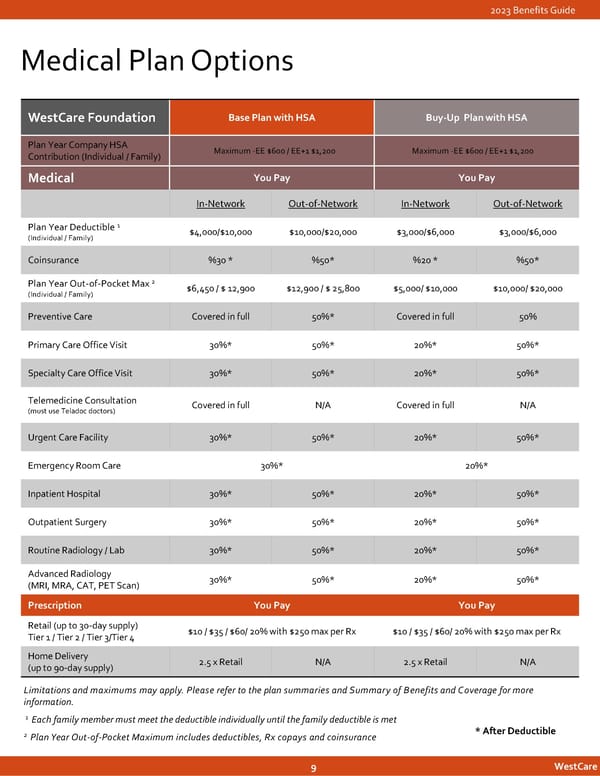

2023 Benefits Guide Medical Plan Options WestCareFoundation Base Plan with HSA Buy-Up Plan with HSA Plan Year Company HSA Contribution (Individual / Family) Maximum -EE $600 / EE+1 $1,200 Maximum -EE $600 / EE+1 $1,200 Medical You Pay You Pay In-Network Out-of-Network In-Network Out-of-Network Plan Year Deductible 1 $4,000/$10,000 $10,000/$20,000 $3,000/$6,000 $3,000/$6,000 (Individual / Family) Coinsurance %30 * %50* %20 * %50* Plan Year Out-of-Pocket Max 2 $6,450 / $ 12,900 $12,900 / $ 25,800 $5,000/ $10,000 $10,000/ $20,000 (Individual / Family) Preventive Care Covered in full 50%* Covered in full 50% Primary Care Office Visit 30%* 50%* 20%* 50%* Specialty Care Office Visit 30%* 50%* 20%* 50%* Telemedicine Consultation Covered in full N/A Covered in full N/A (must use Teladoc doctors) Urgent Care Facility 30%* 50%* 20%* 50%* Emergency Room Care 30%* 20%* Inpatient Hospital 30%* 50%* 20%* 50%* Outpatient Surgery 30%* 50%* 20%* 50%* Routine Radiology / Lab 30%* 50%* 20%* 50%* Advanced Radiology 30%* 50%* 20%* 50%* (MRI, MRA, CAT, PET Scan) Prescription You Pay You Pay Retail (up to 30-day supply) $10 / $35 / $60/ 20% with $250 max per Rx $10 / $35 / $60/ 20% with $250 max per Rx Tier 1 / Tier 2 / Tier 3/Tier 4 Home Delivery 2.5 x Retail N/A 2.5 x Retail N/A (up to 90-day supply) Limitations and maximums may apply. Please refertothe plan summaries and Summary of Benefits and Coverage formore information. 1 Each family member must meet the deductible individually until the family deductible is met 2 Plan Year Out-of-Pocket Maximum includes deductibles, Rx copays and coinsurance *After Deductible 9 WestCare

2023 | Employee Benefits Guide Page 8 Page 10

2023 | Employee Benefits Guide Page 8 Page 10