hire. Hours are accrued based on 160 hours from the bank in any one calendar year. the schedule below. • Requests must be for a minimum of 8 hours. • Effective September 1, 2002, all full-time employees accrue sick time at a rate of 8 hours per month, beginning the first of the month after date of hire. The • Employee must submit the “Catastrophic Leave amount of sick time that may be accrued is capped at Request Form” to his or her immediate supervisor. 480 hours. Family Medical Leave Act and State • Employees may use accrued sick leave to attend doctor Leave Laws or dentist appointments provided WestCare was given advance notice of the appointment and the immediate In the event you become entitled to take a leave of supervisor approves the absence in advance. absence, your health benefits will continue for the duration • Employees may no accrue sick leave during either paid of your qualifying leave. During the leave, WestCare will or unpaid leaves of absence. continue to contribute to the cost of your coverage under the same terms and conditions as if you were actively at • “Banked” sick time is not paid upon termination. • For absences of 5 days or more, a release to return to work.WestCarewill also require you to pay the cost of work from a health care provider may be required before coverage on the same terms and conditions that you would an employee will be allowed to return to work. be required to pay if you were actively at work or to set up a reimbursement plan to pay back WestCare for covering • Sick leave must be reported as such on employees’ time your cost of benefits. sheets. 28 WestCare

2023 Benefits Guide 401(k) Retirement Savings Plan You Choose When to Pay Taxes Making contributions to the 401(k) plan offers tax benefits. The type of contributions you make —pre-tax, Roth (after-tax) or a combination of the two —will determine when you pay taxes on your contributions. You can: Pay taxes later. If you make pre-tax contributions to the 401(k) Plan, you The WestCareFoundation, Inc., 401(k) Retirement Savings Plan will lower your taxes today. allows employees to save for retirement through convenient payroll deductions. Employees who have completed 6 months of service The money you contribute, and any become eligible to participate in the Plan The Plan, administered by earnings will not be subject to income Voya, is designed with the following features: taxes until you withdraw it, likely in retirement. • You can defer up to an annual maximum of the lesser of 50% of your eligible compensation or the annual IRS deferral limit of Pay taxes now. If you make Roth $20,500 for regular contributions and $6,500 for catch-up contributions to the 401(k) Plan, you contributions (for those age 50 and over). This can be done on a will pay income taxes on the pre-tax basis through payroll deduction, or you may choose to contributions today. make after-tax (Roth) contributions. You can withdraw your contributions • WestCarewill match$1 for $1 for up to the first 3% of your and any earnings tax-free once you contributions and an additional $.50 for each $1 contributed for have had the account for at least five the next 2% of your contributions. years and have reached age 59½. • Employees are immediately vested in 100% of the company match. Not Enrolled? Get Started Today Online Phone 1. Go to https://enroll.voya.com 1. Call (888) 311-9487, Monday through 2. Enter plan number 81F805 Friday, 8 a.m. – 9 p.m. ET 3. Enter verification number 81F80599 Be sure to review the disclosures in the Important Information section during online enrollment. If enrolling by phone, you’ll be asked to verify you have reviewed the enrollment booklet. 29 WestCare

2023 Benefits Guide Resources/Contact Information Benefit Provider Phone Website / Email www.brms.com Medical BRMS (844) 747-9708 Medical Claims Status Network: Anthem Option 2 www.brmsclaims.com Prescription Optum Rx (844) 568-2154 www.optumrx.com Health Savings Account Optum Bank (866) 234-8913 www.optumbank.com/support (HSA) www.deltadentalins.com Dental Delta Dental (800) 521-2651 Claims Address: P.O. Box 1809 Alpharetta, CA 30023-1809 Vision Anthem Blue View (866) 723-0515 www.anthem.com/ca Vision Flexible Spending BRMS (844) 747-9708 www.brms.com Accounts (FSA) Life and Disability New York Life (800) 997-1654 www.NewYorkLife.com Life Assistance Program Ny Life (888) 887-4114 www.NewYorkLife.com (LAP) Benefit Enrollment Paycom https://www.paycomonline.net https://servicing.online.metlife.c Optional Protection MetLife (800) 438-6388 om/public/site/presignin?grpNum Benefits ber=171990 401(k) Retirement Voya (888) 311-9487 https://enroll.voya.com Savings Benefits Department [email protected] HelpDeskEmployee Dickerson Insurance (323) 310-0834, Call Center Services M-F, 7 a.m. –5 [email protected] p.m. PST 30 WestCare

2023 Benefits Guide Resources/Contact Information (continued) Benefit Provider Phone Website / Email Pet Insurance United Pet Care (949) 916-7374 www.unitedpetcare.com/westcare (602) 266-5303 Infertility Benefits Progyny (844) 930-3339 www.progyny.com 31 WestCare

2023 Benefits Guide Benefit Definitions What is a premium? A premium (also referred to as a contribution) is the What counts toward my out-of- monthly cost you pay for health insurance, whether you pocket maximum? use medical services or not. Premiums are deducted directly from your paycheck. An out-of-pocket maximum is an annual cap on the dollar amount you are expected to pay out of your What is a deductible? own pocket for services (including deductibles, A deductible is the amount you pay out of your pocket copays, and coinsurance) throughout the plan year. before your insurance pays. Once you meet the out-of-pocket amount, your The deductible runs from January –December each year. insurance provider will cover 100% of remaining Once you have met that dollar amount, you have met the medical expenses for the year. requirements for the plan year. What does a copay pay for? Copayments, or copays, are pre-set dollar amount you are expected to pay for office visits, procedures or prescription drugs under your insurance plan. Once the copay has been met, the insurance company pays all remaining costs. What does coinsurance mean? Coinsurance is a set percentage of service costs that you will be expected to pay once you have met your annual deductible. When your annual deductible is met, your insurance provider pays for their portion of the full cost of the service and you pay the coinsurance, or remaining percentage. What is an out-of-pocket maximum? An out-of-pocket maximum is the amount of money you may pay for medical services in the plan’s calendar year. Once you pay this amount, the plan will cover additional eligible expenses at 100%. 32 WestCare

2023 Benefits Guide 1711 Whitney Mesa Henderson, NV 89014 (702) 385-2090 Uplifting the Human Spirit 33 WestCare